Advanced Materials and Chemicals

Ferrochrome Market

Ferrochrome Market Size, Share, Growth & Industry Analysis, By Application (Stainless Steel, Specialty Steel, Others), By Product Type (High Carbon Ferrochrome, Medium Carbon Ferrochrome, Low Carbon Ferrochrome), By End Use Industry (Automotive, Construction, Consumer Goods & Others), By Segment and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : January 2025

Report ID: KR1226

Market Definition

The ferrochrome market involves the production and trade of ferrochrome, an alloy consisting of chromium and iron, mainly used in the production of stainless steel. Ferrochrome is crucial for enhancing the strength, corrosion resistance, and durability of steel. It is produced through the smelting of chromite ore in electric arc furnaces, with varying compositions of chromium content.

Key factors affecting the market include raw material availability, production costs, technological advancements in manufacturing processes, and global trade dynamics. The market's scope is largely defined by regional production capacities, trade flows, and consumption trends within the steel industry.

Ferrochrome Market Overview

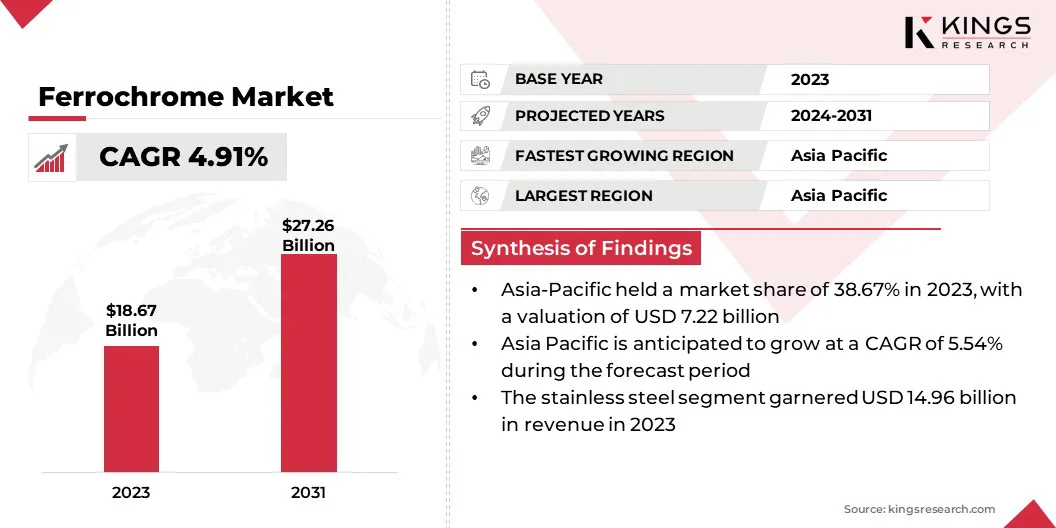

The global ferrochrome market size was valued at USD 18.67 billion in 2023, which is estimated to be valued at USD 19.49 billion in 2024 and reach USD 27.26 billion by 2031, growing at a CAGR of 4.91% from 2024 to 2031.

The rising demand for stainless steel in the automotive, construction, and infrastructure sectors directly fuels the need for ferrochrome, as it is a critical component in enhancing steel's strength and corrosion resistance. This growing consumption drives the market.

Major companies operating in the global ferrochrome industry are Tata Steel, Samancor Chrome, TNC Kazchrome JSC, Ferro Alloys Corporation Ltd.(FACOR), Eurasian Resources Group, IMFA, Yilmaden, Ferbasa, Glencore, Outokumpu, Balasore Alloys Limited, Fondelco Metal & Alloys Pvt Ltd. (Fondelco Group), Zimasco, Maranatha Ferrochrome (Private) Limited and Afarak Group SE.

The ferrochrome market is characterized by a global network of production and consumption, primarily driven by the demand for stainless steel. The market operates in a competitive environment, with production concentrated in key regions. Technological advancements in ferrochrome production, along with fluctuations in raw material prices, impact overall market stability.

The market’s evolution is shaped by shifts in steel industry demands, regional supply capacities, and the balance between production and consumption.

- As per the Indian Ferro Alloy Producers' Association, the majority of ferrochrome production occurs in South Africa, Kazakhstan, and India, which possess abundant chromite resources. Russia and China are also increasing their output. Over 80% of global ferrochrome production is used in stainless steel manufacturing.

Key Highlights:

- The global ferrochrome market size was recorded at USD 18.67 billion in 2023.

- The market is projected to grow at a CAGR of 4.91% from 2024 to 2031.

- Asia Pacific held a market share of 38.67% in 2023, with a valuation of USD 7.22 billion and an anticipated CAGR of 54% during the forecast period.

- The stainless steel segment garnered USD 14.96 billion in revenue in 2023.

- The high carbon ferrochrome segment is expected to reach USD 19.94 billion by 2031.

- The aerospace and defense segment is projected to expand at a CAGR of 6.41% during the forecast period.

Market Driver

"Technological Advancements Driving Growth in Ferrochrome Production"

Technological advancements in ferrochrome production are a key growth factor for the market, as innovations that improve energy efficiency and reduce production costs help enhance overall profitability. New techniques, such as more efficient electric arc furnaces, improved furnace design, and automation, contribute to lower energy consumption and reduced carbon emissions.

These advancements not only make ferrochrome production more sustainable but also allow producers to meet rising demand without significantly increasing costs, thus supporting the long-term growth of the ferrochrome market.

- June 2024 marked a milestone for Outokumpu, as it expanded the use of robotics at its ferrochrome plant in Tornio. ANYmal robots, aiding in safety management, reduce hazardous exposure, optimize maintenance, and enhance operational efficiency, aligning with Outokumpu’s sustainability goals.

Market Challenge

"Mitigating Market Instability in the Ferrochrome Industry"

Market instability is a significant challenge faced by the ferrochrome industry, driven by fluctuations in the demand for stainless steel, geopolitical tensions, and economic slowdowns. These factors can lead to price volatility, production uncertainties, and inventory imbalances.

- In Jan 2024 Outokumpu planed a temporary closure of its ferrochrome furnace and sintering plant, due to weak market conditions and increased inventories. This highlights how market instability can lead to production adjustments, underscoring the importance of flexible operational strategies.

Ferrochrome producers are diversifying their customer base, investing in more flexible production technologies, and adopting advanced forecasting tools to better predict market trends. Additionally, enhancing supply chain resilience through strategic partnerships and improved inventory management helps stabilize operations during market fluctuations.

Market Trend

"Sustainability and Recycling Shaping the Ferrochrome Industry"

Sustainability and recycling trends are increasingly shaping the ferrochrome market as the steel industry adopts more eco-friendly practices. The growing use of recycled stainless steel reduces reliance on raw materials, like chromium ore, while lowering carbon emissions in production.

Ferrochrome producers are adapting by improving energy efficiency, investing in sustainable technologies, and promoting the recycling of ferrochrome itself. This trend not only helps meet global sustainability targets but also drives the demand for high-quality ferrochrome to support the recycling of stainless steel.

- In July 2024, Tata Steel successfully conducted a trial of biomass usage in ferrochrome production at its Athagarh plant. This sustainable initiative, aimed at reducing carbon emissions, reflects the industry's shift toward eco-friendly practices and the growing role of recycling and alternative energy sources.

Ferrochrome Market Report Snapshot

| Segmentation | Details |

| By Application | Stainless Steel, Specialty Steel, Others |

| By Product Type | High Carbon Ferrochrome, Medium Carbon Ferrochrome, Low Carbon Ferrochrome |

| By End Use Industry | Automotive, Construction, Consumer Goods, Aerospace and Defense |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By application (stainless steel, specialty steel and others): The stainless steel segment earned USD 14.96 billion in 2023. Ferrochrome is widely used in stainless steel production, as it enhances corrosion resistance, strength, and durability.

- By product type (high carbon ferrochrome, medium carbon ferrochrome and low carbon ferrochrome): High carbon ferrochrome held 75.21% of the ferrochrome market share in 2023, due to its high chromium content. It is ideal for manufacturing durable and high-performance materials in various industries.

- By end use Industry (automotive, construction, consumer goods, and aerospace and defense): The automotive segment is projected to reach USD 10.11 billion by 2031, as it enhances the toughness and heat resistance of steel. Ferrochrome is increasingly used in the automotive industry.

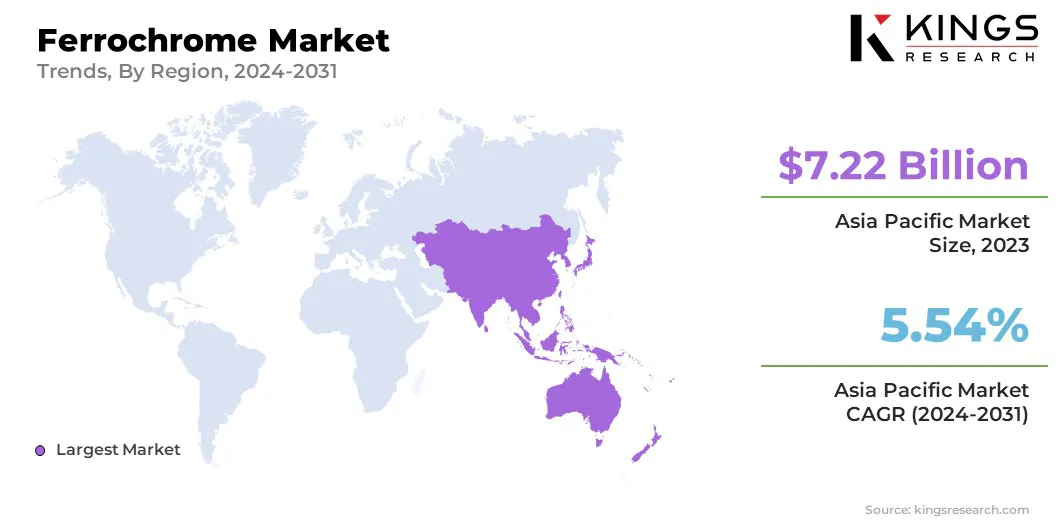

Ferrochrome Market Regional Analysis

Asia Pacific accounted for around 38.67% share of the global ferrochrome market in 2023, with a valuation of USD 7.22 billion. Asia Pacific is the most dominating region for the market, driven by the high demand for stainless steel in countries like China, India, and Japan.

These nations are major consumers of ferrochrome, due to their rapidly growing industries, including construction, automotive, and infrastructure. Additionally, Asia Pacific is home to some of the largest ferrochrome producers, further strengthening the market leadership in the region. The region's strong industrial base and increasing focus on sustainability continue to fuel the demand for ferrochrome.

- In August 2024, Eurasian Resources Group (ERG) signed MoUs with major Japanese companies to enhance operations in Central Asia, including green ferrochrome production. This collaboration supports Asia Pacific’s dominance in the market, driven by sustainable practices and regional industrial growth.

The market in Europe is poised for significant growth over the forecast period at a CAGR of 4.76%. Europe is emerging as a fast-growing region for the ferrochrome market, driven by the rising demand for stainless steel in the automotive, construction, and manufacturing industries.

The region is increasingly focused on sustainability, with companies adopting greener practices and improving recycling efforts, which, in turn, boosts the need for high-quality ferrochrome.

Europe’s robust industrial infrastructure, technological innovations in production, and commitment to energy efficiency and circular economy principles are key factors supporting the market's growth. As environmental concerns continue to rise, Europe’s focus on sustainable production further accelerates the demand for ferrochrome in the region.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Emissions Trading System (ETS) was launched in 2005 in Europe. The EU ETS is based on a “cap and trade” principle. The cap refers to the limit set on the total amount of GHG that can be emitted by installations and operators covered under the scope of the system. This cap is reduced annually in line with the EU’s climate target, ensuring that overall EU emissions decrease over time.

- The Regulation on the registration, evaluation, authorisation and restriction of chemicals (REACH) is the main EU law to protect human health and the environment from the risks that can be posed by chemicals.

- OSHA is part of the United States Department of Labor. OSHA ensures that American workers have safe and healthful working conditions free from unlawful retaliation. OSHA carries out its mission by setting and enforcing standards; enforcing anti-retaliation provisions of the OSHA Act and other federal whistleblower laws; providing and supporting training, outreach, education, and assistance; and working collaboratively with state OSHA programs as well.

- The Clean Air Act, under the United States Environmental Protection Agency, aids companies by providing different means to reduce air pollution while maintaining accountability for achieving required emissions levels.

- The Environment (Protection) Act was enacted in 1986 in India with the objective of providing for the protection and improvement of the environment.

Competitive Landscape:

The global market is characterized by a large number of participants, including both established corporations and rising organizations. Companies in the ferrochrome market are expanding through strategic mergers, acquisitions, and investments in production capacity.

They are also exploring new markets, enhancing technological advancements, and focusing on sustainable practices to meet the growing global demand for stainless steel.

- In January 2024, Metso Corporation secured a major order from Ferro Alloys Corporation Limited (FACOR), part of Vedanta, for a ferrochrome plant in Bhadrak, India. The USD 83.3 million project will produce 300,000 tonnes of ferrochrome annually, with operations set to begin in 2025.

List of Key Companies in Ferrochrome Market:

- Tata Steel

- Samancor Chrome

- TNC Kazchrome JSC

- Ferro Alloys Corporation Ltd.(FACOR)

- Eurasian Resources Group

- IMFA

- Yilmaden

- Ferbasa

- Glencore

- Outokumpu

- Balasore Alloys Limited

- Fondelco Metal & Alloys Pvt Ltd. (Fondelco Group)

- Zimasco

- Maranatha Ferrochrome (Private) Limited

- Afarak Group SE

- Others

Recent Developments

- In November 2024, Tata Steel's Ferro Alloys and Minerals Division (FAMD) became the first in the ferrochrome sector in India to publish an Environmental Product Declaration (EPD). This milestone highlights the company's commitment to sustainability, providing transparent environmental data for eco-conscious customers.

- In January 2025, Eurasian Resources Group (ERG) launched a wind power project in Kazakhstan to reduce the carbon footprint of its ferrochrome production, aligning with sustainability goals and supporting green energy transition in the industry.

- In December 2024, Eurasian Resources Group (ERG) officially launched its Bolashak chromium mine in Khromtau, Kazakhstan. The mine, a key investment for ERG, strengthens Kazakhstan's position in the global market while enhancing local development and safety through advanced automation technologies.

- In January 2025, Outokumpu announced a 95% increase in mineral reserves at its Kemi chrome mine in Finland, securing substantial ferrochrome supply for the long term. The mine’s expansion and sustainability efforts enhance its strategic position in the global market.

- In August 2023, Outokumpu became the first ferrochrome manufacturer to publish an environmental product declaration (EPD) for its ferrochrome production. This move highlights the company’s commitment to sustainability, offering customers low-carbon ferrochrome and aligning with the increasing global demand for eco-friendly materials.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership