ICT-IOT

Digital Out of Home Advertising Market

Digital Out of Home Advertising Market Size, Share, Growth & Industry Analysis, By Format (Billboards, Street Furniture, Transit & Transportation, Place-Based Media), By Application (Indoor, Outdoor), By End-Use (Automotive, Financial Services, Retail, Real Estate & Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR980

Digital Out of Home Advertising Market Size

The global Digital Out of Home Advertising Market size was valued at USD 14.69 billion in 2023 and is projected to grow from USD 16.19 billion in 2024 to USD 34.38 billion by 2031, exhibiting a CAGR of 11.35% during the forecast period. The growth of the market is driven by continual technological advancements, rapid urbanization, data-driven targeting, and the increasing prevalence of smart cities and digital infrastructure.

In the scope of work, the report includes solutions offered by companies such as Broadsign, Clear Channel IP, LLC., Daktronics Dr., Focus Media, Global Outdoor Media Limited, JCDecaux, Lamar Advertising Company, oOh!media Limited., Ströer, OUTFRONT Media Inc., and others.

The expansion of the digital out-of-home (DOOH) advertising market is mainly propelled by rapid urbanization that leads to increased public transport usage and higher pedestrian traffic. Advancements in display technology, such as LED and LCD screens, enhance the quality and impact of advertisements. The integration of data analytics allows for targeted and real-time ad content, thereby maximizing advertiser reach.

- For instance, in April 2024, Provantage introduced Protrack, the first comprehensive audience measurement tool for Place-Based Networks in South Africa, using the globally recognized AllUnite platform. This tool was introduced at major digital and static billboard sites, providing accurate, verified data on audience reach and impact in accordance with international standards. Provantage implemented Protrack across major transit hubs, malls, and airports throughout South Africa.

Additionally, the proliferation of smart cities and digital infrastructure creates more opportunities for DOOH placements. Additionally, environmental concerns are prompting advertisers to transition toward digital formats, thereby reducing paper waste. These factors collectively propel the growth and adoption of DOOH advertising globally.

The digital out-of-home advertising market has witnessed substantial growth in recent years. Characterized by dynamic digital displays in public spaces, the market benefits from ongoing technological advancements and rapid urbanization. High-traffic areas, such as malls, airports, and transit hubs, serve as prime locations for these ads. The integration of real-time data and interactivity has enhanced audience engagement, making DOOH a preferred choice for advertisers.

Moreover, the market is experiencing a notable shift toward programmatic advertising, which facilitates automated and data-driven ad placements. This evolution is supported by increasing investments in digital infrastructure and the growing demand for impactful, targeted advertising solutions.

The digital out-of-home advertising market encompasses digital media displayed in public spaces, excluding traditional broadcast, online, and mobile media. It includes digital billboards, transit ads, street furniture, and place-based networks that deliver dynamic content to a broad audience.

DOOH advertising leverages advanced technologies such as digital screens, sensors, and data analytics to deliver contextually relevant messages. Unlike static billboards, DOOH ads offer the advantage of real-time updates, providing enhanced flexibility and effectiveness.

Click to learn, How data-driven insights can impact your market position

Click to learn, How data-driven insights can impact your market position

Analyst’s Review

Manufacturers in the digital out-of-home advertising market are continually advancing their offerings by introducing advanced display technologies and interactive features. These efforts include developing high-resolution LED and LCD screens that offer dynamic content capabilities.

Furthermore, companies are focusing on integrating artificial intelligence and data analytics to enhance ad targeting and effectiveness. Recent product launches featuring smart billboards and AR-enabled displays that provide immersive consumer experiences are rapidly gaining prominence in the market.

- For instance, in July 2024, Daktronics and Open Media partnered to install a new LED display at BOXPARK Liverpool, marking their inaugural venture outside London. This installation featured Daktronics' EcoSmart technology, which offers up to 50% energy savings and integrates eco-friendly features such as blue light reduction and intelligent content detection. The digital screen, measuring 6.08 meters in height and 16.32 meters in width, replaced a static banner, thereby enhancing image clarity and flexibility in Liverpool's busy downtown area.

To capitalize on growth opportunities, manufacturers are advised to invest in sustainable technologies and expand their presence in emerging markets. Additionally, forming strategic partnerships with tech firms and urban planners is expected to facilitate the deployment of DOOH solutions in smart cities, thereby augmenting market expansion.

Digital Out of Home Advertising Market Growth Factors

The rise of smart cities is fostering the growth of the digital out-of-home (DOOH) advertising market. Urban areas are increasingly integrating advanced technologies and digital infrastructure, creating numerous opportunities for DOOH placements. Digital screens are increasingly prevalent in public spaces such as transportation hubs, streets, and commercial centers.

These smart environments enable real-time data collection and targeted advertising, thereby enhancing the effectiveness of DOOH campaigns. As cities continue to evolve, the demand for dynamic and interactive advertising formats is increasing, offering advertisers innovative opportunities to engage with consumers. This technological advancement is significantly contributing to the expansion of the DOOH advertising market.

A major challenge hampering the development of the digital out-of-home advertising market is the high cost associated with digital displays and infrastructure. These expenses are often prohibitive for small and medium-sized enterprises (SMEs). Overcoming this challenge involves leveraging programmatic advertising, which optimizes ad placements and reduces wastage, thereby ensuring cost efficiency.

Collaborative partnerships with technology providers help lower costs by sharing resources and infrastructure. Additionally, flexible financing options and leasing models make advanced DOOH solutions more accessible to SMEs. By adopting these strategies, the players operating in the market are mitigating cost barriers, making digital out-of-home advertising a viable option for a broader range of businesses.

Digital Out of Home Advertising Market Trends

The integration of augmented reality (AR) is transforming the landscape of the digital out-of-home advertising market. Advertisers are increasingly using AR to create immersive and interactive experiences for consumers. This trend is enhancing engagement by allowing viewers to interact with digital ads in real time.

The widespread adoption of smartphones and AR applications is fueling this trend, providing advertisers with innovative methods to capture audience attention and deliver personalized content. As AR technology continues to evolve, its impact on the market is becoming increasingly significant.

Programmatic DOOH advertising is rapidly gaining traction in the market, revolutionizing the sale and display of ads. This trend involves using automated platforms to purchase and manage digital out-of-home ad space in real time. By leveraging data analytics and machine learning, advertisers are optimizing their campaigns for better targeting and efficiency.

Programmatic DOOH allows for dynamic content changes based on audience demographics, weather conditions, and time of day, thereby enhancing its relevance and impact. This approach is streamlining the ad buying process by reducing manual intervention, and increasing campaign effectiveness. The shift toward programmatic is a significant trend shaping the landscape of the DOOH advertising market.

Segmentation Analysis

The global market is segmented based on format, application, end-use, and geography.

By Format

Based on format, the market is categorized into billboards, street furniture, transit & transportation, and place-based media. The billboards segment led the digital out of home advertising market in 2023, reaching valuation of USD 6.11 billion. This considerable expansion is attributed to their high visibility and impact. Billboards are strategically placed in high-traffic areas such as highways and city centers to reach a wide audience.

Their large size and prominent locations make them effective for brand awareness campaigns. Advances in digital technology have significantly enhanced the appeal of billboards by offering dynamic and interactive content that captures the audience's attention. Advertisers increasingly prefer billboards for their ability to deliver bold and memorable messages.

By Application

Based on application, the market is classified into indoor and outdoor. The outdoor segment is poised to wtiness significant growth at a robust CAGR of 11.93% through the forecast period (2024-2031), primarily due to rapid urbanization and infrastructure development. Public spaces such as transit hubs, parks, and commercial areas are becoming prime locations for digital out-of-home (DOOH) advertising.

Advances in display technology and real-time data integration enhance the effectiveness of outdoor ads. The flexibility of digital screens allows for the delivery of dynamic and targeted content, thereby improving engagement. As cities expand and evolve, there is a rising demand for impactful outdoor advertising.

By End-Use

Based on end use, the market is segmented into automotive, financial services, retail, media & entertainment, real estate, and others. The retail segment secured the largest DOOH advertising market share of 26.03% in 2023, as retailers increasingly adopt digital out-of-home (DOOH) advertising to attract and engage customers. Digital displays in retail environments enhance the shopping experience by providing targeted promotions and interactive content.

Retailers leverage DOOH to drive foot traffic, promote new products, and create brand awareness. The ability to update content in real-time allows for timely and relevant messaging. This expansion is further bolstered by the effectiveness of DOOH in influencing purchasing decisions and enhancing customer engagement within retail spaces.

Digital Out of Home Advertising Market Regional Analysis

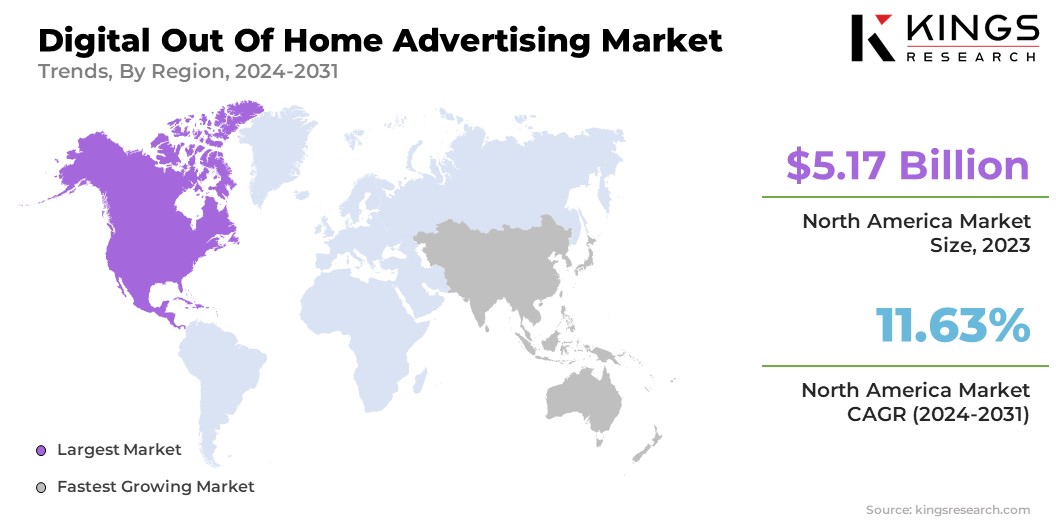

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America digital out of home advertising market accounted for a substantial share of around 35.18% in 2023, with a valuation of USD 5.17 billion. This dominance is reinforced by the region's advanced technological infrastructure and high urbanization rates. The region boasts a robust network of digital displays in high-traffic areas such as airports, shopping malls, and transit hubs, thereby ensuring extensive audience coverage.

Additionally, substantial investments in digital technology and data analytics enhance the effectiveness and appeal of DOOH advertising. The presence of major tech companies and innovative startups further contributes to the growth of the regional market.

Asia-Pacific is poised to experience robust growth, depicting a staggering a CAGR of 12.46% through the projection period. This considerable development is fostered by rapid urbanization and economic development in the region. The region's growing middle-class population and rising consumer spending power are drawing the attention of advertisers.

Significant investments in smart city projects and digital infrastructure are expanding the reach of DOOH advertising. The widespread adoption of smartphones and digital technologies facilitates the integration of interactive and targeted ad content. These factors, combined with the region's large and diverse population, are contributing to the growth of the regional market.

Competitive Landscape

The global digital out of home advertising market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Digital Out of Home Advertising Market

- Broadsign

- Clear Channel IP, LLC.

- Daktronics Dr.

- Focus Media

- Global Outdoor Media Limited

- JCDecaux

- Lamar Advertising Company

- oOh!media Limited.

- Ströer

- OUTFRONT Media Inc.

Key Industry Developments

- April 2024 (Launch): Redken launched an interactive Times Square billboard showcasing the Acidic Color Gloss Collection. The billboard, featuring 3D animations on a high-definition 25,000 square foot screen, allowed consumers across the US to experience it virtually, share on social media, and use an AR filter to visualize the treatment's effects. Passersby were invited to scan a QR code to try the AR feature, receive a shareable video, and obtain an exclusive purchase offer on Redken.com.

- July 2023 (Partnership): Clear Channel Outdoor announced a series of strategic partnerships, integrating its proprietary CCO RADAR data platform with Data Clean Room applications from Habu, Aqfer, LiveRamp, and InfoSum. This integration enabled secure first-party data matching for out-of-home advertising, enabling brands to measure and plan ad campaigns using their own data while ensuring privacy and compliance. This development came in response to the gradual elimination of third-party cookies, providing a privacy-compliant solution for audience targeting and measurement.

The global digital out of home advertising market is segmented as:

By Format

- Billboards

- Street Furniture

- Transit & Transportation

- Place-Based Media

By Application

- Indoor

- Outdoor

By End-Use

- Automotive

- Financial Services

- Retail

- Media & Entertainment

- Real Estate

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years