ICT-IOT

Direct Carrier Billing Market

Direct Carrier Billing Market Size, Share, Growth & Industry Analysis, By Type (Limited DCB, Pure DCB, MSISDN Forwarding), By Platform (Smartphones, Tablets, Feature Phones, Others), By Revenue Model (One-Time Payments, Subscription-Based Payments), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1080

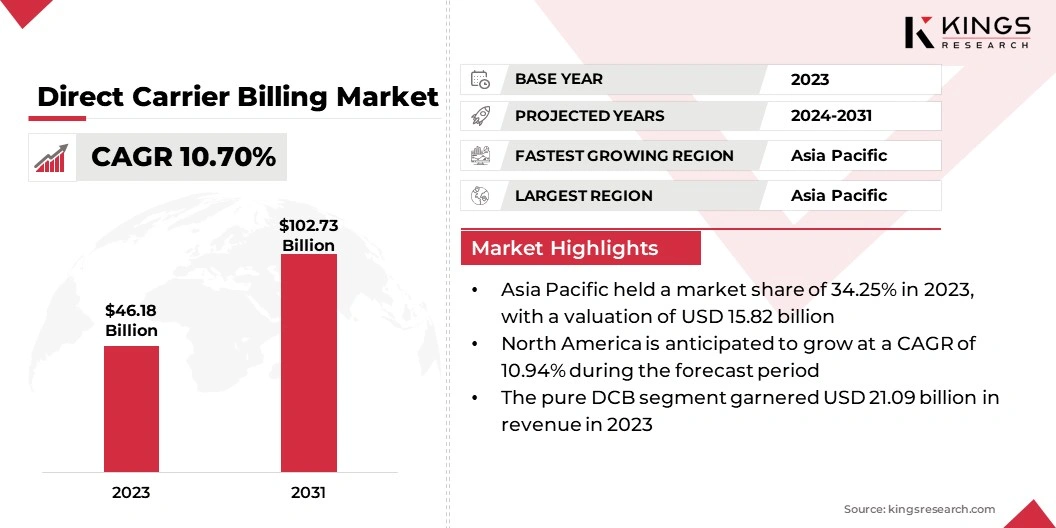

Direct Carrier Billing Market Size

The global Direct Carrier Billing Market size was valued at USD 46.18 billion in 2023 and is projected to grow from USD 50.43 billion in 2024 to USD 102.73 billion by 2031, exhibiting a CAGR of 10.70% during the forecast period. The market is growing due to increased smartphone penetration, rising digital content consumption, and the need for secure payment solutions. Driven by technological advancements and regulatory support, DCB is emerging as a preferred method for microtransactions.

This growth is further fueled by the rise of e-cofmmerce and the global shift toward cashless transactions. In the scope of work, the report includes solutions offered by companies such as Boku Inc., Citcon, Osmosis, Payforit, Empello, TELECOMING S.A., MobiCash, DIMOCO Payments GmbH, PAY 365, Bango.net Limited, and others.

The direct carrier billing market is witnessing robust growth, mainly fostered by the increasing adoption of smartphones and rising demand for digital content such as streaming, gaming, and app-based services.

- A recent survey by Federal Reserve Financial Services (FRFS) revealed that in 2023, the use of digital wallets grew 31% year-over-year to 62%, stimulated primarily by large businesses and the service industry.

Direct carrier billing allows users to charge purchases directly to their mobile phone bills, providing a secure and convenient alternative to traditional payment methods. Emerging markets, where banking infrastructure may be limited, are particularly fueling market expansion.

Key players, including telecom companies and fintech startups, are forming strategic partnerships to improve DCB solutions, enhancing payment security and user experience. This growing adoption across industries is expanding DCB's global market presence.

Direct carrier billing (DCB) is a payment method that allows consumers to make purchases or pay for services by charging the amount directly to their mobile phone bill or prepaid balance. This system simplifies transactions by eliminating the need for credit cards or bank accounts.

Users can buy digital content, such as apps, games, or subscriptions, with the cost added to their monthly phone bill or deducted from their prepaid balance. DCB is particularly valuable in regions with limited banking infrastructure, providing a secure and convenient payment alternative. Its ease of use and broad accessibility contribute to its growing adoption.

Analyst’s Review

The collaboration between key players is expected to boost market growth by enhancing DCB solutions improving payment security, and simplifying billing for digital content. These efforts are increasing adoption, expanding market reach, and boosting revenue streams within the digital payments industry.

- In August 2024, Vodafone Group partnered with a leading fintech startup to improve DCB solutions across Europe. This strategic alliance is expected to strengthen Vodafone’s position in the European digital payments market.

The increasing focus on simplifying digital payments and enhancing user experience is influencing the DCB market. By tapping into underserved regions and improving accessibility through partnerships and technology upgrades, key players are positioning DCB as a mainstream payment solution. This is creating new revenue streams and solidifying DCB's role in the digital economy.

Direct Carrier Billing Market Growth Factors

The widespread adoption of smartphones is significantly propelling the expansion of the direct carrier billing market, as mobile devices increasingly serve as primary means of accessing digital content globally. DCB provides a convenient payment option that allows users to charge purchases directly to their mobile phone bills, eliminating the need for bank accounts or credit cards. This is particularly beneficial in emerging markets with limited banking infrastructure but high mobile penetration.

- According to GSMA, by the end of 2022, the number of people using mobile internet reached 4.6 billion, representing 57% of the global population.

As consumers increasingly use smartphones for activities such as gaming, streaming, and in-app purchases, DCB's seamless integration and accessibility contribute to its growing adoption.

The development of the market is expected to be hampered by security concerns, regulatory complexities, and fragmented payment infrastructures. Fraud and unauthorized transactions undermine consumer trust, while inconsistent regulations and carrier systems hinder global DCB adoption.

Key players are addressing these challenges by investing in security measures such as multi-factor authentication and fraud detection. They are further collaborating with regulators and carriers to streamline billing processes and ensure compliance with local laws. Companies are improving transparency and aligning platforms with global standards to rebuild trust and promote DCB market growth.

Direct Carrier Billing Industry Trends

The integration of direct carrier billing with over-the-top (OTT) platforms such as Netflix and Amazon Prime is bolstering market growth by offering a seamless and convenient payment solution for consumers. This accessibility, especially in regions with limited access to traditional banking infrastructure, allows users to easily subscribe to digital entertainment services by charging payments directly to their mobile bills.

As OTT platforms expand globally, particularly in emerging markets, the simplicity and security of DCB attract more users. This growing user base, coupled with increased consumption of digital content, is fueling the demand for DCB, thereby fostering its market expansion.

Telecom companies are supporting market growth by forming strategic partnerships with direct carrier billing solution providers, offering bundled services that integrate mobile data packages with subscriptions to digital platforms and apps.

- In July 2024, Samsung Electronics introduced a new DCB feature for the Samsung Galaxy Store to streamline checkout processes. This feature allows users to charge digital purchases directly to their mobile accounts, improving the convenience of app and in-game transactions. This upgrade supports Samsung’s focus on enhancing user experience and deepening direct carrier billing integration within its ecosystem, potentially increasing the use of its digital services.

This collaboration enables users to seamlessly charge digital services, such as gaming, streaming, and other subscriptions, directly to their mobile bills. By integrating direct carrier billing into these bundled offerings, telecoms enhance customer engagement, providing a convenient, all-in-one solution for mobile users. These partnerships boost the adoption of DCB and increase revenue for both telecoms and content providers, thereby fueling the growth of the market.

Segmentation Analysis

The global market has been segmented based on type, platform, revenue model, and geography.

By Type

Based on type, the market has been categorized into limited DCB, pure DCB, and MSISDN forwarding. The pure DCB segment led the direct carrier billing market in 2023, reaching a valuation of USD 21.09 billion. Pure DCB allows users to make purchases through their mobile carrier, with charges added to their phone bill, which is ideal for regions with low banking penetration.

With the rise of digital consumption in sectors such as gaming, streaming, and in-app purchases, pure DCB is becoming a preferred payment method for its simplicity and accessibility. Segmental growth is further supported by the rising adoption of mobile devices and the expanding digital economy in emerging markets.

Additionally, partnerships between mobile operators and content providers are enhancing the reach and functionality of pure direct carrier billing, thereby aiding its sustained expansion across various industries globally.

By Platform

Based on platform, the market has been categorized into smartphones, tablets, feature phones, and others. The smartphones segment captured the largest direct carrier billing market share of 69.38% in 2023. With smartphones becoming the primary device for accessing digital content, services, and applications, the demand for convenient payment methods such as pure direct carrier billing is on the rise.

Users can charge in-app content, subscriptions, and gaming services directly to their mobile phone bills, eliminating the need for credit cards or bank accounts. Rapid smartphone adoption in emerging markets, combined with limited banking infrastructure, is fueling the growth of the segment. Moreover, the integration of direct carrier billing with popular mobile apps and gaming platforms is boosting segmental expansion.

By Revenue Model

Based on revenue model, the market has been categorized into one-time payments and subscription-based payments. The subscription-based payments segment is expected to garner the highest revenue of USD 53.31 billion by 2031. This growth is attributed to the increasing adoption of digital content services such as video streaming, gaming, and online news platforms.

With the rise of smartphone usage and mobile internet penetration, consumers are opting for subscription-based services due to the convenience of recurring payments directly billed to their mobile carriers. This segment further benefits from the growing demand for microtransactions and premium content access, particularly in emerging markets with limited traditional banking infrastructure.

The integration of DCB with subscription models is providing a seamless, user-friendly experience, propelling its adoption and contributing significantly to segment growth.

Direct Carrier Billing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific direct carrier billing market accounted for the largest share of 34.25% in 2023, with a valuation of USD 15.82 billion. This expansion is mainly fueled by rapid smartphone adoption, a large and diverse population, and increasing digital content consumption. Countries such as India, China, and Southeast Asia are experiencing significant growth in mobile internet usage, creating high demand for easy payment solutions such as DCB.

The limited access to traditional banking services in many areas makes DCB an ideal alternative, as it allows users to charge payments directly to their mobile bills. Additionally, the region’s young, tech-savvy population and expanding digital economy are supporting this growth.

- In July 2024, China Mobile launched a new DCB platform to enhance mobile payment options for digital content. Furthermore, in August 2024, India’s Ministry of Electronics and Information Technology (MEITY) introduced regulations to standardize mobile payment technologies, including DCB, to improve security and user experience.

These developments underscore the region’s growing influence in the global market.

North America is anticipated to witness significant growth at a robust CAGR of 10.94% over the forecast period. The regional market benefits from a mature mobile network ecosystem, allowing for seamless integration of DCB services and simplifying payments for apps, games, and digital subscriptions.

Major tech companies and mobile carriers have adopted DCB, enhancing consumer convenience and fueling regional industry growth. Additionally, the presence of leading digital content creators and app developers boosts adoption.

- For instance, in August 2024, the Federal Communications Commission (FCC) introduced regulations to increase transparency in mobile payments, ensuring clearer invoicing for DCB purchases.

- Moreover, in September 2024, Verizon formed a strategic partnership with a digital content provider to integrate advanced DCB technologies.

These efforts underscore North America's role in shaping the direct carrier billing landscape.

Competitive Landscape

The global direct carrier billing market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Direct Carrier Billing Market

- Boku Inc.

- Citcon

- Osmosis

- Payforit

- Empello.

- TELECOMING S.A.

- MobiCash

- DIMOCO Payments GmbH

- PAY 365

- Bango.net Limited

Key Industry Developments

- September 2024 (Expansion): Google expanded its direct carrier billing (DCB) options on the google play store across several Asian countries, including India and Indonesia. This update simplifies the purchasing process for apps, games, and digital content by eliminating the need for traditional payment methods. By enhancing its DCB offerings, Google aims to boost app store engagement and revenue, reinforcing its market presence in emerging regions.

The global direct carrier billing market is segmented as:

By Type

- Limited DCB

- Pure DCB

- MSISDN Forwarding

By Platform

- Smartphones

- Tablets

- Feature Phones

- Others

By Revenue Model

- One-Time Payments

- Subscription-Based Payments

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership