ICT-IOT

Data Center Interconnect Market

Data Center Interconnect Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Services), By Application (Disaster Recovery and Business Continuity, Shared Data and Resources), By End-User (Communications Service Providers, Enterprise & Others), and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : April 2025

Report ID: KR1666

Market Definition

The market focuses on technologies that enable high-speed, secure, and efficient data transfer between data centers. These interconnections facilitate seamless data exchange, workload mobility, disaster recovery, and cloud connectivity, ensuring performance and scalability for enterprises, cloud service providers, and telecom operators.

DCI leverage optical networking, ethernet, and software-defined networking (SDN) technologies to support growing data demands, minimize latency, and enhance network resilience.

Data Center Interconnect Market Overview

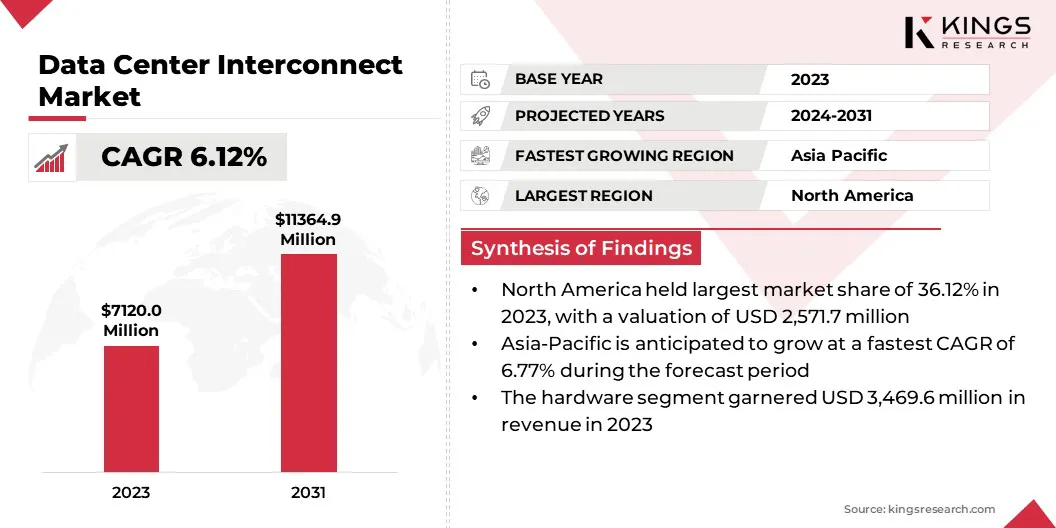

The global data center interconnect market size was valued at USD 7,120.0 million in 2023 and is projected to grow from USD 7,499.4 million in 2024 to USD 11,364.9 million by 2031, exhibiting a CAGR of 6.12% during the forecast period.

This growth is driven by the increasing adoption of cloud computing, big data analytics, and the rising need for seamless data exchange between geographically distributed data centers. Enterprises, cloud service providers, and telecom operators are investing heavily in advanced interconnect solutions to enhance network scalability, support disaster recovery, and optimize workload mobility.

Major companies operating in the data center interconnect industry are Cisco Systems, Inc., Nokia, Huawei Technologies Co., Ltd, Juniper Networks, Inc., Extreme Networks., Dell Inc., Ciena Corporation, Equinix, Inc., Adtran, NEC Corporation, Fujitsu, Microchip Technology Inc., Colt Data Centre Services Holdings., Microsoft, and Oracle.

Innovations in optical networking, software-defined networking, and wavelength-division multiplexing (WDM) are further fueling market expansion. Additionally, the rising need for multi-cloud and hybrid cloud architectures is creating a strong demand for efficient data center interconnection, ensuring seamless data transfer across geographically dispersed locations.

- In September 2024, DE-CIX India launched its Data Center Interconnection services, enabling seamless, high-speed connectivity between data centers. Leveraging robust interconnection infrastructure, the service offers scalability, redundancy, and cost efficiency, supporting both layer 2 and layer 3 connectivity.

Key Highlights

- The data center interconnect industry size was recorded at USD 7,120.0 million in 2023.

- The market is projected to grow at a CAGR of 6.12% from 2024 to 2031.

- North America held a share of 36.12% in 2023, valued at USD 2,571.7 million.

- The hardware segment garnered USD 3,469.6 million in revenue in 2023.

- The shared data and resources segment is expected to reach USD 4,675.9 million by 2031.

- The government/research and education segment is anticipated to witness the fastest CAGR of 4.14% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 6.77% over the forecast period.

Market Driver

Advancements in Optical Networking and SDN

Advancements in optical networking and software-defined networking are propelling the growth of the market by improving speed, scalability, and efficiency. Technologies such as wavelength-division multiplexing (WDM) and coherent optical transmission enable high-bandwidth, low-latency data transfer over long distances.

Software-defined networking enhances flexibility by enabling centralized control, automation, and dynamic traffic management, reducing operational costs and improving security. These innovations support the growing demands of cloud computing, AI, and big data while optimizing network performance.

- In March 2025, Sumitomo Electric Industries, Ltd. partnered with 3M to develop expanded beam optical interconnect technology for data centers. This collaboration aims to enhance performance and reliability in optical connectivity solutions.

Market Challenge

Complex Network Management and High Deployment Costs

Complex network management poses a considerable challenge to the progress of the data center interconnect market, supported by the need to oversee multiple data centers, cloud environments, and service providers while ensuring seamless connectivity, security, and performance.

The diversity of infrastructures, network protocols, and traffic demands requires advanced automation, software-defined networking solutions, and real-time monitoring, adding to operational complexity.

Furthermore, high deployment costs present a significant barrier as data center interconnect solutions require substantial investment in optical networking equipment, fiber infrastructure, and software-defined management systems. Upgrading to high-bandwidth, low-latency connections also incurs ongoing maintenance, energy, and skilled labor costs, making scalability costly.

To address this challenge, organizations are adopting software-defined networking and automation to simplify operations, enhance visibility, and optimize traffic management. Implementing AI-driven analytics and orchestration tools can improve network efficiency while reducing manual intervention.

Businesses are further leveraging network function virtualization (NFV) to reduce hardware dependency and adopt pay-as-you-go models for scalable investments. Additonally, strategic partnerships with cloud providers and shared infrastructure models are contributing to lower costs.

Additionally, advancements in energy-efficient optical networking help minimize operational expenses while ensuring high-performance, cost-effective data center interconnect solutions.

Market Trend

Expansion of 400G and Beyond Optical Networking

The expansion of 400G and beyond optical networking is influencing the market by enabling higher bandwidth, lower latency, and more energy-efficient data transmission. The widespread adoption of 400G, 800G, and terabit-scale optical networks is propelled by advancements in coherent optical transmission, dense wavelength-division multiplexing (DWDM), and silicon photonics.

These technologies enhance fiber capacity while reducing power consumption and cost per bit. Additionally, network operators are investing in intelligent automation and software-defined networking to optimize traffic management and enhance scalability.

- In September 2024, Nippon Telegraph and Telephone Corporation, in partnership with IP Infusion Inc., ACCESS, Ltd, and others, launched the IOWN Network Solution (400G), a high-speed 400Gbps inter-data center connectivity solution. By integrating IOWN technology with a disaggregated switch/router, the solution enables long-distance transmission using 400G ZR/ZR+ optical transceivers, reducing network costs by 50% and power consumption by 40%.

Data Center Interconnect Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Hardware, Software, Services |

|

By Application |

Disaster Recovery and Business Continuity, Shared Data and Resources, Data and Workload Mobility, Others (Content Delivery, Cloud Connectivity) |

|

By End-User |

Communications Service Providers (CSPs), Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs), Government/Research and Education, Enterprise |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 3,469.6 million in 2023, mainly due to rising demand for high-performance networking equipment for data traffic and scalability.

- By Application (Disaster Recovery and Business Continuity, Shared Data and Resources, Data and Workload Mobility, and Others (Content Delivery, Cloud Connectivity)): The shared data and resources segment held a share of 39.49% in 2023, attributed to the growing need for seamless data access, collaboration, and real-time processing across distributed data centers.

- By End-User (Communications Service Providers (CSPs), Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs), Government/Research and Education, and Enterprise): The internet content providers and carrier-neutral providers (ICPs/CNPs) segment is projected to reach USD 5,657.7 million by 2031, propelled by the rising demand for high-speed connectivity, scalable infrastructure, and seamless content delivery fueled by cloud services, streaming, and AI applications.

Data Center Interconnect Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America data center interconnect market share stood at around 36.12% in 2023, with a valuation of 2,571.7 million. This dominance is attributed to the presence of major cloud service providers, hyperscale data centers, and technological advancements in optical networking and software-defined networking.

The regional market benefits from strong digital infrastructure, high internet penetration, and increasing investments in AI and big data applications. Additionally, the growing demand for low-latency, high-bandwidth connectivity across enterprises and content providers is fueling regional market growth.

Asia-Pacific data center interconnect industry is estimated to grow at a CAGR of 6.77% over the forecast period. This expansion is bolstered by digital transformation, increasing cloud adoption, and surging data traffic across key economies such as China, India, and Southeast Asia.

The proliferation of hyperscale data centers, the rollout of 5G networks, and government-led digital infrastructure initiatives further support regional market growth. Moreover, the growing adoption of AI, IoT, and big data analytics is creating a strong demand for high-speed, low-latency connectivity, while substantial investments from global technology companies are strengthening network capacity and scalability across the region.

- In October 2024, HGC Global Communications Limited launched data center interconnect clusters across key Asian hubs, enhancing regional and cross-border connectivity. Leveraging its extensive infrastructure, HGC offers low-latency, scalable solutions, supporting AI-driven demands and seamless market access for global enterprises.

Regulatory Frameworks

- In the US, the Federal Communications Commission (FCC), under the Telecommunications Act of 1996, regulates data transmission infrastructure to promote competition, network expansion, and equitable interconnection. It ensures non-discriminatory access to network facilities, fostering innovation and secure data exchange across digital networks.

- In the EU, the Data Governance Act (DGA) enhances trust in data sharing, increases data availability, and addresses barriers to data reuse.

- In India, the Digital Personal Data Protection Act, 2023, governs the processing of personal digital data, balancing individual rights with lawful data usage.

- In the European Union, the network and information systems (NIS)2 Directive (Directive (EU) 2022/2555) establishes a unified cybersecurity framework across 18 critical sectors, requiring Member States to implement national strategies covering supply chain security, vulnerability management, and cybersecurity education.

Competitive Landscape

The data center interconnect market is characterized by intense competition, with companies focusing on innovation, scalability, and efficiency to gain a competitive edge. Advancements in optical transport, wavelength-division multiplexing (WDM), and software-defined networking are shaping the market landscape.

Strategic partnerships, mergers, and cost-effective solutions further intensify competition as companies strive to enhance network performance, security, and operational efficiency.

- In February 2025, STMicroelectronics introduced advanced silicon photonics and BiCMOS technologies to enhance optical interconnects for data centers and AI clusters. Designed for future 800Gb/s and 1.6Tb/s links, these innovations support energy-efficient pluggable optics and next-generation GPU interconnects in AI computing.

List of Key Companies in Data Center Interconnect Market:

- Cisco Systems, Inc.

- Nokia

- Huawei Technologies Co., Ltd

- Juniper Networks, Inc.

- Extreme Networks.

- Dell Inc.

- Ciena Corporation

- Equinix, Inc.

- Adtran

- NEC Corporation

- Fujitsu

- Microchip Technology Inc.

- Colt Data Centre Services Holdings.

- Microsoft

- Oracle

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, Kyndryl and Nokia expanded their partnership to deliver advanced data center networking solutions for global enterprises. By integrating Kyndryl’s expertise in hybrid cloud and data center management with Nokia’s secure, high-performance networking solutions, the partnership enables enterprises to modernize and expand their data center networks efficiently.

- In December 2024, Marvell Technology, Inc. launched Marvell Aquila, the first coherent-lite DSP featuring a 1.6 Tbps O-band optimized digital signal processor for data center campus connectivity. By combining advanced coherent modulation with scalable O-band optics, Aquila DSP enhances power efficiency and performance for high-bandwidth, low-latency interconnects up to 20 km.

- In October 2024, Elea Data Centers was chosen to host DE-CIX’s first Internet Exchanges in South America, with Points of Presence (PoPs) established at its São Paulo-SPO1 and Rio de Janeiro-RJO1 facilities, strengthening regional interconnection services.

- In August 2024, VA Telecom, a French B2B connectivity provider, selected Ribbon Communications' Apollo 9608D platform to enhance data center interconnectivity. The solution enables ultra-fast 400G data transfers, supports high-speed fibre channel services, and ensures scalable, secure optical transport.

- In January 2024, Digital Realty opened its first Indian data center, MAA10, located on a 10-acre campus in Chennai. With a capacity of up to 100 megawatts of IT load, this facility expands the company’s global platform to meet growing digital transformation demands.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)