Machinery Equipment-Construction

Fire Testing Market

Fire Testing Market Size, Share, Growth & Industry Analysis, By Type (Testing, Inspection, Certification), By Sourcing (In-House, Outsourced), By End Use (Construction, Automotive, Aerospace & Defense, Energy & Power, Consumer Goods, Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : October 2024

Report ID: KR1112

Fire Testing Market Size

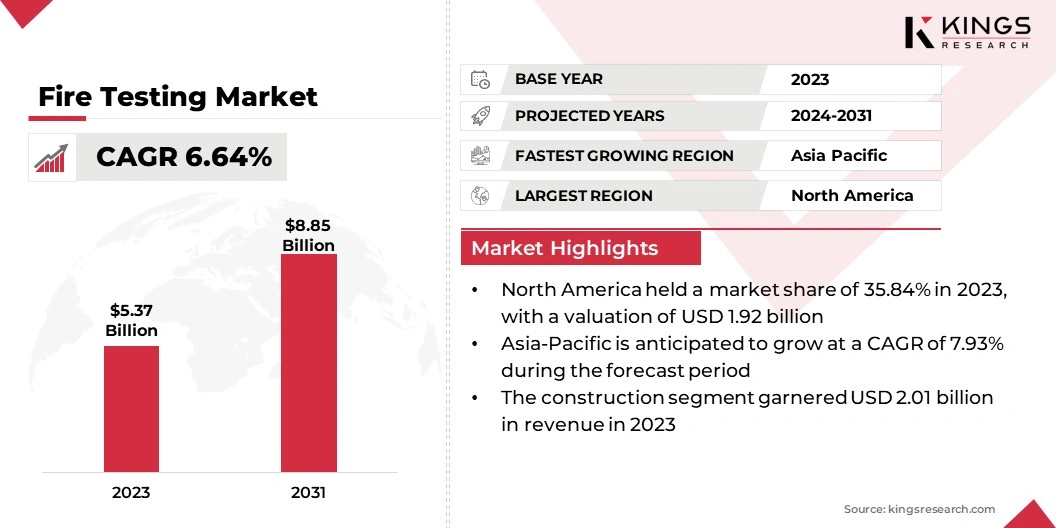

Global Fire Testing Market size was recorded at USD 5.37 billion in 2023, which is estimated to be valued at USD 5.65 billion in 2024 and is projected to reach USD 8.85 billion by 2031, growing at a CAGR of 6.64% from 2024 to 2031. Surging demand for fire testing of electronic products and rising awareness of fire safety in commercial and residential spaces are driving the growth of the market.

In the scope of work, the report includes services offered by companies such as Intertek Group plc, Société Générale de Surveillance SA, TÜV SÜD PSB Pte. Ltd., Bureau Veritas, UL LLC, DEKRA SE, Applus+, QIMA, BRE Group, Vetrotech Saint-Gobain International AG, and others.

The rising demand for fire testing services in smart cities and urban development projects is fueled by the growing need to meet enhanced safety standards amidt rapid urbanization. Smart cities integrate advanced technologies to optimize infrastructure, with fire safety as a critical component. As high-rise buildings, smart transportation networks, and energy-efficient systems are developed, assessing their ability to withstand fire hazards becomes essential.

Fire testing services essential for ensuring that construction materials, building designs, and electrical systems meet stringent fire safety regulations.

- For instance, in December 2023, Siemens Smart Infrastructure expanded its fire safety offerings on Building X with new applications and APIs. This enhances transparency, reduces incident response times, and improves maintenance processes, supporting customers in digitalizing, managing, and optimizing building operations for better performance and sustainability through the Siemens Xcelerator platform.

As governments and developers transition to sustainable and technologically advanced urban spaces, the need for more rigorous fire testing is growing. These services help validate compliance with local and international safety standards, minimizing the risk of fire outbreaks. This opportunity is likely to grow further as the global smart city concept evolves, particularly in regions investing heavily in urban renewal projects.

Companies offering fire testing services are well-positioned to capitalize on the growing demand within urban infrastructure development. Fire testing is the process of evaluating materials, products, and systems to determine their fire resistance, combustion characteristics, and overall safety performance when exposed to fire.

The primary goal is to ensure that building components, electrical systems, and other infrastructure are resilient enough to mitigate the risk of fire, thereby minimizing both damage and injury. There are several types of fire testing, including fire resistance testing, flame spread testing, smoke and toxicity testing, and reaction-to-fire testing.

Fire resistance tests assess the duration a material can withstand fire, while flame spread tests evaluate the speed at which flames travel across a surface. Smoke and toxicity testing measure health hazards from smoke inhalation, while reaction-to-fire testing evaluates a material’s response to fire exposure.

Fire testing services can be sourced internally by manufacturers or externally through accredited third-party labs. Major end users of fire testing services include construction companies, building material manufacturers, automotive companies, aerospace and defense sectors, and regulatory bodies. These tests ensure compliance with local and international safety standards, contributing to safer environments across industries.

Analyst’s Review

The global fire testing market has witnessed substantial growth in recent years, mainly due to stringent regulations and increasing fire safety awareness across industries. Key market playershave implemented strategies to strengthen their position, including portfolio expansion, investment in advanced testing technologies, and an ephasis on certifications to comply with evolving safety standards. These companies are also leveraging digital transformation, by incorporating AI-based fire simulation models and remote testing capabilities to improve testing accuracy and efficiency.

- For instance, in June 2024, UL Solutions introduced a new testing protocol to address fire service organizations' need for advanced evaluations of residential battery energy storage systems. This protocol features a large-scale fire test with robust ignition scenarios and stricter acceptance criteria, thereby improving safety for residential BESS installations.

Market players are experiencing significant growth in the construction, automotive, and energy sectors, where fire safety has become a critical concern. One of the key imperatives for industry players is maintaining strong relationships with regulatory bodies and ensuring compliance with national and international fire safety standards.

To sustain competitiveness, companies must continue to innovate and offer specialized testing solutions for emerging sectors such as electric vehicles and renewable energy infrastructure. Expanding geographic presence through strategic partnerships and acquisitions is becoming a common strategy to address the growing demand for fire testing services in developing regions

Fire Testing Market Growth Factors

The expansion of the fire texting market is fueled by increasing adoption in electronic products, supported by the increasing integration of electronics in everyday life, including in homes, businesses, and transportation systems. With the proliferation of complex electronic devices such as smartphones, laptops, wearables, and smart home gadgets, ensuring the safety of these products from fire hazards has become critical.

Electrical faults, overheating components, and faulty wiring can lead to fires, posing significant risks to users. Manufacturers are prioritizing fire testing to meet safety standards and prevent catastrophic failures. Fire testing services for electronic products typically assess devices' flammability, response to fire exposure, and the toxicity of emissions produced during combustion.

- For instance, in October 2024, Intertek launched Intertek Access, a global market access service for electrical and electronic manufacturers. Leveraging a global regulatory network, this service offers clients early insights into regulatory requirements from product concept to development, ensuring smoother compliance and market entry.

This driver is particularly significant due to the increasing reliance on electronics by consumers and industries, particularly in critical sectors such as healthcare and defense.

As electronic components become more complex and energy-dense, especially due to the growing demand for electric vehicles and battery-powered devices, fire testing is likely to remain for mitigating safety risks. This presents a major growth opportunity for fire testing service providers, particularly those specializing in electronics.

The high costs associated with advanced fire testing equipment present a significant challenge for companies, particularly smaller enterprises that lack the financial resources to invest in such technologies. Fire testing equipment, such as thermal imaging systems, reaction-to-fire testers, and flame spread testers, are costly due to their complexity and precision.

Additionally, these machines often require regular calibration, maintenance, and technical expertise, which increases operational costs and poses considerable challenges to the growth of the fire testing market. This imposes a financial burden on businesses in construction, electronics, and manufacturing as they strive to comply with stringent fire safety regulations. This challenge is especially pronounced for organizations requiring frequent or specialized testing, such as those in electric vehicles, renewable energy, or smart buildings.

To mitigate this challenge, companies can explore partnerships with third-party testing labs that offer advanced fire testing as a service, reducing the need for capital expenditure on equipment. Another mitigation strategy is to adopt a phased approach to equipment investment, prioritizing high-risk products and gradually upgrading testing infrastructure as budgets permit.

Fire Testing Market Trends

Stringent regulatory requirements and building codes are fueling the growth of the fire testing market. Governments and regulatory bodies worldwide are increasingly enforcing stricter fire safety regulations, especially in the construction, manufacturing, and transportation sectors. These regulations require materials, products, and infrastructure to meet specific fire resistance and performance standards prior to approval for use.

Companies are compelled to invest in comprehensive fire testing to ensure compliance with local and international safety codes. This trend is particularly prominent in regions at high risk for fire hazards, such as highly urbanized areas and industries dealing with flammable materials.

- In September 2023, BRE Global and Thomas Bell-Wright International signed an MoU to enhance fire testing and certification services. This partnership enables cross-recognition of test results, offering manufacturers diverse options for obtaining BRE Global classification and LPCB certification, thereby improving global market access for fire-resistant products.

The construction materials must pass fire resistance tests to verify their ability to withstand heat and fire for a set period, while the automotive and aerospace industries focus on flame spread and toxicity testing for their products. As regulatory frameworks become more stringent in emerging economies, fire testing service providers are poised to expand their offerings.

Companies that adhere to these regulations reduce the risk of costly penalties while enhancing their reputations for safety and reliability, thus fostering customer trust and loyalty.

Segmentation Analysis

The global market has been segmented on the basis of type, source, end use, and geography.

By Type

Based on type, the market has been divided into testing, inspection, and certification. The testing segment dominated the fire testing market in 2023 with a major share of 46.32%, primarily due to the growing need for comprehensive fire safety evaluations across industries. This growth is largely attributed to increasing regulatory pressure on manufacturers and builders to meet stringent fire safety standards.

Industries such as construction, automotive, electronics, and energy are facing greater scrutiny, making fire testing crucial for compliance with both local and international regulations. Fire testing evaluates the fire resistance, flame spread, and toxicity of materials, all of which are essential for determining safety and compliance.

Additionally, the rising complexity of products, especially due to the growing adoption of electric vehicles, renewable energy infrastructure, and smart building technologies, has fueled the demand for precise and advanced fire testing services.

Companies aim to ensure their products and infrastructure can withstand fire-related hazards without compromising performance. This growing focus on fire safety, combined with the growing industrialization and urbanization worldwide, has contributed significantly to the expansion of the testing segment.

By Sourcing

Based on sourcing, the market has been classified into in-house and outsourced. The outsourced segment is projected to grow at an impressive CAGR of 7.10% through the forecast period. Outsourcing fire testing services is increasingly favored by companies, particularly smaller firms, as it offers a cost-effective solution without requiring heavy investments in in-house testing infrastructure.

Third-party fire testing laboratories often provide more specialized and accredited services that may be difficult to achieve in-house, particularly for businesses with limited budgets or complex testing processes.

Moreover, outsourcing enables companies to focus on their core competencies while leveraging the expertise and technological capabilities of certified labs. This trend is gaining prominence across industries such as construction, electronics, and automotive, where fire testing is essential for meeting stringent safety standards.

The growing adoption of new technologies such as AI and advanced simulation tools in fire testing has positioned outsourced providers to better integrate these innovations, enabling them to offer more accurate and comprehensive testing services. This shift toward outsourcing is expected to support the progress of the segment in the coming years.

By End Use

Based on end use, the market has been divided into construction, automotive, aerospace & defense, energy & power, consumer goods, and others. The construction segment led the fire testing market in 2023, reaching a valuation of USD 2.01 billion. This growth is primarily fostered by rapid urbanization and infrastructure development worldwide, particularly in emerging economies.

The construction industry is subject to strict regulations, including building codes and fire safety standards, which require extensive fire testing of materials and systems used in residential, commercial, and industrial buildings. Fire resistance, flame spread, and material toxicity are essential factors that require thorough testing prior to the approval of construction projects.

Additionally, the increasing adoption of sustainable building practices, including eco-friendly and fire-resistant materials, has boosted the demand for fire testing services in construction. With governments and regulators tightening safety standards, especially for high-rise buildings, hospitals, schools, and industrial facilities, fire testing has become a crucial part of the construction process.

The industry's focus on meeting these safety regulations, combined with the increasing complexity of modern buildings and smart cities, has aided the expansion of the construction segment.

Fire Testing Market Regional Analysis

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America fire testing market accounted for a substantial share of 35.84% and was valued at USD 1.92 billion in 2023. This dominance is reinforced by the region's stringent regulatory landscape, especially in sectors such as construction, manufacturing, and energy, which necessitates rigorous fire testing.

The U.S., in particular, has stringent fire safety regulations and building codes enforced by agencies such as the National Fire Protection Association (NFPA) and the International Code Council (ICC), which increase the demand for fire testing services. Moreover, the regional market benefits from the high awareness of fire safety measures across industries, coupled with strong infrastructure investments and advanced technology adoption.

Key sectors such as commercial and residential construction, aerospace, and the automotive industry are experiencing strong demand for fire testing. With increasing construction activities, particularly in urban centers, and a focus on energy-efficient buildings, the need for fire safety evaluations is growing.

Furthermore, North America’s commitment to ensuring public safety through regular updates to building codes and safety standards is expected to further support regional market growth in the coming years.

Asia-Pacific fire testing market is poised to record highest CAGR of 7.93% in the forthcoming years. This rapid growth is fostered by the region’s booming construction industry, growing industrialization, and increasing awareness of fire safety standards.

Countries such as China, India, Japan, and South Korea are undergoing substantial urbanization, necessitating large-scale infrastructure and real estate development projects that require stringent fire safety compliance. As governments in the region tighten fire safety regulations and enforce more robust building codes, the demand for fire testing services is projected to surge.

Additionally, the expansion of the manufacturing sector, particularly in the electronics and automotive industries, is highlighting the need for fire testing across the region. Asia-Pacific market is witnessing increasing investments in smart cities and renewable energy infrastructure, which necessitate rigorous fire safety evaluations.

Furthermore, rising foreign investments in construction and industrial projects, coupled with growing public awareness regarding fire hazards, are expected to fuel domestic market growth.

Competitive Landscape

The global fire testing market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Fire Testing Market

- Intertek Group plc

- Société Générale de Surveillance SA

- TÜV SÜD PSB Pte. Ltd.

- Bureau Veritas

- UL LLC

- DEKRA SE

- Applus+

- QIMA

- BRE Group

- Vetrotech Saint-Gobain International AG

Key Industry Developments

- February 2024 (Expansion): SGS expanded its flammability testing services across aviation, automotive, building materials, furnishings, carpets, textiles, and wire and cables. This expansion underscores SGS’s dedication to exceptional service delivery. The team has enhanced methodologies and integrated new tests, utilizing cutting-edge technology to meet evolving client needs across various industries.

The global fire testing market has been segmented:

By Type

- Testing

- Inspection

- Certification

By Sourcing

- In-House

- Outsourced

By End Use

- Construction

- Automotive

- Aerospace & Defense

- Energy & Power

- Consumer Goods

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)