Machinery Equipment-Construction

Construction Equipment Rental Market

Construction Equipment Rental Market Size, Share, Growth & Industry Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment, Concrete Equipment, Road Construction Equipment, Others), By Application (Residential Construction, Commercial Construction, Infrastructure Projects, Industrial Construction, Mining & Quarrying), and Regional Analysis, 2024-2031

Pages : 110

Base Year : 2023

Release : February 2025

Report ID: KR1278

Market Definition

The market involves rental services for machinery and equipment used in construction projects. Instead of purchasing heavy machinery, construction companies or contractors can rent these machines for short-term or long-term use, depending on the project’s requirements.

Renting equipment helps construction businesses save on the large upfront costs of purchasing machinery, reduces maintenance & storage costs, and gives them access to the latest, most advanced equipment without significant capital investment.

Construction Equipment Rental Market Overview

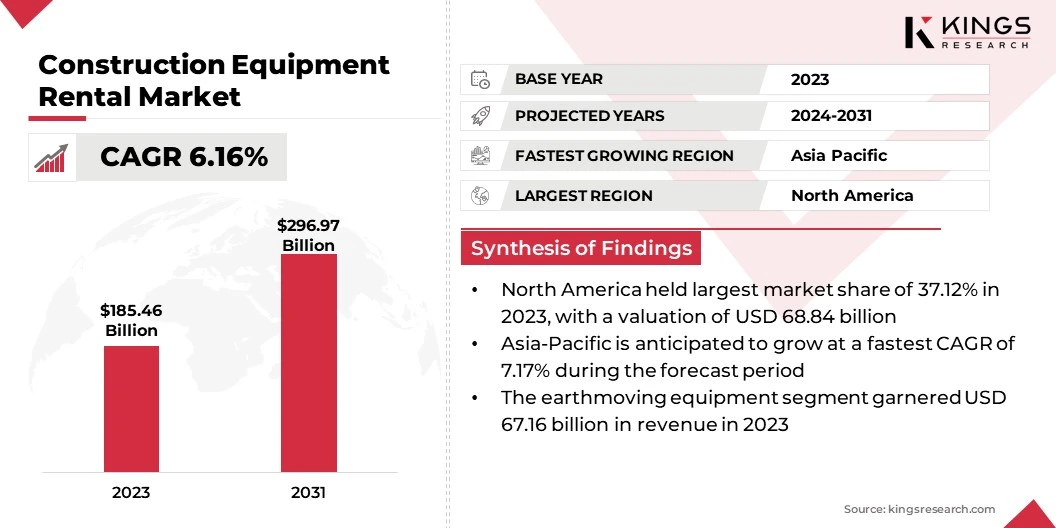

The global construction equipment rental market size was valued at USD 185.46 billion in 2023, which is estimated to be valued at USD 195.43 billion in 2024 and reach USD 296.97 billion by 2031, growing at a CAGR of 6.16% from 2024 to 2031.

Cost-effectiveness drives growth in the market, as renting is more affordable than purchasing. It allows companies with limited capital or those working on short-term projects to access necessary equipment without the large upfront investment.

Major companies operating in the construction equipment rental industry are United Rentals, Inc., LOXAM, Sunbelt Rentals, Inc, AKTIO Corporation, Herc Rentals Inc., Ahern Rentals, H&E Rentals, Mitsubishi Corporation (Nikken Corporation), Nishio Rent All Singapore Pte Ltd, Caterpillar, Byrne Equipment Rental, Finning International Inc., Liebherr-International Deutschland GmbH, Kanamoto Co., Ltd., HOLT Group (Texas First Rentals).

The construction equipment rental market is dynamic and plays a crucial role in the global construction industry. It supports efficient project execution across various construction activities by offering businesses the flexibility to access a wide range of machinery without the financial burden of ownership.

The market is characterized by a variety of service providers, ranging from local rental companies to large global firms, all contributing to the seamless operation of construction projects, regardless of their size or complexity.

Key Highlights:

- The construction equipment rental market size was recorded at USD 185.46 billion in 2023.

- The market is projected to grow at a CAGR of 6.16% from 2024 to 2031.

- North America held a market share of 37.12% in 2023, with a valuation of USD 68.84 billion.

- The earthmoving equipment segment garnered USD 67.16 billion in revenue in 2023.

- The infrastructure projects segment is expected to reach USD 108.28 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.17% during the forecast period.

Market Driver

"Increased Infrastructure Development"

Increased infrastructure development is a major growth driver for the construction equipment rental market. Construction companies require more specialized machinery to meet project demands as global demand for infrastructure projects, such as roads, bridges, and airports, continues to rise.

- According to a March 2024 article by the Ministry of Information & Broadcasting, India’s infrastructure has advanced significantly, with projects like the Atal Tunnel, Chenab Bridge, and national highways under Bharatmala. These initiatives have improved connectivity, boosting economic growth and sustainability.

Renting equipment provides the flexibility to access the right tools for specific tasks without the need for large capital investments. This growing need for construction machinery directly fuels the demand for rental services, supporting the ongoing expansion of the market.

- In March 2024, Sumitomo Corporation announced that its subsidiary, Sunstate Equipment Co., LLC, acquired 100% of Trench Shore Rentals, Inc. (TSR). This acquisition expands Sunstate’s trench safety equipment rental business across key U.S. states, positioning it to double rental revenues and strengthen its market presence.

Market Challenge

"Fluctuating Demand"

Fluctuating demand is a significant challenge for the construction equipment rental market, driven by seasonal variations, economic downturns, cyclical construction trends, and interest rate fluctuations.

- In November 2024, the American Rental Association (ARA) forecasted a 5.7% growth in equipment rental revenue for 2025. This growth is expected to be influenced by Federal Reserve interest rate cuts, which will impact investment behavior over time.

Higher interest rates can reduce the demand for construction projects, affecting rental revenues. Rental companies can implement flexible pricing strategies, diversify their fleet to serve various industries, and secure long-term rental contracts.

Additionally, adopting data analytics for demand forecasting and investing in maintenance to minimize downtime ensures a steady revenue stream, even during periods of low demand.

Market Trend

"Digitalization and Technology Integration"

A prominent trend in the construction equipment rental market is the increased integration of digital technologies. The innovations allow rental companies to track equipment in real-time, optimize usage, and streamline maintenance processes. Companies can improve efficiency, reduce downtime, and enhance customer satisfaction by providing data-driven insights.

This technological shift not only boosts operational productivity but also helps rental businesses manage their fleets more effectively, ensuring that equipment is used and maintained optimally.

- In May 2023, Spartan Solutions introduced PHALANX 6, an innovative software platform designed to streamline rental operations. With AI-powered Rental Copilot, customizable mobile apps, and an Operations Dashboard, PHALANX 6 automates logistics and service processes, enhancing efficiency, productivity, and customer satisfaction.

Construction Equipment Rental Market Report Snapshot

| Segmentation | Details |

| By Application | Residential Construction, Commercial Construction, Infrastructure Projects, Industrial Construction, Mining & Quarrying |

| By Equipment Type | Earthmoving Equipment (Excavators, Bulldozers, Backhoe Loaders, Dump Trucks, Others), Material Handling Equipment (Cranes, Forklifts, Aerial Work Platforms, Others), Concrete Equipment (Concrete Mixers, Concrete Pumps, Concrete Cutters, Concrete Finishing Machines), Road Construction Equipment (Pavers, Road Rollers, Asphalt Spreaders), Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Equipment Type (earthmoving equipment, material handling equipment, concrete equipment, road construction equipment, and others): The earthmoving equipment segment earned USD 67.16 billion in 2023, due to increased demand for large-scale infrastructure projects, urban development, and earth excavation activities.

- By Application (residential construction, commercial construction, infrastructure projects, industrial construction and mining & quarrying): The infrastructure projects segment held 34.45% share of the market in 2023, due to significant government investments in transportation, energy, and public infrastructure development globally.

Construction Equipment Rental Market Regional Analysis

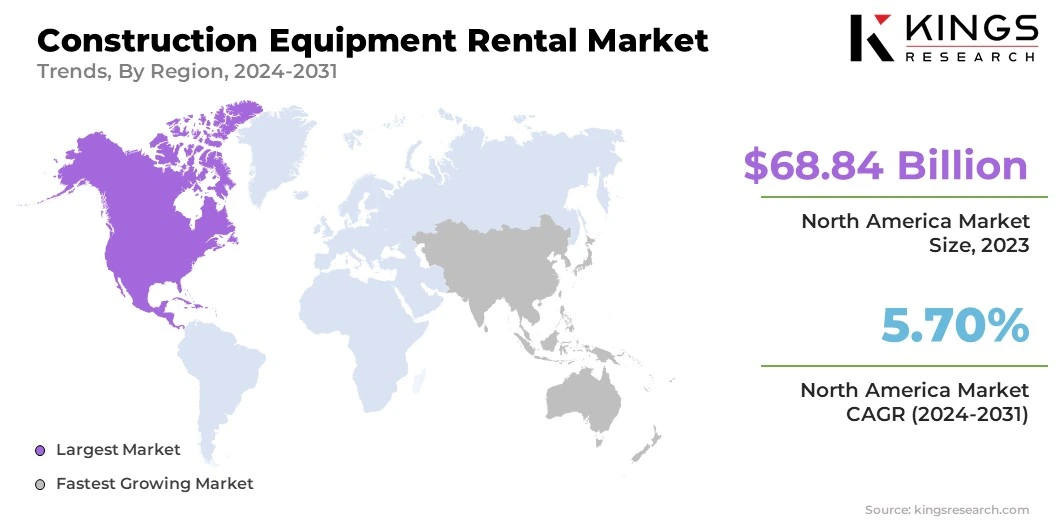

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 37.12% share of the construction equipment rental market in 2023, with a valuation of USD 68.84 billion.

North America remains a dominant region in the market, driven by the strong demand for infrastructure development, ongoing urbanization, and robust construction activity across both residential and commercial sectors.

The U.S. and Canada are key contributors, benefiting from a large number of construction projects, government-funded infrastructure upgrades, and high reliance on equipment rental due to cost-efficiency. Additionally, technological advancements, growing preference for flexible rental models, and an increasing focus on sustainability continue to fuel the market in the region.

- In December 2024, North American Construction Group Ltd. (NACG) announced an extended regional services contract with a major Canadian oil sands producer. The USD 500 million agreement, focuses on heavy equipment rentals and earthwork, reinforcing NACG's commitment to operational efficiency and long-term growth in the oil sands sector.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 7.17% over the forecast period. Asia Pacific is emerging as the fastest-growing market for construction equipment rental, driven by rapid urbanization, infrastructure development, and government initiatives.

Increased demand for construction equipment in large-scale projects, such as roads, bridges, and urban buildings, along with a shift toward cost-efficient rental models, is fueling growth. Additionally, rising construction activity in emerging economies, coupled with advancements in technology and equipment availability, positions Asia Pacific as a key growth hub in the rental market.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S. the Occupational Safety and Health Administration (OSHA), which comes under the U.S. Department of Labor, ensures that assure America's workers have safe and healthful working conditions free from unlawful retaliation.

- The United States Environmental Protection Agency (U.S. EPA) protects human health and the environment through various environmental laws.

- The EU machinery legislation is one of the main legislations governing the harmonisation of essential health and safety requirements for machinery at EU level is the current Machinery Directive 2006/42/EC.

- In the EU, many products require CE marking before they can be sold in the region. CE marking indicates that a product has been assessed by the manufacturer and deemed to meet EU safety, health and environmental protection requirements. It is required for products manufactured anywhere in the world that are then marketed in the EU.

- In Japan, the Industrial Safety and Health Act ensures workers' safety and health in the workplace and to facilitate the creation of comfortable work environments, by advancing comprehensive and systematic measures related to industrial injury prevention, in conjunction with the Labor Standards Act of Japan.

Competitive Landscape:

The construction equipment rental industry is characterized by a number of participants, including both established corporations and rising organizations.

Companies in the market are actively expanding their operations by increasing their fleet size, entering new geographic regions, and diversifying their service offerings. These expansions aim to capture a larger market share, meet growing customer demand, and leverage technological advancements to improve operational efficiency and competitiveness.

- In June 2023, H&E Equipment Services Inc. opened its 22nd Texas location, the Houston South branch. Strategically situated with expanded fleet inventory, the branch enhances coverage across the Houston market, providing efficient equipment rentals and services to meet the growing regional demand.

List of Key Companies in Construction Equipment Rental Market:

- United Rentals, Inc.

- LOXAM

- Sunbelt Rentals, Inc

- AKTIO Corporation

- Herc Rentals Inc.

- Ahern Rentals

- H&E Rentals

- Mitsubishi Corporation (Nikken Corporation)

- Nishio Rent All Singapore Pte Ltd

- Caterpillar

- Byrne Equipment Rental

- Finning International Inc.

- Liebherr-International Deutschland GmbH

- Kanamoto Co., Ltd.

- HOLT Group (Texas First Rentals)

Recent Developments:

- In April 2023, Boels Rental announced the acquisition of BAS Maskinutleie, a prominent Norwegian rental company. This move enhances Cramo’s market leadership in Norway, highlighting the strategic importance of strengthening market position for future growth.

- In March 2024, United Rentals completed the USD 1.1 billion acquisition of Yak Access, Yak Mat, and New South Access & Environmental Solutions. This strategic move strengthens its position in the North American matting industry, expanding its rental offerings and enhancing its ability to serve construction, utility, and maintenance sectors with comprehensive surface protection solutions.

- In June 2024, Herc Rentals acquired Durante Rentals, a leading construction equipment rental company in the New York tri-state area. The acquisition follows Durante’s expansion into the mid-Atlantic through Iron Source, positioning Herc for increased market growth and regional reach.

- In July 2023, Komatsu announced the introduction of its 20-ton class electric excavators, the PC200LCE-11 and 210LCE-11, as rental machines in Japan and Europe. This marks a significant step toward electrifying the construction equipment rental market, supporting sustainability goals.

- In February 2024, CASE Construction Equipmen showcased over 30 new machines at The ARA Show in New Orleans, highlighting innovations like the Utility Plus backhoe loader, mini excavators, and new attachments. The lineup emphasizes versatility, performance, and enhanced dealer support for rental businesses.

- In June 2023, Renta Group acquired Mylift Holding AS, expanding its rental network in Norway. The acquisition strengthens Renta’s presence in Oslo and Innlandet, enhances its product offerings, and provides access to a broader customer base, particularly in scaffolding and site modules.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership