Automotive and Transportation

Electric Vehicle Supply Equipment Market

Electric Vehicle Supply Equipment Market Size, Share, Growth & Industry Analysis, By Product Type (EV Charging Kiosk, Portable Charger, Onboard Charging Station, Others,), By Charging Type (AC Charging, DC Charging), By Application (Residential, Commercial, Public Charging, Fleet Charging), and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : March 2025

Report ID: KR1433

Market Definition

The electric vehicle supply equipment (EVSE) market involves the production, installation, and maintenance of equipment that supplies electrical power to electric vehicles (EVs).

This includes charging stations, connectors, and related components essential for recharging EV batteries. The market is growing in response to the increasing adoption of EVs, boosting demand for efficient and accessible charging solutions.

Electric Vehicle Supply Equipment Market Overview

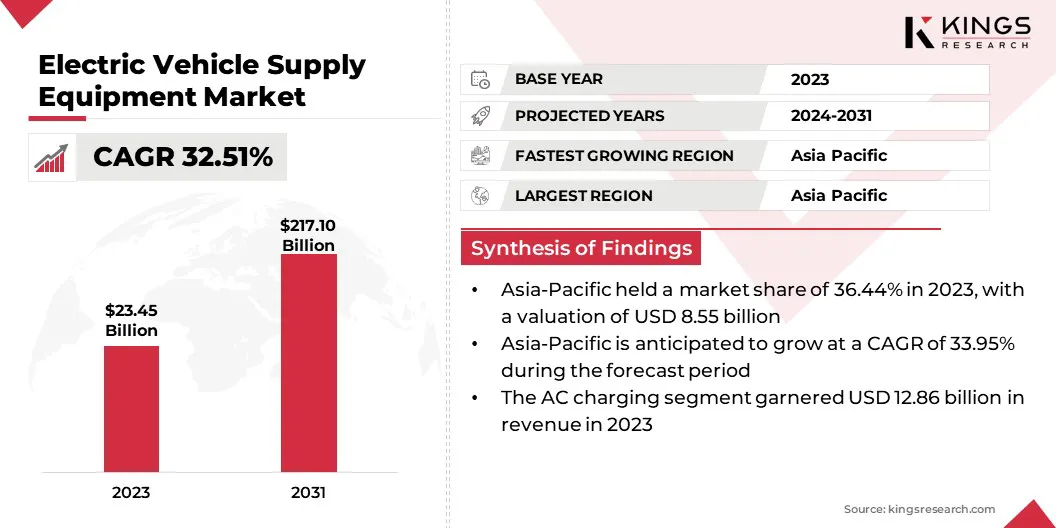

Global electric vehicle supply equipment market size was valued at USD 23.45 billion in 2023, which is estimated to be valued at USD 30.27 billion in 2024 and reach USD 217.10 billion by 2031, growing at a CAGR of 32.51% from 2024 to 2031.

Government incentives and policies propelling market growth. By offering subsidies, tax breaks, and mandates that promote electric vehicle adoption, these measures stimulate investment in in charging infrastructure, thereby accelerating market expansion.

Major companies operating in the global electric vehicle supply equipment industry are AeroVironment, Inc., ABB, ChargePoint, Inc, Enphase Energy, Eaton, Leviton Manufacturing Co., Inc., Schneider Electric, Siemens, Tesla, Webasto Group, Delta Electronics, Inc., Ecotap, Comeca Group, Heliox Energy, Efacec, and others.

The market is rapidly expanding due to the global shift toward sustainable transportation. With increasing investments in charging infrastructure and advancements in charging technologies, the market is seeing a significant rise in demand for efficient, accessible, and reliable charging solutions.

The growing adoption of electric vehicles (EVs) highlights the importance of EVSE in facilitating their integration into daily transportation, making charging stations an integral part of urban and rural landscapes worldwide.

- In December 2024, Tivolt Electric Vehicles, a Murugappa Group venture, signed an MoU with Tata Power Renewable Energy Limited (TPREL) to enhance e-mobility for commercial vehicles in India. This partnership focuses on building a comprehensive EV charging ecosystem, leveraging TPREL’s expertise in diversified charging solutions and Tivolt's growing electric vehicle network.

Key Highlights:

- The global electric vehicle supply equipment market size was recorded at USD 23.45 billion in 2023.

- The market is projected to grow at a CAGR of 32.51% from 2024 to 2031.

- Asia-Pacific held a share of 36.44% in 2023, valued at USD 8.55 billion.

- The EV charging kiosk segment garnered USD 8.80 billion in revenue in 2023.

- The AC charging segment is expected to reach USD 113.82 billion by 2031.

- The public charging segment is anticipated to witness the fastest CAGR of 35.10% over the forecast period

- Europe is anticipated to grow at a CAGR of 32.52% through the projection period.

Market Driver

"Rising Demand for Electric Vehicles (EVs)"

The rising global demand for electric vehicles (EVs) is boosing the growth of the electric vehicle supply equipment (EVSE) market.

- According to the International Energy Agency (IEA), electric vehicle (EV) sales reached nearly 14 million units in 2023, resulting in a significant rise in the share of electric cars, which accounted for approximately 18.5% of global sales in 2023.

As more consumers and businesses transition to EVs for environmental and cost-efficiency reasons, the need for extensive, reliable, and accessible charging infrastructure increases. This demand drives the development and deployment of EVSE, including charging stations and connectors, to support the growing EV market.

- In February 2025, NASCAR, in partnership with Florida Power & Light Company (FPL) and ABB, installed 30 Level 2 electric vehicle (EV) chargers at its Daytona Beach headquarters. This initiative highlights the increasing need for reliable charging infrastructure as organizations transition to electric vehicles, creating a strong demand for electric vehicle supply equipment.

Market Challenge

"Availability and Accessibility of Charging Stations"

A significant challenge impeding the expansion of the electric vehicle supply equipment (EVSE) market is the inconsistent availability and accessibility of charging stations, particularly in rural or remote areas. This limited infrastructure hinders the widespread adoption of electric vehicles.

This challenge can be addressed through increased investment in public and private charging networks, supported by government incentives and strategic partnerships. Expanding the deployment of fast-charging stations and integrating renewable energy sources can ensure widespread accessibility and reliability for EV users.

Market Trend

"Ongoing Technological Advancements"

Technological advancements in fast-charging and smart charging solutions are emerging as a key trend in the electric vehicle supply equipment (EVSE) market. Innovations such as ultra-fast charging stations and intelligent charging systems are significantly improving efficiency, reducing charging times, and enhancing the overall user experience.

Smart charging solutions enable dynamic load balancing, remote monitoring, and integration with renewable energy sources, offering cost-effective and sustainable options. These advancements are crucial in supporting the increasing adoption of electric vehicles and meeting the growing demand for reliable, accessible charging infrastructure.

- In November 2023, Webasto Charging Systems announced the wider availability of its TurboConnect charger, along with new products such as the Turbo DX 2 Charging Station and Webasto Go Gen 2 High-Power Cordset. These innovations enhance EV charging solutions, offering improved efficiency, accessibility, and convenience for both residential and commercial users. With advanced features such as smart connectivity and high-power outputs, Webasto aims to provide secure, efficient charging infrastructure to support the growing electric vehicle market.

Electric Vehicle Supply Equipment Market Report Snapshot

|

Segmentation |

Details |

|

By Product Type |

EV Charging Kiosk, Portable Charger, Onboard Charging Station, Others |

|

By Charging Type |

AC Charging, DC Charging |

|

By Application |

Residential, Commercial, Public Charging, Fleet Charging |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Product Type (EV Charging Kiosk, Portable Charger, Onboard Charging Station, and Others): The EV charging kiosk segment earned USD 8.80 billion in 2023, primarily due to its widespread deployment in high-traffic locations, enhancing charging accessibility for users.

- By Charging Type (AC Charging and DC Charging): The AC charging segment held a share of 54.83% in 2023, mainly attributed to its cost-effectiveness and suitability for residential applications, providing convenient home charging solutions.

- By Application (Residential, Commercial, Public Charging, and Fleet Charging): The commercial segment is projected to reach USD 92.86 billion by 2031, propelled by increasing demand for EV charging in workplaces and retail locations.

Electric Vehicle Supply Equipment Market Regional Analysis

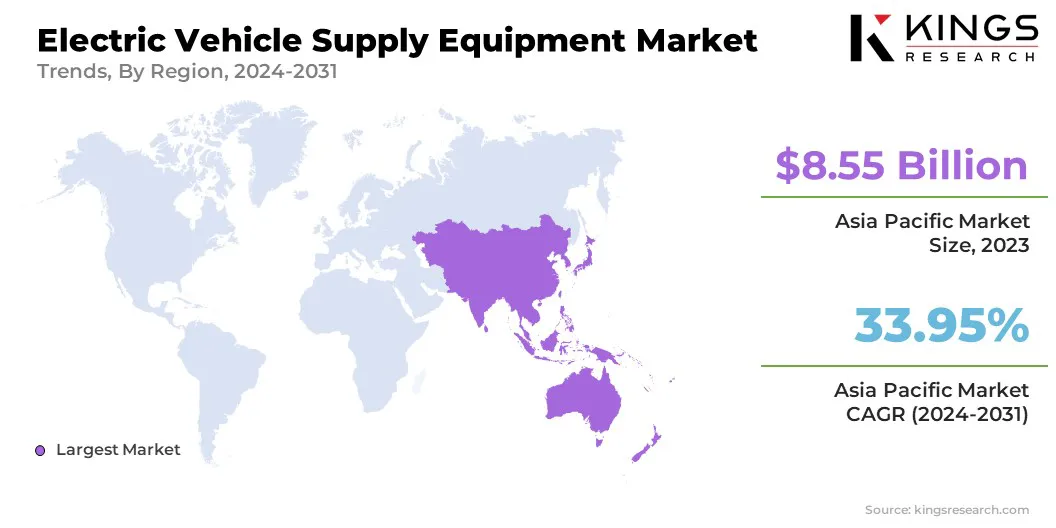

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific electric vehicle supply equipment market captured a share of around 36.44% in 2023, valued at USD 8.55 billion. This dominace is reinforced by rapid urbanization and government support for electric vehicle adoption.

Countries such as China, Japan, and South Korea are contributing significantly to this growth by making substantial investments in EV infrastructure. China, in particular, has emerged as a global hub for EV manufacturing and charging stations, fueled by strong incentives for consumers and businesses. The region’s focus on clean energy policies and high EV penetration continues to fuel this growth.

- In August 2024, Tata Motors partnered with Delta Electronics India and Thunderplus Solutions Pvt Ltd to set up 250 new fast-charging stations across 50 cities in India. This initiative aims to support electric commercial vehicle adoption by expanding the charging infrastructure.

Europe electric vehicle supply equipment industry is poised to grow at a staggering CAGR of 32.52% over the forecast period. This growth is propelled by stringent environmental regulations and a strong commitment to reducing carbon emissions.

Countries such as Germany, the UK, and France are significantly expanding their EV charging infrastructure to meet growing demand. Europe's policies, coupled with rising investments in EV charging networks, are accelerating the adoption of electric vehicles, positioning the regional market for rapid growth in the coming years.

- In February 2025, the EU will co-finance the installation of 1,400 charging points, including 430 for heavy-duty trucks, across 13 European countries. The DRIVE-E Global project, led by E.ON, ZSE, and Eldrive, aims to enhance charging infrastructure with USD 47.1 million in EU funding by 2027.

Regulatory Frameworks

- In the U.S., the National Electrical Code (NEC) establishes the minimum safety requirements for electrical installations in a standardized framework.

- The U.S. Department of Transportation’s (DOT) Federal Highway Administration (FHWA) NEVI Formula Program provides funding to states for the strategic deployment of electric vehicle (EV) chargers and the establishment of an interconnected network to facilitate data collection, access, and reliability.

- The Indian goverment's Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme provides incentives to accelerate EV adoption and support the expansion of EV charging infrastructure.

Competitive Landscape

The global electric vehicle supply equipment market is characterized by a large number of participants, including both established corporations and emerging players. Market participants are prioritizing mergers and acquisitions to expand their market presence and enhance technological capabilities.

These acquisitions enable access to new technologies, strengthen regional distribution networks, and improve product offerings. Integrating complementary businesses enable companies to scale operations, and meet the rising demand for efficient charging solutions in the expanding EV market.

- In August 2024, Exicom Tele-systems Limited acquired Tritium, a global leader in DC Fast Chargers, headquartered in Australia. This acquisition, which includes Tritium’s manufacturing facility in Tennessee, USA, and engineering centre in Brisbane, enhances Exicom’s global reach and commitment to advancing EV charging infrastructure. It strengthens Exicom’s position in the fast-growing EV market, providing access to new technologies and expanding its footprint across key regions.

List of Key Companies in Electric Vehicle Supply Equipment Market:

- AeroVironment, Inc.

- ABB

- ChargePoint, Inc

- Enphase Energy

- Eaton

- Leviton Manufacturing Co., Inc.

- Schneider Electric

- Siemens

- Tesla

- Webasto Group

- Delta Electronics, Inc.

- Ecotap

- Comeca Group

- Heliox Energy

- Efacec

Recent Developments (Expansion/Agreement/Launch)

- In February 2025, TATA.ev announced its plan to increase India’s EV charging infrastructure to 400,000 charge points by 2027. This initiative includes its collaboration with major Charging Point Operators to install 30,000+ new public chargers, launch TATA.ev Mega Chargers, and introduce verified chargers, helplines, and unified payments to enhance EV adoption across the country.

- In September 2024, Amazon, through The Climate Pledge, launched a shared EV charging network in Bengaluru. With an investment of USD 2.65 million, the project aims to support over 5,500 EVs by 2030, facilitating the adoption of electric vehicles in India while promoting renewable energy-powered infrastructure.

- In March 2024, Uno Minda signed a Technical License Agreement (TLA) with StarCharge Energy Pte. Ltd. to produce and distribute wall-mounted AC Electric Vehicle Supply Equipment (EVSE) in India, expanding its electric vehicle product range for the passenger car sector.

- In March 2024, Leviton launched a plug-in version of its EV Series Smart Home, expanding its residential EV charging portfolio. The new charger, compatible with the My Leviton App, offers portability, flexibility, and features such as scheduling, remote control, and energy savings.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership