Energy and Power

Columnar Battery Market

Columnar Battery Market Size, Share, Growth & Industry Analysis, By Type (Lithium, Alkaline, Other), By Application (Electronic Products, Communication Products, Toys, Others), and Regional Analysis, 2024-2031

Pages : 130

Base Year : 2023

Release : March 2025

Report ID: KR1419

Market Definition

The columnar battery market involves cylindrical energy storage solutions, widely used in consumer electronics, electric vehicles (EVs), industrial applications, and medical devices.

Driven by advancements in lithium-ion technology, energy density improvements, and sustainability efforts, this market is expanding with increasing demand for high-efficiency rechargeable batteries worldwide.

Columnar Battery Market Overview

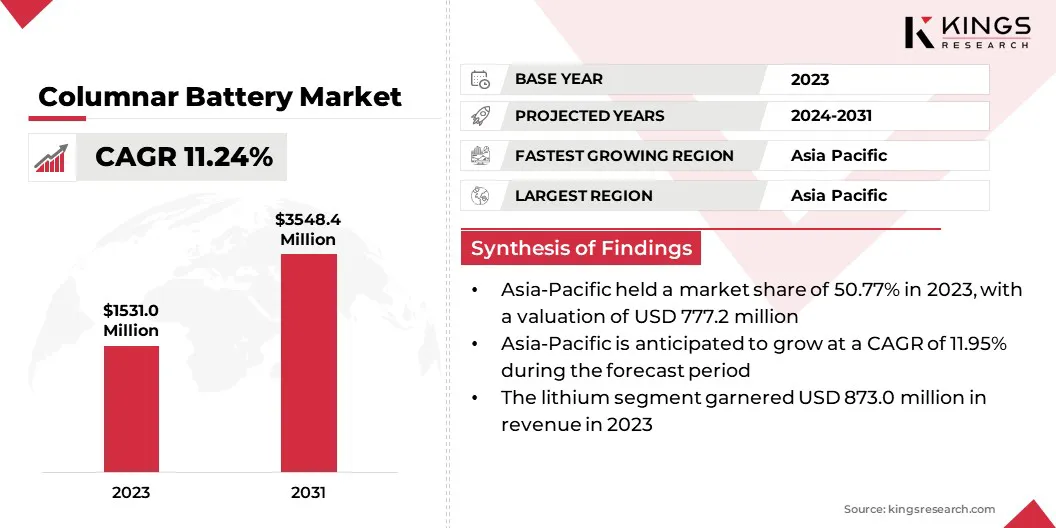

The global columnar battery market size was valued at USD 1531.0 million in 2023, which is estimated to be valued at USD 1683.8 million in 2024 and reach USD 3548.4 million by 2031, growing at a CAGR of 11.24% from 2024 to 2031.

The rising demand for consumer electronics, including smartphones, laptops, and wearables, is driving the market by increasing the need for compact, high-energy-density storage solutions that enhance device performance, efficiency, and battery life.

Major companies operating in the global columnar battery industry are Panasonic Corporation, FUJIAN NANPING NANFU BATTERY CO., LTD., Maxell, Ltd., Energizer, GPIndustrial, Camelion Batterien GmbH, SAMSUNG SDI Co., Ltd, LG Energy Solution, EVE Energy Co., Ltd., SVOLT Energy, Tianjin Lishen Battery Joint-Stock Co., Ltd., Amara Raja Group, Eveready Industries India Ltd., Duracell Inc, and MOLICEL.

The market is registering steady growth, driven by advancements in battery technology and increasing adoption across various industries. These batteries are widely used in applications requiring compact, high-energy-density power solutions, ensuring reliable performance.

Manufacturers are focusing on enhancing battery efficiency, longevity, and safety to meet evolving consumer and industrial demands. With growing investments in research and development, innovations in materials and energy storage capabilities are expanding the market potential, making columnar batteries a preferred choice for modern electronic and industrial applications.

- In September 2024, researchers from Justus Liebig University Giessen unveiled a breakthrough in columnar battery technology by elucidating the microstructure of lithium and sodium metal anodes. This advancement enhances electrochemical performance, boosting efficiency and durability in next-generation solid-state energy storage solutions.

Key Highlights:

- The global columnar battery market size was valued at USD 1531.0 million in 2023.

- The market is projected to grow at a CAGR of 11.24% from 2024 to 2031.

- Asia Pacific held a market share of 50.77% in 2023, with a valuation of USD 2 million.

- The lithium segment garnered USD 873.0 million in revenue in 2023.

- The electronic products segment is expected to reach USD 8 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 10.96% during the forecast period.

Market Driver

"High EV Demand"

The rapid expansion of the electric vehicle (EV) market is a key driver of the columnar battery market, as automakers seek high-energy-density solutions to improve vehicle performance and battery longevity.

- According to the International Energy Agency (IEA), approximately 14 million electric cars were sold globally in 2023. This represents around 18% of the total car sales for the year.

With increasing government incentives, research and development, rising consumer demand, and advancements in EV technology, the need for efficient and durable batteries is surging.

Columnar batteries offer superior energy storage, longer lifespans, and faster charging capabilities, making them an ideal choice for EV manufacturers striving for enhanced driving range and sustainability.

- In October 2024, researchers at McGill University advanced all-solid-state lithium battery technology, enhancing efficiency and safety. Their breakthrough indirectly supports columnar battery innovation, improving energy storage for high-performance applications like EVs and portable electronics through stable electrolytes and optimized interfaces.

Market Challenge

"High Manufacturing Costs"

High manufacturing costs pose a significant challenge for the columnar battery market, as the production involves advanced materials and specialized techniques, making it more expensive than traditional battery types.

Investments in research and development are crucial to streamline production processes, optimize material usage, and reduce costs. Collaborations between manufacturers and suppliers could lead to economies of scale, further driving down expenses. Additionally, technological advancements in automation and efficiency could help lower the overall cost of columnar battery production over time.

Market Trend

"Solid-State Innovations"

The columnar battery market is registering a significant shift with advancements in solid-state technology. Increasing R&D in solid-state electrolytes is enhancing battery efficiency, safety, and longevity, addressing challenges like thermal instability and limited lifespan. These innovations enable higher energy density, faster charging, and improved performance in applications such as EVs and consumer electronics.

As manufacturers focus on developing next-generation solid-state columnar batteries, the market is poised for growth, driven by increasing demand for safer, more efficient energy storage solutions.

- In March 2023, CHAM Battery launched the world's first quasi-solid-state 21700 cylindrical battery, enhancing safety and energy density. This innovation aligns with the market's shift toward solid-state advancements, improving thermal stability, efficiency, and longevity for smart homes and green mobility applications.

Columnar Battery Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Lithium, Alkaline, Other |

|

By Application |

Electronic Products, Communication Products, Toys, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Lithium, Alkaline, Other): The lithium segment earned USD 873.0 million in 2023, due to its high energy density and widespread adoption in EVs.

- By Application (Electronic Products, Communication Products, Toys, Others): The electronic products segment held 43.70% share of the market in 2023, due to the increasing demand for efficient, long-lasting power sources in consumer electronics.

Columnar Battery Market Regional Analysis

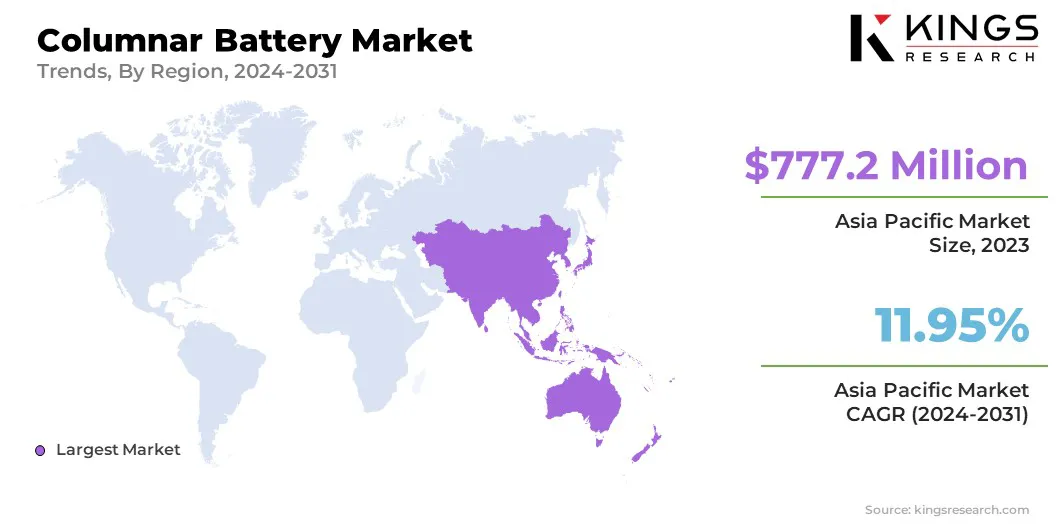

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a columnar battery market share of around 50.77% in 2023, with a valuation of USD 777.2 million. Asia Pacific remains the dominant region in the market, driven by rapid advancements in EV adoption and consumer electronics manufacturing.

China, Japan, and South Korea are key players, with robust investments in battery technology and infrastructure development. The region benefits from a strong supply chain for raw materials and efficient manufacturing processes.

Government incentives and environmental regulations further fuel the demand for advanced energy storage solutions, ensuring that Asia Pacific retains its market leadership.

The columnar battery industry in North America is poised for significant growth at a robust CAGR of 10.96% over the forecast period. North America is emerging as a fast-growing region in the market, propelled by significant growth in EV adoption and energy storage innovations.

The U.S., in particular, is registering a surge in R&D investments and partnerships between automakers and battery manufacturers, accelerating the demand for high-performance batteries.

Additionally, the region’s emphasis on sustainability, renewable energy, and reducing reliance on fossil fuels is driving a shift toward more efficient energy storage solutions, supporting rapid market expansion.

- In February 2023, Panasonic showcased its commitment to sustainability at CES 2023, highlighting its green initiatives in North America. The company emphasized the importance of advanced battery technologies, like cylindrical lithium-ion batteries, which support the growing EV market, aligning with its long-term environmental goals.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) protects people and the environment from significant health risks, sponsors and conducts research, and develops and enforces environmental regulations.

- The European Union (EU) adopted a new Batteries Regulation in 2023 aimed at reducing the environmental impacts of batteries throughout their lifecycle. This new regulation replaces the 2006 EU Batteries Directive and presents key considerations for U.S. exporters entering or expanding in the EU market.

Competitive Landscape:

The global columnar battery market is characterized by a large number of participants, including established corporations and rising organizations. Companies in the market are actively forming strategic partnerships to drive innovation, enhance production capabilities, and expand market reach.

Collaborations focus on advancing solid-state technology, optimizing supply chains, and integrating cutting-edge materials for improved efficiency and safety. Such alliances accelerate research, streamline manufacturing, and support the growing demand across consumer electronics, EVs, and renewable energy storage sectors.

- In January 2025, LG Energy Solution partnered with Aptera Motors and CTNS through an exclusive supply agreement to provide 2170 cylindrical batteries for Aptera’s solar EVs. This strategic collaboration aimed to enhance battery technology, production efficiency, and market expansion in sustainable mobility solutions.

List of Key Companies in Columnar Battery Market:

- Panasonic Corporation

- FUJIAN NANPING NANFU BATTERY CO., LTD.

- Maxell, Ltd.

- Energizer

- GPIndustrial

- Camelion Batterien GmbH

- SAMSUNG SDI Co., Ltd

- LG Energy Solution

- EVE Energy Co., Ltd.

- SVOLT Energy

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Amara Raja Group

- Eveready Industries India Ltd.

- Duracell Inc

- MOLICEL

Recent Developments (Joint Venture/Launch/Partnership)

- In April 2024, Panasonic Energy initiated discussions with Indian Oil Corporation Ltd to establish a joint venture for manufacturing cylindrical lithium-ion batteries in India. This partnership aims to enhance battery production capabilities, support EV growth, and strengthen India’s position in the global energy storage market.

- In December 2024, Ampace launched the JP30 cylindrical lithium battery, redefining high-power battery performance. Featuring 36A continuous discharge, rapid charging, and enhanced longevity, JP30 accelerates cordless transformation in power tools. This innovation reinforces Ampace’s leadership in compact, high-efficiency energy solutions.

- In June 2024, Amara Raja Advanced Cell Technologies partnered with Gotion-InoBat-Batteries to license lithium-ion cell technology. This collaboration supports Amara Raja’s Gigafactory development in India, reinforcing its position in advanced energy storage solutions and accelerating India’s EV and energy transition.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership