Healthcare Medical Devices Biotechnology

Dermatology Devices Market

Dermatology Devices Market Size, Share, Growth & Industry Analysis By Application (Skin Cancer, Hair Removal, Acne, Psoriasis, Wrinkle Removal, Skin Rejuvenation, Others), By End-User (Hospitals, Dermatology Clinics, Others), By Product Type (Diagnostic Devices, Treatment Devices), and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : February 2025

Report ID: KR1341

Market Definition

The dermatology devices industry involves the development, manufacturing, and distribution of medical devices used for the diagnosis, treatment, and management of various skin conditions. This market includes devices employed in procedures such as skin resurfacing, hair removal, acne treatment, tattoo removal, and anti-aging therapies.

Technologies such as lasers, radiofrequency, and light therapy are commonly utilized for non-invasive or minimally invasive treatments, serving both cosmetic and therapeutic dermatology applications.

Dermatology Devices Market Overview

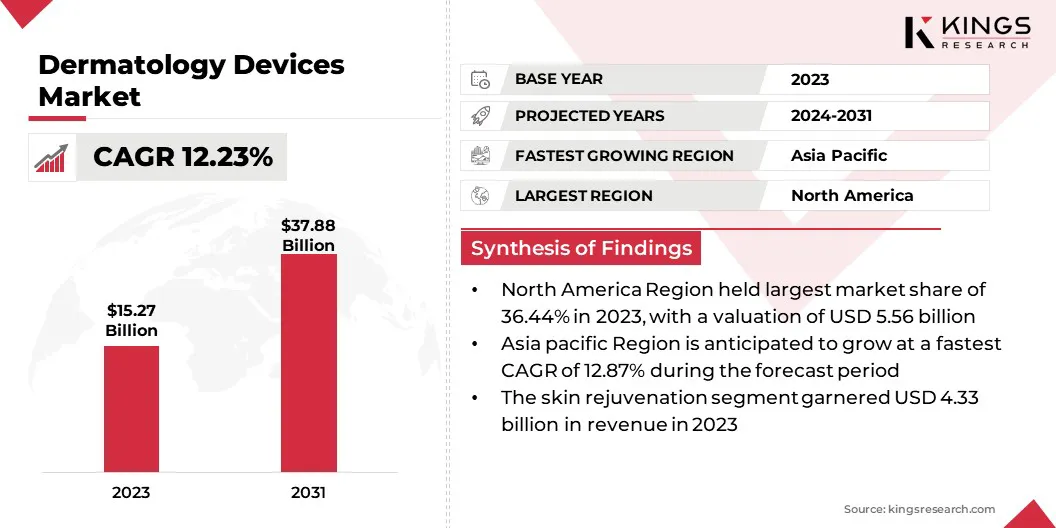

The global dermatology devices market size was valued at USD 15.27 billion in 2023 and is projected to grow from USD 16.89 billion in 2024 to USD 37.88 billion by 2031, exhibiting a CAGR of 12.23% during the forecast period.

The market is growing rapidly, due to the rising prevalence of skin disorders, increasing demand for minimally invasive cosmetic procedures, and technological advancements. Key drivers include AI integration, laser treatments, medical tourism, and improved diagnostic tools.

Government investments and tele-dermatology services further boost the market, though high costs and regulatory challenges may hinder expansion.

Major companies operating in the dermatology devices market are Alma Lasers, Bruker, ZEISS Group, Cutera, Inc, Galderma, Lumenis Be Ltd, AbbVie Inc, Candela Corporation, GSK plc, Hologic, Inc, photomedex.com, Johnson & Johnson Services, Inc, Cynosure, LLC, Solta Medical Inc, and Canfield Scientific, Inc.

The integration of artificial intelligence (AI) in dermatology devices, increasing adoption of laser treatments for esthetic and medical purposes, and the expanding medical tourism industry are contributing to the market growth. The availability of innovative diagnostic tools, such as AI-powered imaging systems for early skin cancer detection, is enhancing patient outcomes and fueling market demand.

- In June 2024, Canfield Scientific announced advancements in AI-driven imaging systems to enhance dermatology consultations. These innovations improve diagnostic accuracy, streamline workflows, and support early detection, revolutionizing precision and efficiency in dermatological care.

Key Highlights:

- The dermatology devices industry size was valued at USD 15.27 billion in 2023.

- The market is projected to grow at a CAGR of 12.23% from 2024 to 2031.

- North America held a market share of 36.44% in 2023, with a valuation of USD 5.56 billion.

- The treatment devices segment garnered USD 8.94 billion in revenue in 2023.

- The skin rejuvenation segment is expected to reach USD 9.36 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 12.87% during the forecast period.

Market Driver

"Growing Demand for Esthetic Procedures"

The growing demand for esthetic procedures is a major driver of the dermatology devices market, fueled by increasing beauty awareness, social media influence, and technological advancements. Consumers are increasingly opting for non-invasive and minimally invasive treatments such as laser hair removal, skin tightening, and anti-aging procedures, due to their effectiveness and shorter recovery times.

- The Elite iQ Pro by Cynosure is a versatile laser platform designed for a variety of esthetic treatments, including hair removal, skin rejuvenation, and pigmentation correction. It combines advanced technology with intelligent features to deliver personalized treatments, ensuring optimal results for patients. The device is known for its speed, effectiveness, and precision, making it a popular choice for both practitioners and patients seeking high-quality, non-invasive cosmetic solutions.

The rising popularity of energy-based devices, including lasers and radiofrequency treatments, has led to innovations by companies like Cutera, Cynosure, and Alma Lasers.

Social media and celebrity endorsements have significantly influenced consumer preferences, making esthetic dermatology treatments more mainstream. As disposable income rises and technology improves, the demand for these procedures is expected to grow further.

Market Challenge

"Strict Regulatory Requirements"

Stringent regulatory approvals is a key challenge in the dermatology devices market. Devices must undergo rigorous testing and meet strict safety and efficacy standards set by regulatory bodies like the FDA and EMA.

This process, involving clinical trials and extensive documentation, can delay product launches and increase costs. It creates barriers for smaller companies and slows the adoption of new technologies like lasers and AI-driven tools in the market.

Companies can take several steps to streamline the process. Early engagement with regulatory authorities helps clarify requirements and ensures compliance from the start. Investing in thorough research and well-designed clinical trials provides the necessary data to support safety and efficacy claims, potentially speeding up approvals.

Collaborating with regulatory consultants can also be beneficial, as their expertise helps companies navigate complex regulatory landscapes more efficiently.

Market Trend

"Growth in Non-Invasive Treatments"

Growth in non-invasive treatments is a major trend in the dermatology devices market, as patients increasingly seek effective procedures with minimal recovery time.

Treatments like laser hair removal, skin resurfacing, acne treatments, and wrinkle reduction through injectables such as botox and dermal fillers are becoming mainstream, due to their convenience and safety.

- In April 2023, Alma Lasers introduced the Harmony XL Pro, a versatile platform offering a range of non-invasive esthetic treatments. It combines advanced technologies like laser, intense pulsed light (IPL), and radiofrequency to provide effective solutions for skin rejuvenation, acne treatment, hair removal, and pigmentation correction. With minimal downtime, the device caters to both cosmetic and medical dermatology practices, delivering precision and efficiency in patient care.

The growing focus on esthetics, along with consumers seeking affordable yet effective solutions, has led to significant advancements in radiofrequency (RF) and ultrasound technologies for skin tightening and collagen stimulation. The popularity of these treatments has been fueled by rising disposable income and an increase in wellness awareness, particularly in regions with high consumer spending power.

Dermatology Devices Market Report Snapshot

|

Segmentation |

Details |

|

By Application |

Skin Cancer, Hair Removal, Acne, Psoriasis, Wrinkle Removal, Skin Rejuvenation, Others |

|

By End-User |

Hospitals, Dermatology Clinics, Others |

|

By Product Type |

Diagnostic Devices, Treatment Devices |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Application (Skin Cancer, Hair Removal, Acne, Psoriasis, Wrinkle Removal, Skin Rejuvenation, Others): The skin rejuvenation segment earned USD 3.41 billion in 2023, driven by the rising demand for non-invasive esthetic treatments, advancements in laser and energy-based technologies, and increasing consumer awareness of anti-aging solutions.

- By End-User (Hospitals, Dermatology Clinics, Others): The hospitals segment held 46.51% share of the market in 2023, driven by the growing number of patients seeking advanced dermatological treatments and the increasing adoption of state-of-the-art dermatology devices in hospital settings.

- By Product Type (Diagnostic Devices, Treatment Devices): The treatment devices segment earned USD 8.94 billion in 2023, driven by the increasing demand for non-invasive and minimally invasive procedures, as well as advancements in technologies such as lasers, radiofrequency, and light-based treatments for skin conditions.

Dermatology Devices Market Regional Analysis

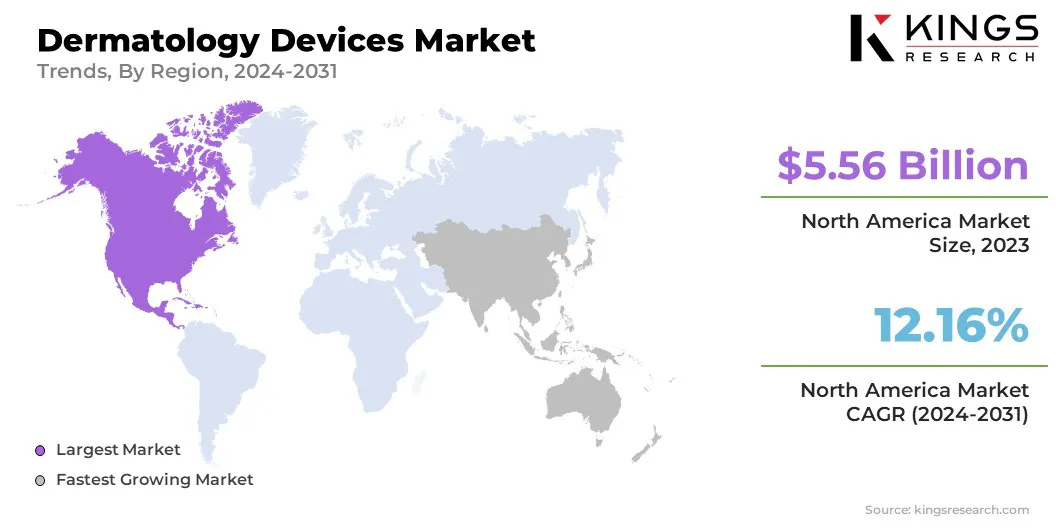

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a significant dermatology devices market share of around 36.44% in 2023, valued at USD 5.56 billion. This market leadership is attributed to the high prevalence of skin-related conditions, rising demand for esthetic treatments, and continuous advancements in dermatological technologies.

The region benefits from a well-established healthcare infrastructure, a large number of dermatology clinics, and an increasing emphasis on skincare, all of which contribute to the growing demand for non-invasive procedures and innovative dermatology devices.

- In 2024, Candela’s GentleMax Pro laser system is highlighted for its dual technology—Alexandrite and Nd:YAG lasers—offering effective hair removal and skin rejuvenation. It is known for its precision and minimal discomfort, making it popular in dermatology and medspa settings for various esthetic treatments, including deeper skin rejuvenation. This system provides long-lasting results across multiple skin types.

The dermatology devices industry in Asia Pacific is poised to grow at a CAGR of 12.87% through the projection period. This growth is attributed to increasing awareness of skin health, rising disposable incomes, and improved access to healthcare services.

The demand for advanced esthetic treatments and dermatology technologies is expanding, with emerging markets in countries like China and India playing a key role in driving the market in the region.

- In June, 2023, Crown Aesthetics announced its strategic expansion into Asia Pacific. The company is set to introduce its advanced esthetic products and services to key markets, including China, Japan, and South Korea. This move aims to capitalize on the growing demand for non-invasive skin care and esthetic treatments in these rapidly developing markets.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Food and Drug Administration (FDA) 510(k) Premarket Notification process is a regulatory framework for moderate-risk devices. It requires manufacturers to prove that their new device is substantially equivalent to an already marketed device. The submission includes design, performance data, and labeling. If the FDA confirms equivalence, the device can be marketed. This process speeds up the approval for devices that do not pose significant risk.

- In Europe, the European Medicines Agency (EMA) regulates medical devices in the European Union (EU) under the Medical Devices Regulation (MDR) and In-vitro Diagnostic Devices Regulation (IVDR). The EMA ensures device safety and performance through market surveillance and post-market monitoring. Devices must undergo rigorous testing and clinical evaluations to obtain CE marking before being sold. The agency also monitors ongoing compliance to safeguard public health.

- In India, Medical Device Rules regulate dermatology devices under the Central Drugs Standard Control Organization (CDSCO). Devices are classified by risk, with higher-risk devices needing extensive testing and approval. Compliance with Indian standards and CE certification is crucial for ensuring the safety and effectiveness of devices used in dermatology treatments.

- In Europe, the Medical Device Regulation (MDR) introduced in May 2021 impacts medical device manufacturers, distributors, and clinicians, including dermatologists. The regulation tightens control over devices and software, requiring more clinical evidence for safety and efficacy. This will result in improved device quality and safety but may lead to higher costs, longer approval times, and potential market consolidation. Existing devices that do not meet MDR standards will no longer be manufactured after 2024.

Competitive Landscape

Companies should prioritize continuous innovation to gain a competitive edge in the dermatology devices industry, focusing on advanced technologies that meet consumer needs.

Emphasizing safety, patient comfort, and treatment efficacy will be crucial. Expanding into emerging markets, fostering strategic partnerships, and enhancing brand presence can further strengthen market position.

- In May 2024, Revance expanded into the U.S. therapeutics market with the launch of DAXXIFY for the treatment of cervical dystonia. DAXXIFY is the first botulinum toxin treatment using peptide exchange technology, providing a long-lasting effect compared to other options. This launch marks a significant milestone for Revance as it broadens its portfolio, introducing a new therapeutic option for patients with cervical dystonia.

List of Key Companies in Dermatology Devices Market:

- Alma Lasers

- Bruker

- ZEISS Group

- Cutera, Inc

- Galderma

- Lumenis Be Ltd

- AbbVie Inc

- Candela Corporation

- GSK plc

- Hologic, Inc

- com

- Johnson & Johnson Services, Inc

- Cynosure, LLC

- Solta Medical Inc

- Canfield Scientific, Inc.

Recent Developments:

- In September 2024, ArchiMed, a private equity firm based in Europe, acquired Jeisys Medical, a leading South Korean company specializing in esthetic medicine devices. Jeisys Medical is known for its energy-based technologies used in non-invasive treatments like wrinkle reduction and acne therapy. This acquisition marks ArchiMed's first investment in Asia and strengthens its portfolio in the growing medical esthetics industry.

- In August 2024, L'Oréal acquired a 10% stake in Galderma, a global leader in dermatology, marking a strategic move into medical esthetics. This partnership enhances L'Oréal's presence in the dermatology devices market, particularly in anti-wrinkle injectables and other skin care treatments, further strengthening its portfolio in the growing medical aesthetics industry.

- In August 2024, Alma Lasers and Prollenium announced their collaboration to bring innovative esthetics solutions to the market. The partnership combines Alma’s expertise in energy-based devices with Prollenium’s advanced dermal fillers, aiming to offer enhanced treatment options for patients. This alliance strengthens both companies' positions in the growing global market, providing practitioners with a broader range of effective, non-invasive solutions for skin rejuvenation and enhancement.

- In August 2024, Candela Medical launched the Profound Matrix System for skin rejuvenation and expanded the Vbeam laser to treat port wine stains in pediatric patients. The PicoWay platform also received FDA clearance for treating melasma, underscoring Candela's focus on advancing non-invasive dermatology solutions.

- In August 2024, Cutera announced an exclusive distribution agreement with L’Oréal. This collaboration aims to expand the availability of Cutera’s dermatology devices through L’Oréal’s global distribution network. By combining their strengths, the two companies aim to enhance access to advanced, non-invasive skin treatments and address the growing demand for esthetic solutions globally.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)