Machinery Equipment-Construction

Digital Shipyard Market

Digital Shipyard Market Size, Share, Growth & Industry Analysis, By Shipyard Type (Commercial, Military), By Technology (AR/VR, Digital Twin & Simulation, Additive Manufacturing, and others), By Process (Research & Development, Design & Engineering, and others), By Digitization Level, and Regional Analysis, 2024-2031

Pages : 200

Base Year : 2023

Release : February 2025

Report ID: KR1369

Market Definition

A digital shipyard leverages advanced technologies to streamline shipbuilding and maintenance, enhancing efficiency, precision, and automation across design, construction, and lifecycle management.

Digital Shipyard Market Overview

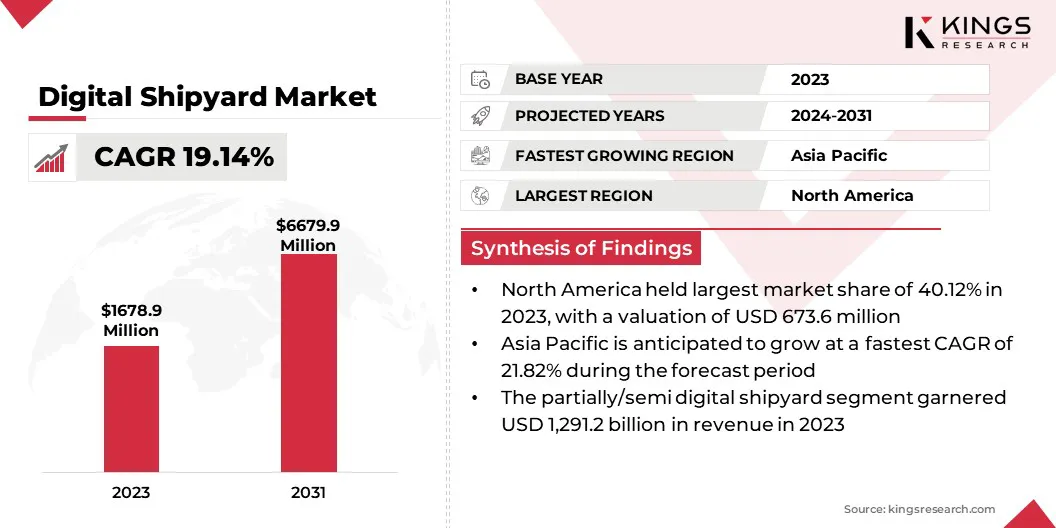

The global digital shipyard market size was valued at USD 1,678.9 million in 2023 and is projected to grow from USD 1,960.7 million in 2024 to USD 6,679.9 million by 2031, exhibiting a CAGR of 19.14% during the forecast period.

This market is registering significant growth, driven by the increasing adoption of advanced technologies such as digital twins, IoT, AI, and automation in shipbuilding and maintenance. Shipbuilders and naval organizations are investing in smart manufacturing solutions to enhance efficiency, reduce costs, and improve vessel lifecycle management.

Major companies operating in the digital shipyard industry are Siemens AG, Dassault Systèmes, Samsung Group, Accenture, ShipConstructor Software Inc., SAP SE, BAE Systems plc, Schneider Electric, Wärtsilä Corporation, Hexagon AB, Altair Engineering Inc., EQT AB, PROSTEP AG, Inmarsat Global Limited, and Pemamek.

The demand for predictive maintenance, real-time monitoring, and data-driven decision-making is fueling the integration of big data analytics and cloud-based solutions.

Additionally, government initiatives for naval modernization, sustainability efforts in the maritime sector, and the rising need for enhanced cyber security to protect digital shipyard infrastructure from cyber threats are further accelerating market expansion.

- In January 2025, HII’s Ingalls Shipbuilding division, in collaboration with the U.S. Navy, Accelerate Mississippi, and Mississippi Gulf Coast Community College (MGCCC), inaugurated a virtual reality (VR) welding lab at the shipyard. The new facility enhances workforce development by integrating VR technology into the welder certification curriculum, providing shipbuilders with immersive, hands-on training.

Key Highlights:

- The digital shipyard industry size was valued at USD 1,678.9 million in 2023.

- The market is projected to grow at a CAGR of 19.14% from 2024 to 2031.

- North America held a market share of 40.12% in 2023, with a valuation of USD 673.6 million.

- The commercial segment garnered USD 1,180.9 million in revenue in 2023.

- The robotics and automation segment is expected to reach USD 1,518.4 million by 2031.

- The design & engineering segment is expected to reach USD 2,879.8 million by 2031.

- The partially/semi digital shipyard segment is expected to reach USD 4,961.3 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 21.82% during the forecast period.

Market Driver

"Increasing Adoption of Digital Twin Technology is Expanding the Market"

The digital shipyard market is being driven by the increasing adoption of digital twin technology, which enables shipbuilders to enhance predictive maintenance, optimize vessel performance, and reduce operational costs by creating real-time virtual replicas of ships.

This technology allows shipbuilders to monitor and analyze ship performance, predict maintenance needs, and optimize operational efficiency.

Digital twins help in early fault detection, reducing downtime and improving overall vessel reliability by simulating real-world conditions. Additionally, they assist in optimizing fuel consumption and emissions, contributing to sustainability goals.

- In December 2024, Navantia partnered with Siemens to implement Siemens Xcelerator in the Coastal Hydrographic Vessel (BHC) project, enhancing ship design, production, and lifecycle management under the Shipyard 5.0 initiative. Navantia engineers have received training through Siemens' Marine Digital Twin program.

Additionally, the growing demand for autonomous and smart ships is accelerating the integration of digital solutions in shipbuilding. With increasing interest in autonomous and remotely operated ships, shipbuilders are integrating advanced digital infrastructure to support these next-generation vessels.

Smart ships rely on AI, IoT, and ML to enhance navigation, optimize fuel efficiency, and improve safety. This shift is driving shipyards to develop advanced manufacturing processes, automated ship design, and digital monitoring systems.

Market Challenge

"High Costs and Cybersecurity Risks in the market"

One of the major challenges in the digital shipyard market is the high initial investment costs required for implementing advanced technologies such as digital twins, IoT, and AI-driven systems. Shipyards need to upgrade their infrastructure, purchase specialized software, and train employees to adapt to new digital workflows.

These costs can be prohibitive for smaller and mid-sized shipbuilders, delaying the adoption of digital solutions and limiting their competitiveness. Shipyards can explore phased adoption strategies, government subsidies, and partnerships with technology providers to ease the financial burden.

Another critical challenge is cyber security risks, as digital shipyards rely on interconnected systems, cloud-based platforms, and real-time data exchange. This increased digitalization makes shipyards vulnerable to cyber threats such as hacking, ransomware attacks, and data breaches, which can disrupt operations and compromise sensitive maritime data.

Companies must implement robust cyber security protocols, such as end-to-end encryption, continuous network monitoring, and employee cyber security training.

Market Trend

"Digitalization and Sustainability Transforming the market"

The digital shipyard market is registering significant transformation driven by advancements in IoT and big data analytics, as well as a strong push toward sustainability and green shipbuilding initiatives.

The integration of IoT sensors and big data analytics is revolutionizing shipbuilding by enabling real-time monitoring of equipment, predictive maintenance, and efficient resource allocation. These technologies enhance operational efficiency, reduce downtime, and improve decision-making through data-driven insights.

- n September 2024, ST Engineering officially opened its new Gul Yard shipyard to enhance ship repair capabilities and expand into new market segments. Equipped with 5G digital infrastructure, AI-powered technologies, and IoT-enabled safety solutions, the next-generation smart yard will improve efficiency, sustainability, and workplace safety.

Additionally, the industry is shifting toward sustainability, with shipyards adopting eco-friendly solutions such as AI-driven fuel efficiency systems, alternative energy sources like hydrogen and ammonia, and optimized hull designs to reduce carbon emissions.

Shipbuilders are embracing digitalization to create smarter, greener, and more efficient vessels as global emission regulations tighten.

Digital Shipyard Market Report Snapshot

|

Segmentation |

Details |

|

By Shipyard Type |

Commercial, Military |

|

By Technology |

AR/VR, Digital Twin & Simulation, Additive Manufacturing, Internet of Things (IoT), Artificial Intelligence (AI) and Machine Learning (ML), Big Data and Cloud Computing, Robotics and Automation, Blockchain, Others |

|

By Process |

Research & Development, Design & Engineering, Manufacturing & Planning, Maintenance & Support, Training & Simulation |

|

By Digitization Level |

Fully Digitally Shipyard, Partially/Semi Digital Shipyard |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Shipyard Type (Commercial, Military): The commercial segment earned USD 1,180.9 million in 2023, due to the increasing demand for advanced shipbuilding solutions in global trade and transportation.

- By Technology (AR/VR, Digital Twin & Simulation, Additive Manufacturing, Internet of Things (IoT), Artificial Intelligence (AI) and Machine Learning (ML), Big Data and Cloud Computing, Robotics and Automation, Blockchain, Others): The robotics and automation segment held 20.12% share of the market in 2023, due to the need for efficiency, precision, and reduced labor costs in shipyard operations.

- By Process (Research & Development, Design & Engineering, Manufacturing & Planning, Maintenance & Support, Training & Simulation): The design & engineering segment is projected to reach USD 2,879.8 million by 2031, owing to the rising adoption of digital twin technology and simulation tools for optimized ship design.

- By Digitization Level (Fully Digitally Shipyard, Partially/Semi Digital Shipyard): The partially/semi digital shipyard segment is projected to reach USD 4,961.3 million by 2031, owing to gradual digital transformation efforts and the integration of smart technologies in traditional shipyards.

Digital Shipyard Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial digital shipyard market share of 40.12% in 2023, with a valuation of USD 673.6 million. The region's dominance is driven by strong investments in naval modernization programs, presence of leading shipbuilders, and rapid adoption of advanced digital technologies such as AI, IoT, and digital twin solutions.

The U.S. leads the regional market, with significant government and defense contracts supporting the digital transformation of shipbuilding and maintenance operations. Additionally, the demand for automated shipyards and cyber security solutions fuels the market in North America.

The digital shipyard industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 21.82% over the forecast period. This rapid expansion is attributed to increasing shipbuilding activities in countries like China, South Korea, and Japan, which are investing heavily in smart shipyards to enhance production efficiency and global competitiveness.

The rising adoption of Industry 4.0 technologies, government initiatives for maritime infrastructure development and growing defense budgets in emerging economies such as India further drive the demand for digital shipyard solutions.

Asia Pacific is poised to become a key growth hub for the market with the region’s strong presence in commercial and naval shipbuilding.

- In February 2025, BEML Ltd. and Goa Shipyard Limited (GSL) signed a Memorandum of Understanding (MoU) to collaborate on maritime projects and composite manufacturing, strengthening India’s maritime capabilities. The partnership aims to leverage BEML’s engineering expertise and GSL’s shipbuilding experience to develop glass fiber-reinforced polymer composite parts, specialized marine equipment, and infrastructure for vessel repair and overhaul.

Regulatory Frameworks Also Plays a Significant Role in Shaping the Market

- In the U.S., the Federal Maritime Commission (FMC) and the Maritime Administration (MARAD) are the primary federal agencies that regulate the maritime industry, including shipyards.

- In Europe, the primary regulatory authority overseeing aspects of a digital shipyard is the European Maritime Safety Agency (EMSA), which provides technical expertise and guidance on maritime safety, including the adoption and implementation of new digital technologies within shipyards.

- In China, the Ministry of Industry and Information Technology (MIIT) oversees shipbuilding, formulating policies, standards, and regulations to promote its development. The China Classification Society (CCS), a state-owned classification society, establishes technical standards for ship design and construction, ensuring compliance with national and international regulations.

- In Japan, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) regulates the shipbuilding sector, setting policies and standards to ensure safety and technological advancement. The Nippon Kaiji Kyokai (ClassNK), a prominent classification society, develops and maintains technical rules and guidelines for ship design and construction, ensuring that vessels meet safety and environmental standards.

- In India, the regulatory authority overseeing the implementation of digital shipyard technologies is the Directorate General of Shipping (DGS), which falls under the Ministry of Ports, Shipping and Waterways, responsible for regulating maritime activities and ensuring safety standards across Indian shipyards, including the adoption of new digital technologies.

Competitive Landscape:

The digital shipyard industry is characterized by a large number of participants, including both established corporations and rising organizations. Key players in the market are investing in Research and Development (R&D) to integrate cutting-edge solutions such as digital twins, IoT, AI, and automation into shipyard operations.

Collaboration with naval defense agencies, commercial shipbuilders, and technology providers is a common strategy to expand market presence and enhance digital transformation capabilities.

- For instance, in July 2024, Fincantieri and Accenture announced their collaboration to drive innovation and digitization in the cruise, defense, and port services sectors. The collaboration will focus on developing a technological platform for integrating onboard ship functions and innovative digital solutions to enhance port efficiency, safety, and intelligence.

Additionally, companies are focusing on cloud-based platforms, cyber security enhancements, and real-time data analytics to improve operational efficiency and reduce downtime in ship manufacturing and maintenance.

Market participants are also engaging in mergers and acquisitions to strengthen their technological expertise and expand their geographic footprint. With increasing demand for smart shipyard solutions, firms are offering customized digitalization services tailored to specific shipyard needs, including predictive maintenance, robotics-driven automation, and AR/VR-based training programs.

The growing emphasis on sustainability and energy-efficient shipbuilding practices is also influencing competition, with companies investing in eco-friendly digital solutions to align with regulatory standards.

List of Key Companies in Digital Shipyard Market:

- Siemens AG

- Dassault Systèmes

- Samsung Group

- Accenture

- ShipConstructor Software Inc.

- SAP SE

- BAE Systems plc

- Schneider Electric

- Wärtsilä Corporation

- Hexagon AB

- Altair Engineering Inc.

- EQT AB

- PROSTEP AG

- Inmarsat Global Limited

- Pemamek

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In October 2024, Wärtsilä and Qatar Shipyard Technology Solutions signed an MoU to enhance vessel maintenance, repairs, and retrofit services. The partnership focuses on engine and propulsion solutions, decarbonization projects, and dual-fuel conversions, strengthening maritime sustainability and operational efficiency.

- In June 2024, Hanwha Systems acquired Philly Shipyard for $100 million, expanding its global shipbuilding and naval defense capabilities. Hanwha aims to integrate its advanced marine technologies into Philly Shipyard, leveraging opportunities in unmanned maritime systems and smart ship solutions.

- In May 2024, Nippon Yusen Kabushiki Kaisha (NYK) and MTI Co., Ltd., in collaboration with Smert Design Co. Ltd., launched a trial using 3D models for LPG tanker design. By integrating the basic design platform into CADMATIC software, the project enables early visualization, streamlines decision-making, and converts 2D drawings into 3D Digital Finished Plans to enhance efficiency in shipbuilding.

- In January 2024, HD Hyundai Heavy Industries announced a joint development project with NAPA and Cadmatic to accelerate digital transformation in shipbuilding. The collaboration will create a next-generation ship design and information management solution, incorporating product lifecycle management (PLM) and advanced 3D models.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)