ICT-IOT

Digital Biomarkers Market

Digital Biomarkers Market Size, Share, Growth & Industry Analysis, By Type (Wearable, Mobile Application, Others), By Application (Neurological Disorders, Respiratory Disease & Others), By Clinical Practices (Monitoring, Diagnostics, Prognostics), By End User and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1050

Digital Biomarkers Market Size

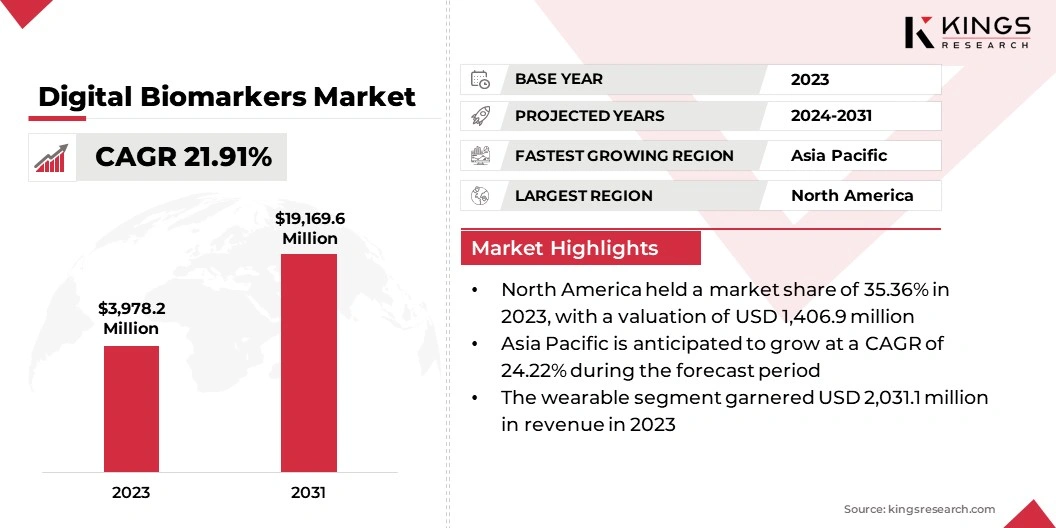

The global Digital Biomarkers Market size was valued at USD 3,978.2 million in 2023 and is projected to grow from USD 4,790.1 million in 2024 to USD 19,169.6 million by 2031, exhibiting a CAGR of 21.91% during the forecast period. The development of sophisticated wearable devices, mobile health apps, and sensors has revolutionized data collection for continuous and accurate monitoring of health metrics.

This technological progress enables the effective tracking of digital biomarkers in real-time, enhancing disease management and personalized medicine. In the scope of work, the report includes products offered by companies such as AliveCor, Inc., Amgen Inc., Biogen, Huma, Koneska Health, Evidation Health, Inc., Eli Lilly and Company, Pfizer Inc., Novartis Pharmaceuticals Corporation, GSK plc., and others.

Moreover, the growing emphasis on personalized medicine, where treatments are tailored to individual patients based on their unique health data, is expected to drive the digital biomarkers market over the forecast period. Digital biomarkers facilitate this approach by providing precise, individualized health insights for personalized treatment plans and interventions.

Digital biomarkers are quantifiable physiological, behavioral, or environmental data points collected through digital devices and technologies, such as wearables, mobile health applications, and remote sensors. These biomarkers provide real-time insights into an individual’s health status, disease progression, and treatment response.

By leveraging continuous data collection and advanced analytics, digital biomarkers enable accurate monitoring, early detection of health issues, and personalized medical interventions. They play a critical role in enhancing disease management, supporting preventive care, and advancing personalized medicine by offering precise, individualized health information.

Analyst’s Review

Governments worldwide are supporting the adoption of digital health technologies, including digital biomarkers, as part of their healthcare modernization strategies. Policies and funding are being directed toward improving digital infrastructure, facilitating telehealth services, and encouraging the integration of digital biomarkers into standard healthcare practices.

Regulatory initiatives, grants, and public-private partnerships are creating favorable landscape for the development and deployment of these technologies.

- In August 2023, during the G20 Summit in India, the World Health Organization unveiled the Global Initiative on Digital Health. This initiative aims to expedite the adoption of digital technologies to advance Universal Health Coverage (UHC) and the Sustainable Development Goals (SDGs), integral to the Digital Health Strategy. The initiative introduced a revised set of 23 indicators, updated to align with the WHO Strategy's strategic objectives. This standardized framework ismonitors progress in implementing digital health solutions, serving as a crucial resource within the Global Initiative on Digital Health.

The healthcare industry is witnessing a number of partnerships and collaborations that are driving innovation in digital biomarkers. Leading pharmaceutical companies, technology firms, and healthcare providers are combining their expertise and resources to advance the development of digital health solutions. These strategic collaborations are focused on enhancing data accuracy, improving patient outcomes, and scaling the use of digital biomarkers across clinical settings.

- In March 2024, Biogen partnered with Indivi, a prominent MedTech company, to advance digital health technology and create digital biomarkers for Parkinson’s disease. Under this agreement, Biogen will license its Konectom platform to Indivi. This smartphone-based digital biomarker system allows remote assessment of neurological functions, enabling more accurate and frequent monitoring of disease progression.

Digital Biomarkers Market Growth Factors

The rise in chronic diseases, such as diabetes, cardiovascular disorders, and neurological conditions, is driving the digital biomarkers market. These health issues require continuous monitoring and management, which digital biomarkers can effectively provide.

By delivering real-time insights into disease progression and treatment efficacy, digital biomarkers support more effective disease management strategies. This capability is crucial in addressing the growing burden of chronic diseases, making digital biomarkers an essential tool for both patients and healthcare providers.

- In 2023, the World Health Organization reported that chronic diseases claim 41 million lives annually, representing 74% of global deaths. Cardiovascular diseases lead the list with 17.9 million fatalities each year, followed by cancer with 9.3 million fatalities, chronic respiratory diseases with 4.1 million deaths, and diabetes causing 2 million deaths annually.

Moreover, the growth of telemedicine and remote patient monitoring solutions has expanded the use of digital biomarkers. Telemedicine platforms enable healthcare providers to remotely monitor patient health using digital biomarkers, facilitating ongoing care without the need for in-person visits.

This shift toward remote healthcare services is driven by the need for convenience and accessibility. Digital biomarkers play a crucial role in this transition by providing continuous health data that supports remote diagnosis and management.

However, limited standardization of digital health platforms and high costs of advanced technologies are restraining the expansion of the digital biomarkers market. The lack of uniformity in data formats, protocols, and integration systems makes it difficult for healthcare providers to implement digital biomarkers seamlessly.

Additionally, the high costs of developing and deploying advanced technologies limit accessibility, particularly for smaller healthcare providers. To mitigate these challenges, companies are collaborating on open-source platforms and using industry-wide standards to promote interoperability.

They are also investing in cost-effective technologies and offering scalable solutions to ensure wider adoption, which is expected to drive the market while enhancing accessibility.

Digital Biomarkers Industry Trends

The market is witnessing significant technological advancements. The emergence of sophisticated wearable devices, such as smartwatches and health-tracking sensors, enables continuous and precise health monitoring. These innovations enable comprehensive tracking of various health parameters, allowing for immediate analysis and response.

Enhanced data accuracy and accessibility drive the adoption of digital biomarkers, supporting proactive health management and personalized treatment approaches.

Moreover, the rise of digital healthcare platforms is significantly boosting the growth of the digital biomarkers market. These platforms, integrating technologies like telemedicine, mobile health apps, and cloud-based solutions, provide seamless access to healthcare services.

- In January 2024, Eli Lilly and Company introduced LillyDirect, a new digital healthcare platform designed for U.S. patients to manage obesity, migraines, and diabetes. LillyDirect provides comprehensive disease management resources, including access to independent healthcare providers, personalized support, and direct home delivery of select Lilly medications through third-party pharmacy services.

Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into digital biomarker systems significantly enhances their capabilities. These technologies enable the development of predictive models that improve disease detection and treatment personalization.

By leveraging AI and ML, digital biomarkers become more effective in delivering actionable health insights, thus driving their adoption across various healthcare applications.

Segmentation Analysis

The global market has been segmented on the basis of type, application, clinical practices, end user, and geography.

By Type

Based on type, the digital biomarket market has been segmented into wearable, mobile application, and others. The wearable segment led the digital biomarkers market in 2023, reaching USD 2,031.1 million due to its ability to continuously collect real-time health data, offering unparalleled convenience and accessibility for users.

Wearables, such as smartwatches and fitness trackers, are increasingly popular for tracking vital health metrics like heart rate, sleep patterns, and physical activity. These devices are widely adopted by both consumers and healthcare providers for their non-invasive nature and ease of integration into daily life.

By Application

Based on application, the digital biomarket market has been classified into neurological disorders, respiratory disease, cardiovascular disease, diabetes, and others. The neurological disorders segment secured the largest revenue share of 26.55% in 2023. This growth can be attributed to the increasing prevalence of Parkinson’s, Alzheimer’s, and multiple sclerosis.

These disorders require continuous monitoring to track disease progression, and digital biomarkers offer a more precise and non-invasive method for capturing real-time data. Moreover, advancements in digital health technologies, such as wearable devices and smartphone applications, have made it easier to collect and analyze biomarkers.

By Clinical Practices

Based on clinical practices, the digital biomarkers market has been divided into monitoring, diagnostics, and prognostics. The monitoring segment is anticipated to witness significant growth at a robust CAGR of 23.14% over the forecast period. Clinical practices increasingly rely on digital biomarkers for continuous health monitoring, providing real-time insights into disease progression and treatment effectiveness.

Additionally, the rise of chronic conditions like cardiovascular diseases and diabetes, which require long-term monitoring, further fuels the demand for digital biomarkers in clinical settings.

By End User

Based on end user, the market has been divided into healthcare providers, healthcare consumers, and others. The healthcare providers segment is expected to secure the largest revenue share of 53.98% in 2031, due to the rising adoption of digital marker by healthcare providers in their clinical practice.

Healthcare providers, including hospitals, clinics, and diagnostic centers, are using digital biomarkers to enhance patient care by enabling continuous monitoring, early diagnosis, and personalized treatment plans. Additionally, the growing use of telehealth and remote patient monitoring systems has further amplified the demand for digital biomarkers among healthcare providers, as they seek to optimize care delivery while reducing costs and enhancing patient engagement.

Digital Biomarkers Market Regional Analysis

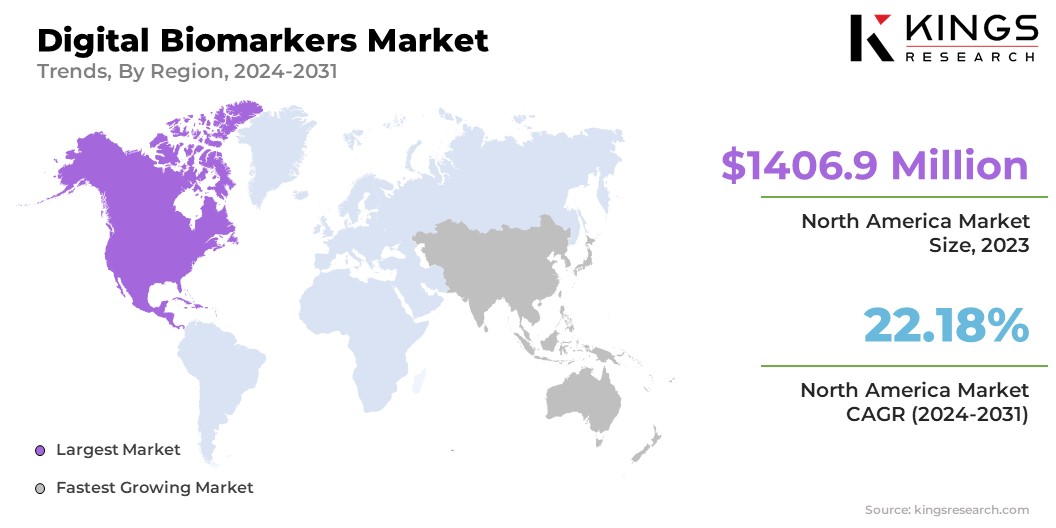

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America digital biomarkers market share stood around 35.36% in 2023 in the global market, at a value of USD 1,406.9 million. North America, particularly the U.S., readily adopts advanced healthcare technologies, including wearables, mobile health apps, and AI-powered devices.

The region’s strong technology infrastructure and significant investments in healthcare innovation drive the widespread use of digital biomarkers for real-time health monitoring and disease management.

Moreover, North America’s strong venture capital ecosystem is actively supporting digital health startups, several of which focus on digital biomarkers. Increased funding for research and development in this space is accelerating the introduction of innovative products, driving competition, and further boosting market growth across the region.

- In July 2023, the Peterson Health Technology Institute was established as part of the Digital Health Collaborative, with USD 50 million in funding. Its mission is to assess digital health technologies and separate genuine innovations from the surrounding hype, ensuring they truly benefit patients. The institute plans to focus on research, grant funding, and regular gatherings to promote the development and scaling of evidence-based, efficient, and equitable digital health solutions aimed at improving patient outcomes while reducing costs.

Asia Pacific is expected to witness significant growth at a robust CAGR of 24.22% over the forecast period. Governments across Asia Pacific are investing in healthcare infrastructure and digital health technologies. Initiatives promoting smart healthcare systems, particularly in countries like Japan and South Korea, are also accelerating the adoption of digital biomarkers.

Additionally, the growing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, coupled with an aging population, is intensifying the need for continuous health monitoring in the region. Digital biomarkers enable efficient disease management and early detection, which are crucial in addressing the increasing healthcare needs of the aging population across countries like China and Japan.

- The latest Asian Development Policy Report, published in 2024, highlights that individuals aged 60 and above make up 13.5% of the regional population in 2022, a figure projected to almost double to 25.2% by 2050. Over the past two decades, the disease burden from Alzheimer’s and other forms of dementia in developing Asia has risen by 7.8%. Additionally, the percentage of older adults diagnosed with at least one non-communicable disease (NCD) ranges between 35% and 68% across nine economies in the region.

Competitive Landscape

The global digital biomarkers market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Digital Biomarkers Market

- AliveCor, Inc.

- Amgen Inc.

- Biogen

- Huma

- Koneska Health

- Evidation Health, Inc.

- Eli Lilly and Company

- Pfizer Inc.

- Novartis Pharmaceuticals Corporation

- GSK plc.

Key Industry Developments

- July 2024 (Partnership): Biogen announced its plans to partner with Beckman Coulter and Fujirebio to develop blood-based biomarkers and tests targeting tau pathology in Alzheimer’s disease. This collaboration aims to advance tau-specific biomarkers and diagnostic tools. These biomarkers are expected be integrated into clinical practices to facilitate the adoption of future therapies addressing tau pathology.

- July 2023 (Technological Advancement): Pfizer upgraded its serverless architecture for processing digital biomarker data at scale, making it more adaptable and configurable. The updated design now accommodates multiple data sources and supports various algorithms, each with unique parameter configurations, offering greater flexibility in managing complex datasets.

The global digital biomarkers market has been segmented:

By Type

- Wearable

- Mobile Application

- Others

By Application

- Neurological Disorders

- Respiratory Disease

- Others

- Cardiovascular Disease

- Diabetes

By Clinical Practices

- Monitoring

- Diagnostics

- Progonostics

By End User

- Healthcare Providers

- Healthcare Consumers

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership