Automotive and Transportation

Electric Tractor Market

Electric Tractor Market Size, Share, Growth & Industry Analysis, By Propulsion (Battery, Hybrid, Hydrogen), By Capacity (Less than 50 kWh, 51-100 kWh, Above 100 kWh), By Application (Agriculture, Utility, Industrial), and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : March 2025

Report ID: KR1434

Market Definition

The electric tractor market involves manufacturing, selling, and adopting electric-powered tractors for agricultural use. These tractors are powered by batteries or other electric energy sources, offering environmentally friendly alternatives to traditional diesel-powered tractors. The market is driven by the demand for sustainable farming, reduced emissions, and lower operational costs in agriculture.

Electric Tractor Market Overview

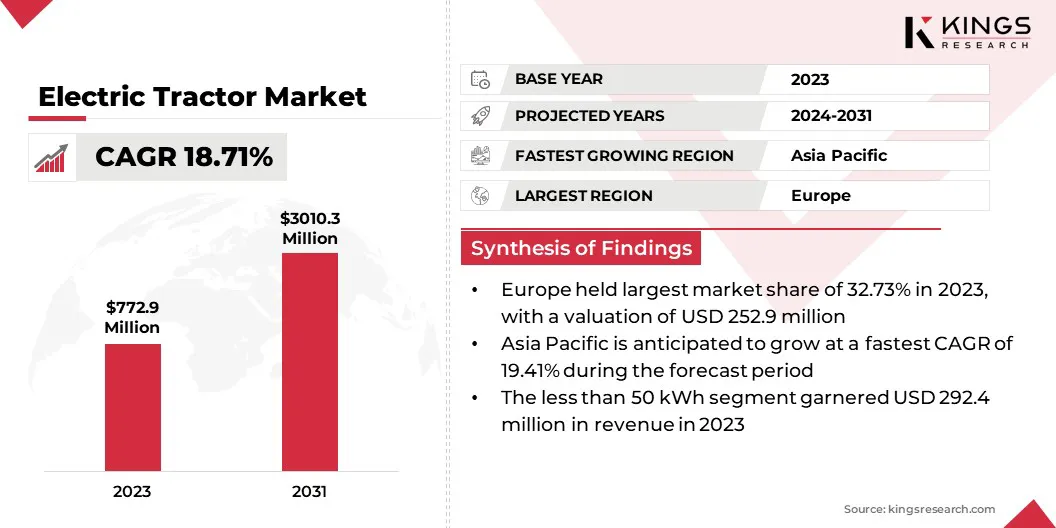

The global electric tractor market size was valued at USD 772.9 million in 2023, which is estimated to be valued at USD 906.0 million in 2024 and reach USD 3010.3 million by 2031, growing at a CAGR of 18.71% from 2024 to 2031.

Environmental concerns are driving the shift toward electric tractors, as they help reduce carbon emissions and reliance on fossil fuels. Growing awareness of climate change and the need to adopt sustainable farming practices are encouraging eco-friendly alternatives, like electric-powered machinery.

Major companies operating in the global electric tractor industry are Kubota Corporation, CNH Industrial N.V., Motivo Engineering, SOLECTRAC, Tractors and Farm Equipment Limited, TADUS GmbH, AGCO Corporation, Monarch Tractor, Murugappa Group, AutoNXT Automation Pvt. Ltd., VST TRACTORS, ZY Elektrik Traktör Sanayi ve Ticaret A.┼×, Sonalika, Alke, and BULLWORK MOBILITY.

The market is evolving as agriculture shifts toward more sustainable, energy-efficient machinery. Electric tractors are gaining traction, due to their lower environmental impact.

The market offers a diverse range of products, including small, medium, and large tractors. These machines are increasingly being adopted in various farming sectors, such as crop production, livestock, and horticulture. The market spans both developed and emerging economies, with manufacturers focusing on improving battery performance, charging infrastructure, and cost efficiency to meet evolving demand.

- In August 2024, Monarch Tractors, a U.S.-based electric tractor company, met with the Telangana government to discuss the expansion of its R&D center in Hyderabad and setting up an autonomous tractor testing facility. The company also explored the possibility of establishing manufacturing operations in the state, aligning with the growing market.

Key Highlights:

- The global electric tractor market size was valued at USD 772.9 million in 2023.

- The market is projected to grow at a CAGR of 18.71% from 2024 to 2031.

- Europe held a market share of 32.73% in 2023, with a valuation of USD 252.9 million.

- The battery segment garnered USD 277.4 million in revenue in 2023.

- The less than 50 kWh segment is expected to reach USD 1139.1 million by 2031.

- The utility segment is anticipated to register the fastest CAGR of 19.25% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 19.41% during the forecast period.

Market Driver

Sustainability

Sustainability is a key driver of the electric tractor market as farmers and companies increasingly prioritize eco-friendly practices. The rising demand for sustainable farming solutions aligns with the need to reduce greenhouse gas emissions, minimize environmental impact, and conserve resources.

Electric tractors, with their zero-emission engines and lower operational costs, provide an effective way to achieve sustainability in farming. Electric tractors are seen as an essential tool in promoting greener, more efficient agricultural practices globally as environmental awareness grows.

- In September 2023, New Holland’s T4 Electric Power utility tractor made its European debut at Agritechnica, showcasing its all-electric, zero-emission design. With autonomous features and enhanced performance, it represents a key milestone in New Holland's electrification strategy for sustainable farming.

Market Challenge

Battery Range Challenge

A major challenge faced by the electric tractor market is the limited battery range, which affects the tractor's operational hours, particularly for larger agricultural operations. Extended use in the field can require frequent recharging, impacting productivity.

A solution lies in the development of more efficient and higher-capacity batteries, as well as the implementation of fast-charging systems. Additionally, creating a robust charging infrastructure in rural areas can ensure seamless operation and reduced downtime, enhancing overall efficiency and reliability in the market.

Market Trend

Technological Advancements

Technological advancements in battery efficiency and electric power systems are transforming the electric tractor market. With innovations such as longer-lasting batteries, faster charging capabilities, and improved energy management systems, electric tractors are becoming more practical for daily agricultural use. These advancements not only extend the operational range of electric tractors but also enhance their overall performance and reliability.

As manufacturers continue to refine these technologies, electric tractors are poised to offer farmers more efficient, cost-effective, and sustainable alternatives to traditional fuel-powered machinery.

- In November 2023, VST Tillers Tractors showcased its advanced electric tractor, the FIELDTRAC 929 EV, at Agritechnica 2023. This tractor features cutting-edge technology, including a 25kWh battery, enhanced power steering, and improved ergonomics, reflecting significant technological advancements in battery efficiency and electric power systems in the market.

Electric Tractor Market Report Snapshot

|

Segmentation |

Details |

|

By Propulsion |

Battery, Hybrid, Hydrogen |

|

By Capacity |

Less than 50 kWh, 51-100 kWh, Above 100 kWh |

|

By Application |

Agriculture, Utility, Industrial |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Propulsion (Battery, Hybrid, Hydrogen): The battery segment earned USD 277.4 million in 2023, due to the increasing demand for sustainable, low-emission farming solutions and advancements in battery efficiency.

- By Capacity (Less than 50 kWh, 51-100 kWh, Above 100 kWh): The less than 50 kWh segment held 37.83% share of the market in 2023, due to its affordability, compact size, and suitability for small to medium-scale farming operations.

- By Application (Agriculture, Utility, Industrial): The agriculture segment is projected to reach USD 1119.5 million by 2031, owing to the growing adoption of electric tractors for eco-friendly, cost-effective farming practices and the push for sustainable agriculture solutions.

Electric Tractor Market Regional Analysis

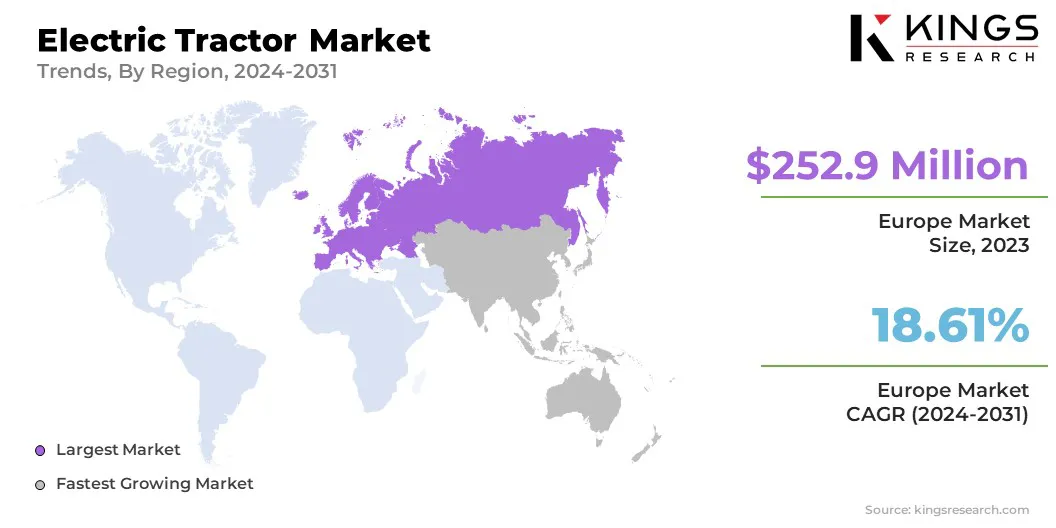

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe accounted for a electric tractor market share of around 32.73% in 2023, with a valuation of USD 252.9 million. Europe continues to lead the market, due to the strong regulatory push for sustainability and carbon-neutral farming practices.

The European Union's commitment to reducing greenhouse gas emissions and promoting eco-friendly agriculture has driven the demand for electric tractors in the region.

Several European countries offer incentives for adopting green technologies, further enhancing the appeal of electric tractors for both small and large-scale farmers. The shift toward clean energy and precision farming is expected to maintain Europe’s dominance in the market.

The electric tractor industry in Asia Pacific is poised for significant growth at a robust CAGR of 19.41% over the forecast period. Asia Pacific is expected to register the highest growth rate in the market, due to rapid technological advancements, increasing agricultural mechanization, and rising environmental concerns.

Countries like China and India are investing in sustainable farming solutions, offering significant opportunities for the adoption of electric tractors. The need to reduce emissions in densely populated agricultural sectors and improve farm productivity will drive the market, positioning Asia Pacific as the fastest-growing region globally.

- In September 2024, MKR HARTAMAS (MKR) launched Malaysia’s first electric tractor, the TerraGlide EV40, marking a significant step toward transforming the nation’s agricultural sector. This initiative aligns with national sustainability goals, offering a carbon-neutral farming solution and supporting smarter, greener agriculture.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) protects people and the environment from significant health risks, sponsors and conducts research, and develops and enforces environmental regulations.

- In the EU, the Outdoor Noise Directive 2000/14/EC (OND) regulates the generation of noise emissions into the environment by outdoor equipment.

- The Bureau of Indian Standards was established in 1947 for the harmonious development of activities of standardization, marking and quality certification of goods, and for matters connected therewith or incidental thereto. This Act also covers agriculture equipment.

Competitive Landscape:

The global electric tractor market is characterized by a large number of participants, including established corporations and rising organizations. Companies have introduced smart electric tractors equipped with advanced technologies like autonomous driving, IoT integration, and enhanced battery efficiency.

These tractors offer zero emissions, reduced operational costs, and improved productivity, aligning with the growing demand for sustainable farming practices. With innovations like real-time monitoring and autonomous capabilities, these tractors are revolutionizing the agricultural sector, enhancing both efficiency and environmental sustainability.

- In July 2024, Monarch unveiled a groundbreaking smart electric tractor featuring both driver-optional and autonomous operation capabilities. Designed for efficiency, it can be operated traditionally or autonomously, and is capable of functioning within a fleet of robotic tractors, revolutionizing farming technology.

List of Key Companies in Electric Tractor Market:

- Kubota Corporation

- CNH Industrial N.V.

- Motivo Engineering

- SOLECTRAC

- Tractors and Farm Equipment Limited

- TADUS GmbH

- AGCO Corporation

- Monarch Tractor

- Murugappa Group

- AutoNXT Automation Pvt. Ltd.

- VST TRACTORS

- ZY Elektrik Traktör Sanayi ve Ticaret A.┼×

- Sonalika

- Alke

- BULLWORK MOBILITY

Recent Developments (Launch/Partnership)

- In November 2023, TAFE made its mark at AGRITECHNICA with the launch of its electric tractor, featuring a 20 kW power system, low noise powertrain, and fast charging. The tractor aims to cater to agriculture, municipalities, and logistics, emphasizing sustainability.

- In September 2024, Fendt launched the e107 Vario, an electric tractor offering 100 kWh battery capacity, three driving modes, and a low-maintenance, emission-free design. With energy-efficient features and fast-charging options, it promises sustainable solutions for agriculture, municipalities, and short-distance transport.

- In March 2024, AGCO Power unveiled its 100 kWh battery pack for the Fendt e100 Vario, marking a significant step toward zero-emission farming. The battery stores surplus wind or solar power, contributing to carbon-free farming and sustainable tractor contracting.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership