Construction Machinery Telematics Market

Construction Machinery Telematics Market Size, Share, Growth & Industry Analysis, By Machinery Type (Crane, Excavator, Telescopic Handling, Loaders and Backhoes, Others), By Type (Tracking, Diagnostics, Fleet Management, Others), By Sales Channel (OEM, Aftermarket) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : March 2024

Report ID: KR555

Construction Machinery Telematics Market Size

The global Construction Machinery Telematics Market size was valued at USD 1,393.5 Million in 2023 and is projected to reach USD 3,129.8 Million by 2031, growing at a CAGR of 10.83% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Caterpillar, Komatsu, AB Volvo, Deere & Company, J C Bamford Excavators Ltd., Trimble, Geotab Inc., Hexagon AB, Bosch Rexroth GmbH and Others.

The global market is undergoing a paradigm shift, fueled by the imperative for operational efficiency, safety, and sustainability in the construction industry. Technological advancements in connectivity, sensor technology, and data analytics are constantly refining existing solutions and enabling emerging trends such as predictive maintenance and autonomous equipment operation. Rising infrastructure investments across the globe, particularly in developing regions, are creating a surge in demand for intelligent construction solutions. Stringent regulations on emissions and operator safety are further prompting construction companies to adopt data-driven decision making using telematics.

Additionally, the growing adoption of connected technologies, including the Internet of Things (IoT) and artificial intelligence (AI), is fostering the development of advanced telematics solutions.

However, navigating the market requires addressing key challenges, including data security concerns, ensuring seamless integration with existing systems, and bridging the skill gap required to effectively utilize and interpret telematics data. By addressing these challenges and capitalizing on the lucrative opportunities presented by technological advancements and regional growth potential, market participants can position themselves as key players in the construction industry.

Analyst’s Review

The construction machinery telematics market is experiencing robust growth globally, driven by factors such as increasing demand for operational efficiency, regulatory compliance, and safety measures in the construction sector. With key regions such as North America, Europe, and Asia-Pacific leading the charge, the market is poised to witness notable expansion. Telematics solutions, including tracking, diagnostic, and fleet management systems, are becoming integral to construction machinery, offering real-time monitoring, predictive maintenance, and enhanced security. As construction companies continue to prioritize efficiency and productivity, the adoption of telematics is set to increase, thereby presenting lucrative opportunities for market players across the value chain.

Market Definition

The construction machinery telematics market encompasses the provision and utilization of telecommunications and informatics technologies within the construction industry to enable remote monitoring, management, and optimization of heavy equipment and machinery. It involves the deployment of hardware devices, such as GPS trackers and sensors, installed on construction machinery, coupled with software solutions for data collection, analysis, and visualization. Telematics solutions offer insights into various aspects of equipment performance, including location tracking, fuel consumption, engine health, and maintenance needs, thereby facilitating proactive decision-making and operational efficiency enhancement.

With a growing focus on improving safety, productivity, and sustainability in construction operations, the market continues to evolve with advancements in connectivity, data analytics, and automation technologies. This market serves diverse stakeholders, including construction companies, equipment manufacturers, rental firms, and technology providers, addressing their needs for better asset management, cost control, and regulatory compliance in an increasingly digitized construction landscape.

Construction Machinery Telematics Market Dynamics

The global construction machinery telematics market is significantly influenced by infrastructure investments worldwide. In the year 2022, there were over 13,000 major infrastructure projects underway globally, representing a substantial demand for heavy equipment and machinery. For instance, initiatives such as China's Belt and Road Initiative and the infrastructure plans outlined in the European Union's Recovery and Resilience Facility have spurred construction activities across regions. These projects require efficient management and monitoring of construction machinery, thus driving the adoption of telematics solutions.

Additionally, governments' focus on enhancing transportation networks, energy infrastructure, and urban development contributes to the demand for telematics-enabled construction machinery. As infrastructure investments continue to rise, the market for construction machinery telematics is poised to experience robust growth, offering significant opportunities for both technology providers and equipment manufacturers.

Furthermore, stringent regulations governing emissions and operator safety standards are compelling construction companies to prioritize compliance, thus boosting the adoption of telematics solutions. For instance, regulations such as the Stage V emissions standards in Europe and similar mandates in other regions necessitate the monitoring and reporting of emissions from construction machinery. Telematics systems provide real-time data on fuel consumption and emissions, enabling companies to track and manage their environmental impact effectively.

Furthermore, regulations mandating the use of safety features, such as rollover protection systems (ROPS) and seatbelt usage, are driving the integration of safety-focused telematics solutions. As regulatory scrutiny intensifies, construction firms are increasingly turning to telematics to ensure adherence to standards while optimizing equipment performance and operator safety.

Additionally, rapid advancements in connectivity, sensor technology, and data analytics are serving as major factors supporting the expansion of the construction machinery telematics market. The integration of cutting-edge technologies, such as 5G connectivity, has revolutionized data transmission, enabling real-time monitoring and remote diagnostics of construction equipment. For instance, companies such as Caterpillar have introduced telematics systems such as Cat® Product Link™, which utilize 5G connectivity to deliver seamless data access and analytics capabilities, thereby enhancing operational efficiency and productivity.

Moreover, innovations in sensor technology have led to the development of more sophisticated monitoring systems, providing granular insights into equipment performance and health. For instance, Komatsu has introduced Intelligent Machine Control (IMC) systems that combine GPS technology with advanced sensors to enable semi-automated machine operation, thereby significantly improving precision and productivity on job sites.

Despite the promising aspects, the market faces major challenges due to the complexity associated with integrating telematics solutions into existing construction workflows and systems. Construction companies often manage diverse fleets of equipment from different manufacturers, each equipped with its proprietary telematics systems or data formats. Integrating these disparate systems and ensuring seamless interoperability can be challenging and time-consuming, requiring significant investments in technology infrastructure and expertise.

However, with ongoing advancements in cybersecurity technologies and increased awareness among industry stakeholders, data security concerns can be effectively addressed. Additionally, the development of standardized protocols and interoperability standards can streamline the integration process, making telematics solutions more accessible and beneficial to construction companies.

Segmentation Analysis

The global construction machinery telematics market is segmented based on machinery type, type, sales channel, and geography.

By Machinery Type

Based on machinery type, the market is categorized into crane, excavator, telescopic handling, loaders and backhoes, and others. Excavator generated the highest revenue of USD 400.9 million in 2023. Excavators are vital equipment in various construction activities, ranging from digging trenches to demolition tasks, thereby experiencing consistent demand across construction projects globally. Additionally, the increasing adoption of telematics solutions in excavators is driven by the need for enhanced operational efficiency, real-time monitoring, and predictive maintenance capabilities, which contribute to cost savings and improved productivity for construction firms.

Moreover, advancements in excavator telematics technology, such as integration with artificial intelligence (AI) algorithms for predictive analytics and remote diagnostics, thereby bolstering the growth of the segment. Furthermore, the excavation sector is witnessing a paradigm shift toward digitization and automation, with telematics playing a pivotal role in enabling data-driven decision-making and optimizing fleet management practices. The excavator segment's strong growth potential underscores the lucrative opportunities for telematics solution providers to offer tailored solutions that cater to the specific needs of construction companies utilizing excavators.

By Sales Channel

Based on sales channel, the market is bifurcated into OEM and aftermarket. The OEMs segment accounted for the largest market share of more than 65.00% in 2023. The significant market share held by OEMs correlates with their proactive integration of telematics solutions directly into machinery during the manufacturing process. This approach ensures that a vast majority of construction equipment sold is equipped with telematics systems right from the point of sale, thus bolstering OEMs' market presence.

Moreover, the expansive distribution networks and direct sales channels of OEMs play a pivotal role in their market dominance. By leveraging these established channels, OEMs effectively bundle telematics offerings with machinery sales, thereby amplifying their market penetration and revenue generation capabilities. Furthermore, the expertise of OEMs in construction equipment design and engineering enables them to develop telematics solutions precisely tailored to the specifications and requirements of their machinery. This tailored approach enhances the appeal of OEM-integrated telematics systems, resulting in higher adoption rates among construction companies and strengthening OEMs' leading position in the market.

By Type

Based on type, the market is classified into tracking, diagnostic, fleet management, and others. Tracking telematics accounted for the largest market share of 33.00% in 2023 and is estimated to continue its dominance over 2024-2031. The prevalence of tracking telematics can be attributed to its fundamental role in providing real-time location monitoring and asset tracking capabilities for construction machinery. This functionality is essential for construction companies striving to optimize equipment utilization, enhance operational efficiency, and mitigate the risk of theft or unauthorized usage.

Moreover, tracking telematics solutions offer valuable insights into equipment movement patterns, job site productivity, and adherence to project timelines, enabling construction firms to make informed decisions and streamline their operations effectively. Additionally, the increasing adoption of tracking telematics is fueled by advancements in GPS technology, cloud computing, and wireless connectivity, which have improved the accuracy, reliability, and scalability of tracking solutions.

Construction Machinery Telematics Market Regional Analysis

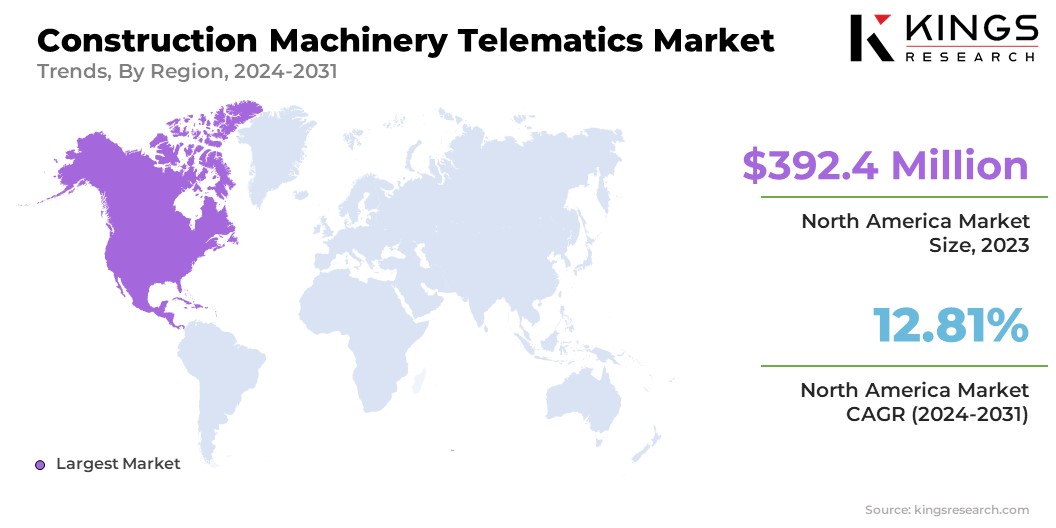

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Construction Machinery Telematics Market share stood around 28.16% in 2023 in the global market, with a valuation of USD 392.4 million. This significant market share can be attributed to North America's mature construction industry, which has adopted technological advancements such as telematics solutions to enhance operational efficiency and productivity. The substantial revenue figure underscores the region's proactive adoption of telematics systems across construction fleets, driven by stringent regulatory standards for safety, emissions, and equipment efficiency, which necessitate compliance and risk mitigation measures.

Moreover, North America's leadership in the market is bolstered by its advanced telecommunications infrastructure and the presence of established telematics solution providers. This facilitates seamless integration and widespread adoption of telematics solutions among construction companies. Furthermore, the region's commitment to innovation and R&D initiatives fosters continuous advancements in telematics technology, contributing to the introduction of cutting-edge features and integrated solutions tailored to the specific needs of North American construction firms.

Europe accounted for a substantial share of 23.11% in 2023. This substantial construction machinery telematics market share is indicative of Europe's robust construction sector, propelled by ongoing infrastructure development projects and a strong emphasis on technological integration to enhance operational efficiency and competitiveness. The anticipated CAGR reflects Europe's proactive approach toward adopting telematics solutions across construction fleets, driven by factors such as regulatory mandates for emissions reduction and equipment safety, which necessitate the implementation of telematics systems for compliance and performance optimization.

Furthermore, Europe's diverse and technologically sophisticated market landscape fosters innovation and collaboration among key industry players, leading to the development of advanced telematics solutions tailored to the unique needs and requirements of European construction companies. As Europe continues to utilize telematics technology to address evolving industry challenges and capitalize on emerging opportunities, the global market is poised to expand in the forthcoming years.

Competitive Landscape

The construction machinery telematics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Widely adopted strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, are positively influencing the market outlook.

List of Key Companies in Construction Machinery Telematics Market

- Caterpillar

- Komatsu

- AB Volvo

- Deere & Company

- J C Bamford Excavators Ltd.

- Trimble

- Geotab Inc.

- Hexagon AB

- Bosch Rexroth GmbH

- Liebherr-International Deutschland GmbH

Key Industry Development

- December 2023 (Acquisition) - Komatsu, a leading company in construction and mining equipment, acquired iVolve Holdings, a renowned provider of fleet management software. The acquisition, facilitated through Komatsu's subsidiary in Australia, marks a significant step for the company. iVolve specializes in offering its software solutions to miners, contractors, and quarries. With their innovative systems, users gain access to real-time data, enabling them to visualize operation management information and prioritize safety measures. The software has proven its effectiveness in both Australia and North America. This strategic acquisition by Komatsu fills a crucial gap in their portfolio, as it allows them to cater to mid-tier operations. By expanding its reach and targeting this specific market segment, Komatsu is set to enhance its overall offering and solidify its position in the industry.

The global Construction Machinery Telematics Market is segmented as:

By Machinery Type

- Crane

- Excavator

- Telescopic Handling

- Loaders and Backhoes

- Others

By Type

- Tracking

- Diagnostics

- Fleet Management

- Others

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership