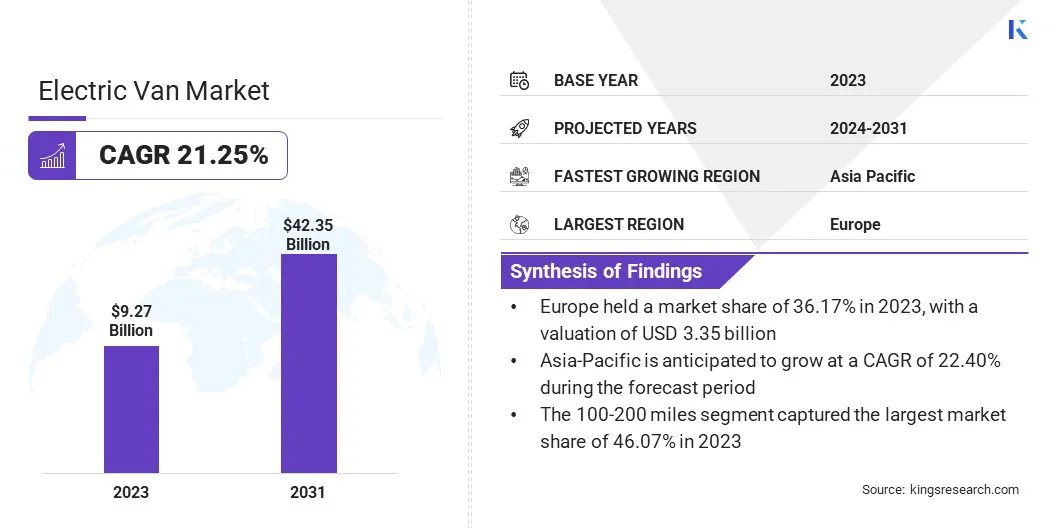

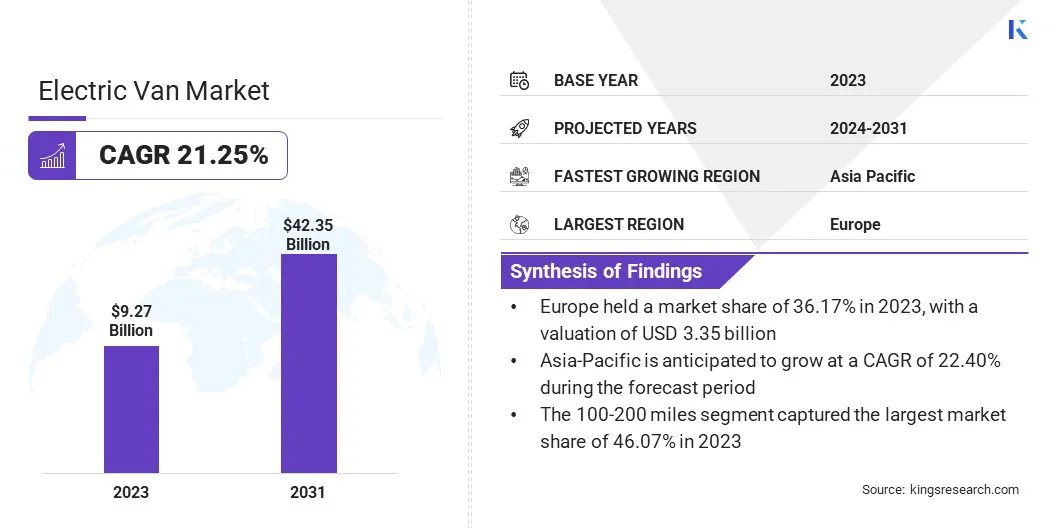

Electric Van Market Size

The global Electric Van Market size was valued at USD 9.27 billion in 2023 and is projected to grow from USD 10.99 billion in 2024 to USD 42.35 billion by 2031, exhibiting a CAGR of 21.25% during the forecast period. Rising popularity of multi-purpose vehicles and increasing adoption by logistics companies are driving the growth of the market.

In the scope of work, the report includes services offered by companies such Ford Motor Company, Hyundai Motor Company, Nissan, Volkswagen AG, Tata Motors Limited, Renault, BYD Company Ltd., General Motors, Stellantis N.V., Honda Motor Co., Ltd., and others.

Integration with renewable energy presents a significant opportunity for the development of the electric van market, offering a sustainable and cost-effective transportation solution. By utilizing renewable energy sources such as solar, wind, and hydroelectric power for charging electric vans, companies are significantly reducing their carbon footprint and operational costs. This integration supports the broader goal of transitioning to a low-carbon economy and is in alignment with global efforts to combat climate change.

Additionally, the use of renewable energy mitigates the impact of fluctuating fossil fuel prices, thereby providing a more stable and predictable energy cost structure. Moreover, companies are leveraging government incentives and subsidies aimed at promoting renewable energy and electric vehicle adoption.

Moreover, integrating electric vans with renewable energy systems enhances energy resilience by reducing dependency on the grid and enabling decentralized energy production. This is particularly beneficial for businesses operating in remote or underserved areas. The integration of electric vans with renewable energy contributes to environmental sustainability and offers economic and operational advantages for businesses.

An electric van is a type of vehicle that operates solely on electricity, utilizing electric motors for propulsion instead of internal combustion engines. These vans are equipped with large battery packs that store electrical energy, which is used to power one or more electric motors. The range of electric vans varies widely depending on the battery capacity, typically ranging from 100 to over 300 miles on a single charge.

Electric vans are designed for a variety of applications, including urban delivery, passenger transport, and specialized services such as postal delivery and maintenance operations. They offer significant advantages such as lower operational costs, reduced emissions, and quieter operation compared to traditional diesel or gasoline-powered vans.

Electric vans are particularly well-suited for short to medium-range routes within urban areas, where charging infrastructure is more accessible. The growing shift toward electric vans is further fueled by increasing environmental regulations, corporate sustainability initiatives, and advancements in battery technology, making them a viable and attractive option for both businesses and public sector fleets.

Analyst’s Review

The electric van market is experiencing robust growth, mainly due to ongoing technological advancements, growing regulatory pressures, and shifting consumer preferences. Companies in this market are employing several strategies to capitalize on these trends and maintain a competitive edge. Key players are heavily investing in research and development to enhance battery performance, increase vehicle range, and reduce charging times.

Strategic partnerships and collaborations with technology firms and energy providers are frequently established, aimed at integrating advanced telematics, autonomous driving capabilities, and renewable energy solutions. Additionally, businesses are expanding their product portfolios to cater to diverse market segments, including urban delivery, logistics, and public transportation.

- For instance, in April 2024, Honda Motor unveiled its plans to establish a robust EV value chain in Canada, with an investment of approximately USD 10.98 billion, including contributions from joint venture partners. This initiative aims to enhance Honda's EV supply system and capabilities to meet anticipated future demand in North America.

The growing emphasis on sustainable and eco-friendly transportation solutions is compelling companies to adopt aggressive marketing and branding strategies that highlight their environmental benefits. The growth of the market is fueled by government incentives, subsidies, and the proliferation of charging infrastructure, all of which collectively lower the barriers to adoption.

The imperative for key market players is to persist in their innovation efforts while expanding production capabilities to meet the rising demand for electric vans. This is likely to enable them to deliver reliable, cost-effective, and environmentally sustainable transportation solutions.

Electric Van Market Growth Factors

The increasing adoption of electric vans by logistics companies is a significant factor boosting the expansion of the electric van market. As environmental regulations become more stringent and the public demand for sustainable business practices grows, logistics companies are turning to electric vans to meet their green goals. Electric vans offer substantial benefits, including lower operational costs, reduced emissions, and quieter operation, which make them an attractive option for both urban and last-mile deliveries.

The lower maintenance costs associated with electric vehicles, due to fewer moving parts compared to internal combustion engines, further enhance their appeal. Moreover, advancements in battery technology have extended the range of electric vans, thereby enhancing their suitability for longer delivery routes.

By adopting electric vans, logistics companies are enhancing their brand image, appealing to environmentally conscious customers, and ensuring compliance with regulatory requirements. This trend is further supported by the expansion of charging infrastructure, which alleviates range anxiety and enables more widespread use of electric vans in logistics operations.

High initial costs remain a significant challenge for the widespread adoption of electric vans. The purchase price of electric vans is typically higher than that of their traditional internal combustion engine counterparts, primarily due to the expensive battery technology. This cost barrier poses a major challenge for small and medium-sized enterprises that may lack the necessary financial resources to invest in electric vehicles. The higher upfront cost may serve as a deterrent, despite the long-term savings on fuel and maintenance.

To address this challenge, businesses are leveraging government incentives and subsidies that are often available for electric vehicle purchases, which effectively reduce the initial investment required. Additionally, companies are exploring financing options such as leasing or purchasing through fleet management services, which allow for the distribution of costs over an extended period.

Collaborating with energy providers to secure lower electricity rates for charging further helps offset the initial expenses. Moreover, as battery technology progresses and economies of scale are achieved, the cost of electric vans is expected to decrease, thereby making them more accessible to a broader range of businesses.

Electric Van Market Trends

Government incentives and subsidies are a key trend driving the growth of the electric van market. Various governments around the world are implementing policies and financial support mechanisms to promote the adoption of electric vehicles as part of their broader environmental and energy strategies. These incentives may include various forms such as tax credits, rebates, grants, and lower registration fees for electric vehicle purchasers.

By reducing the overall cost of ownership, these incentives make electric vans a more attractive option for both businesses and individuals. Additionally, subsidies for charging infrastructure development play a crucial role, as they facilitate the expansion of the necessary support systems for electric vehicles. These government initiatives are often accompanied by stricter emissions regulations and targets, thereby prompting companies to transition to cleaner transportation solutions.

In addition, public sector fleets are increasingly being mandated to incorporate a specified percentage of electric vehicles, thereby creating a significant growth opportunity for electric van manufacturers.

Segmentation Analysis

The global market is segmented based on range, propulsion, application, and geography.

By Range

Based on range, the market is categorized into up to 100 miles, 100-200 miles, and above 200 miles. The 100-200 miles segment captured the largest electric van market share of 46.07% in 2023, largely attributed to its optimal balance between range and cost-efficiency, which meets the needs of a wide range of users. This range is particularly suitable for urban and suburban delivery routes, where daily mileage typically falls within this bracket.

Logistics and delivery companies find this range ideal for last-mile deliveries, allowing them to complete a full day's work on a single charge without the need for frequent recharging. Moreover, advancements in battery technology have made it possible to offer electric vans with 100-200 miles range at a more affordable price point compared to those with longer ranges.

This development has made electric vans more accessible to a broader market, including small and medium-sized enterprises. This segment also benefits from the expanding network of charging infrastructure, which provides more flexibility and convenience for users. Additionally, regulatory incentives and corporate sustainability goals are leading to increased demand for batteries in this range, as businesses increasingly seek to reduce their carbon footprint while maintaining operational efficiency.

By Propulsion

Based on propulsion, the electric van market is classified into battery electric vehicle (BEV), fuel cell electric vehicles, and plug-in hybrid electric vehicles (PHEV). The battery electric vehicle (BEV) segment is poised to record a staggering CAGR of 21.84% through the forecast period. BEVs, which operate solely on electric power stored in batteries, are increasingly favored over hybrid or plug-in hybrid electric vehicles as they offer zero emissions and lower maintenance costs.

The continuous advancements in battery technology, which lead to higher energy densities and lower costs, are making BEVs more affordable and extending their driving ranges. Government policies and incentives aimed at reducing greenhouse gas emissions and promoting clean energy are further playing a critical role in aiding segmental growth. Numerous countries are setting ambitious targets for phasing out internal combustion engine vehicles, which is boosting the demand for BEVs.

Additionally, the expansion of charging infrastructure, including fast-charging networks, is reducing range anxiety and enhancing the practicality of BEVs more practical for everyday use. Consumers and businesses are becoming more environmentally conscious, resulting in the widespread adoption of BEVs. Furthermore, major automotive manufacturers are investing heavily in BEV production and are launching new models across various segments, which is expected to foster the growth of the segment.

By Application

Based on application, the market is divided into logistics and transportation, e-commerce, passenger transportation, and field services. The logistics and transportation segment led the electric van market in 2023, reaching a valuation of USD 4.51 billion, mainly propelled by the rising demand for efficient and eco-friendly delivery solutions.

The sector's growth is attributed to the exponential increase in e-commerce activities, which has created a demand for reliable and cost-effective last-mile delivery options. Electric vans are increasingly favored by logistics companies due to their lower operational costs, reduced emissions, and suitability for urban deliveries.

Government regulations that mandate lower emissions and promote the adoption of electric vehicles are significantly contributing to the expansion of the segment. Numerous logistics companies are integrating electric vans into their fleets to meet these regulatory requirements and enhance their sustainability credentials.

Additionally, advancements in battery technology have made electric vans more viable for longer delivery routes, thereby boosting their adoption. The expansion of charging infrastructure is mitigating range anxiety and enabling logistics companies to operate electric vans more efficiently. Furthermore, corporate sustainability goals are compelling companies to reduce their carbon footprint, leading to increased investments in electric vans.

Electric Van Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe electric van market share stood around 36.17% in 2023 in the global market, with a valuation of USD 3.35 billion, reflecting the region's leading position in the adoption of electric vehicles.

European countries have been at the forefront of implementing stringent emissions regulations and promoting clean transportation through various incentives and subsidies. These policies have facilitated the shift toward electric vehicles, including vans. Moreover, European cities are increasingly adopting low-emission zones, permitting only electric or highly efficient vehicles, resulting in the rising demand for electric vans.

- For instance, in 2023, Ford has set a goal for all its European passenger vehicles to be zero-emissions capable, with a transition to all-electric lineup by 2030. Ford intends for its commercial vehicle range in Europe to meet this target by 2024. Additionally, the company aims for two-thirds of its sales to be all-electric or plug-in hybrid by 2030, leveraging new products, services, and strategic alliances by mid-2026.

The regional market further benefits from a well-developed charging infrastructure, which mitigates range anxiety and supports the daily operations of electric vans. Additionally, the commitment of European automakers to electrification has resulted in a diverse range of electric van models that cater to various commercial needs. The strong environmental consciousness among European consumers and businesses further plays a crucial role in supporting regional market growth.

Asia-Pacific is projected to grow at a staggering CAGR of 22.40% in the forthcoming years. The region's rapid urbanization and industrialization are creating a substantial demand for efficient and sustainable transportation solutions.

Governments across Asia-Pacific countries are implementing policies and incentives to promote electric vehicles as part of their efforts to reduce air pollution and dependence on fossil fuels. Countries such as China, Japan, and South Korea are investing heavily in electric vehicle infrastructure and technology, which is spurring regional market expansion.

- For instance, in 2023, China accounted for nearly 60% of global new electric car registrations, with over 35% of domestic car sales being electric, surpassing the 2025 target. India’s electric 3-wheeler market reached 34%, according to the Society of Manufacturers of Electric Vehicles (SMEV).

The expansion of e-commerce and logistics sectors in the region is significantly fostering this growth, as businesses increasingly seek cost-effective and environmentally friendly delivery options.

Additionally, the rising fuel prices and the economic benefits of lower operational costs are promoting the adoption of electric vans. The presence of major electric vehicle manufacturers and the development of new, affordable electric van models tailored to the needs of the Asia-Pacific market further support this growth.

Competitive Landscape

The global electric van market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Electric Van Market

- Ford Motor Company

- Hyundai Motor Company

- Nissan

- Volkswagen AG

- Tata Motors Limited

- Renault

- BYD Company Ltd.

- General Motors

- Stellantis N.V.

- Honda Motor Co., Ltd.

Key Industry Developments

- May 2024 (Launch): Tata Motors enhanced its e-cargo mobility solutions by launching the Ace EV 1000. This zero-emission mini-truck, designed for last-mile delivery, boasts a 1-tonne payload capacity and a certified range of 161 km on a single charge.

- May 2024 (Expansion): Leapmotor International plans to begin expanding its global electric vehicle sales in nine European countries starting in September 2024. Stellantis announced a USD 1.64 billion investment in October 2023 for a 21% equity stake in Leapmotor, with a goal of boosting Leapmotor’s sales both in China and globally.

- January 2024 (Launch): Ram, a brand of Stellantis, launched the new Ram ProMaster electric van (EV), which boasts a city driving range of up to 174 miles. The Ram ProMaster EV is likely to be available in two specialized configurations: a delivery model and two cargo models, with cargo lengths of 12 feet and an extended 13 feet.

The global electric van market is segmented as:

By Range

- Up to 100 miles

- 100-200 Miles

- Above 200 Miles

By Propulsion

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicles

- Plug-In Hybrid Electric Vehicles (PHEV)

By Application

- Logistics and Transportation

- E-commerce

- Passenger Transportation

- Field Services

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America