Advanced Materials and Chemicals

Fiberglass Fabric Market

Fiberglass Fabric Market Size, Share, Growth & Industry Analysis, By Application (Aerospace & Defense, Wind Energy, Construction & Infrastructure, Electrical & Electronics, Automotive, Marine), By Product Type (E-Glass Fabric, Others), By Fabric Type (Woven Fabrics, Non-Woven Fabrics), and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : February 2025

Report ID: KR1337

Market Definition

The fiberglass fabric industry includes the production, distribution, and use of woven or non-woven fiberglass textiles in industries such as aerospace, construction, automotive, and marine for reinforcement, insulation, and fire resistance.

Fiberglass Fabric Market Overview

Global fiberglass fabric market size was valued at USD 9.01 billion in 2023 and is projected to grow from USD 9.46 billion in 2024 to USD 13.83 billion by 2031, exhibiting a CAGR of 5.58% during the forecast period.

The growth of the fiberglass market is fueled by several factors such as advancements in composite manufacturing, rising infrastructure projects, and increasing adoption of fiberglass-based solutions in the automotive and aerospace sectors to enhance fuel efficiency and performance.

Major companies operating in the fiberglass fabric market are Owens Corning, China Jushi Co., Ltd., Saint - Gobain., CHOMARAT, TAIWAN GLASS IND. CORP., Auburn Manufacturing, Inc., SAERTEX GROUP, BGF Industries, PORCHER INDUSTRIES, Fothergill Group, Mid-Mountain Materials Inc., Central Glass Co., Ltd., Asahi Kasei Corporation., DuPont de Nemours, Inc., Hexcel Corporation, and others.

The increasing adoption of fiberglass fabrics in wind energy and defense applications is prompting companies to invest in innovation, optimize manufacturing processes for efficiency, expand applications, and strengthen market presence.

Key Highlights:

- The global fiberglass fabric industry size was recorded at USD 9.01 billion in 2023.

- The market is projected to grow at a CAGR of 5.58% from 2024 to 2031.

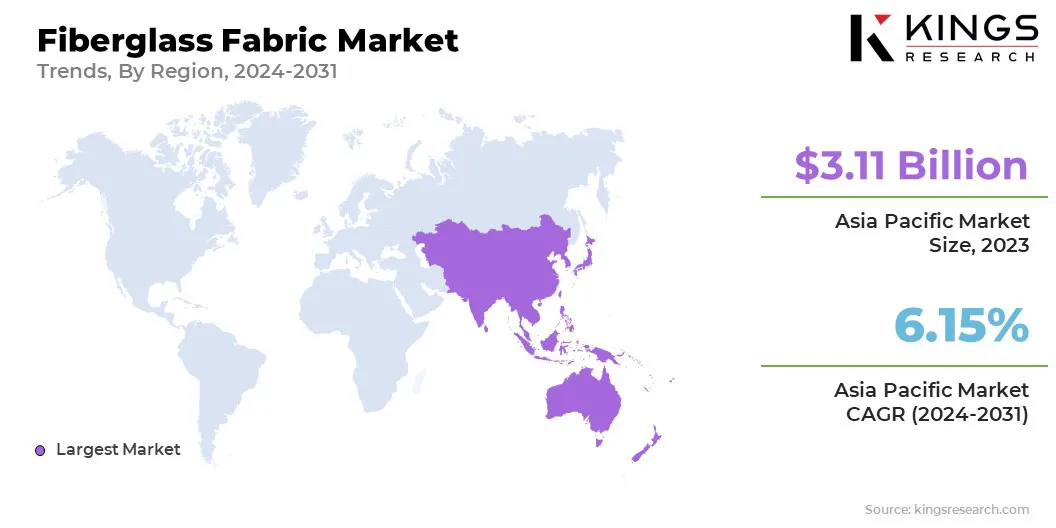

- Asia-Pacific held a share of 34.56% in 2023, valued at USD 3.11 billion.

- The wind energy segment garnered USD 2.71 billion in revenue in 2023.

- The e-glass fabric segment is expected to reach USD 8.79 billion by 2031.

- The woven fabrics segment is projected to generate a valuation of USD 7.65 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.15% through the forecast period.

Market Driver

"Rising Demand for Lightweight and High-Strength Materials"

The fiberglass fabric market is witnessing substantial growth, mainly fueled by the increasing demand for lightweight and high-strength materials across various industries.

The growing wind energy sector, supported by the demand for durable and efficient turbine blades, is contributing significantly to this growth. Additionally, the transportation and automotive industries are accelerating market expansion adopting lightweight materials to enhance fuel efficiency.

The rising global construction activities, where fiberglass fabrics are used for reinforcing concrete and enhancing structural integrity, further propel market growth.

- In May 2024, BASF is advancing sustainability by targeting a 15% reduction in Scope 3.1 emissions by 2030 and net-zero by 2050. In the market, BASF integrates sustainably produced glass fibers from 3B Fibreglass into its Ultramid A&B compounds, leveraging green energy to minimize environmental impact.

Market Challenge

"High Manufacturing Costs"

High manufacturing cost pose a major challenge to the growth of the fiberglass fabrics market, particularly in price-sensitive applications. To address this challenge, manufacturers are optimizing processes, adopting cost-effective production methods, and exploring alternative raw materials.

Additionally, manufacturers are investing in research and development to enhance production efficiency and develop advanced materials that maintain performance while reducing costs.

Market Trend

"Development of High-Performance Materials and Emphasis on Sustainability"

The fiberglass fabric market is witnessing a notable shift toward the development of specialized, high-performance fabrics tailored to specific applications.

Innovations in fiber technology, such as the use of advanced glass formulations and weaving techniques, are leading to improved strength, durability, and other desirable properties. The increasing adoption of composite materials, where fiberglass fabric is a key component, is further boosting market growth.

Furthermore, the market is seeing a growing emphasis on sustainability, with manufacturers exploring bio-based fiberglass options and promoting recycling initiatives to reduce environmental impact.

- For instance, in April 2023, the DecomBlades consortium partnered with 3B-Fibreglass partnered to develop a Zero-waste model for recycling glass fiber from decommissioned wind turbine blades. A commercial-scale pyrolysis experiment in Norway aims to demonstrate the viability of producing high-quality glass fiber from recycled blades, advancing sustainable blade recycling and a closed-loop value chain.

Fiberglass Fabric Market Report Snapshot

| Segmentation | Details |

| By Application | Aerospace & Defense (Aircraft Components, Defense Equipment, Space Exploration, Others) , Wind Energy (Wind Turbine Blades, Wind Tower Reinforcement, Other Wind Energy Applications), Construction & Infrastructure (Concrete Reinforcement, Waterproofing & Corrosion Resistance, Other Applications), Electrical & Electronics (PCB Laminates, Electrical Insulation, Cable Reinforcement), Automotive(Body Panels & Exterior Parts, Interior Components, Engine & Mechanical Parts), Marine |

| By Product Type | E-Glass, S-Glass Fabric, Others |

| By Fabric Type | Woven Fabrics Fabric (Plain Weave, Twill Weave, Satin Weave, Multiaxial Weave), Non-Woven Fabrics(Chopped Strand Mat (CSM), Continuous Filament Mat (CFM), Needle-Punched Non-Wovens, Wet-Laid Non-Wovens) |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Application (Aerospace & Defense, Wind Energy, Construction & Infrastructure, Electrical & Electronics, and Automotive): The wind energy segment earned USD 2.71 billion in 2023 due to the increasing global focus on renewable energy sources and the subsequent rise in wind turbine installations, where fiberglass fabrics are crucial for blade manufacturing due to their lightweight and high-strength properties.

- By Product Type (E-Glass Fabric, S-Glass Fabric, and Others): The e-glass fabric segment held a share of 68.90% in 2023, attributed to the cost-effectiveness and versatile properties of E-glass, making it suitable for a wide range of applications across various industries.

- By Fabric Type (Woven Fabrics and Non-Woven Fabrics): The woven fabrics segment is projected to reach USD 7.65 billion by 2031, fueled by the superior strength and dimensional stability offered by woven fiberglass fabrics, making them ideal for aerospace, construction, and automotive applications.

Fiberglass Fabric Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific fiberglass fabric market captured a substantial share of around 34.56%, valued at USD 3.11 billion. This growth is attributed to rapid industrialization, increasing infrastructure development, a growing focus on renewable energy sources, and a large manufacturing base in countries such as China and India.

The rising demand across construction, automotive, wind energy, and electrical & electronics sectors further boost regional market growth.

North America fiberglass fabric industry is poised grow at a CAGR of 5.71% over the forecast period. This growth is largely propelled by the increasing demand for lightweight and durable materials across various sectors.

Rising investments in infrastructure development, coupled with a growing focus on advanced materials and composite applications, are further fostering this growth. Furthermore, the presence of key industry players and ongoing technological advancements are expected to fuel domestic market growth.

Regulatory Framework

- In the U.S., the Occupational Safety and Health Administration (OSHA) sets standards for worker safety, including permissible exposure limits for fiberglass dust and requirements for personal protective equipment. Additionally, the Environmental Protection Agency (EPA) regulates air and water emissions from manufacturing facilities and oversees hazardous waste disposal.

- In Europe, the European Union (EU) plays a pivotal role in regulating fiberglass fiber through its comprehensive regulatory framework. Key EU regulations include REACH, CLP, and BPR, which ensure the safe handling and use of chemicals in fiberglass manufacturing and applications.

- In Japan, fiberglass fabric regulation involves multiple agencies and laws. The Industrial Safety and Health Act ensures worker safety by setting standards for dust exposure and protective equipment. The Building Standards Act mandates compliance with fire resistance and material use requirements in conctruction.

Competitive Landscape

The fiberglass fabric industry is highly competitive, fueled by the growing demand for high-performance fiberglass fabrics, increasing focus on sustainability, and the emergence of regional players in developing markets.

Furthermore, geographic expansion is a key strategy for many companies, as they seek to establish a presence in new markets and capitalize on growth opportunities in different regions. This is enabling companies to access new customers, reduce transportation costs, and diversify supply chains.

- For instance, in February 2023, Saint-Gobain expanded its presence in the Indian insulation market by acquiring U.P. Twiga Fiberglass Ltd., a leading glass wool insulation provider. This acquisition aligns with Saint-Gobain's growth strategy in high-potential regions and enhances its position in India's building materials sector.

List of Key Companies in Fiberglass Fabric Market:

- Owens Corning

- China Jushi Co., Ltd.

- Saint - Gobain

- CHOMARAT

- TAIWAN GLASS IND. CORP.

- Auburn Manufacturing, Inc.

- SAERTEX GROUP

- BGF Industries

- PORCHER INDUSTRIES

- Fothergill Group

- Mid-Mountain Materials Inc.

- Central Glass Co., Ltd.

- Asahi Kasei Corporation.

- DuPont de Nemours, Inc.

- Hexcel Corporation

Recent Developments (New Product Launch)

- In September 2024, Hexcel Corporation, launched HexForce 1K, a lightweight woven fabric made from its proprietary HexTow AS4C 1K carbon fiber, designed for high-strength, low-weight composite applications.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)