Environmental Remediation Market

Environmental Remediation Market Size, Share, Growth & Industry Analysis, By Application (Mining & Forestry, Oil & Gas, Agriculture, Automotive, Landfills & Waste Disposal Sites & Others), By Technique, By Environment Medium, By Site Type and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR944

Environmental Remediation Market Size

The global Environmental Remediation Market size was valued at USD 112.34 billion in 2023 and is projected to grow from USD 119.86 billion in 2024 to USD 199.73 billion by 2031, exhibiting a CAGR of 7.57% during the forecast period. The growth of the market is driven by stringent environmental regulations, increased awareness of pollution, continual technological advancements, and the rising need to address industrial contamination and urbanization impacts.

In the scope of work, the report includes solutions offered by companies such as Engineering & Maintenance Solutions, Jacobs, Terra Systems, Tetra Tech, Inc., AECOM, CLEAN HARBORS, INC., DEME, ENTACT, HDR, Inc., WSP, and others.

The expansion of the environmental remediation market is primarily fostered by the increasing stringency of environmental regulations, surging awareness of pollution, and the imperative to manage hazardous waste. Governments and regulatory bodies worldwide are implementing stricter environmental policies, which compel industries to invest in remediation technologies.

Additionally, rising concerns regarding climate change and the health impacts of contamination are fueling the demand for effective cleanup solutions. Advances in technology further play a critical role, as innovations in remediation techniques enhance efficiency and effectiveness. Increased industrial activities and rapid urbanization further contribute to the expansion of the market, as these factors generate more pollutants that require remediation efforts.

- In 2023, according to Eurostat, the EU increased its environmental investment to USD 75.20 billion, with a major focus on wastewater treatment and cleaner production technologies. Companies contributed 60% of this funding, which was allocated to specialized environmental services and broader sustainability initiatives across various industries.

The market is experiencing robust growth due to increased environmental awareness and regulatory pressures. This sector encompasses various technologies and services aimed at cleaning up and restoring polluted environments, including soil, water, and air. Market participants include technology providers, service contractors, and consulting firms.

The market is characterized by diverse solutions such as bioremediation, chemical treatment, and physical methods. Regional variations in regulations and pollution levels influence market dynamics, with significant activity observed globally. Continuous advancements in technology and growing environmental consciousness are propelling the evolution and expansion of this market.

The environmental remediation market refers to the industry focused on the restoration of polluted or contaminated environments to a safe and usable state. Environmental remediation involves the application of various techniques and technologies designed to remove or neutralize hazardous substances from soil, water, and air.

Services provided include site assessments, treatment processes, and ongoing monitoring. Environmental remediation addresses issues resulting from industrial activities, waste disposal, and accidental spills, with the aim of mitigating environmental and health risks. The market supports efforts aimed at complying with environmental regulations, restoring ecosystems, and ensuring public safety.

Analyst’s Review

Companies are focusing on developing advanced technologies such as electrokinetic remediation and bioremediation to address complex contamination challenges. The market is witnessing increased investment in research and development to enhance the efficiency and cost-effectiveness of remediation solutions. Businesses are recommended to prioritize the adoption of innovative technologies and collaborate with private players and regulatory bodies to meet evolving standards.

- For instance, in September 2023, environmental services firm ENTACT acquired White Lake Dock & Dredge, a company specializing in water cleanup projects. White Lake’s expertise included dredging, sediment capping, and marine construction. This acquisition strengthened ENTACT’s ability to serve clients in both the public and private sectors.

Additionally, investing in sustainable practices and exploring green remediation methods are likely to offer competitive advantages. Staying informed about regulatory changes and technological advancements are anticipated to be crucial for maintaining market relevance and achieving long-term success.

Environmental Remediation Market Growth Factors

Increasing environmental regulations are driving the growth of the market. Governments and international bodies are continuously implementing stricter standards to manage pollution and mitigate environmental damage. These regulations are prompting industries to adopt advanced remediation technologies and practices to comply with legal requirements.

The increased regulatory pressure is creating a steady demand for services and solutions that address soil, water, and air contamination. As regulations become more stringent, companies are investing heavily in innovative and efficient remediation methods to ensure compliance, resulting in sustained market expansion and increased opportunities for technology providers and service firms.

A major challenge in the environmental remediation market is the high cost associated with advanced remediation technologies. These technologies often involve significant investment in equipment, materials, and specialized personnel. To overcome this challenge, companies are increasingly adopting a multi-faceted approach that includes optimizing existing technologies, leveraging research and development for cost-effective solutions, and seeking funding or incentives from government programs.

Collaborative efforts and partnerships between the public and private sectors are playing a major role. By focusing on innovation and cost management, companies are reducing the financial burden of remediation projects and enhancing the accessibility and augmenting market growth.

Environmental Remediation Market Trends

The widespread adoption of green technologies is reshaping the landscape of the market. Companies are increasingly focusing on eco-friendly solutions that minimize environmental impact and enhance sustainability. Techniques such as bioremediation, which uses natural processes to clean up contaminants, are gaining significant traction due to their lower environmental footprint and cost-effectiveness.

This trend is further fueled by the growing awareness of environmental issues and the shift toward more sustainable practices across diverse industries. The emphasis on green technologies is leading to the development of innovative remediation solutions that align with global sustainability goals and regulatory requirements.

The integration of digital technologies is boosting the growth of the environmental remediation market. The use of advanced data analytics, remote sensing, and artificial intelligence is improving the efficiency and accuracy of remediation processes. Digital tools are enabling real-time monitoring, predictive maintenance, and better decision-making during cleanup operations.

This trend is enhancing the ability to address contamination issues more effectively and efficiently. As technology continues to evolve, the integration of these digital solutions is expected to foster advancements in remediation practices and contribute to market growth.

Segmentation Analysis

The global market is segmented based on application, technique, environment medium, site type, and geography.

By Application

Based on application, the market is categorized into mining & forestry, oil & gas, agriculture, automotive, landfills & waste disposal sites, construction & development, and others. The mining & forestry segment led the environmental remediation market in 2023, reaching a valuation of USD 29.97 billion. The segment is expanding due to increasing environmental concerns associated with these industries.

Mining operations often result in significant soil and water contamination, necessitating advanced remediation solutions to manage and mitigate these impacts. Additionally, forestry activities lead to deforestation and soil erosion, which require environmental restoration. As regulatory standards become more stringent and companies invest in sustainable practices, the demand for effective remediation solutions in mining and forestry is growing.

By Technique

Based on technique, the market is classified into air sparging, soil washing, chemical treatment, bioremediation, electrokinetic remediation, permeable reactive barriers, and others. The electrokinetic remediation segment is poised to witness significant growth at a robust CAGR of 11.07% through the forecast period (2024-2031), largely due to its effectiveness in treating contaminated soils and sediments.

This technique involves applying an electric field to facilitate the movement of contaminants, making it particularly useful for treating heavy metals and organic pollutants. As industries seek more advanced and effective remediation technologies, the appeal of electrokinetic remediation is increasing.

By Environment Medium

Based on environment medium, the market is segmented into soil and groundwater. The soil segment secured the largest environmental remediation market share of 84.77% in 2023. This growth is largely attributed to the widespread prevalence of soil contamination issues. Soil contamination often arises from industrial activities, agricultural practices, and waste disposal, thereby necessitating extensive remediation efforts.

The high demand for soil remediation is propelled by stringent environmental regulations and growing awareness of soil health's impact on ecosystems and human health, thereby supporting the growth of the segment.

Environmental Remediation Market Regional Analysis

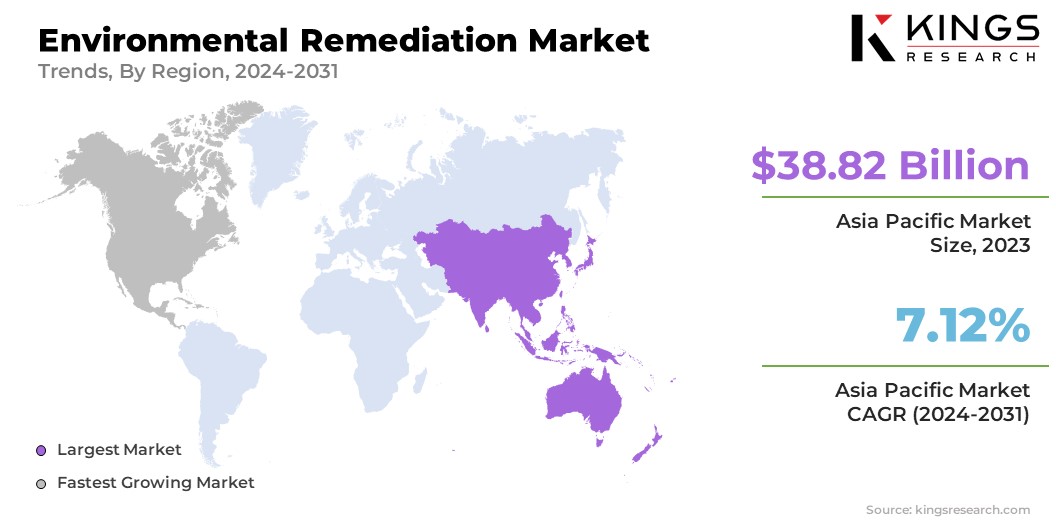

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific environmental remediation market accounted for a major share of around 34.56% in 2023, with a valuation of USD 38.82 billion. Many countries in this region are experiencing significant economic growth, which is contributing to increased pollution and environmental degradation. This is leading to a rising demand for effective remediation technologies and services.

Additionally, governments in Asia-Pacific countries are implementing stringent environmental regulations to address pollution issues, thereby supporting regional market growth. The combination of industrial activity, regulatory pressures, and growing environmental awareness positions Asia-Pacific as a major market for environmental remediation.

North America is poised to experience robust growth at a CAGR of 8.55% over the forecast period. This growth is fostered by several factors, including advanced regulatory frameworks that mandate strict pollution control measures, and increased investments in innovative remediation technologies.

The region's strong emphasis on environmental protection and sustainability is prompting industries to adopt more effective remediation practices. Additionally, the presence of leading technology providers and a high level of environmental awareness among businesses and consumers are contributing to North America's rapid expansion in the market.

Competitive Landscape

The global environmental remediation market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Environmental Remediation Market

- Engineering & Maintenance Solutions

- Jacobs

- Terra Systems

- Tetra Tech, Inc.

- AECOM

- CLEAN HARBORS, INC.

- DEME

- ENTACT

- HDR, Inc.

- WSP

Key Industry Developments

- May 2024 (Partnership): Allonnia partnered with Terra Systems to distribute their 1,4 D-Stroy solution in North America. This technology used naturally occurring microbes to break down 1,4-dioxane, a harmful chemical found in groundwater. Terra Systems deployed the solution at sites across the US and Canada.

- April 2024 (Acquisition): WSP Global Inc. announced the signing of an acquisition agreement for 1A Ingenieros, S.L., a Spanish consulting firm in the Energy & Power sector. The acquisition is anticipated to be completed in the second quarter of 2024. This strategic move is expected to enhance WSP’s capabilities, expanding its workforce by 70% and establishing the presence in four new regions. This development is estimated to strengthen WSP’s multidisciplinary business and position it as a leading international firm in Spain.

The global environmental remediation market is segmented as:

By Application

- Mining & Forestry

- Oil & Gas

- Agriculture

- Automotive

- Landfills & Waste Disposal Sites

- Construction & Development

- Others

By Technique

- Air Sparging

- Soil Washing

- Chemical Treatment

- Bioremediation

- Electrokinetic Remediation

- Permeable Reactive Barriers

- Others

By Environment Medium

- Soil

- Groundwater

By Site Type

- Private

- Public

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership