Healthcare Medical Devices Biotechnology

Digital Health Market

Digital Health Market Size, Share, Growth & Industry Analysis, By Product Type [Telehealth/Telemedicine, mHealth, Electronic Health Records (EHR)/Electronic Medical Records (EMR), Healthcare Analytics, Digital Therapeutics, Others], By Application, By End User, By Component and Regional Analysis, 2024-2031

Pages : 150

Base Year : 2023

Release : January 2025

Report ID: KR1211

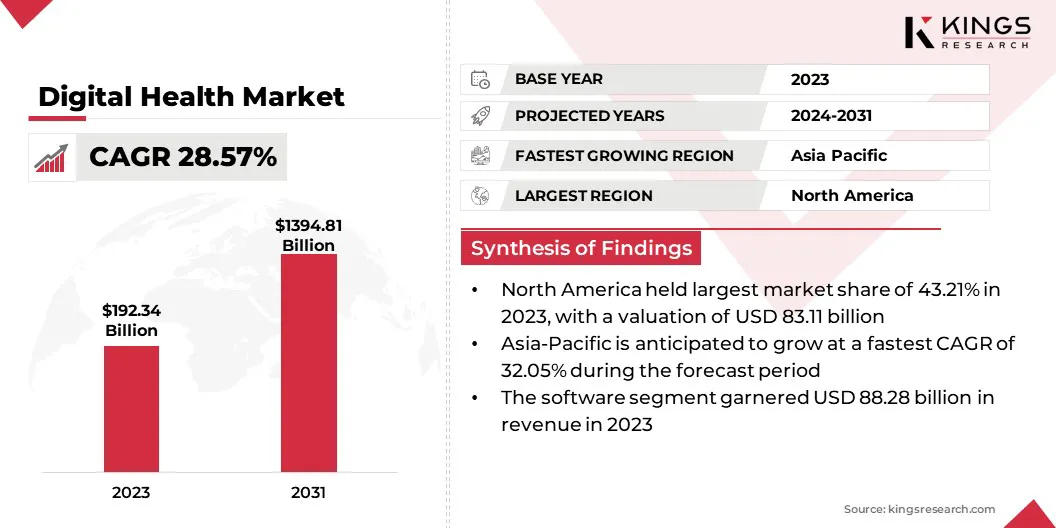

Digital Health Market Size

The global digital health market size was valued at USD 192.34 million in 2023, and is projected to grow from USD 240.14 million in 2024 to USD 1,394.81 million by 2031, exhibiting a CAGR of 28.57% during the forecast period.

The aging global population is driving the demand for healthcare services, leading to greater adoption of digital health tools. These technologies help manage chronic diseases, enable remote monitoring, and improve elderly care, fueling the adoption of digital health solutions.

In the scope of work, the report includes solutions offered by companies such as Koninklijke Philips N.V., Medtronic, GE HealthCare, Abbott, OMRON Healthcare Co., Ltd., Johnson & Johnson Services, Inc. (Janssen Global Services, LLC), Siemens Healthcare Private Limited, AT&T Intellectual Property, Teladoc Health, Inc., Noom, Inc, and others.

The digital health industry is rapidly evolving as healthcare systems increasingly embrace technology to improve service delivery and patient outcomes. It is reshaping traditional healthcare models by integrating innovative solutions that enhance the efficiency, accessibility, and personalization of care.

This transformation is driven by advancements in technology, growing healthcare needs, and changing patient expectations. The digital health space fosters collaboration between healthcare providers, tech companies, and consumers, creating a dynamic environment focused on improving healthcare experiences and empowering patients in managing their health.

- In November 2024, GE HealthCare and RadNet's DeepHealth announced a strategic collaboration to enhance imaging systems using AI-powered SmartTechnology. Their partnership aims to improve radiology workflows, diagnostic accuracy, and patient care, starting with the integration of DeepHealth’s SmartMammo and GE HealthCare’s Senographe Pristina for breast cancer screening.

The digital health market involves the integration of digital technologies into healthcare systems to improve patient care, enhance operational efficiencies, and streamline healthcare delivery.

This market encompasses a wide range of solutions, including software, devices, and digital platforms that use data analytics, mobile apps, and artificial intelligence (AI) to transform healthcare practices.

Digital health aims to make healthcare more accessible, cost-effective, and patient-centered by enabling real-time monitoring, personalized treatment, and better communication between healthcare providers and patients. The market is driven by technological advancements and the increasing need for healthcare system optimization.

Analyst’s Review

The digital health market is increasingly driven by the growing focus on preventive healthcare and wellness management. Companies are leveraging advanced strategies such as integrating fitness trackers, wellness apps, and health data analytics tools to empower consumers in managing their health proactively.

These technologies enable personalized health insights and early detection, promoting healthier lifestyles. By investing in AI-powered platforms, wearable devices, and mobile solutions, businesses aim to expand their market reach while addressing the rising demand for preventive and personalized care solutions.

- In June 2024, Cleveland Clinic and FitNow, Inc. launched the Cleveland Clinic Diet app, combining evidence-based nutrition science with a comprehensive food & fitness tracker. The app offers personalized health and diet advice, guiding users through sustainable lifestyle changes with expert-backed programs, AI-powered tracking, and empathetic support.

Digital Health Market Growth Factors

The key growth drivers for the digital health industry is the ability of digital health technologies to reduce operational costs, streamline processes, and enhance healthcare delivery. These technologies are increasingly appealing to both healthcare providers and patients as they enable more efficient management of resources, faster service delivery, and improved patient care.

By optimizing workflows, reducing administrative burdens, and enhancing decision-making, digital health tools help make healthcare more affordable, driving widespread adoption and boosting the market.

- In October 2024, Clarify Health launched the Performance IQ Suite, the first fully AI-enabled application for cost, quality, and utilization assessment. Utilizing advanced machine learning and natural language processing (NLP), the suite optimizes provider performance, reduces costs, and improves care quality, offering actionable insights for strategic decision-making.

Data privacy and security remain critical challenges in the digital health market, as protecting sensitive patient information is essential. Breaches or unauthorized access can undermine trust and slow the adoption of digital health technologies. To mitigate these risks, it is crucial to implement robust encryption, secure data storage, and comply with the applicable regulations.

Additionally, adopting multi-factor authentication, conducting regular security audits, and educating both healthcare providers and patients on best practices can further strengthen the security and credibility of digital health solutions.

- In November 2024, Barts Health NHS Trust implemented Cynerio’s healthcare-focused platform to enhance data security across all sites. The platform’s advanced network detection, proactive patching, and real-time threat analysis help safeguard sensitive patient data, reduce risks like data breaches & ransomware, and support healthcare providers in securing their digital health infrastructure.

Digital Health Industry Trends

The integration of AI and machine learning (ML) into digital health solutions has become a prominent trend, significantly enhancing decision-making, predictive analytics, and personalized care. These technologies enable more accurate diagnoses, real-time health monitoring, and tailored treatment plans, improving overall healthcare delivery.

AI and ML also streamline administrative tasks, reduce human errors, and provide insights for preventive care. As a result, healthcare providers can offer more efficient, effective, and personalized services, driving better patient outcomes and fostering wider adoption of digital health tools.

- In November 2024, Monash University’s Faculty of Information Technology partnered with Apollo Hospitals to advance digital health solutions through data sharing and AI integration. The collaboration aims to test and refine AI algorithms for disease diagnosis, leveraging insights from over 200 million patient records to enhance healthcare research and innovation.

The digital health market is witnessing a growing trend in the use of wearable health devices, such as fitness trackers and smartwatches, for continuous health monitoring. These devices enable users to track vital signs, activity levels, and overall wellness in real-time, providing personalized insights.

The increasing adoption of wearables empowers consumers to proactively manage their health, while also offering healthcare providers valuable data for improved diagnosis and treatment. This shift toward wearable technology is enhancing preventive healthcare and fostering a more personalized approach to wellness.

- In July 2024, Sonde Health launched its innovative Sonde Cognitive Fitness tracker, a tool that measures cognitive effort in real-time using vocal biomarkers. This solution allows users to monitor cognitive strain, manage productivity, and track well-being. With FDA-approved therapies for Alzheimer's, it highlights the importance of early cognitive intervention.

Segmentation Analysis

The global market is segmented based on product type, application, end user, component, and geography.

By Product Type

Based on product type, the market has been segmented into telehealth/telemedicine, mHealth, electronic health records (EHR)/electronic medical records (EMR), healthcare analytics, digital therapeutics, AI and machine learning solutions, and others. The telehealth/telemedicine segment led the digital health industry in 2023, reaching the valuation of USD 77.38 million.

The telehealth/telemedicine segment is registering significant market expansion, due to the increasing demand for remote healthcare services. With advancements in technology, telemedicine platforms now offer video consultations, remote monitoring, and virtual diagnostics, making healthcare more accessible, especially for patients in rural or underserved areas.

As telemedicine solutions improve, integrating AI, wearables, and secure data exchange, the segment is poised for sustained growth, transforming how healthcare is delivered globally.

- In January 2024, Eli Lilly launched LillyDirect, a digital healthcare platform for patients in the U.S. with obesity, migraine, and diabetes. The platform integrates telehealth services, offering remote consultations, disease management resources, and home delivery of medications. LillyDirect expands telehealth’s role in providing accessible, convenient healthcare, supporting market growth.

By Application

Based on application, the market has been segmented into chronic disease management, population health management, remote patient monitoring, diagnostic and preventive applications, and fitness and wellness tracking. The chronic disease management segment secured the largest revenue share of 34.63% in 2023.

The digital health market is rapidly expanding in chronic disease management. Technologies such as telemedicine, wearable devices, and AI-driven platforms are transforming the care of conditions like diabetes, heart disease, and asthma. These innovations provide continuous monitoring, personalized treatment plans, and remote consultations, improving patient outcomes and accessibility.

Moreover, digital solutions help reduce healthcare costs by streamlining treatment processes and encouraging proactive care. With growing adoption of remote monitoring tools and virtual healthcare, digital health is poised to play a critical role in managing chronic conditions and fostering better long-term health management, thus driving market growth.

By End User

Based on end user, the market has been classified into healthcare providers, patients, payers, pharmaceutical companies, and others. The patients segment is poised for significant growth at a CAGR of 35.96% through the forecast period. Digital health solutions are embraced by patients, due to their convenience, accessibility, and ability to improve care outcomes.

Patients will be using wearable devices, telemedicine platforms, and health apps for continuous monitoring of chronic conditions, managing medications, and receiving virtual consultations. These technologies will empower individuals to take control of their health, access personalized care, and track progress in real time.

The growing adoption of digital health solutions will make healthcare more patient-centered, providing greater flexibility, reducing the need for in-person visits, and fostering proactive health management. This shift will transform the healthcare experience for patients globally.

Digital Health Market Regional Analysis

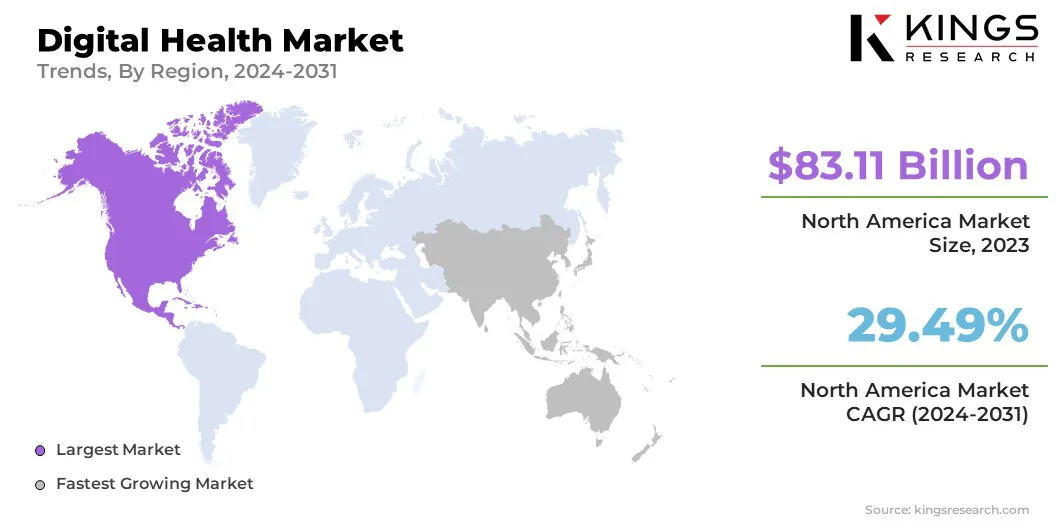

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 43.21% share of the global digital health market in 2023, with a valuation of USD 83.11 million. North America remains the most dominant region in the market, driven by advanced healthcare infrastructure, high adoption rates of technology, and strong support from government initiatives.

The U.S. is a key player, with widespread use of telemedicine, wearable devices, and health apps, along with significant investments in AI-driven solutions. The region benefits from a robust regulatory framework and increasing consumer demand for accessible healthcare.

Additionally, North America's large healthcare spending, coupled with a growing emphasis on cost-effective solutions and personalized care, has fueled the growth of digital health solutions. These factors make North America the leading market for digital health innovations.

The market in Asia Pacific is poised for significant growth over the forecast period at a CAGR of 32.05%. Asia is the fastest-growing region in the digital health market, fueled by technological advancements, high smartphone penetration, and growing healthcare demands.

Countries like China, India, and Japan are adopting telemedicine, wearables, and health apps to address healthcare challenges. The region’s large population, coupled with supportive government policies and investments in healthcare, drives the adoption of digital health solutions. As healthcare accessibility improves, the rapid market expansion in Asia positions it as a significant force in the global digital health landscape.

- In September 2024, ST Engineering and Royal Philips announced a strategic partnership to offer digital health solutions for bedside support and capacity management in Asia Pacific. Combining ST Engineering’s AI-driven operations command centre and Philips’ clinical command centre, they aim to improve patient care and optimize healthcare resources through integrated data and advanced analytics.

Competitive Landscape

The global digital health market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for the market growth.

List of Key Companies in Digital Health Market

- Koninklijke Philips N.V.

- Medtronic

- GE HealthCare

- Abbott

- OMRON Healthcare Co., Ltd.

- Johnson & Johnson Services, Inc. (Janssen Global Services, LLC)

- Siemens Healthcare Private Limited

- AT&T Intellectual Property

- Teladoc Health, Inc.

- Noom, Inc

Key Industry Developments

- October 2024 (Acquisition): Huma, a leader in healthcare AI and digital solutions, acquired eConsult, a major digital-first triage and automated consultation platform. This acquisition strengthens Huma's mission to accelerate adoption in healthcare, enhancing efficiency across primary and emergency care. Additionally, Huma launched its Cloud Platform and Workspace, integrating various digital health solutions to streamline care and improve outcomes.

- October 2024 (Partnership): Suki, a leader in AI healthcare technology, announced a partnership with Zoom Video Communications to integrate its AI engine, Suki Platform, into Zoom's telehealth solutions. This collaboration aims to enhance clinician productivity by automating clinical note generation, reducing documentation overhead, and improving patient care. With AI-powered documentation, clinicians can spend more time with patients, advancing efforts to streamline healthcare processes.

The global digital health market is segmented as:

By Product Type

- Telehealth/Telemedicine

- Virtual consultations

- Remote patient monitoring

- Tele-ICU

- mHealth

- Health apps

- Wearable devices

- Patient engagement solutions

- Electronic Health Records (EHR)/Electronic Medical Records (EMR)

- Healthcare Analytics

- Predictive analytics

- Prescriptive analytics

- Descriptive analytics

- Digital Therapeutics

- AI and Machine Learning Solutions

- Others

By Application

- Chronic disease management

- Population health management

- Remote patient monitoring

- Diagnostic and preventive applications

- Fitness and wellness tracking

By End User

- Healthcare Providers

- Hospitals

- Clinics

- Diagnostic centers

- Patients

- Payers

- Pharmaceutical Companies

- Others

By Component

- Software

- Hardware

- Services

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership