Automotive and Transportation

Fire Truck Market

Fire Truck Market Size, Share, Growth & Industry Analysis, By Type (Aerials, Pumpers, Tankers, Rescue, Others), By Propulsion (ICE, Electric), By Capacity, By Application, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2025

Report ID: KR388

Market Definition

The market involves the design, production, and distribution of fire trucks and related equipment used for firefighting, rescue, and emergency response. It involves various players such as vehicle designers, equipment providers, and end users who require these specialized vehicles to ensure public safety and disaster management.

Fire Truck Market Overview

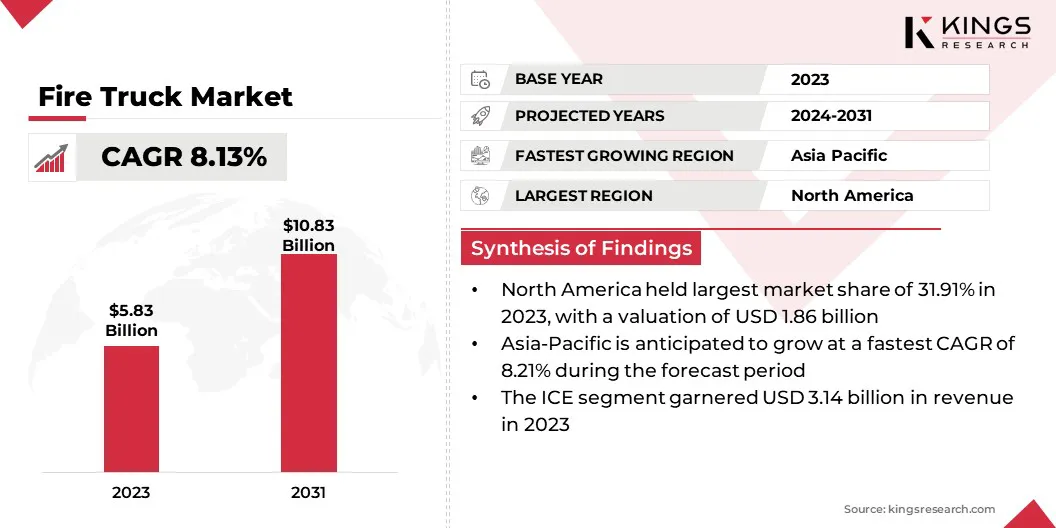

The global fire truck market size was valued at USD 5.83 billion in 2023, which is estimated to be valued at USD 6.27 billion in 2024 and reach USD 10.83 billion by 2031, growing at a CAGR of 8.13% from 2024 to 2031.

Enhanced public awareness of safety and disaster preparedness is a key growth driver of the market. The demand for modern fire trucks rises as communities prioritize efficient emergency response, prompting fire departments to invest in advanced firefighting equipment.

Major companies operating in the fire truck industry are Rosenbauer, LLC., Oshkosh Corporation, Magirus, Danko Emergency Equipment, E-ONE, Spartan Fire, LLC, XUZHOU HANDLER SPECIAL VEHICLE CO. LTD., Zoomlion Heavy Industry Science&Technology Co., Ltd., Bronto Skylift, MORITA HOLDINGS CORPORATION, REV GROUP, TATRA TRUCKS A.S., Sutphen, Darley, and VOLKAN.

The market is characterized by a dynamic landscape, driven by the need for efficient, reliable firefighting vehicles. It is a critical component of emergency response infrastructure and involves constant innovations in vehicle design and functionality.

Fire departments and agencies prioritize public safety, which is increasing the emphasis on vehicle performance, safety features, and durability. The market is shaped by a diverse set of stakeholders, fostering competition among manufacturers while responding to ever-evolving demands for specialized firefighting solutions.

- In April 2023, Pierce Manufacturing featured 13 advanced fire apparatus at FDIC in Indianapolis, including Electric Vehicles (EVs) like the Pierce Volterra Platform and Oshkosh Striker Volterra ARFF vehicle. The exhibit will showcase cutting-edge technology and educational sessions.

Key Highlights:

Key Highlights:

- The fire truck industry size was valued at USD 5.83 billion in 2023.

- The market is projected to grow at a CAGR of 8.13% from 2024 to 2031.

- North America held a market share of 31.91% in 2023, with a valuation of USD 1.86 billion.

- The pumpers segment garnered USD 1.62 billion in revenue in 2023.

- The ICE segment is expected to reach USD 5.83 billion by 2031.

- The less than 500 gallons’ segment is anticipated to register a CAGR of 8.17% during the forecast period.

- The residential and commercial segment is expected to hold a market share of 36.99% in 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.21% during the forecast period.

Market Driver

“Impact of Increasing Urbanization on the Fire Truck Market”

Increasing urbanization is a significant growth driver of the fire truck market. The need for advanced fire trucks capable of handling larger, more complex firefighting challenges intensifies as cities expand.

- According to the World Bank Group, approximately 56% of the global population currently resides in cities. This urbanization trend is expected to persist, with the urban population more than doubling by 2050. By that time, nearly 70% of the world’s population will be living in urban areas.

Urban areas face higher population densities, taller buildings, and more intricate infrastructures, necessitating specialized vehicles with enhanced capabilities.

These advanced fire trucks are essential for rapid response, improved firefighting efficiency, and ensuring safety in densely populated environments. Consequently, urbanization drives the demand for modern fire trucks equipped with advanced features and technologies.

- In April 2023, the City of Boulder in Colorado, U.S. announced the purchase of Colorado's first Rosenbauer RTX electric fire engine. This advanced vehicle combines all-electric power with a diesel backup, enhancing firefighting capabilities while reducing emissions and improving firefighter safety, supporting Boulder’s climate goals.

Market Challenge

“Limited Charging Infrastructure”

Limited charging infrastructure is a significant challenge for the fire truck market, especially with the growing adoption of electric fire trucks. The absence of widespread charging stations in remote or rural areas can hinder their operational efficiency and reliability.

Local governments and fire departments can invest in the development of dedicated charging stations at fire stations and collaborate with energy providers to ensure fast, reliable charging solutions. Integrating range-extender technologies or hybrid models could further mitigate this challenge.

Market Trend

“Technological Advancements Shaping the Future of the market”

Technological advancements are transforming the fire truck market, with the adoption of smart technologies, automation, and enhanced vehicle features. These innovations include improved navigation systems, real-time communication tools, and advanced sensors that optimize route planning and firefighting strategies.

Automation is also playing a role in vehicle diagnostics and equipment management, increasing efficiency and reducing human error. These advancements not only enhance fire truck performance but also improve safety for both firefighters and the communities they serve, streamlining emergency response efforts.

- In December 2024, Rosenbauer America and the Dallas Fire Rescue Department announced a partnership to develop the PANTHER 6×6 electric fire truck for series production. The vehicle will undergo testing at Dallas Love Field Airport in mid-2025, contributing to sustainability and operational performance.

Fire Truck Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Aerials, Pumpers, Tankers, Rescue, Others |

|

By Propulsion |

ICE, Electric |

|

By Capacity |

Less than 500 Gallons, 501 - 1000 Gallons, 1001 - 2000 Gallons, Above 2000 Gallons |

|

By Application |

Residential and Commercial, Airports and Enterprises, Military, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Aerials, Pumpers, Tankers, Rescue, Others): The pumpers segment earned USD 1.62 billion in 2023, driven by the increasing demand for efficient, high-performance firefighting vehicles in urban areas and industrial sectors.

- By Propulsion (ICE, Electric): The ICE segment held 53.90% share of the market in 2023, as internal combustion engine vehicles continue to dominate due to their established infrastructure and reliable performance in firefighting operations.

- By Capacity (Less than 500 Gallons, 501 - 1000 Gallons, 1001 - 2000 Gallons, Above 2000 Gallons): The 501 - 1000 gallons segment is projected to reach USD 3.22 billion by 2031, driven by the growing demand for mid-sized fire trucks offering a balance of capacity and maneuverability.

- By Application (Residential and Commercial, Airports and Enterprises, Military, Others): The residential and commercial segment is anticipated to register a CAGR of16% during the forecast period, fueled by infrastructure development and the need for enhanced firefighting capabilities in growing urban areas.

Fire Truck Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

.webp) North America accounted for around 31.91% market share in 2023, with a valuation of USD 1.86 billion. North America remains the dominating region in the fire truck market, driven by advanced infrastructure, well-established fire safety standards, and a large number of fire departments across the U.S. and Canada.

North America accounted for around 31.91% market share in 2023, with a valuation of USD 1.86 billion. North America remains the dominating region in the fire truck market, driven by advanced infrastructure, well-established fire safety standards, and a large number of fire departments across the U.S. and Canada.

The high demand for technologically advanced firefighting vehicles, including electric and hybrid models, contributes to the regional market growth. Furthermore, government initiatives focused on enhancing fire safety and modernizing equipment continue to drive the region's dominance, with ongoing investments in fire truck fleets and research & development.

- In August 2024, Victoria Fire Department in Canada placed its first Rosenbauer RTX electric fire truck into service, marking a significant step toward electrifying 80% of its fleet by 2040. A second unit has already been ordered to support the initiative.

The fire truck industry in Asia Pacific is poised for significant growth at a robust CAGR of 8.21% over the forecast period. Asia Pacific is the fastest-growing region in the market, driven by rapid urbanization, increased industrialization, and growing awareness of fire safety in emerging economies like India, China, and Southeast Asia.

These countries are investing heavily in fire truck fleets to address the increasing risk of fire in densely populated areas. Moreover, the push for sustainable and advanced firefighting technologies, such as electric fire trucks, is gaining momentum, fostering market growth in this region, especially in urban centers.

Regulatory Frameworks

- In the U.S., the Environment Protection Act (EPA) aims to protect human health and the environment. It identifies and tries to solve environmental problems through laboratories located throughout the nation.

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) reduces deaths, injuries, and economic losses from motor vehicle crashes by enforcing vehicle performance standards and entering into partnerships with state & local governments.

- The Ministry of Environment, Forest and Climate Change (MoEFCC) is the nodal agency in the administrative structure of the Government of India for the planning, promoting, coordinating, and overseeing the implementation of India’s environmental and forestry policies and programs. It also sets down rules, requiring fire trucks, particularly diesel models, to meet stringent pollution control standards.

Competitive Landscape: Fire Truck Market

The global fire truck industry is characterized by a large number of participants, including established corporations and rising organizations. The increasing focus on sustainability has led to a surge in the electrification of fire trucks, with several companies adopting electric drivetrains to reduce emissions and improve operational efficiency.

This shift is also driving the market as demand for eco-friendly, high-performance fire trucks grows globally, especially in regions prioritizing green technologies and sustainable emergency response solutions.

- In March 2023, the Saint Paul Fire Department became the first in Minnesota, U.S. to purchase an electric fire truck, aligning with the city's climate goals. The move supports carbon neutrality, enhances firefighter safety, and reduces emissions. Delivery of the Rosenbauer RTX is expected by 2025.

List of Key Companies in Fire Truck Market:

- Rosenbauer, LLC.

- Oshkosh Corporation

- Magirus

- Danko Emergency Equipment

- E-ONE

- Spartan Fire, LLC

- XUZHOU HANDLER SPECIAL VEHICLE CO. LTD.

- Zoomlion Heavy Industry Science&Technology Co., Ltd.

- Bronto Skylift

- MORITA HOLDINGS CORPORATION

- REV GROUP

- TATRA TRUCKS A.S.

- Sutphen

- Darley

- VOLKAN

Recent Developments (Launch/Partnership/Expansion)

- In October 2024, the PANTHER 6×6 electric, a fully electric aircraft rescue and firefighting vehicle, was introduced. It offers superior acceleration, top speed, and a significant reduction in CO2 emissions. Pre-series vehicles are expected by late 2025. The EV supports the climate goals of airports while maintaining high-performance standards.

- In December 2024, Pierce Manufacturing unveiled its Volterra electric fire truck at CES 2025 in Las Vegas. The innovative model emphasizes sustainability, performance, and safety, showcasing advancements in electrification, connectivity, and safety technology to enhance the efficiency of fire departments and reduce environmental impact.

- In October 2024, NAFFCO GROUP formed a strategic partnership with IVECO to enhance operational efficiency. This collaboration strengthens NAFFCO's position as a leading fire safety company, combining IVECO's certified vehicles with advanced automation for superior quality and innovation in safety solutions.

- In September 2023, a significant meeting took place between NAFFCO GROUP executives and Telangana's Minister for Municipal Administration & Urban Development. The discussion focused on establishing a state-of-the-art manufacturing plant worth USD 85 million in India, along with the creation of a Fire Safety Training Academy in collaboration with NAC, Hyderabad.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership