Semiconductor and Electronics

Current Sensor Market

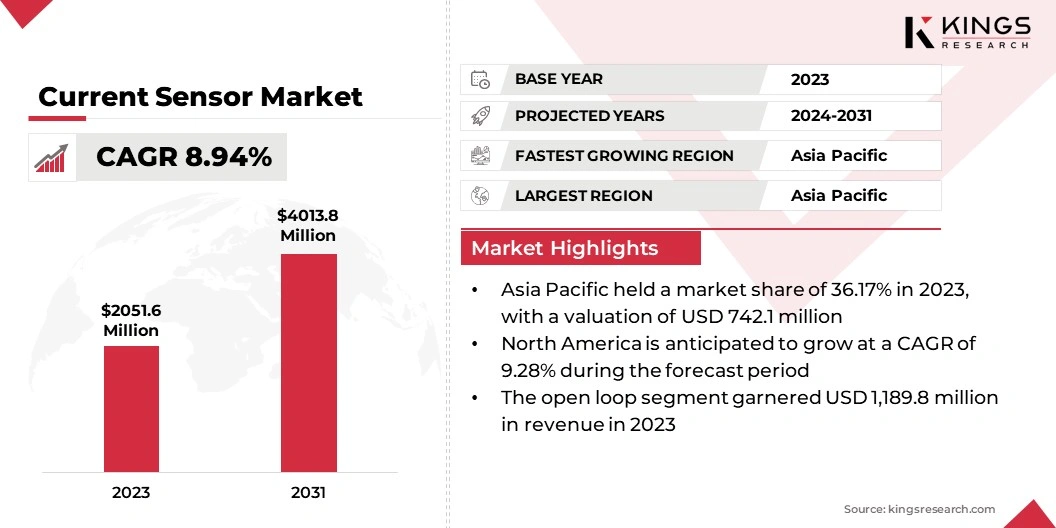

Current Sensor Market Size, Share, Growth & Industry Analysis, By Sensor Type (Open Loop, Closed Loop), By Sensing Type (Direct Current Sensing, Indirect Current Sensing), By Application (Motor drive, Converter & inverter, Battery management, UPS & SMPS, Starter & generators, Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1101

Current Sensor Market Size

Global Current Sensor Market size was recorded at USD 2,051.6 million in 2023, which is estimated to be valued at USD 2,204.2 million in 2024 and is projected to reach USD 4,013.8 million by 2031, growing at a CAGR of 8.94% from 2024 to 2031.

The market is experiencing significant growth driven by advancements in renewable energy technologies and the increasing adoption of automation across various industries. Industries are focusing on enhancing energy efficiency and optimizing operations, leading to a rising demand for accurate current measurement systems. Ongoing investments in smart manufacturing and energy management systems are further propelling market expansion and fostering innovation.

In the scope of work, the report includes solutions offered by companies such as Allegro, MicroSystems LLC, TDK-Micronas GmbH, Infineon Technologies AG, Melexis., Honeywell International Inc, Asahi Kasei Microdevices Corporation., ABB, NK Technologies, TAMURA Corporation, Vacuumschmelze GmbH & Co KG, and others.

The market is expanding rapidly, fueled by the Industry 4.0 revolution and the rising adoption of intelligent machines in industrial applications. With machines becoming more autonomous, the demand for sensors that monitor performance, usage, and failure is growing. These innovations are highlighting the need for current sensors to ensure efficiency, safety, and flexibility in industrial environments. Additionally, the automotive industry’s shift toward electric vehicles (EVs) and hybrid electric vehicles (HEVs) is augmenting current sensor market growth.

- According to the International Energy Agency, 300 million electric automobiles are expected to be on the road by 2030, accounting for over 60% of new car sales.

This rising adoption of EVs, coupled with the pressing need for power electronics efficiency in renewable energy systems, is bolstering the demand for current sensors.

Current sensors are devices used to measure the flow of electric current in a circuit. They operate by detecting the magnetic field around a conductor carrying current and translating this information into a readable signal for monitoring or control.

Current sensors come in various types, including Hall effect sensors, shunt resistors, and current transformers, each suited for different applications. They play a crucial role in a wide range of industries, including automotive, industrial automation, and renewable energy, ensuring efficient energy management, enhancing safety, and enabling real-time monitoring of electrical systems to optimize performance and reliability.

Analyst’s Review

Favorable government regulations are crucial to the growth of the electric vehicle (EV) industry. In response to rising climate change concerns and the need for sustainable transportation, several governments are implementing policies to promote EV adoption, thereby fostering current sensors market expansion.

- For instance, in early 2022, the European Union launched a substantial EUR 750 billion (USD 770.5 billion) stimulus package, allocating EUR 20 billion (USD 20.5 billion) to promote clean vehicle sales and install approximately 1 million electric and hydrogen vehicle charging stations by 2025.

- Moreover, in China, multiple initiatives aim to stimulate the automotive sector. In September 2022, the State Taxation Administration (STA), the Ministry of Finance (MOF), and the Ministry of Industry and Information Technology (MIIT) extended tax exemptions for new energy vehicle purchases.

As EV sales are expected to continue growing steadily, the demand for current sensors in the automotive sector is projected to increase significantly through the forecast period.

Current Sensor Market Growth Factors

The rapid growth of electric vehicles (EVs) is significantly increasing the demand for current sensors, which are integral to battery management systems (BMS).

- According to the International Energy Agency (IEA), electric car sales reached nearly 14 million in 2023, with 95% of those sales occurring in China, Europe, and the United States.

Current sensors facilitate precise measurement of electrical flow, optimizing battery performance, extending battery life, and enhancing safety by preventing overcharging or excessive heat generation. They are vital for monitoring energy consumption during charging and discharging cycles, making them essential for EVs and charging infrastructures. The global shift toward EV adoption to reduce carbon emissions is propelling the growth of the current sensor market, due to the increasing reliance on efficient BMS.

Current Sensor Market Trends

Current sensors are increasingly being incorporated into smart grid applications, enhancing the grid’s operational efficiency by providing accurate, real-time monitoring of power flow. These sensors are enabling utilities to better manage electricity distribution by improving load balancing, detecting faults swiftly, and allowing for predictive maintenance, which helps prevent downtime and costly repairs.

By offering continuous data on energy consumption and system performance, current sensors are playing a critical role in optimizing energy usage and supporting the integration of renewable energy sources. The current sensors market is witnessing significant growth as smart grids become essential for modernizing energy infrastructures and meeting the growing demand for reliable and sustainable power.

- According to the International Energy Agency (IEA), the European Commission unveiled the EU action plan “Digitalisation of the energy system” at the end of 2022, expecting about EUR 584 billion (USD 633 billion) in investments for the European electricity grid by 2030, including EUR 170 billion (USD 184 billion) allocated for digitalisation.

- China planned to invest USD 442 billion in and expanding its power grids from 2021 to 2025.

The hybrid electric vehicle (HEV) is rapidly gaining popularity as a green car option, resulting in a increasing demand for advanced current sensors. These vehicles utilize sophisticated electronic circuitry to control the flow of electric energy, optimizing power distribution between the electric motor and internal combustion engine.

In single-motor HEVs, the motor serves either as a drive motor or as a generator during regenerative braking to recharge the battery. As HEV adoption increases, the demand for current sensors in systems such as AC motors and DC-DC converters is rising.

- The European Alternative Fuels Observatory (EAFO) reports that Germany recorded 823,900 new registrations of plug-in electric cars in 2022, with battery electric vehicle (BEV) representing 56.36% of these sales.

This surge in electric vehicle adoption is further fueling the demand for high-precision current sensors, thereby fostering market expansion.

Segmentation Analysis

The global market has been segmented based on sensor type, sensing type, application, and geography.

By Sensor Type

Based on sensor type, the current sensor market has been categorized into open loop and closed loop. The open loop segment garnered the highest revenue of USD 1,189.8 million in 2023.

Open loop current sensors, primarily based on the Hall effect or magnetic sensing technology, are increasingly being utilized for their high accuracy and cost-effectiveness. This segment benefits from the growing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs), which require precise current monitoring for battery management systems.

Additionally, the rising adoption of smart grid technologies and energy management systems is fueling the demand for open loop sensors to enhance energy efficiency. With continuous advancements in sensor technology and increasing investments in infrastructure, the open loop segment is set to witness significant expansion in the coming years.

By Sensing Type

Based on sensing type, the market has been categorized into direct current sensing and indirect current sensing. The direct current sensing segment captured the largest current sensor market share of 60.51% in 2023.

DC current sensors, which provide precise measurements of current flow, are essential for battery management systems in EVs, ensuring optimal performance and safety. Additionally, the increasing deployment of renewable energy sources, such as solar and wind power, requires accurate DC current monitoring to maximize efficiency and reliability.

As industries focus on improving energy efficiency and implementing smart grid technologies, the demand for DC sensing solutions is growing significantly. Furthermore, ongoing innovations in sensor technology, including miniaturization and enhanced sensitivity, are expected to propel the growth of the segment.

By Application

Based on application, the market has been categorized into motor drive, converter & inverter, battery management, UPS & SMPS, starter & generators, and others. The motor drive segment is expected to garner the highest revenue of USD 1,234.6 million by 2031.

Current sensors are crucial for monitoring motor performance, ensuring efficient operation, and preventing damage through overload protection. The rise of electric vehicles (EVs) is significantly impacting this segment, as advanced motor control systems require precise current measurement for optimal performance and energy efficiency.

Moreover, the trend toward automation and the integration of smart technologies in manufacturing are boosting the demand for current sensors in motor drives. Rising focus of industries on improving operational efficiency and reducing energy consumption, is expected to further contribute to segmental expansion.

Current Sensor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific current sensor market accounted for the largest share of 36.17% in 2023, with a valuation of USD 742.1 million. This dominance is reinforced by population growth and rapid urbanization in developing economies such as India and China.

- According to the IEA, India's urban population is estimated to increase by approximately 270 million people by 2040, thereby increasing the demand for current sensors across sectors such as energy, automotive, telecom, and healthcare.

- The Consumer Electronics and Appliances Manufacturers Association projects that India's appliances and consumer electronics industry is expected to reach INR 1.48 lakh crore (USD 17.9 billion) by 2024-25, highlighting the need for integrated and programmable current sensors.

Additionally, Japan is investing significantly in renewable energy infrastructure, with initiatives worth billions to achieve net-zero emissions by 2050. For instance, Japan’s Green Growth Strategy includes a commitment to developing hydrogen energy technologies. Moreover, China's focus on electric vehicles, supported by government incentives such as tax exemptions for new energy vehicles, is expected to foster Asia-Pacific market .

North America current sensor market is anticipated to witness significant growth, registering a robust CAGR of 9.28% over the forecast period. This notable expansion is facilitated by the rise of smart grid technologies and automation in manufacturing.

Industries are increasingly focusing on enhancing energy efficiency and modernizing infrastructure, creating ample opportunities for current sensor manufacturers. With continuous innovations and a favorable regulatory environment, the regional market is poised to experience substantial expansion in the coming years.

- In October 2022, the BMW Group announced a USD 1.7 billion investment in its American facilities to produce electric vehicles and batteries. This project includes USD 700 million for a high-voltage battery assembly plant in Woodruff and USD 1 billion to upgrade the Spartanburg manufacturing facility in South Carolina for EV production.

BMW aims to manufacture at least six all-electric vehicles in the United States by 2030, leading to increased demand for current sensors. These factors are expected to boost the development of the North America market.

Competitive Landscape

The global current sensor market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Current Sensor Market

- Allegro MicroSystems LLC

- TDK-Micronas GmbH

- Infineon Technologies AG

- Melexis

- Honeywell International Inc

- Asahi Kasei Microdevices Corporation.

- ABB

- NK Technologies

- TAMURA Corporation

- Vacuumschmelze GmbH & Co KG

Key Industry Developments

- September 2023 (Product Launch): Melexis introduced the MLX91230, its third generation of current sensors. This innovative product offers 0.5 percent accuracy at a competitive price within a compact design. It features integrated IVT measurement capabilities and includes a microcontroller (MCU) to reduce processing demands on the ECU. Additionally, the MLX91230 comes with pre-installed safety features, making it an ideal solution for electric vehicle (EV) battery management and power distribution systems.

The global current sensor market is segmented as:

By Sensor Type

- Open Loop

- Closed Loop

By Sensing Type

- Direct Current Sensing

- Indirect Current Sensing

By Application

- Motor drive

- Converter & inverter

- Battery management

- UPS & SMPS

- Starter & generators

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership