Consumer Goods

Diamond Jewelry Market

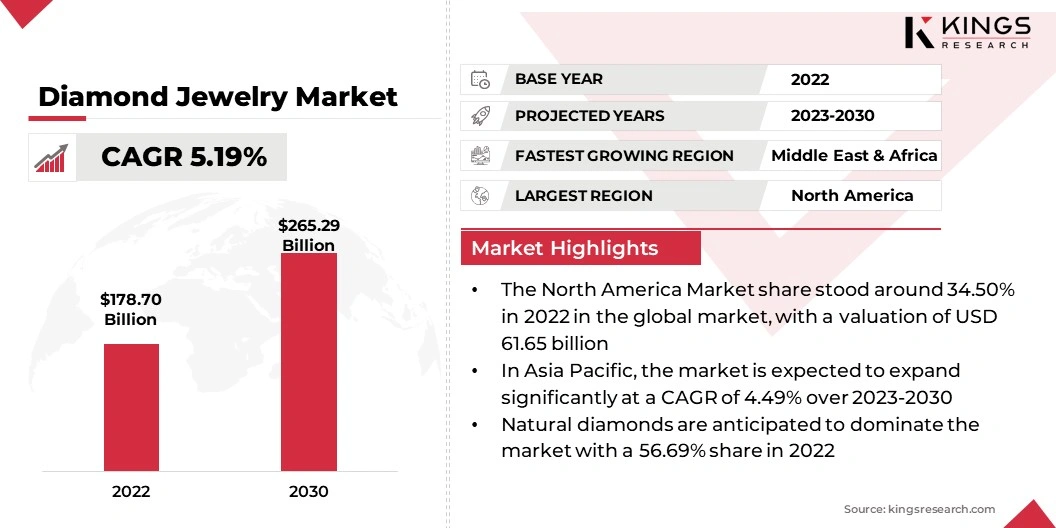

Diamond Jewelry Market Size, Share, Growth & Industry Analysis, By Type (Natural Diamond, Lab-grown Diamond), By Jewelry Type (Rings, Earrings, Necklaces, Pendants, Others), By Consumer Orientation (Men, Women), By Sales Channel (Online, Offline) and Regional Analysis, 2023-2030

Pages : 120

Base Year : 2022

Release : January 2024

Report ID: KR349

Diamond Jewelry Market Size

The global Diamond Jewelry Market size was valued at USD 178.70 billion in 2022 and is projected to reach USD 265.29 billion by 2030, growing at a CAGR of 5.19% from 2023 to 2030. In the scope of work, the report includes products offered by companies such as Tiffany & Co., Bulgari S.p.A., Cartier, Signet Jewelers, De Beers plc, Pandora Jewelry, LLC, Chow Tai Fook Jewellery Group Limited, Swarovski AG, Petra Diamonds Limited, Trans Hex Group, and Others.

The market is a thriving segment within the global luxury goods industry. Diamonds, known for their rarity, brilliance, and enduring value, have consistently held a special place in the hearts of consumers. The market encompasses a wide range of products, including engagement rings, necklaces, earrings, bracelets, and more.

These exquisite pieces of diamond jewelry are not only symbols of love and commitment but also cherished heirlooms that can be passed down from generation to generation. With advancements in technology, the market has also embraced innovative designs and cuts, offering consumers a plethora of options. Whereas, in the vast market of diamond jewelry, one can find a wide range of options that cater to the distinct tastes and preferences of individuals.

Key factors driving the growth of the diamond jewelry market include the enduring appeal of diamonds as symbols of love, status, and elegance, as well as their use in various cultural and social traditions. In addition, the increasing urbanization and rising disposable income levels in emerging economies have also contributed to the growth of the market.

The desire for luxury and the influence of celebrity endorsements have further fueled the demand for diamond jewelry. Moreover, technological advancements in diamond cutting and polishing techniques have enhanced the quality and brilliance of diamonds, making them even more desirable among consumers.

Analyst’s Review

The market is influenced by several key drivers that shape its growth and dynamics. Firstly, consumer demand plays a pivotal role, driven by factors such as increasing disposable incomes, changing consumer preferences, and a desire for luxury and status symbols. Besides this, the market is heavily influenced by global economic conditions. When the economy is strong, consumers have more confidence to spend on luxury items like diamond jewelry.

Conversely, during economic downturns, consumers may prioritize essential goods over luxury purchases, leading to a decline in demand for diamond jewelry. Additionally, the market is impacted by cultural and social factors, as different societies have varying levels of appreciation and demand for these precious gemstones.

Market Definition

The diamond jewelry market encompasses the global trade and consumer demand for jewelry items that feature diamonds as their primary or prominently featured gemstones. Diamond jewelry consists of pieces like rings, necklaces, earrings, bracelets, and watches, where diamonds are set in various precious metals such as gold, platinum, or silver. These exquisite gemstones are renowned for their exceptional brilliance, durability, and rarity, making them highly sought after in the luxury and fashion sectors.

The market includes various categories, including engagement rings, wedding bands, anniversary gifts, and high-end designer jewelry, catering to a diverse consumer base, from individuals celebrating special occasions to collectors and enthusiasts. Factors influencing the market include fluctuations in diamond prices, consumer preferences, and economic conditions.

Additionally, ethical and sustainable sourcing practices have gained importance in recent years, affecting consumer choices. The market represents a dynamic and evolving industry, where craftsmanship, design innovation, and market trends play significant roles in shaping its landscape.

Market Dynamics

One key trend in the diamond jewelry market is the growing demand for ethically sourced and sustainable diamonds. Consumers are becoming more conscious of the environmental and ethical implications of diamond mining, leading to an increased interest in lab-grown diamonds and diamonds sourced from conflict-free regions.

Ethical certifications and transparency in the supply chain are becoming important factors for buyers. As a result, jewelry companies are now putting more effort into ensuring that their diamonds are ethically sourced and sustainable. They are collaborating with organizations that provide certifications to guarantee that the diamonds are mined in a responsible manner.

Additionally, companies are making their supply chains more transparent, providing consumers with detailed information about the journey of their diamonds, from the mine to the finished piece of jewelry.

Changing consumer preferences and demographics pose a challenge. Younger generations often prioritize experiences over material possessions, impacting the demand for traditional diamond jewelry. Additionally, the rise of lab-grown diamonds as a more affordable and eco-friendly alternative has disrupted the market. As a result, diamond retailers are having to adapt their strategies to cater to these changing preferences.

Moreover, some retailers are embracing lab-grown diamonds and integrating them into their product offerings, appealing to eco-conscious consumers who seek sustainable options. Overall, the diamond industry is undergoing a transformation as it navigates the evolving consumer landscape and aims to remain relevant in the market.

Segmentation Analysis

The global market is segmented based on type, jewelry type, consumer orientation, sales channel, and geography.

By Type

The market is bifurcated into two main categories based on diamond type: natural and lab-grown diamonds. Natural diamonds are anticipated to dominate the diamond jewelry market with a 56.69% share in 2022, primarily because of their rarity and elevated perceived value. They are frequently linked with opulence and prestige, rendering them highly sought-after for premium jewelry pieces and engagement rings.

Conversely, lab-grown diamonds are gaining traction thanks to their ethical and sustainable attributes, being produced in controlled environments devoid of any environmental harm or human rights issues associated with traditional mining. Additionally, lab-grown diamonds often come at a more affordable price point, which expands their accessibility for a broader consumer base.

By Jewelry Type

Based on diamond jewelry type, the diamond jewelry industry is bifurcated into rings, earrings, necklaces, pendants, and others. The Pendants segment is expected to hold the largest market share of 31.80% in 2022 due to its versatility and popularity among consumers. Pendants offer a wide range of designs and styles, making them suitable for various occasions and outfits.

Additionally, pendants are often considered a timeless and elegant piece of jewelry that can be passed down through generations, further driving their demand in the market. With the increasing trend of personalized jewelry, pendants also provide the opportunity for customization, allowing people to express their individuality and create unique pieces that hold sentimental value.

By Sales Channel

Based on sales channel, the market is bifurcated into online & offline. The Offline segment is expected to hold the largest diamond jewelry market share of 63.79% in 2022 due to the wide availability of products in physical stores and the convenience of trying them before making a purchase. Additionally, offline channels provide a more personalized shopping experience and immediate product gratification.

However, with the growing popularity of e-commerce platforms, the online segment is projected to witness significant growth in the coming years. The ease of online shopping, competitive pricing, and doorstep delivery options are driving consumers to opt for the online sales channel.

Geographical Analysis

Based on regional analysis, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America Diamond Jewelry Market share stood around 34.50% in 2022 in the global market, with a valuation of USD 61.65 billion, due to the high purchasing power and strong consumer demand. With a large population of affluent individuals and a culture that values luxury and status, North America is expected to continue its dominance in the market.

Additionally, the region is home to several prominent diamond mining companies, giving it a competitive edge in terms of supply and distribution. Overall, the combination of economic strength, consumer preferences, and industry infrastructure positions North America to maintain its leading position in the market.

In Asia Pacific, the diamond jewelry market is expected to expand significantly at a CAGR of 4.49% over 2023-2030. This growth can be attributed to factors such as rising disposable incomes, changing consumer preferences, and a growing middle-class population. Additionally, the increasing number of luxury brands entering the market and the growing trend of gifting diamond jewelry on special occasions are also contributing to the market's expansion.

Furthermore, the growing popularity of online shopping platforms has made diamond jewelry more accessible to a wider consumer base, further fueling the regional market's growth. However, the Middle East & Africa is anticipated to witness the fastest growth at 7.89% CAGR from 2023 to 2030 owing to increasing investments in infrastructure development and rapid urbanization across the region.

Competitive Landscape

The diamond jewelry market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing heavily/extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Diamond Jewelry Market

- Tiffany & Co.

- Bulgari S.p.A.

- Cartier

- Signet Jewelers

- De Beers plc

- Pandora Jewelry, LLC

- Chow Tai Fook Jewellery Group Limited

- Swarovski AG

- Petra Diamonds Limited

- Trans Hex Group

Key Industry Developments

- August 2023 (Partnership) – The United States Tennis Association (USTA) and Tiffany & Co. renewed their multiyear agreement, and Tiffany & Co. stated that it would remain the US Open's official trophy partner.

- July 2023 (Partnership): De Beers Group and the Government of the Republic of Botswana inked a contract for a new 10-year Sales Agreement for Debswana's production of rough diamonds until 2033 and a 25-year extension of the Debswana mining licenses through 2054.

The Global Diamond Jewelry Market is Segmented as:

By Type

- Natural Diamond

- Lab-grown Diamond

By Jewelry Type

- Rings

- Earrings

- Necklaces

- Pendants

- Others

By Consumer Orientation

- Men

- Women

By Sales Channel

- Online

- Offline

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership