Semiconductor and Electronics

Fiber Optic Gyroscope Market

Fiber Optic Gyroscope Market Size, Share, Growth & Industry Analysis, By Application (Aerospace and Aviation, Military and Defense, Robotics and Autonomous Vehicles, Civil Engineering & Infrastructure, and Others), By Device Type, By Sensing Axis, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR910

Fiber Optic Gyroscope Market Size

The global Fiber Optic Gyroscope Market size was valued at USD 1,106.5 million in 2023 and is projected to grow from USD 1,142.1 million in 2024 to USD 1,471.3 million by 2031, exhibiting a CAGR of 3.68% during the forecast period. The expansion of the market is driven by increasing demand for precise navigation in aerospace and defense, along with advancements in autonomous technologies.

This growth is further fueled by rising applications in UAVs, satellites, and industrial automation, supported by innovations in miniaturization and cost-effective manufacturing processes to enhance market accessibility.

In the scope of work, the report includes solutions offered by companies such as EMCORE Corporation., Honeywell International Inc., KVH Industries, Inc, Safran, iXBlue SAS, Northrop Grumman LITEF GmbH, Cielo inertial Solutions Ltd, Fizoptika Malta, NEDAERO, Optolink LLC, and others.

The fiber optic gyroscope market is experiencing robust growth, mainly propelled by increasing demand across aerospace, defense, and industrial sectors. FOGs are highly favored due to their high precision and reliability in navigation and motion sensing applications, which are essential for unmanned aerial vehicles (UAVs), satellites, and autonomous systems

- The significant rise in defense exports from India, which reached USD 1.9 billion in FY23 and extended to over 85 countries, is contributing significantly to the growth of the fiber optic gyroscope sector.

This surge underscores increasing global demand for advanced defense technologies, including high-precision navigation systems such as FOGs. Manufacturers in the market are poised to benefit from this trend, as defense sectors worldwide actively seek reliable and accurate gyroscopic solutions for applications such as UAVs, satellites, and autonomous systems.

The expanding defense export capabilities of countries such as India create new opportunities for FOG manufacturers to expand their market presence and enhance technological innovation.

A fiber optic gyroscope (FOG) is a sensor device that uses the interference of light within a coil of optical fiber to detect changes in orientation, thereby providing precise measurements of angular rotation rates. It is widely used in navigation systems for aerospace, defense, and industrial applications due to its high accuracy, reliability, and resistance to external factors such as shock and vibration.

FOGs are crucial for stabilizing platforms, controlling movements, and accurately determining positions in various vehicles and equipment, including aircraft, satellites, submarines, and autonomous vehicles.

Analyst’s Review

The expansion of the market is augmented by the increasing demand for precise navigation systems in both traditional aerospace and emerging space sectors. Companies such as Optolink and Cielo Inertial Solutions are strategically leveraging technological advancements to enhance gyroscopic performance and meet evolving industry requirements.

For instance, the successful integration of Optolink's TRS-500 gyroscopes into the Soyuz MS-21 spacecraft highlights their critical role in ensuring navigation accuracy during complex space missions.

- Additionally, EMCORE Corporation has made significant progress in advancing its Photonic Integrated Chip (PIC) technology, integrating it into all open-loop FOG-based products. This development, which began over three years ago and culminated in the launch of the TAC-450 Inertial Measurement Unit (IMU) series, along with the new TAC-450 single- and multi-axis FOGs featuring PIC Inside technology, underscores EMCORE's commitment to innovation and market leadership in the field of inertial navigation solutions.

These advancements reflect the industry's ongoing commitment to enhancing precision and reliability in navigation systems, driving market growth.

Fiber Optic Gyroscope Market Growth Factors

The fiber optic gyroscope market is experiencing significant growth, primarily due to its expanding applications in navigation systems for aircraft, missiles, and drones. FOGs are highly preferred in these critical applications due to their exceptional precision and reliability compared to traditional mechanical gyroscopes.

They offer advantages such as high accuracy, resistance to shock and vibration, and reliability in harsh environments, making them ideal for aerospace and defense sectors where precision navigation is crucial for mission success and safety. The increasing adoption of unmanned aerial vehicles (UAVs) and autonomous systems further amplifies the demand for FOGs, as they provide precise orientation and positional data necessary for autonomous operations.

This trend underscores FOGs' pivotal role in modern navigation technology and their growing significance in advancing aerospace and defense capabilities.

- In 2024, the Federal Aviation Administration (FAA) recorded a total of 782,203 drone registrations in the United States. Of these, 383,302 were registered for commercial use.

The market is facing a significant challenge due to growing competition from micro-electro-mechanical systems (MEMS) gyroscopes. MEMS gyroscopes offer advantages such as smaller size, lower cost, and suitability for use in consumer electronics and automotive applications, posing a threat to traditional markets for FOG's in the aerospace, defense, and industrial sectors.

Additionally, the higher manufacturing costs associated with FOGs remain a significant barrier to their broader adoption. To address these challenges, FOG manufacturers are focusing on continuous innovation to enhance performance, reduce costs, and emphasize their superior precision and reliability in critical applications that require high accuracy and robustness.

Strategic partnerships with system integrators and end-users are being forged to ensure seamless integration and comprehensive support throughout the product lifecycle, strengthening FOGs' competitive edge and expanding their reach across diverse industries.

Fiber Optic Gyroscope Market Trends

The rising trend of miniaturizing fiber optic gyroscopes (FOGs) for use in consumer electronics and industrial applications, coupled with efforts to reduce manufacturing costs, is significantly propelling market growth. By making FOGs smaller and more cost-effective, manufacturers are expanding their potential applications across various sectors such as consumer electronics, automotive, aerospace, and industrial automation.

This expansion is leading to increased adoption of FOGs in new and existing markets, fueled by their enhanced precision and reliability. As the demand for compact, high-performance sensors continues to rise, the market for FOGs is poised to witness substantial growth in the coming years.

The fiber optic gyroscope market is experiencing notable growth, largely attributed to increasinbg global demand in the military, intelligence, and civilian sectors. This surge in demand is further propelled by the versatility of UAVs, which utilize fiber optic gyroscopes for critical tasks such as motion sensing to measure angular velocity and speed in aviation applications. Furthermore, projections indicate a rising need for small UAVs in defense services, which is expected to further boost market expansion.

- According to Stockholm International Peace Research Institute (SIPRI), India's robust military expenditure, which increased by 4.2% to US$ 83.6 billion in 2023 underscores the strategic importance of advanced technologies, such as fiber optic gyroscopes, in bolstering defense capabilities.

These developments highlight the importance of fiber optic gyroscopes in advancing navigation and operational capabilities across diverse sectors. They play a pivotal role in driving technological advancements for both defense and civilian applications on a global scale.

Segmentation Analysis

The global market is segmented based on application, device type, sensing axis, and geography.

By Application

Based on application, the market is categorized into aerospace and aviation, military and defense, robotics and autonomous vehicles, civil engineering & infrastructure, and others. The aerospace and aviation segment led the fiber optic gyroscope market in 2023, reaching a valuation of USD 426.6 million, primarily due to the increasing demand for precise navigation and stabilization systems in aircraft, spacecraft, and UAVs.

Fiber optic gyroscopes offer high accuracy, reliability, and durability, making them essential for applications that require stable navigation in challenging environments. As aerospace technology advances and the demand for autonomous and unmanned systems grows, the adoption of fiber optic gyroscopes is anticipated to expand. This expansion is further supported by their critical role in enhancing flight safety, operational efficiency, and mission success in both the military and civilian sectors.

By Device Type

Based on device type, the market is divided into fiber optics gyrocompass, inertial measurement units (IMUS), inertial navigation systems, and others. The inertial measurement units (IMUS) segment captured the largest fiber optic gyroscope market share of 41.23% in 2023.

The inertial measurement units (IMUs) leverages fiber optic gyros and accelerometers to determine the directional orientation (backward, forward, left, or right) and object position. By monitoring linear acceleration and angular velocity relative to the moving object, these systems accurately ascertain the object's relative orientation and location.

IMUs are pivotal in navigation applications where precision, efficiency, size, and cost-effectiveness are crucial considerations. With ongoing advancements in navigation system technologies, particularly in inertial navigation systems, the IMU segment is poised to witness significant growth in the near future.

By Sensing Axis

Based on sensing axis, the market is categorized into 1-axis, 2-axis, and 3-axis. The 3-axis segment is expected to garner the highest revenue of USD 655.6 million by 2031. This growth is propelled by the increasing demand across diverse industries such as aerospace, defense, marine navigation, and robotics, where precise and reliable orientation data is essential for navigation, stabilization, and control systems.

Technological advancements in micro-electromechanical systems (MEMS), which have led to smaller, more accurate, and cost-effective gyroscopes, further propel segmental growth.

Additionally, the integration of 3-axis fiber optic gyroscopes into autonomous vehicles and drones, as well as their role in enhancing the accuracy of virtual reality (VR) and augmented reality (AR) applications, is leading to their widespread adoption. As industries continue to prioritize efficiency, safety, and operational reliability, the 3-axis segment is expected to witness sustained growth,

Fiber Optic Gyroscope Market Regional Analysis

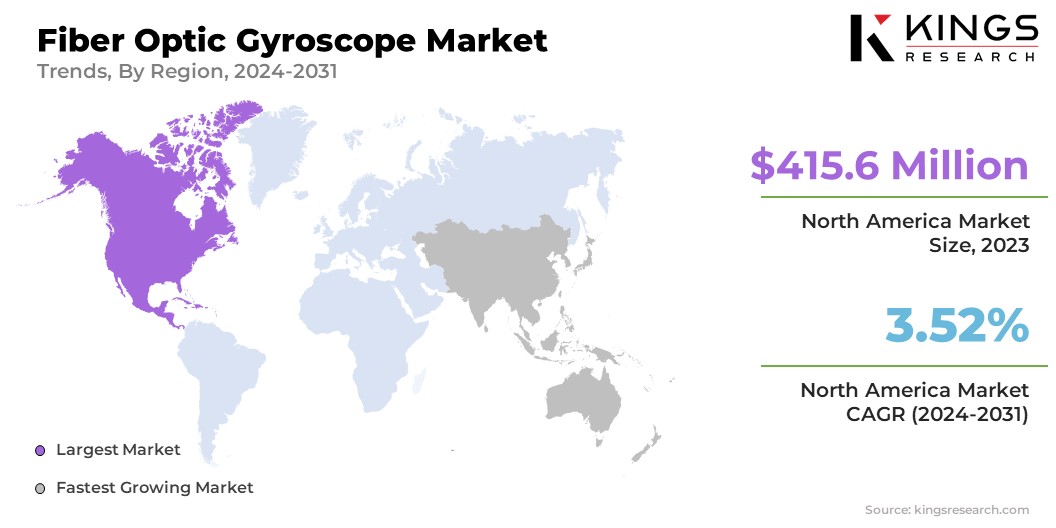

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America fiber optic gyroscope market share stood around 37.56% in 2023 in the global market, with a valuation of USD 415.6 million. This dominance is reinforced by substantial defense spending, especially in the United States.

- According to USA Spending, the Department of Defense comprises $779.60 billion of a total federal budget of $2.08 trillion.

North America's emphasis on cutting-edge technology and its ongoing increase in defense spending creates a favorable environment for regional market expansion. In addition, FOGs are essential in military applications such as RADAR, electronic surveillance, GPS, navigation, and Air Traffic Control (ATC). Increased investment in these technologies is significantly fostering the demand for FOGs, which is expected to augment regional market growth.

Asia-Pacific is anticipated to witness robust growth at a CAGR of 4.65% over the forecast period. This notable growth is primarily attributable to ongoing advancements in defense, aerospace, and maritime sectors. Countries such as China, India, South Korea, and Japan are increasing defense expenditures to enhance military capabilities, leading to a strong demand for FOGs.

The region's expanding aerospace industry, with a major focus on innovation in commercial and military aircraft, further boosts domestic market expansion. Additionally, the maritime sector's growing emphasis on improved naval and underwater navigation systems contributes to the widespread adoption of FOG. With surging investments in autonomous vehicles and smart transportation, the demand for FOG technology is expected to rise.

Competitive Landscape

The global fiber optic gyroscope market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Fiber Optic Gyroscope Market

- EMCORE Corporation.

- Honeywell International Inc.

- KVH Industries, Inc

- Safran

- iXBlue SAS

- Northrop Grumman LITEF GmbH

- Cielo inertial Solutions Ltd

- Fizoptika Malta

- NEDAERO

- Optolink LLC

Key Industry Development

- August 2022 (Acquisition): EMCORE Corporation, a leading provider of advanced mixed-signal products for aerospace, defense, communications, and sensing markets, completed the acquisition of KVH Industries, Inc.'s Fiber Optic Gyroscope (FOG) and Inertial Navigation Systems business segment. This strategic move involved acquiring all intellectual property, assets, and liabilities associated with KVH’s FOG and Inertial Navigation Systems operations. Additionally, EMCORE assumed control of a significant production facility, spanning 100,384 square feet, located in Tinley Park, Illinois. By expanding its portfolio with KVH’s FOG and Inertial Navigation Systems business, EMCORE enhanced its offerings to meet the growing demand for reliable navigation solutions across aerospace, defense, and industrial sectors.

The global fiber optic gyroscope market is segmented as:

By Application

- Aerospace and Aviation

- Military and Defense

- Robotics and Autonomous Vehicles

- Civil Engineering & Infrastructure

- Others

By Device Type

- Fiber Optics Gyrocompass

- Inertial Measurement Units (IMUs)

- Inertial Navigation Systems

- Others

By Sensing Axis

- 1-Axis

- 2-Axis

- 3-Axis

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership