Energy and Power

Economizer Market

Economizer Market Size, Share, Growth & Industry Analysis, By Application (Power Plants, Boilers, HVAC, Refrigeration, and Others), By Boiling Efficiency (Condensing and Non-Condensing), By Type (Fluid Side Economizer and Air Side Economizer), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR906

Economizer Market Size

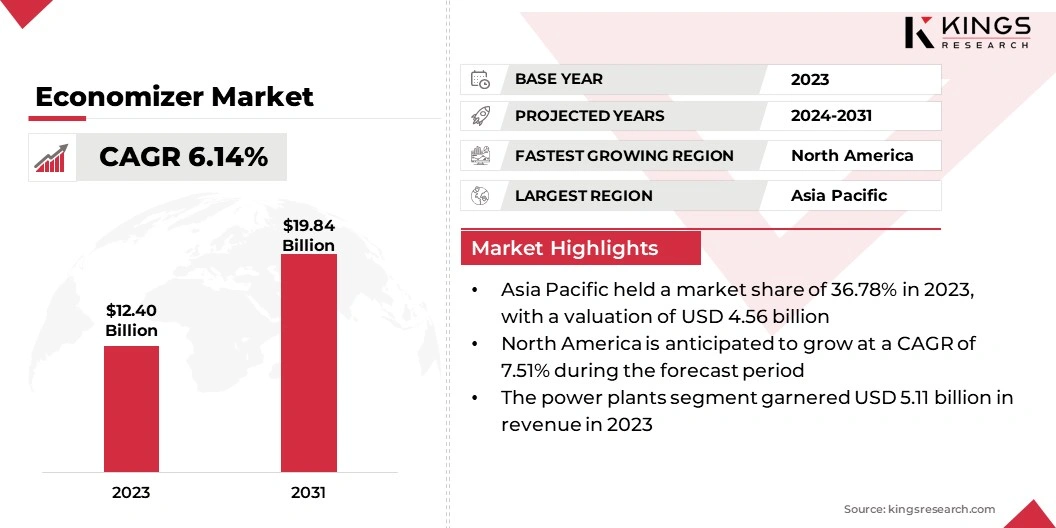

The global Economizer Market size was valued at USD 12.40 billion in 2023 and is projected to grow from USD 13.07 billion in 2024 to USD 19.84 billion by 2031, exhibiting a CAGR of 6.14% during the forecast period. The expansion of the market is driven by the increasing demand for energy efficiency across HVAC and industrial sectors.

This demand is further bolstered by technological advancements such as IoT and AI, which enhance system performance. Moreover, the growth of the market is supported by rising awareness of sustainability, which is promoting the adoption of greener practices in construction and industry, creating market opportunities.

In the scope of work, the report includes solutions offered by companies such as Honeywell International Inc., Schneider Electric, ALFA LAVAL, Johnson Controls Inc., BELIMO AIRCONTROLS (USA), INC, Cain Industries, Cleaver-Brooks, Inc, SWEP International AB, Thermax Limited, STULZ Air Technology Systems, Inc., and others.

The economizer market is experiencing robust growth, mainly fueled by the increasing demand for energy-efficient solutions across various industries. As businesses and governments worldwide strive to reduce energy consumption and carbon emissions, there has a significant increase in the adoption of economizers in HVAC systems and industrial processes.

Technological advancements, particularly the integration of IoT and AI, are enhancing the efficiency and reliability of economizers, thereby further propelling market expansion. Additionally, the rising adoption of sustainable construction practices and green building certifications is boosting demand.

With significant contributions to operational cost savings and environmental sustainability, the market is poised to witness sustained growth and innovation.

An economizer is a mechanical device designed to improve energy efficiency by utilizing waste heat or external environmental conditions to reduce the energy consumption of a system. Commonly used in HVAC systems and industrial processes, economizers work by capturing excess heat from exhaust gases or by leveraging cooler outdoor air for cooling, thereby reducing the load on primary heating or cooling systems.

This enhances the overall efficiency of the system and leads to significant cost savings and reduced environmental impact by lowering fuel consumption and greenhouse gas emissions.

Analyst’s Review

The surge in energy consumption is fueling the demand for energy-efficient solutions.

- According to a report by the International Energy Agency (IEA), global energy demand from air conditioners is anticipated to increase threefold by 2050.

This rising demand underscores the need for sustainable technologies. Furthermore, companies are increasingly collaborating to enhance sustainability.

- For instance, in June 2023, Alfa Laval and SSAB collaborated to advance a global carbon-neutral supply chain by incorporating SSAB's recycled steel, which is free from fossil carbon emissions, into Alfa Laval's heat exchangers. This initiative intends to deliver over 100 heat exchangers, aimed at improving energy efficiency in areas such as HVAC and significantly reducing the global carbon footprint in the coming years.

Economizer Market Growth Factors

Increasing government regulations and global corporate sustainability initiatives are significantly increasing the demand for economizers. These devices enhance energy efficiency in HVAC systems and industrial processes by utilizing external environmental conditions to reduce the need for mechanical cooling.

By integrating economizers, businesses are achieving significant energy savings and operational cost reductions, while simultaneously lowering carbon emissions. This trend aligns with global efforts to combat climate change and meet environmental targets.

As regulations become more stringent and sustainability gains importance, economizers play a crucial role in helping industries and commercial buildings meet compliance standards and improve their environmental footprint, thereby fostering a greener and more efficient future.

- The Ministry of Environment, Forest and Climate Change (MoEF&CC) in India launched the National Clean Air Programme (NCAP) in January 2019 to enhance air quality in 131 cities across 24 States and Union Territories. Targeting non-attainment cities and Million Plus Cities, the programme aims to engage all stakeholders in achieving significant reductions, aiming for up to 40% reduction or attainment of National Ambient Air Quality Standards for Particulate Matter 10 (PM 10) concentrations by 2025-26.

One of the critical challenges in the economizer market is tube failure, with approximately 30% of these failures occurring in the economizer due to corrosion on both the fireside and waterside of the tubes. Fireside corrosion occurs due to high temperatures and exposure to corrosive combustion gases, whereas waterside corrosion is influenced by the quality of the water.

Key industry players are addressing these challenges through innovative materials and coatings development to enhance tube durability and corrosion resistance. They are further focusing on improving manufacturing processes to ensure high-quality tube production.

Additionally, proactive maintenance strategies, such as regular inspections and monitoring systems, are employed to detect and mitigate corrosion early, thereby ensuring prolonged economizer tube lifespan and reliable operation.

Economizer Industry Trends

The growing focus on sustainable construction practices and the rising number of green building certifications are leading to the widespread adoption of economizers. As the construction industry increasingly prioritizes energy efficiency and environmental sustainability, economizers are being widely implemented in new building projects.

These systems optimize the use of outdoor air for cooling, thereby reducing the reliance on mechanical cooling and lowering energy consumption. By meeting stringent energy efficiency standards, economizers enable buildings to obtain green certifications such as LEED and BREEAM, which are recognized as essential benchmarks in the industry.

Economizers contribute to reducing the overall environmental impact of new constructions while enhancing their operational efficiency, thereby supporting the economizer market growth.

The incorporation of IoT and AI in economizer systems represents a transformative trend, significantly enhancing their efficiency and reliability. IoT sensors collect real-time data on environmental and operational parameters, which are then analysed by AI algorithms to optimize economizer performance.

This continuous monitoring allows for early detection of anomalies, which enables predictive maintenance and helps minimize downtime. In addition, economizer systems operate at peak efficiency, leading to substantial energy savings and reduced operational costs.

Additionally, real-time insights from these smart technologies ensure precise control over indoor environments, thereby improving both comfort and operational efficiency. As energy efficiency and sustainability become paramount, IoT and AI integration in economizers is setting new industry standards and consequently stimulating market growth.

Segmentation Analysis

The global market is segmented based on application, boiling efficiency, type, and geography.

By Application

Based on application, the market is categorized power plants, boilers, HVAC, refrigeration, and others. The power plants segment led the economizer market in 2023, reaching a valuation of USD 5.11 billion.. This growth is further propelled by increasing global electricity demand and regulatory pressures to improve energy efficiency and reduce emissions.

Economizers play a pivotal role in these plants by recovering waste heat from flue gases to preheat boiler feed water, thereby enhancing overall thermal efficiency. This capability minimizes fuel consumption, lowers operational costs, and reduces greenhouse gas emissions, aligning with sustainability goals.

Moreover, as power generation capacities expand globally, particularly in emerging economies, the demand for economizers continues is increasing. This trend is fostering segmental expansion and innovation in heat recovery technologies.

By Boiling Efficiency

Based on boiling efficiency, the market is divided into condensing and non-condensing. The non-condensing segment captured the largest economizer market share of 61.55% in 2023. This expansion is propelled by increasing industrial activities and the widespread adoption of cogeneration systems aimed at boosting energy efficiency.

This segment benefits from stringent regulatory frameworks that prioritize emissions reduction and energy conservation. Innovations in economizer technology are pivotal, as they focus on optimizing heat recovery and enhancing operational efficiency to meet the diverse needs of industrial applications.

As industries worldwide seek to improve sustainability and reduce operational costs, there is a growing demand for efficient heat recovery solutions in non-condensing environments. This demand is contributing to both segmental growth and technological advancements in economizer systems.

By Type

Based on type, the market is categorized into fluid side economizer and air side economizer. The fluid side economizer segment is expected to garner the highest revenue of USD 11.56 billion by 2031. The fluid side economizer aims to enhance optimizing thermal efficiency by extracting heat from fluid streams, such as water or glycol.

This recovered heat is then used to preheat or directly transfer thermal energy for heating and cooling purposes in HVAC systems, industrial processes, and renewable energy applications. This economizer is pivotal in meeting stringent energy efficiency regulations and promoting sustainable building practices in commercial and industrial sectors.

Innovations in heat exchanger technology and advanced materials enhance the performance and reliability of fluid side economizers. These advancements address the increasing demand for cost-effective and environmentally friendly heating and cooling solutions across diverse applications and industries.

Economizer Market Regional Analysis

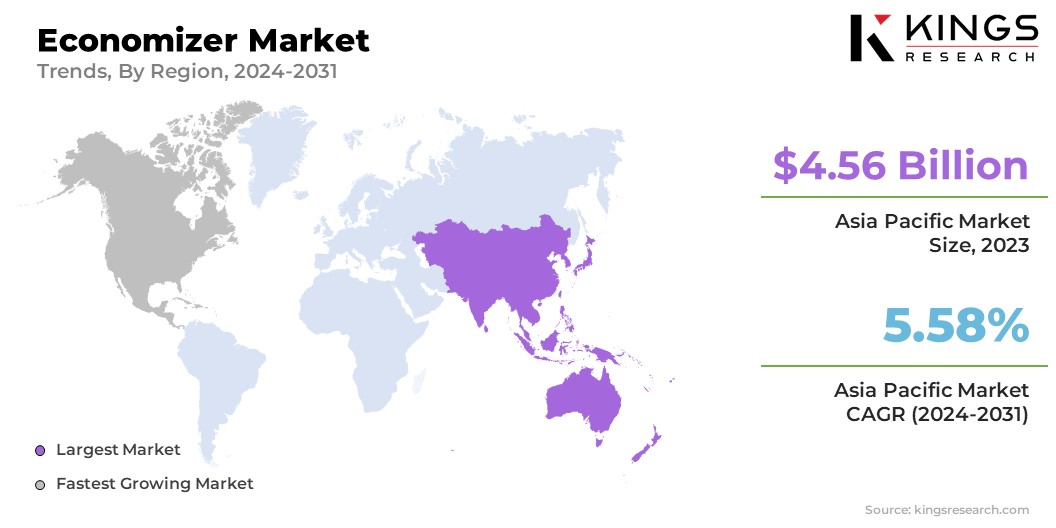

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia Pacific economizer market share stood around 36.78% in 2023 in the global market, with a valuation of USD 4.56 billion. This notable growth is stimulated by increasing demand from thermal power plants and the expanding applications in the commercial sector. China, Japan, and India are contributing significantly to this dominance, supported by ambitious electricity generation targets set by national authorities.

- For instance, India's goal of 1750 Billion Units (BU) for 2023-24 reflects a 7.2% increase compared to the previous year.

Leading producers such as Schneider Electric, Honeywell International Inc., ALFA LAVAL, Johnson Controls International PLC, and BELIMO AIRCONTROLS (USA), INC are strategically positioned in the Asia-Pacific region, thereby bolstering the region's prominence in economizer production and innovation.

North America is anticipated to witness substantial growth at a CAGR of 7.51% over the forecast period. This growth is supported by stringent energy efficiency regulations and the growing adoption of green building certifications such as LEED.

These factors compel industries and commercial sectors to integrate economizers into HVAC systems and industrial processes, aiming to reduce energy consumption and environmental impact. The region's robust industrial base further supports regional market growth, thereby fostering innovation in economizer technologies.

Competitive Landscape

The global economizer market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Economizer Market

- Honeywell International Inc.

- Schneider Electric

- ALFA LAVAL

- Johnson Controls Inc.

- BELIMO AIRCONTROLS (USA), INC

- Cain Industries

- Cleaver-Brooks, Inc

- SWEP International AB

- Thermax Limited

- STULZ Air Technology Systems, Inc.

Key Industry Development

- February 2024 (Acquisition): RectorSeal, a leading manufacturer of quality HVAC/R and plumbing products, announced the acquisition of Dust Free to complement and expand its Indoor Air Quality product line. Dust Free, which is known for its innovative solutions in purification and filtration, specializes in ozone-free products that effectively neutralize indoor air pollutants. Dust Free's ozone-free products has been validated through independent lab testing. This acquisition is likely to bolster RectorSeal's capabilities in providing high-performance economizer solutions for both residential and commercial HVAC applications.

The global economizer market is segmented as:

By Application

- Power Plants

- Boilers

- HVAC

- Refrigeration

- Others

By Boiling Efficiency

- Condensing

- Non-Condensing

By Type

- Fluid Side Economizer

- Air Side Economizer

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership