Luxury Goods Market

Luxury Goods Market Size, Share, Growth & Industry Analysis, By Product Type (Clothing and Apparel, Footwear, Perfumes & Cosmetics, and Others), By Distribution Channel (Direct Sales, Multi- Brand Stores and Online Retailers), By End User (Men and Women), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR813

Luxury Goods Market Size

Global Luxury Goods Market size was recorded at USD 368.85 billion in 2023, which is estimated to be at USD 389.50 billion in 2024 and projected to reach USD 601.05 billion by 2031, growing at a CAGR of 6.39% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as LVMH Group, RALPH LAUREN, Compagnie Financière Richemont SA, KERING, Chow Tai Fook Jewellery Company Limited, EssilorLuxottica, The Swatch Group Ltd, L’Oréal S.A., Shiseido Company, Limited, Rolex and others. Digital transformation in luxury retail is reshaping brands engage with their customers and conduct their business is driving the market.

One of the primary factors propelling this transformation is the increasing influence of the internet and mobile technology, which made online shopping more accessible and convenient. Luxury brands are increasingly leveraging advanced technologies such as artificial intelligence, augmented reality, and big data analytics to enhance customer experiences.

- For instance, virtual try-ons, personalized recommendations, and immersive online experiences allow consumers to interact with products in innovative ways, bridging the gap between the customer and brands.

Moreover, social media platforms have become crucial marketing tools, enabling brands to reach a broader audience and engage with younger, tech-savvy consumers. The use of e-commerce platforms and direct-to-consumer strategies is on the rise, providing luxury brands with valuable data on consumer preferences and behaviors.

Luxury goods are high-end products characterized by their superior quality, exclusivity, and premium pricing. These goods often include designer clothing, high-end accessories, luxury vehicles, fine jewelry, and exclusive experiences such as upscale travel and dining experiences. The growth of the luxury goods market is propelled by several factors such as the increasing wealth of high-net-worth individuals and the burgeoning affluent middle class in emerging markets, which significantly boosts demand.

Moreover, rapid urbanization and higher disposable incomes enable more consumers to afford luxury products. Additionally, brand heritage and the exclusivity associated with luxury brands attract consumers seeking unique and prestigious items. Social media and celebrity endorsements further play a vital role, influencing consumer perceptions and enhancing brand visibility. These drivers collectively fuel the growth of the market, making it a dynamic and lucrative sector.

Analyst’s Review

The luxury goods market is undergoing significant transformations due to evolving consumer preferences and ongoing technological advancements. One critical strategy is the seamless integration of digital and physical channels, providing a cohesive omnichannel experience that meets the expectations of modern consumers.

Luxury brands must invest in advanced digital tools, such as AI and AR, to enhance personalization and customer engagement. Additionally, sustainability has emerged as a vital imperative, with consumers increasingly prioritizing ethical and eco-friendly products. Brands need to adopt sustainable practices across their supply chains, from sourcing materials to production processes, to align with these values.

Another strategic focus is the expansion into emerging markets, particularly in Asia, where rising wealth and urbanization present significant growth opportunities. Tailoring products and marketing strategies to local tastes and cultural nuances enhance the effective penetration of these markets. Collaboration and partnerships, both within and outside the luxury sector, offer avenues for fostering innovation and achieving differentiation. Brands leverage collaborations to create unique products and experiences that resonate with their target audience.

- For instance, in March 2023, H&M's collaboration with luxury brand Mugler was a resounding success, with items rapidly selling out. This partnership exemplifies the strategic advantage of blending high fashion with accessible retail, driving consumer demand and expanding market reach for both brands.

Moreover, combating counterfeit goods through advanced tracking technologies and robust legal frameworks is essential to maintaining brand integrity and consumer trust. By prioritizing these strategies and imperatives, luxury brands navigate the evolving market landscape and sustain their growth.

Luxury Goods Market Growth Factors

Increasing disposable income among consumers is a critical factor fueling the growth of the global luxury goods market. As economies expand and more individuals achieve higher income levels, discretionary spending on non-essential goods and services rises. Higher disposable income allows consumers to spend more on premium brands and experiences, thereby fueling demand for high-end fashion, accessories, automobiles, and other luxury items. This financial empowerment leads to a significant change in consumer behavior, with a greater emphasis on quality, exclusivity, and brand reputation.

Additionally, increased disposable income enables consumers to explore new luxury categories, such as wellness, technology, and personalized services, thus diversifying their buying patterns. Luxury brands are aiming to capitalize on this opportunity by tapping into new customer segments and expanding into geographical regions. By understanding and leveraging the spending power of these consumers, luxury brands tailor their marketing strategies, product offerings, and retail experiences to meet the evolving expectations of a more affluent and discerning clientele.

- For instance, in 2024, according to Clarkston Consulting, millennials and Gen Z are anticipated to collectively comprise 70% of global luxury goods sales by 2025. This significant shift in consumer demographics underscores the increasing purchasing power and influence of these younger generations within the luxury market. Millennials and Gen Z prioritize unique, personalized experiences and are highly receptive to brands that align with their values, such as sustainability and social responsibility.

By understanding and catering to the distinct preferences of these cohorts, luxury brands can tap into this burgeoning market segment, ensuring sustained growth and relevance in an evolving marketplace. The proliferation of counterfeit luxury goods poses a significant challenge to the development of the global luxury market, undermining brand integrity and consumer trust.

Counterfeit products, often sold at a fraction of the price of genuine items, misleading consumers and dimishing the exclusivity and perceived value of luxury brands. This widespread issue affects the revenue and profitability of luxury companies tarnishes their reputation and diminishes brand loyalty. Counterfeit goods are typically of inferior quality, leading to consumer dissatisfaction and potential harm, which negatively impacts the reputation of the original brand.

Furthermore, the rise of e-commerce and online marketplaces has exacerbated this issue, making it easier for counterfeiters to reach a global audience. To combat this challenge, luxury brands are investing in advanced anti-counterfeiting technologies, such as blockchain for supply chain transparency, and implement stringent legal measures to protect their intellectual property.

Additionally, educating consumers about the importance of purchasing from authorized retailers and the risks associated with counterfeit products is crucial. By adopting a multifaceted approach, luxury brands safeguard their reputation, ensure the authenticity of their products, and maintain consumer trust.

Luxury Goods Market Trends

Personalized and customized luxury experiences and products are becoming a defining trend in the luxury goods market, catering to the growing demand for uniqueness and individual expression among consumers. In an era where personalization is highly valued, luxury brands are offering bespoke services that allow customers to tailor products to their specific tastes and preferences. This trend spans various categories, including custom-tailored fashion, personalized jewelry, unique travel experiences, and bespoke automotive features.

By providing options for customization, brands enhance the emotional connection with their customers, making them feel valued and special. Advanced technologies, such as AI and machine learning, play a significant role in facilitating personalization by analyzing consumer data to offer tailored recommendations and exclusive offers.

Additionally, luxury brands are increasingly leveraging digital platforms to provide virtual consultations and interactive design tools, allowing customers to co-create products. This focus on personalization differentiates luxury brands in a competitive market, enhancing customer loyalty and satisfaction. As consumers continue to seek products that reflect their individuality, the trend toward personalized and customized luxury experiences is likely to support industry growth.

Segmentation Analysis

The global market is segmented based on type, end user, sales channel, and geography.

By Product Type

Based on product type, the market is categorized into clothing and apparel, footwear, bags/purses, perfumes & cosmetics, and others. The clothing and apparel segment captured the largest luxury goods market share of 38.58% in 2023. The enduring appeal and necessity of clothing ensure a constant demand for high-end fashion, which is often seen as a symbol of status and an expression of personal style. Leading luxury fashion houses persist in innovating through seasonal collections, exclusive collaborations, and limited-edition releases that attract fashion-conscious consumers.

- For instance, in April 2024, according to yodlee, as of December 2023, Louis Vuitton and Gucci dominate the luxury market with a combined 70% market share. The remaining 30% is distributed more evenly among brands like Prada, Christian Dior, Burberry, and Chanel. While some brands have increased their market share, others have remained stable or are experiencing long-term decline.

Additionally, the rise of influencer marketing and social media platforms has significantly impacted consumer behavior, with luxury clothing brands leveraging these channels to enhance visibility and desirability. The increasing disposable income among consumers, particularly in emerging markets, has further fueled demand for premium clothing.

Furthermore, advancements in e-commerce have made luxury fashion more accessible to a global audience, allowing consumers to purchase high-end apparel from the comfort of their homes. The trend toward personalization and customization in fashion, wherein consumers opt for bespoke or tailor-made pieces, which is contributing to the growth of the segment.

By Distribution Channel

Based on distribution channel, the luxury goods market is divided into direct sales, multi- brand stores, mono-brand stores, and online retailers. The online retailers segment is poised to record a staggering CAGR of 7.90% through the forecast period, propelled by the continued shift in consumer shopping habits toward digital platforms. The convenience and accessibility of online shopping have revolutionized the retail landscape, making it easier for consumers to browse, compare, and purchase luxury goods irrespective of geographical constraints.

The COVID-19 pandemic accelerated the adoption of e-commerce, as lockdowns and social distancing measures led consumers to increasingly rely on online shopping. Additionally, advancements in technology, such as augmented reality and virtual try-ons have enhanced the online shopping experience, by reducing the traditional barriers associated with buying luxury goods online. Luxury brands have further improved their digital presence, by offering personalized online shopping experiences, exclusive online collections, and seamless customer service.

The advancement of digital payment systems and improved logistics and delivery services support the expansion of online retail. Moreover, younger, tech-savvy consumers who prioritize convenience and instant access to products are contributing to the growth of the segment.

By End User

Based on end user, the market is divided into men and women. The women segment garnered the highest revenue of USD 220.39 billion in 2023, propelled by the substantial influence and purchasing power in the luxury goods market. The wide range of luxury categories targeted at women, including high-end fashion, accessories, jewelry, cosmetics, and personal care products, caters to their diverse preferences and needs. Additionally, the growing emphasis on personal appearance and self-expression prompts women to seek premium brands that offer quality, exclusivity, and status.

The rise of social media and influencer culture has played a crucial role, with a growing number of women following fashion influencers and celebrities who endorse luxury brands, thereby influencing their purchasing decisions. Furthermore, luxury brands have been adept at marketing and creating campaigns specifically aimed at women, highlighting aspects such as empowerment, elegance, and individuality. Seasonal collections, exclusive collaborations, and limited-edition products designed for women further stimulate the growth of the segment.

Luxury Goods Market Regional Analysis

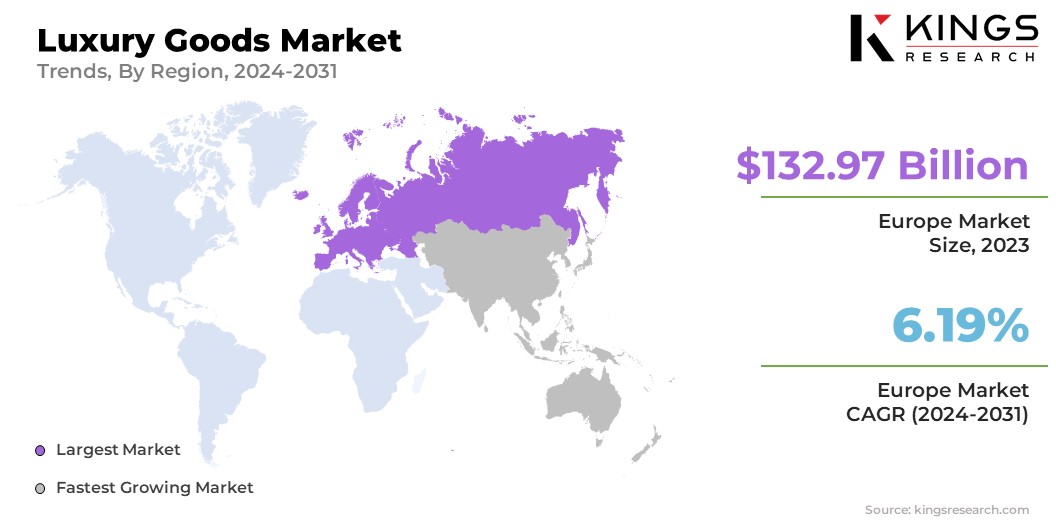

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe Luxury Goods Market share stood around 36.05% in 2023 in the global market, with a valuation of USD 132.97 billion, mainly fueled by its rich heritage of luxury craftsmanship and the presence of numerous iconic luxury brands. Countries such as France, Italy, and Switzerland are globally recognized for their high-end fashion, accessories, watches, and jewelry. The region's deep-rooted traditions in quality and design excellence attract affluent consumers from around the world. Furthermore, Europe's luxury market benefits from a robust tourism sector, with major cities such as Paris, Milan, and Geneva being top destinations for luxury shopping.

The concentration of flagship stores and exclusive boutiques in these fashion capitals significantly enhances the overall shopping experience for luxury consumers. Additionally, European brands continue to innovate and set trends, thereby maintaining their appeal and prestige. The rising emphasis on sustainability and ethical production by numerous European luxury brands resonates with modern consumers values, fostering brand loyalty and boosting the luxury goods market growth.

Asia-Pacific is set to grow at the highest CAGR of 7.14% in the foreseeable future owing to the rapidly expanding middle-class population and increasing number of high-net-worth individuals. Countries such as China, India, and Southeast Asian nations are witnessing robust economic growth, leading to higher disposable incomes and a growing demand for luxury products.

Moreover, the cultural shift toward aspirational consumption, where owning luxury items signifies social status and success, bolsters regional market expansion. The digital transformation in the region, with a high penetration of e-commerce platforms and mobile shopping, makes luxury goods more accessible to a broader audience.

Additionally, luxury brands are investing heavily in localized marketing strategies and opening new stores to cater to the preferences and tastes of Asian consumers. Collaborations with popular local influencers and celebrities further enhance brand visibility and appeal, thereby contributing significantly to market expansion.

Competitive Landscape

The global luxury goods market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Luxury Goods Market

- LVMH Group

- Compagnie Financière Richemont SA

- Kering SA

- Chow Tai Fook Jewellery Group Limited

- The Estée Lauder Companies Inc.

- Luxottica Group SpA

- The Swatch Group Ltd.

- L’Oréal Group

- Ralph Lauren Corporation

- Shiseido Company, Limited

Key Industry Development

- April 2024 (Launch): Rolex introduced the GMT-Master II, which features a Chromalight display and is crafted from premium Oystersteel material. It is equipped with a triangle-tipped 24-hour graduated and a 24-hour hand bidirectional rotatable bezel,allowing the user to easily track time in an additional time zone.

The global luxury goods market is segmented as:

By Product Type

- Clothing and Apparel

- Footwear

- Bags/Purses

- Perfumes & Cosmetics

- Others

By Distribution Channel

- Direct Sales

- Multi- Brand Stores

- Mono-Brand Stores

- Online Retailers

By End User

- Men

- Women

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U,.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)