Automotive and Transportation

E-Mobility Market

E-Mobility Market Size, Share, Growth & Industry Analysis, By Product Type (Electric Bicycle, Electric Motorcycle, Electric Car, Others), By Battery [NiMH, Lead-Acid, Lithium-Ion (Li-ion), Others], By End Use (Personal, Commercial), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : January 2025

Report ID: KR301

E-Mobility Market Size

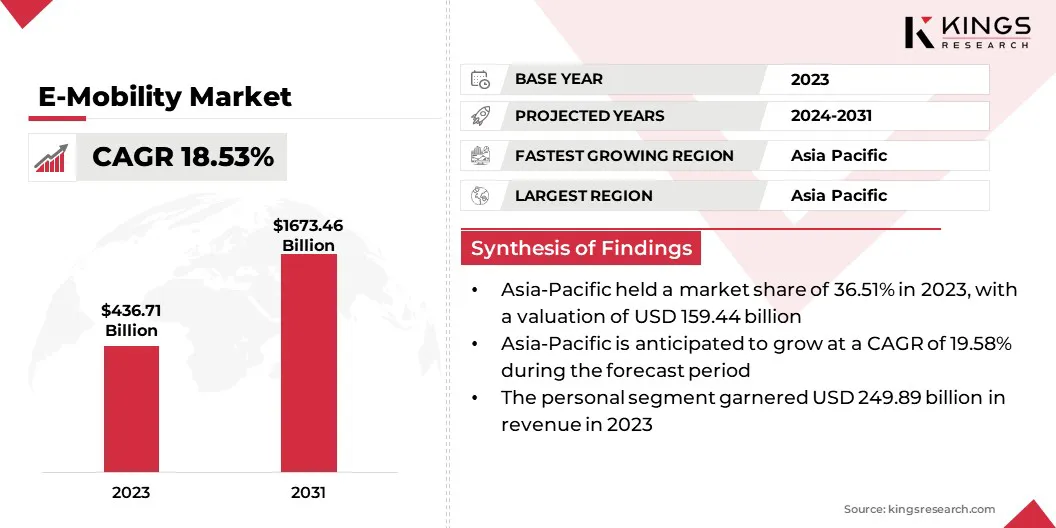

The Global E-Mobility Market size was valued at USD 436.71 billion in 2023 and is projected to grow from USD 508.98 billion in 2024 to USD 1,673.46 billion by 2031, exhibiting a CAGR of 18.53% during the forecast period. Environmental concerns are fueling the growth of the market, fueled by the growing demand for eco-friendly, low-emission transportation options.

In the scope of work, the report includes products and services offered by companies such as Tesla, Nissan Motor Co., Ltd, Volkswagen Group, Hyundai Motor Company, Ford Motor Company, General Motors, Toyota Motor Corporation, Mercedes-Benz AG, Rivian, BMW AG, and others.

The e-mobility market is contributing significantly to the global transition to sustainable transportation, with a growing emphasis on reducing environmental impact. The market is characterized by technological innovation, increased consumer adoption, and a shift toward cleaner, electric alternative to traditional vehicles. Investments in electric vehicles, infrastructure, and technologies are reshaping mobility systems to reduce environmental impact.

- The Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) Scheme Phase-II, announced on 25th July 2023 by the Press Information Bureau, supports the growth of the market by promoting the adoption of electric vehicles and infrastructure. The scheme aims to electrify public transport and enhance the manufacturing of eBuses, e-3 wheelers, e-4 wheelers, e-2 wheelers, and related charging infrastructure development.

E-mobility refers to the use of electric power to drive various forms of transportation, replacing traditional internal combustion engine (ICE) vehicles. E-mobility covers electric cars, bikes, buses, and other vehicles powered by batteries instead of fossil fuels.

E-mobility also encompasses charging infrastructure, energy storage, power management technologies, and advanced vehicle design. This transition aims to promote sustainable transportation, reduce dependency on fossil fuels, and minimize environmental impact.

Analyst’s Review

Analyst’s Review

Automakers’ significant investments in electric vehicle (EV) development reflect a notable shift toward sustainable transportation. As traditional automotive companies prioritize EVs, the e-mobility sector is rapidly advancing, positioning e-mobility as a key component of modern transportation systems, aligning with global efforts to reduce environmental impact.

- In December 2024, Maruti Suzuki India Limited (MSIL), India’s largest passenger vehicle manufacturer, announced plans to showcase the production-ready eBorn SUV, the eVITARA, at the Bharat Mobility Global Expo 2025. Designed for global markets, the eVITARA was recently unveiled by Suzuki Motor Corporation in Milan, Italy.

The transition to EVs drives innovation in vehicle performance, battery technology, and design while intensifying market competition.

- In December 2024, Hyundai Motor Group partnered with IIT Delhi, IIT Bombay, and IIT Madras to establish the Hyundai Center of Excellence (CoE). This initiative backed by a USD 7 million investment for 2025 to 2029, aims to focus on research in battery technology and electrification.

E-Mobility Market Growth Factors

The growing demand for eco-friendly, low-emission transportation is fostering the growth of the e-mobility market. With increasing concerns over climate change and the need to reduce carbon footprints, consumers and governments are prioritizing sustainable alternatives.

EVs provide a cleaner alternative compared to traditional internal combustion engine vehicles, reducing emissions and improving air quality. This transition to greener transportation is contributing to the expansion of the market.

- In November 2024, Hyundai UAE, in partnership with Emirates Transport, celebrated the delivery of 376 Hyundai vehicles, including 60 Sonata Hybrids to Abu Dhabi Taxi. This initiative supports the UAE's sustainability goals by enhancing eco-friendly public transportation with innovative and efficient vehicles.

A significant challenge in the e-mobility market is the high upfront cost of electric vehicles (EVs), primarily driven by expensive battery technology. This cost barrier limits affordability and hinders widespread adoption.

This challenge can be addressed by reducing the initial purchase price, making them more accessible to a broader population. Reducing costs may accelerate the shift toward electric transportation, aligning with environmental goals and supporting the growing demand for sustainable mobility solutions.

E-Mobility Industry Trends

The rapid development of both public and private charging networks is a key trend in the market, driven by the increasing adoption of EVs. In response to this trend, governments and private companies are expanding charging infrastructure, including fast-charging stations in highways, urban areas, and residential spaces. This development reduces range anxiety, increases convenience, and supports the widespread adoption of EVs.

- In March 2024, Mahindra & Mahindra signed an MoU with Adani Total Energies E-Mobility Limited to promote EV adoption in India. The partnership focuses on building a nationwide charging infrastructure, offering seamless access through the Bluesense+ App, and expanding charging options for Mahindra XUV400 customers, supporting India’s sustainability goals.

Strategic partnerships between automotive companies are influencing the e-mobility market. These collaborations aim to accelerate the development of electric and autonomous vehicles, combining expertise in vehicle manufacturing with advancements in battery technology and innovations.

This synergy enhances vehicle performance, improves safety features, and fosters innovation in autonomous driving, leading to widespread adoption. Such partnerships are crucial in supporting the transition to sustainable, high-tech transportation solutions.

- In September 2024, Hyundai Motor and GM entered into an agreement to collaborate on product development, manufacturing, and clean energy technologies. The partnership aims to enhance efficiencies, reduce costs, and accelerate advancements in electric, hydrogen, and internal combustion engine technologies.

Segmentation Analysis

The global market has been segmented based on product type, battery, end use, and geography.

By Product Type

Based on product type, the market has been segmented into electric bicycle, electric motorcycle, electric car, and others. The electric cars segment led the e-mobility market in 2023, reaching a valuation of USD 189.71 billion.

The demand for electric car is rising among consumers and governments prioritizing sustainability and clean energy. Advances in battery technology, improvements in vehicle range, and growing public charging infrastructure are promoting the shift toward EVs. Numerous automakers are committing to ambitious electrification goals, with new models and innovative designs entering the market.

Furthermore, governments are implementing policies and incentives to support EV adoption, aiming to reduce carbon emissions and support environmental sustainability. These efforts are accelerating the transition to electric cars, making them more affordable, accessible, and practical for a broader range of consumers worldwide.

- According to the International Energy Agency (IEA), electric vehicle sales surged to nearly 14 million units in 2023, representing 18% of total car sales, a significant rise from 4% in 2020.

By Battery

Based on battery, the market has been classified into NiMH, lead-acid, lithium-ion (Li-ion) and others. The Li-ion segment secured the largest revenue share of 42.82% in 2023. This growth is primarily driven by the growing adoption of EVs worldwide.

Li-ion batteries, known for their high energy density, long lifespan, and relatively fast charging capabilities, are becoming the preferred choice for EVs. The rising global demand for electric vehicles is supported by advancements in battery technology, increased production capacity, and declining costs. This trend is vital to boost the shift toward sustainable and energy-efficient transportation.

By End Use

Based on end use, the market has been bifurcated into personal and commercial. The commercial segment is projected to grow at a staggering CAGR of 19.36% through the forecast period. This expansion is majorly fueled by the rising demand for sustainable and cost-effective transportation solutions.

The increasing adoption of electric trucks, vans, and buses is propelled by businesses aiming to reduce carbon footprints. Government incentives, advancements in battery technologies, and sustainability initiatives are accelerating this transition, enabling the sector to support global environmental goals while enhancing operational efficiency in logistics, public transport, and delivery services.

- In November 2024, UltraTech Cement Limited, India’s largest cement company, announced the deployment of 100 electric trucks to transport 75,000 MT of clinker per month. The company plans to deploy 500 electric trucks by June 2025 under its eFAST initiative.

E-Mobility Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

.webp) The Asia-Pacific e-mobility market captured a notable share of around 36.51% in 2023, with a valuation of USD 159.44 billion. This dominance is reinforced by significant investments in electric vehicle technology, infrastructure, and supportive government policies.

The Asia-Pacific e-mobility market captured a notable share of around 36.51% in 2023, with a valuation of USD 159.44 billion. This dominance is reinforced by significant investments in electric vehicle technology, infrastructure, and supportive government policies.

Countries such as China, Japan, and South Korea are at the forefront, with rapid adoption of EVs, extensive charging networks, and a major focus on reducing carbon emissions. The region’s strong manufacturing capabilities and growing consumer demand for eco-friendly transport solutions further contribute to its leading position.

- In October 2024, Mercedes-Benz expanded its Mercedes me Charge network to over 2 million charging points across 32 countries. This initiative aims to provide customers with easy access, transparent costs, and reliable services worldwide.

North America e-mobility market is set to witness significant growth over the forecast period, recording a robust CAGR of 18.96%. This rapid growth is fostered by growing consumer demand for EVs and significant improvements in charging infrastructure. The United States and Canada are seeing increased investments in EV manufacturing, characterized by strong government incentives.

Major automakers are expanding their electric vehicle offerings, while new entrants introduce innovative solutions. This combination of policy support, technological progress, and rising consumer interest is accelerating the region's transition to sustainable transportation, positioning it as one of the fast-growing markets for electric mobility.

Competitive Landscape

The global e-mobility market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in E-Mobility Market

- Tesla

- Nissan Motor Co., Ltd

- Volkswagen Group

- Hyundai Motor Company

- Ford Motor Company

- General Motors

- Toyota Motor Corporation

- Mercedes-Benz AG

- Rivian

- BMW AG

Key Industry Developments

- December 2024 (Partnership): Ford Pro and Southern Company launched a six-month pilot program to assist businesses in the southeastern U.S. transitioning to electric vehicles. The initiative aims to optimize fleet management, depot charging practices, and total cost of ownership. Insights gathered from over 200 Ford F-150 Lightning trucks and 150 charging stations will inform the development of a scalable electrification model, enhancing fleet performance and energy efficiency.

The global e-mobility market has been segmented as:

By Product Type

- Electric Bicycle

- Electric Motorcycle

- Electric Car

- Others

By Battery

- NiMH

- Lead-Acid

- Lithium-Ion (Li-ion)

- Others

By End Use

- Personal

- Commercial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)