Automotive and Transportation

CV Depot Charging Market

CV Depot Charging Market Size, Share, Growth & Industry Analysis, By Vehicle (eLCV, eMCV, eHCV, eBuses), By Type (AC charging, DC charging) and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : March 2025

Report ID: KR1461

Market Definition

The CV depot charging market is focused on providing charging infrastructure for commercial vehicles (CVs) at centralized depot locations. This market encompasses charging hardware, energy management systems, and related services designed to support fleet electrification for logistics, public transport, and last-mile delivery.

CV Depot Charging Market Overview

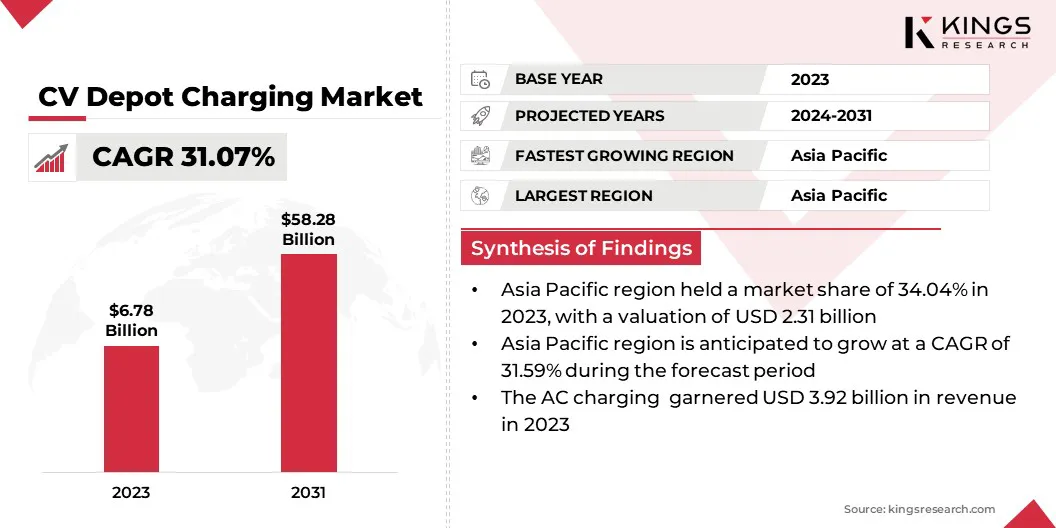

The global CV depot charging market size was valued at USD 6.78 billion in 2023 and is projected to grow from USD 8.77 billion in 2024 to USD 58.28 billion by 2031, exhibiting a CAGR of 31.07% over the forecast period.

The rapid market expansion is driven by the accelerating adoption of electric commercial vehicles (eCVs), stringent emissions regulations, and increasing investments in charging infrastructure. Fleet operators are prioritizing depot charging solutions to enhance operational efficiency, reduce downtime, and optimize energy management.

Major companies operating in the global CV depot charging industry are ABB, SETEC POWER Co., Ltd, Electrify America LLC, StarCharge, ChargePoint, Inc., Wallbox Chargers, BP p.l.c., Heliox Energy, EVgo Services LLC, Blink Charging Co., Delta Electronics, Inc., Schneider Electric SE, Shell, Juuce Limited, and Siemens.

Advancements in ultra-fast charging technologies, such as high-power DC chargers, are further enabling seamless fleet electrification. Strategic partnerships, mergers, and acquisitions are reshaping the competitive landscape, with key players focusing on scalability and developing intelligent charging solutions. As demand for eBuses and eTrucks surges, the need for reliable, high-capacity charging infrastructure will continue to drive market growth.

- For instance, in September 2024, Tata Power EV Charging Solutions Ltd and subsidiary of Tata Power Renewable Energy Ltd., signed an MoU with Tata Motors, India’s largest commercial vehicle manufacturer, to establish 200 fast-charging stations across metro cities. This initiative will help in advancing sustainable mobility for small electric commercial vehicles.

Key Highlights:

- The global CV depot charging market size was recorded at USD 6.78 billion in 2023.

- The market is projected to grow at a CAGR of 31.07% from 2024 to 2031.

- Asia Pacific held a market share of 34.04% in 2023, with a valuation of USD 2.31 billion.

- The eMCV segment garnered USD 2.15 billion in revenue in 2023.

- The AC charging segment is expected to reach USD 33.64 billion by 2031.

- Europe is anticipated to grow at a CAGR of 31.10% during the forecast period.

Market Driver

"Rising Fleet Electrification Initiatives"

The CV depot charging market is experiencing significant growth due to the increasing adoption of electric commercial vehicles (ECVs) by fleet operators. Governments and regulatory bodies worldwide are implementing stringent emission norms and offering incentives to accelerate the transition from internal combustion engine (ICE) vehicles to electric alternatives.

Logistics, public transport, and last-mile delivery companies are actively electrifying their fleets to meet sustainability goals, reduce fuel costs, and improve operations.

As fleet operators prioritize centralized, high-power charging solutions, the market is expected to winess continued expansion, with infrastructure providers focusing on scalable and cost-effective charging solutions tailored to commercial fleet requirements.

- In January 2025, the U.S. Department of Energy (DOE) invested USD 68 million in innovative heavy-duty EV charging solutions, boosting the market by advancing high-power charging infrastructure, reducing fleet operational costs, and accelerating commercial vehicle electrification across logistics and transportation sectors.

Market Challenge

"High Initial Infrastructure Costs"

The primary challenges in the CV depot charging market is the high upfront investment required for establishing charging infrastructure. Fleet operators have to invest in high-capacity chargers, grid upgrades, and energy management systems, which can strain capital expenditures.

To mitigate this challenge, fleet operators and charging infrastructure providers can explore innovative financing models such as leasing, public-private partnerships, and energy-as-a-service (EaaS) solutions.

Additionally, integrating smart energy management systems with renewable energy sources (e.g., solar or wind) and battery storage can help reduce grid dependency and optimize energy costs.

Market Trend

"Integration of Smart Charging and Energy Management Systems"

The key trend shaping the CV depot charging market is the integration of smart charging and energy management systems to enhance efficiency and reduce operational costs.

Depot charging requires significant power consumption, making energy optimization essential for fleet operators. Advanced load management solutions enable dynamic charging, balancing energy distribution across multiple vehicles without exceeding grid capacity or incurring peak demand charges.

Smart charging software utilizes AI-driven analytics to schedule charging based on real-time electricity tariffs, vehicle usage patterns, and grid availability. Additionally, demand response programs and battery energy storage solutions help optimize energy consumption, reduce costs, and enhance grid stability, making depot charging more sustainable and cost-effective.

- In January 2025, Schneider Electric and The Mobility House partnered to deploy smart charging solutions for EV fleets. This collaboration will likely enhance the market by optimizing energy management, reducing costs, and enabling seamless fleet electrification with intelligent charging infrastructure.

CV Depot Charging Market Report Snapshot

|

Segmentation |

Details |

|

By Vehicle |

eLCV, eMCV, eHCV, eBuses |

|

By Type |

AC charging, DC charging |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Vehicle (eLCV, eMCV, eHCV, eBuses): The eMCV segment earned USD 2.15 billion in 2023 due to increasing fleet electrification, supportive incentives, and growing demand for sustainable mid-duty commercial transport solutions.

- By Type (AC charging, DC charging): The AC charging held 57.86% of the market in 2023, due to lower installation costs, widespread adoption in depot-based overnight charging, and compatibility with existing grid infrastructure.

CV Depot Charging Market Regional Analysis

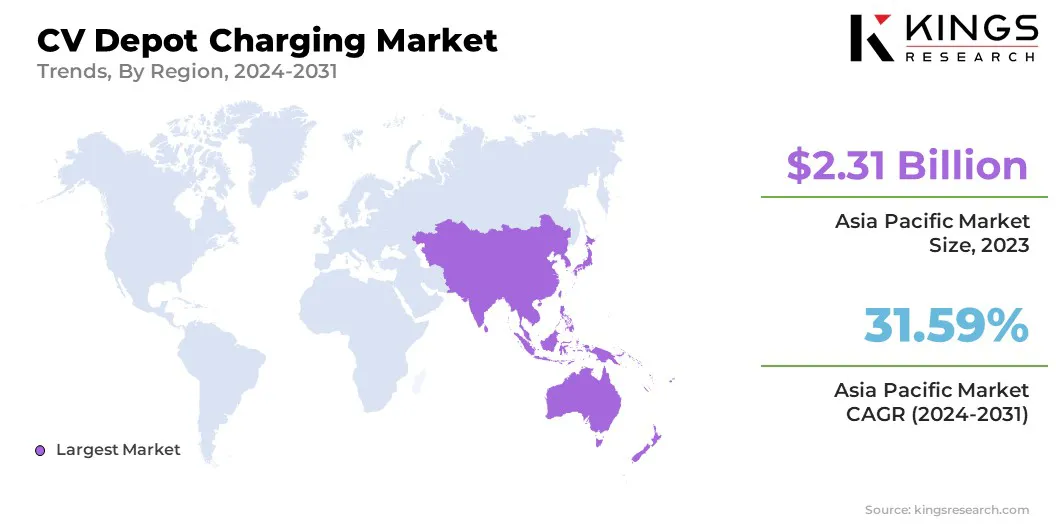

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific CV depot charging market share stood at around 34.04% in 2023 in the global market, with a valuation of USD 2.31 billion. The dominance is driven by government incentives, increasing electric commercial vehicle adoption, and expanding charging infrastructure.

Countries like China, India, and Japan are investing heavily in fleet electrification to reduce carbon emissions and enhance energy efficiency. China dominates the region due to strong policy support, extensive manufacturing capabilities, and a well-developed EV ecosystem.

India is witnessing significant advancements in the form of government initiatives promoting electric fleet adoption and strategic partnerships accelerating depot charging deployment.

Rising registrations and 'Make in India' manufacturing initiatives further fuel the demand for advanced depot charging solutions.The rising demand for sustainable logistics, combined with technological advancements in fast-charging and grid integration, further strengthens Asia Pacific’s market position.

- In August 2024, according to NITI Aayog, India aimed for 70% EV sales penetration in commercial vehicles by 2030, fueling the growth of the Market. This initiative drives fleet electrification, increasing investments in charging infrastructure, energy management, and depot charging solutions nationwide.

The CV depot charging industry in europe is poised to grow at a stagering CAGR of 31.10% over the forecast period, driven by strict emission regulations, increasing adoption of electric fleets, and large-scale investments in charging infrastructure.

The European Union’s Green Deal and national policies supporting electrification are accelerating the expansion of depot charging networks. Germany, the UK, France, and the Netherlands are leading this growth due to robust government funding, advanced EV manufacturing capabilities, and widespread deployment of high-power charging stations.

Moreover, public-private partnerships and grid modernization efforts are fueling market expansion, positioning Europe as a key player in the global market.

Regulatory Frameworks

- In the U.S., the Department of Energy (DOE) supports the market through funding, research, and policies that promote fleet electrification and grid integration. The Federal Energy Regulatory Commission (FERC) regulates interstate electricity transmission, wholesale pricing, and grid access, ensuring reliable energy distribution for large-scale depot charging infrastructure.

- In Europe, the Agency for the Cooperation of Energy Regulators (ACER) regulates the market by overseeing electricity grid policies, ensuring fair energy market practices, and facilitating cross-border energy integration to support efficient depot charging infrastructure.

- In India, the Ministry of Power (MoP) regulates the CV depot charging market by formulating policies for EV) charging infrastructure. MoP ensures grid integration, tariff regulations, and nationwide deployment of charging stations to support fleet electrification, promoting sustainable mobility and efficient energy management for commercial vehicle operators.

Competitive Landscape

The global CV depot charging market is characterized bymany major and minor participants. Companies are focusing on strategic partnerships, mergers & acquisitions, and technological advancements to strengthen their market position.

Industry participants are investing in high-power depot charging solutions, smart energy management systems, and seamless grid integration to meet the growing demand for fleet electrification. Emerging players are introducing cost-effective, modular, and scalable charging solutions tailored for commercial fleets.

Innovations in battery storage, vehicle-to-grid (V2G) technology, and AI-driven charging optimization are reshaping the competitive landscape. Additionally, government incentives and funding programs are fostering new entrants, further intensifying competition.

Market leaders are expanding their global presence through regional collaborations and infrastructure deployment projects, ensuring widespread adoption of CV depot charging solutions to support the increasing demand for sustainable, electric fleet operations worldwide.

- In December 2023, Ford Pro partnered with Xcel Energy to deploy 30,000 EV charging ports by 2030, reducing upfront costs for qualifying fleet customers and expanding CV depot charging infrastructure across Xcel’s U.S. service territories.

List of Key Companies in CV Depot Charging Market:

- ABB

- SETEC POWER Co., Ltd

- Electrify America LLC

- StarCharge

- ChargePoint, Inc.

- Wallbox Chargers

- BP p.l.c.

- Heliox Energy

- EVgo Services LLC

- Blink Charging Co.

- Delta Electronics, Inc.

- Schneider Electric SE

- Shell

- Juuce Limited

- Siemens

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In April 2024, Daimler Truck AG announced Greenlane Infrastructure’s first U.S. EV charging corridor for commercial vehicles. Greenlane, a joint venture of Daimler Truck North America, NextEra Energy Resources, and BlackRock’s Climate Infrastructure fund, aims to develop a high-performance, zero-emission public charging and hydrogen refueling network for medium- and heavy-duty electric and hydrogen fuel cell vehicles.

- In April 2024, Delta launched the 500kW UFC 500 DC charger, addressing high-power CV depot charging needs. With a superior power-to-footprint ratio, it enables efficient eBus and eTruck charging, optimizing land use while supporting full-day operations through rapid charging within 2 hours.

- In February 2024, Electrify America and NFI launched a cutting-edge CV depot charging facility in Ontario, CA, to support 50 heavy-duty electric trucks. With 7 MW capacity and 38 fast chargers, this project accelerates fleet electrification and enhances sustainable drayage operations between the Ports of Los Angeles and Long Beach.

- In August 2023, Siemens acquired Heliox to strengthen its position in the market, enhancing eBus and eTruck fast-charging solutions. This strategic move expands Siemens’ EV infrastructure portfolio, driving efficiency and scalability in fleet electrification to meet growing demand for sustainable commercial vehicle operations.

- In June 2023, Schneider opened a large-scale electric charging depot at its South El Monte Intermodal Operations Center, supporting its growing BET fleet. With nearly 100 Freightliner eCascadias by year-end, this move strengthens its position in the market and advances zero-emission freight operations in North America.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)