Automotive and Transportation

Electric Utility Vehicle Market

Electric Utility Vehicle Market Size, Share, Growth & Industry Analysis, By Battery (Lithium-ion, Lead-acid, Others), By Drive Type (Front Wheel Drive, Rear Wheel Drive, All-wheel Drive), By Type (All-terrain Vehicle, Multi Utility Vehicle, Others), By Application, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2025

Report ID: KR332

Market Definition

Electric utility vehicles (EUVs) are battery-powered vehicles designed for commercial, industrial, and specialized applications, offering an eco-friendly alternative to traditional fuel-powered utility vehicles. These vehicles are widely used in logistics, agriculture, construction, and municipal services for transporting goods, equipment, and personnel.

EUVs include electric forklifts, compact utility trucks, maintenance vehicles, and off-road transporters, providing efficient and low-emission mobility solutions. Their adoption is driven by advancements in battery technology, regulatory support for sustainable transportation, and the growing demand for cost-effective, energy-efficient vehicles in diverse operational environments.

Electric Utility Vehicle Market Overview

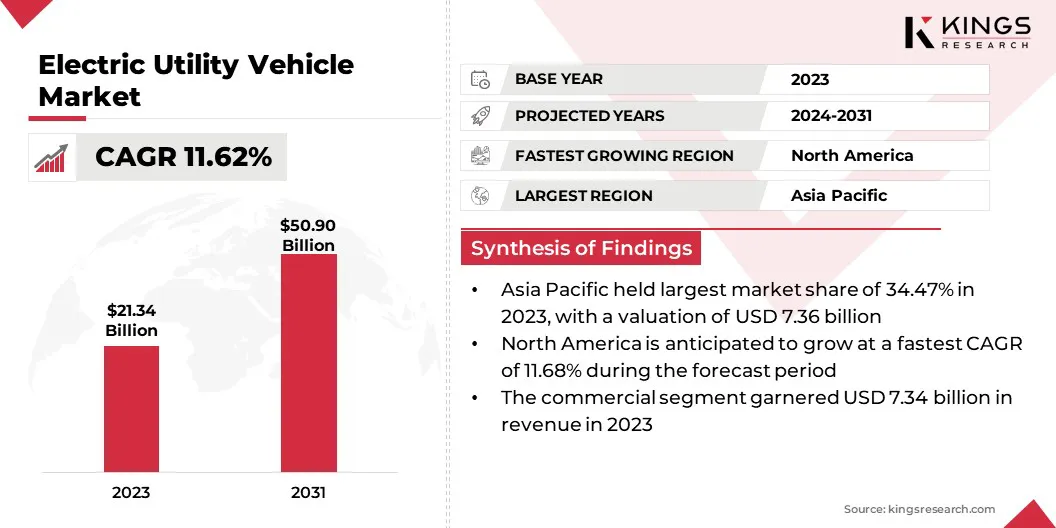

The global electric utility vehicle market size was valued at USD 21.34 billion in 2023 and is projected to grow from USD 23.58 billion in 2024 to USD 50.90 billion by 2031, exhibiting a CAGR of 11.62% during the forecast period.

The market is expanding, due to the rising demand for sustainable transportation solutions in agriculture, logistics, and construction, driven by stringent emissions regulations and government incentives promoting electric mobility.

Advancements in battery technology are enhancing vehicle range, efficiency, and charging speed, thereby increasing the adoption of EUVs. Additionally, growing investments in charging infrastructure and fleet electrification are further accelerating market growth by improving operational feasibility.

Major companies operating in the electric utility vehicle industry are Deere & Company, BYD Company Ltd, Toyota Material Handling, Polaris Inc., Club Car, The Toro Company, Star EV Corporation, Alke, American Landmaster, Hyster-Yale, Inc, Addax Motors, Marshell Green Power, Ford Motor Company, General Motors, and Mahindra & Mahindra Ltd.

Governments worldwide are implementing stricter emission norms to combat environmental pollution, driving demand in the market. Regulatory frameworks mandate the reduction of carbon footprints across industries, prompting businesses to transition toward electric fleets.

Financial incentives, including tax credits and subsidies, further accelerate adoption. Municipalities and corporations are investing in zero-emission solutions to meet sustainability goals and regulatory compliance.

Stringent policies restricting diesel-powered fleet operations in urban areas enhance the market outlook. These regulations, coupled with a shift toward clean mobility solutions, encourage fleet operators to integrate EUVs into daily operations.

- The Inflation Reduction Act (IRA) offers tax credits of up to USD 7,500 for EV purchases, alongside federal funding for the expansion of charging infrastructure. The Bipartisan Infrastructure Law allocates USD 7.5 billion to develop a nationwide charging network.

Key Highlights:

Key Highlights:

- The electric utility vehicle industry size was valued at USD 21.34 billion in 2023.

- The market is projected to grow at a CAGR of 11.62% from 2024 to 2031.

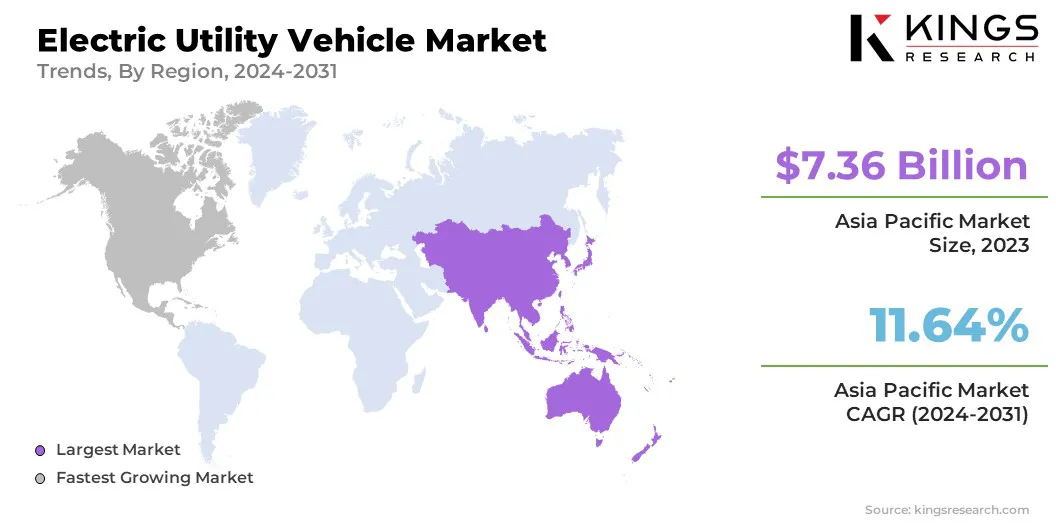

- Asia Pacific held a market share of 34.47% in 2023, with a valuation of USD 7.36 billion.

- The lithium-ion segment garnered USD 9.38 billion in revenue in 2023.

- The rear wheel drive segment is expected to reach USD 19.92 billion by 2031.

- The electric shuttle segment secured the largest revenue share of 31.22% in 2023.

- The agricultural segment is poised for a robust CAGR of 11.67% through the forecast period.

- The market in North America is anticipated to grow at a CAGR of 11.68% during the forecast period.

Market Driver

"Growth of Last-mile Delivery and E-commerce"

E-commerce expansion is fueling demand in the electric utility vehicle market, particularly for last-mile delivery operations.

- The World Economic Forum reports that global demand for last-mile delivery is surging and is projected to increase by 78% by 2030.

Logistics companies prioritize sustainable fleet solutions to reduce operational costs and enhance delivery efficiency. Lower energy consumption and minimal maintenance improve profitability for delivery service providers and retail logistics.

EUVs provide a cost-effective alternative for urban and suburban distribution networks. Businesses are integrating EUVs into automated warehouse systems for streamlined distribution processes.

Additionally, the push toward carbon-neutral logistics operations reinforce the adoption of EUVs across supply chain networks. Companies investing in fleet electrification contribute to increased market penetration and long-term growth.

Market Challenge

"Infrastructure Limitations Hindering Market Expansion"

The expansion of the electric utility vehicle market faces significant challenges, due to inadequate charging infrastructure, particularly in remote and industrial areas where these vehicles are extensively used. Limited access to fast-charging stations increases downtime, reducing operational efficiency and deterring adoption.

Companies are investing in expanding charging networks, integrating fast-charging technology, and developing mobile charging solutions. Strategic collaborations with energy providers and government agencies are also facilitating the deployment of widespread charging infrastructure.

Additionally, advancements in battery technology, including higher energy density and rapid charging capabilities, are enhancing vehicle range and minimizing charging constraints.

Market Trend

"Growth in Electric Recreational and Tourism Vehicles"

The hospitality and tourism industry contributes to the growth of the electric utility vehicle market by adopting EUVs for guest transportation, maintenance services, and adventure tourism. Resorts, golf courses, amusement parks, and eco-tourism destinations invest in electric fleets to enhance visitor experiences while reducing environmental impact.

EUVs provide quiet operation, reduced operational expenses, and compliance with sustainability goals. Parks and nature reserves use EUVs for guided tours and patrolling services. The increasing focus on sustainable tourism practices reinforces market demand, encouraging businesses to transition toward electric transport solutions.

- In June 2024, Polaris introduced an off-road charging network in Michigan’s Upper Peninsula. Alongside this launch, the company unveiled the nation’s first all-electric off-road vehicle rental fleet. Hamilton’s North Coast Adventures now offers rentals of Polaris’ all-electric RANGER XP Kinetic. This initiative enables customers to experience the Pioneer ORV Trail using the latest electric off-road vehicles while benefiting from the newly established charging infrastructure.

Electric Utility Vehicle Market Report Snapshot

|

Segmentation |

Details |

|

By Battery |

Lithium-ion, Lead-acid, Others |

|

By Drive Type |

Front Wheel Drive, Rear Wheel Drive, All-wheel Drive, |

|

By Type |

All-terrain Vehicle, Multi Utility Vehicle, Electric Shuttle, Others |

|

By Application |

Commercial, Industrial, Agricultural, Recreation, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Battery (Lithium-ion, Lead-acid, Others): The lithium-ion segment earned USD 9.38 billion in 2023, due to its superior energy density, longer lifespan, and faster charging capabilities, which enhance vehicle efficiency and operational productivity across industrial and commercial applications.

- By Drive Type (Front Wheel Drive, Rear Wheel Drive, All-wheel Drive): The rear wheel drive segment held 38.96% share of the market in 2023, due to its superior load-bearing capacity, enhanced traction for heavy-duty applications, and optimized power distribution.

- By Type (All-terrain Vehicle, Multi Utility Vehicle, Utility Terrain Vehicle, and Electric Shuttle): The electric shuttle segment is projected to reach USD 15.88 billion by 2031, owing to the rising demand for sustainable public and commercial transportation solutions, driven by increasing urbanization, government incentives, and expanding adoption across airports, campuses, and industrial facilities for efficient passenger mobility.

- By Application (Commercial, Industrial, Agricultural, Recreation, Others): The agricultural segment is poised for significant growth at a CAGR of 11.67% through the forecast period, due to the increasing adoption of EUVs for farm operations, driven by rising fuel costs, government incentives for sustainable farming, and the demand for efficient, low-emission transportation in large-scale agricultural activities.

Electric Utility Vehicle Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 34.47% share of the electric utility vehicle market in 2023, with a valuation of USD 7.36 billion. The rapid expansion of urban centers and smart city projects fuels demand in the market across Asia Pacific.

Asia Pacific accounted for around 34.47% share of the electric utility vehicle market in 2023, with a valuation of USD 7.36 billion. The rapid expansion of urban centers and smart city projects fuels demand in the market across Asia Pacific.

Governments are investing in sustainable urban transport solutions to address congestion, pollution, and last-mile mobility challenges. Smart cities integrate EUVs into public services, waste management, and intra-city logistics, improving operational efficiency. Countries such as China, Singapore, and South Korea deploy EUVs for municipal services, electric buses, and shared mobility solutions.

Additionally, the surge in e-commerce and logistics operations is a key driver for the electric utility vehicle industry in Asia Pacific. Online retail giants such as Alibaba, JD.com, and Flipkart invest in electric delivery vehicles to optimize distribution networks while reducing fuel expenses.

Logistics hubs and urban delivery networks integrate compact EUVs to streamline last-mile connectivity. Countries such as China and India, with their rapidly growing e-commerce sectors, are registering increased demand for electric cargo vans, three-wheelers, and small utility trucks.

- In January 2025, Eicher Trucks and Buses, a division of VE Commercial Vehicles, introduced its electric-first lineup of Small Commercial Vehicles (SCVs), the Eicher Pro X Range, at the Bharat Mobility Global Expo 2025. This groundbreaking launch marks Eicher's strategic expansion into the fast-growing 2-3.5T segment, reinforcing the company’s dedication to driving growth in India by revolutionizing last-mile logistics.

The market in North America is poised for significant growth at a robust CAGR of 11.68% over the forecast period. Government initiatives across the region are accelerating the adoption of EUVs, strengthening market growth.

The Inflation Reduction Act (IRA) in the U.S. offers tax credits for EV purchases, battery production, and charging infrastructure development. Similar programs in Canada, such as the Incentives for Zero-Emission Vehicles (iZEV) program, encourage fleet operators to transition to EUVs.

State-level policies, including California’s Advanced Clean Fleets regulation, mandate fleet electrification in commercial and municipal sectors. These financial incentives reduce upfront costs, making EUV adoption more attractive across multiple industries.

Furthermore, the rapid deployment of charging stations across North America is driving demand in the market. Investments from governments, utilities, and private companies are expanding fast-charging networks, fleet charging hubs, and vehicle-to-grid (V2G) solutions.

The National Electric Vehicle Infrastructure (NEVI) program in the U.S. allocates funding for charging corridors to support commercial EV fleets. In Canada, the Zero-Emission Vehicle Infrastructure Program (ZEVIP) enhances accessibility for businesses and municipal services transitioning to EUV fleets.

Regulatory Framework

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) sets and enforces vehicle performance standards to ensure safety on public roads. The Environmental Protection Agency (EPA) regulates vehicle emissions under the Clean Air Act, establishing standards that impact EUV design and manufacturing. Recent regulatory developments include proposed bans on imports of vehicles and components from China and Russia due to national security concerns, with software restrictions effective from Model Year 2027 and hardware restrictions from Model Year 2030.

- In the UK, the Vehicle Certification Agency (VCA) is responsible for vehicle type approval, ensuring compliance with safety and environmental standards. The UK government offers grants for electric vehicles (EVs) and announced plans to ban the sale of new petrol and diesel cars by 2030, promoting the adoption of EUVs.

- China has implemented stringent regulations to promote the adoption of EVs, including EUVs. The government offers substantial subsidies for new energy vehicles (NEVs), which include battery electric vehicles (BEVs) and plug-in hybrids. However, recent developments indicate a tightening of regulations concerning foreign technology in vehicles. The U.S. Commerce Department has proposed rules to ban imports of Chinese vehicles and components due to security concerns, which could impact China's vehicle export strategy.

- India regulates vehicle emissions through the Bharat Stage Emission Standards (BSES), which are progressively aligned with European standards. The government has introduced the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) India scheme to promote electric mobility, offering incentives for the purchase of EVs and the development of charging infrastructure. Safety standards are governed by the Automotive Industry Standards (AIS), which outline requirements for various vehicle categories, including EUVs.

Competitive Landscape:

The electric utility vehicle industry is characterized by a large number of participants, including both established corporations and rising organizations.

Market players are actively investing in product innovation and Research and Development (R&D) to enhance the capabilities of commercial work Utility Task Vehicles (UTVs), catering to the evolving demands of agriculture, construction, and logistics. Companies are introducing advanced battery technologies and improving vehicle range, load capacity, and durability to optimize operational efficiency.

- In February 2024, Polaris introduced the all-electric Pro XD Full-Size Kinetic utility vehicle, designed to endure demanding jobsite conditions while delivering all-day performance with zero emissions, enhancing both efficiency and sustainability. Its advanced electric powertrain expands the range of environments where these UTVs can operate, providing a reliable solution for worksites that require low-noise, high-performance, and eco-friendly transportation.

The integration of smart telematics, autonomous driving features, and AI-powered fleet management systems is further enhancing productivity and reducing downtime. Strategic collaborations with technology providers and government-backed research initiatives are accelerating innovation, reinforcing the expansion of the market and driving broader industry adoption.

List of Key Companies in Electric Utility Vehicle Market:

- Deere & Company

- BYD Company Ltd

- Toyota Material Handling

- Polaris Inc.

- Club Car

- The Toro Company

- Star EV Corporation

- Alke

- American Landmaster

- Hyster-Yale, Inc

- Addax Motors

- Marshell Green Power

- Ford Motor Company

- General Motors

- Mahindra & Mahindra Ltd

Recent Developments (Partnerships/New Product Launch)

- In January 2025, John Deere unveiled the participants for its 2025 Startup Collaborator program, an initiative aimed at driving innovation in agriculture and construction technology. It also includes a trailblazer in wireless charging technology for commercial and passenger vehicles, eliminating the need for plug-in charging and paving the way for future autonomous solutions.

- BYD is set to introduce its next-generation Blade Batteries in 2025, featuring improved energy density, safety, and performance. The upgraded battery technology is expected to enhance the range and efficiency of BYD’s EVs while maintaining its ultra-safe lithium iron phosphate (LFP) chemistry. This innovation aligns with the company’s commitment to advancing EV battery technology and strengthening its position in the global electric utility vehicle market.

- In June 2024, BYD partnered with HUB Power Company (HUBCO) to introduce EVs in Pakistan, aiming to advance the country’s transition to sustainable transportation. The collaboration focuses on expanding EV adoption by leveraging BYD’s advanced technology and HUBCO’s local expertise. This initiative aligns with Pakistan’s clean energy goals, supporting reduced emissions and enhanced energy efficiency while fostering growth in electric mobility in Pakistan.

- In January 2025, Club Car introduce innovative vehicles and feature upgrades at the PGA Show 2024 in Orlando. The lineup includes the latest Cru Tempo Lithium-Ion golf car and enhancements to the Carryall utility vehicle range, focusing on sustainability, performance, and efficiency. These advancements reinforce Club Car’s commitment to delivering cutting-edge solutions for golf course management and commercial transportation.

- In Nov 2024, Mahindra & Mahindra unveiled the 06 and XUV.e9, the latest additions to its Born Electric lineup, at the Bharat Mobility Global Expo 2024. These cutting-edge electric SUVs, built on Mahindra’s INGLO platform, feature advanced technology and innovative design, reinforcing the company’s commitment to sustainable mobility.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)