BFSI

Financial Service Software Market

Financial Service Software Market Size, Share, Growth & Industry Analysis, By Component (Software, Services), By Software Type (Audit , Business Transaction Processing, Risk and Compliance Management, BI and Analytics Applications, Customer Experience), By Deployment Model (On Premises, Cloud) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : March 2024

Report ID: KR539

Financial Service Software Market Size

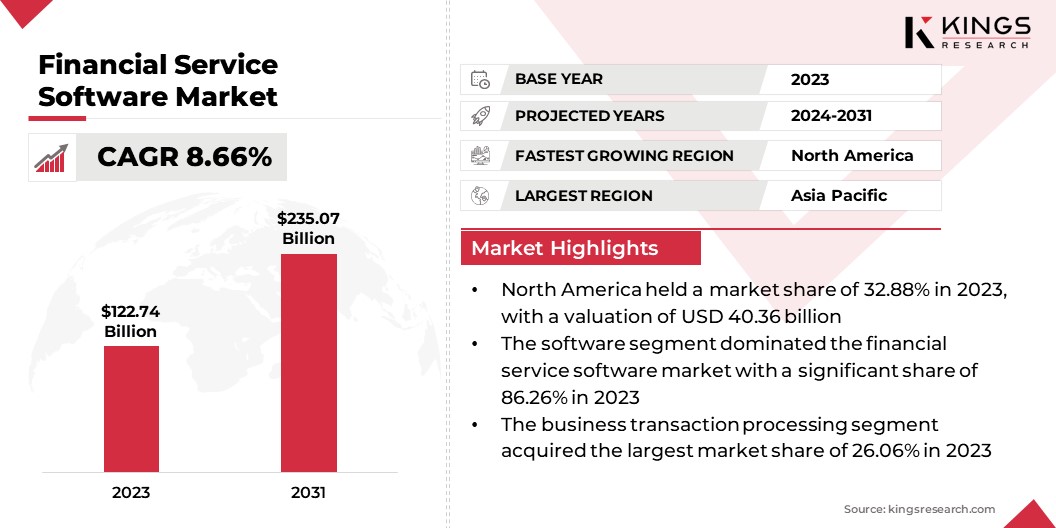

The global Financial Service Software Market size was valued at USD 122.74 billion in 2023 and is projected to reach USD 235.07 billion by 2031, growing at a CAGR of 8.66% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Oracle, SAP, Payability, Sage, Hyland Software, Workday, Finastra, Focus Softnet, Debt Pay, IBM and Others.

The financial service software market is witnessing substantial growth driven by the increasing demand for digital banking solutions and the disruption caused by fintech companies in the traditional financial sector. This growth is fueled by the need for more efficient and secure financial services, coupled with the rising popularity of mobile banking and online payment platforms.

The integration of artificial intelligence and machine learning technologies in financial software is further contributing to market expansion by enabling personalized and automated services for consumers. In order to remain competitive in this evolving industry, financial service software providers are proactively anticipating and adapting to changing customer preferences and technological advancements. Utilizing emerging technologies and delivering seamless user experiences are essential for attracting and retaining customers in this rapidly changing landscape.

Companies that prioritize innovation and customer satisfaction are thriving in the dynamic landscape of financial technology. By maintaining a proactive approach and aligning with the latest trends, financial service software providers can differentiate themselves from competitors and establish a strong market position. By continuously improving their products and services, companies are ensuring long-term success in the highly competitive and dynamic financial technology sector.

Analyst’s Review

The financial service software market is undergoing rapid growth and innovation, driven by the ongoing development of new technologies to meet the evolving needs of financial institutions. A notable trend in the market is the increasing adoption of cloud-based solutions, offering enhanced flexibility and scalability for financial service providers. Furthermore, there is a growing emphasis on data security and compliance as regulatory requirements become more stringent.

Furthermore, the financial service software market is experiencing a consistent growth trajectory, driven by organizations' efforts to optimize their processes and improve client interactions. In an increasingly competitive landscape, providers of financial service software are striving to set themselves apart by incorporating sophisticated analytics and artificial intelligence functionalities. Such technological advancements facilitate a more profound understanding of consumer patterns, allow for the customization of services, and support more strategic decision-making processes. Furthermore, the growing collaboration between fintech enterprises and conventional financial entities is fostering innovation and expansion in the sector.

Market Definition

Financial service software encompasses technology solutions that are purpose-built to streamline and automate diverse financial processes within the industry. These software applications are specifically designed to cater to the distinct requirements of financial institutions, including banks, investment firms, and insurance companies. By utilizing these tools, organizations aim to optimize operational efficiency, enhance accuracy, and ensure compliance with regulatory mandates. For instance, financial service software may incorporate modules for customer relationship management, risk management, and financial reporting, all integrated into a unified platform for seamless operations. The utilization of such applications is crucial in today's rapid and tightly governed financial environment.

Financial Service Software Market Dynamics

The ongoing digital transformation in the financial sector is revolutionizing the operational landscape and customer engagement strategies of financial institutions. This shift toward digitization has led to a surge in demand for innovative financial services software that can streamline processes, enhance security, and improve overall customer experience. As a result, the global financial services software market is experiencing significant growth, with companies investing heavily in cutting-edge technologies to stay ahead of the competition. For instance, many banks are adopting cloud-based solutions and artificial intelligence to offer personalized services and optimize decision-making processes. This trend is expected to continue to drive the expansion of the financial services software market in the coming years.

Additionally, financial institutions are prioritizing the development of mobile apps and digital platforms to meet the changing demands of consumers who are increasingly relying on their smartphones for banking services. Utilizing such technological progressions enables businesses to both appeal and retain clientele, while also reducing operational expenditures. Moreover, the financial services software market is growing rapidly, due to the ongoing innovations that are reshaping the landscape and fostering opportunities for the expansion of the market.

However, cybersecurity risks have emerged as a significant obstacle to the global financial services software market growth. The prevalence of data breaches, ransomware attacks, and other cyber threats has led to a rise in the demand for robust security measures within the industry. These risks compromise sensitive financial information and undermine consumer confidence in financial institutions. In response to this trend, many companies are increasingly prioritizing cybersecurity as a pivotal component of their business strategy.

By implementing advanced security measures such as encryption, multi-factor authentication, and regular security audits, financial institutions can fortify their operations and foster trust with their customers. Moreover, establishing partnerships with cybersecurity firms and providing ongoing employee training is likely to bolster a company's defense against cyber threats, thereby ensuring the long-term stability and growth of the financial services software market.

Segmentation Analysis

The global financial service software market is segmented based on component, software type, deployment model, enterprise size, and geography.

By Component

Based on component, the market is bifurcated into software and services. The software segment dominated the financial service software market with a significant share of 86.26% in 2023. This can be attributed to its capacity to optimize operations, increase efficiency, and elevate customer experience. Notably, the adoption of advanced analytics software empowers financial institutions to acquire valuable insights into customer behavior and market trends, thereby facilitating informed decision-making.

Moreover, the incorporation of artificial intelligence and machine learning algorithms within financial software has revolutionized risk management and fraud detection procedures, thus enhancing their efficacy and dependability. These technological advancements have firmly established the software segment as a pivotal factor contributing to innovation and growth within the financial services industry.

By Software Type

Based on software type, the market is bifurcated into audit, business transaction processing, risk and compliance management, bi and analytics applications, customer experience, and enterprise IT. The business transaction processing segment acquired the largest market share of 26.06% in 2023. This growth is mainly driven by its proficiency in optimizing and automating critical financial processes. This segment offers significant value to financial institutions by providing efficient solutions for tasks such as payment processing, reconciliation, and fraud detection. By leveraging these solutions, organizations strive to enhance operational efficiency and reduce costs.

Furthermore, the business transaction processing segment enables real-time data analysis and reporting, empowering businesses to make timely and accurate decisions. This agility and responsiveness are essential in the fast-paced financial landscape, where market conditions can rapidly evolve. This segment plays a pivotal role in enhancing efficiency, security, and innovation within the financial industry.

By Deployment Model

Based on deployment model, the market is bifurcated into on premises, and cloud. The on premises segment led the financial service software market with a notable revenue share of 59.52% in 2023, due to its enhanced security measures. Financial institutions highly prioritize data protection and confidentiality, thus making on-premises solutions the preferred choice.

Moreover, these institutions often operate complex infrastructures and are subject to stringent regulatory requirements, which are optimally supported by on-premises software solutions. The ability to customize and tailor software to specific needs further contributes to the dominance of the on-premises segment in the financial services sector.

Financial Service Software Market Regional Analysis

Based on region, the global financial service software market is classified into North America, Europe, Asia Pacific, MEA and Latin America.

The North America Financial Service Software Market share stood around 32.88% in 2023 in the global market, with a valuation of USD 40.36 billion, due to its advanced technological infrastructure and robust regulatory framework. The highly skilled workforce in the region and strong emphasis on innovation have enabled companies to develop cutting-edge software solutions that meet the complex needs of the financial services industry.

Additionally, the leading position of North America in the global economy has provided firms with access to a large customer base and ample opportunities for growth and expansion. This competitive advantage has solidified the position of the region in the financial services software market. As a result, North America continues to attract high-caliber professionals and investment in the financial technology sector, further fueling its growth.

Asia-Pacific is projected to register the highest CAGR over the forecast period in the financial service software market. This growth is primarily fueled by the increasing adoption of digital technologies, particularly in emerging economies such as China and India, which has resulted in a notable surge in demand for innovative financial solutions. This has created a conducive environment for software companies to develop cutting-edge products tailored to the specific needs of this diverse and dynamic market. Additionally, the robust economic growth and the growing middle-class population have contributed to the increasing demand for financial services, thereby propelling the growth of the financial service software market in the region.

Competitive Landscape

The global financial service software market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Financial Service Software Market

- Oracle

- SAP

- Payability

- Sage

- Hyland Software

- Workday

- Finastra

- Focus Softnet

- Debt Pay

- IBM

Key Industry Developments

- May 2022 (Collaboration): Finastra collaborated with Amazon Web Services to provide AWS cloud services for accessing Finastra Managed Services (FMS), which assist large financial institutions in managing lending solutions.

The Global Financial Service Software Market is Segmented as:

By Component

- Software

- Services

By Software Type

- Audit

- Business Transaction Processing

- Risk and Compliance Management

- BI and Analytics Applications

- Customer Experience

- Enterprise IT

By Deployment Model

- On Premises

- Cloud

By Enterprise Size

- SMEs

- Large Enterprises

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership