Fitness App Market Size

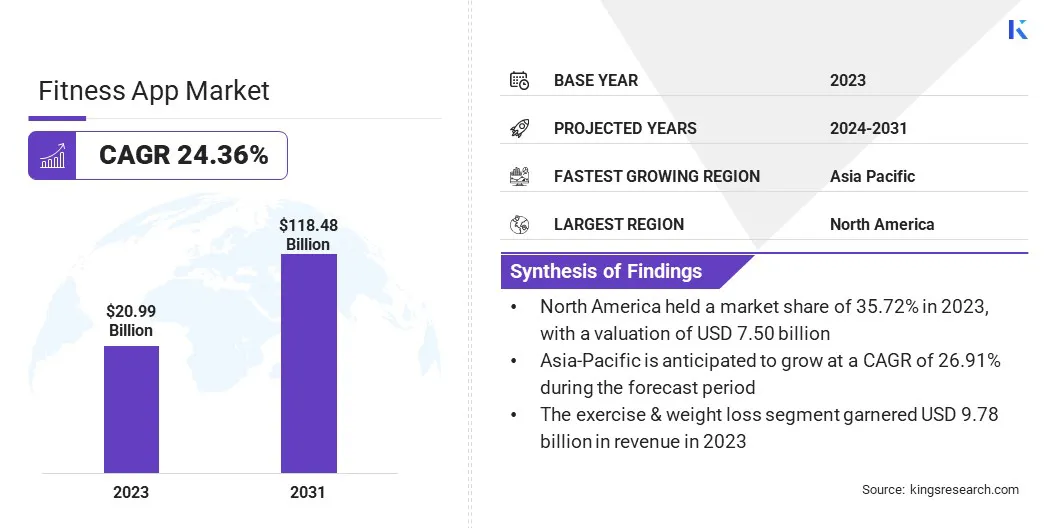

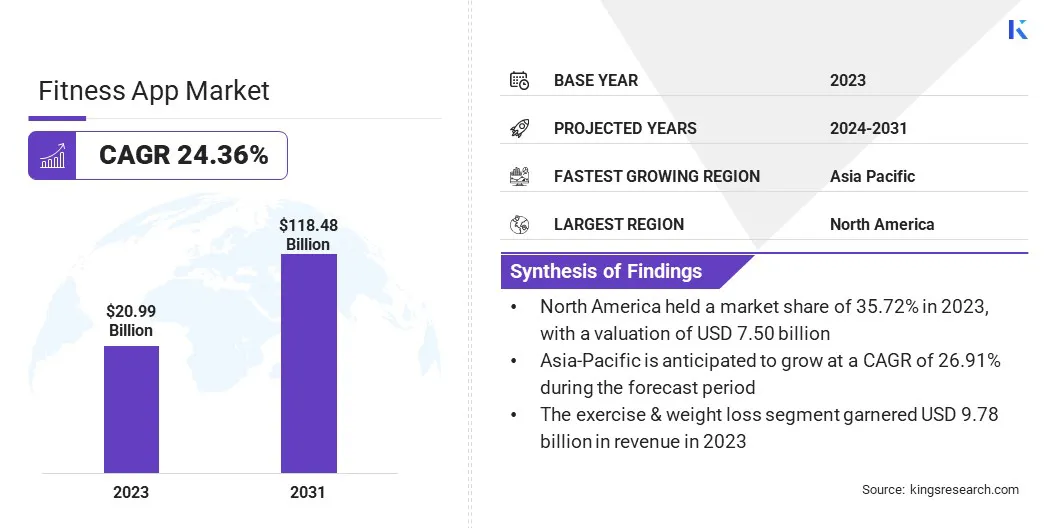

Global Fitness App Market size was valued at USD 20.99 billion in 2023 and is projected to grow from USD 25.76 billion in 2024 to USD 118.48 billion by 2031, exhibiting a CAGR of 24.36% from 2024 to 2031. In the scope of work, the report includes services offered by companies such adidas AG, Google LLC, Azumio, Inc., MyFitnessPal, Inc., Nike, Inc., Apple Inc., Centr, Alo Moves, ASICS Canada Corporation, FITNESS KEEPER, and others.

Rising integration of wearable technologies and advanced analytics and insights are propelling market expansion. Surging integration of wearable technology in the fitness app market is a significant trend, driven by advancements in wearable devices such as smartwatches, fitness trackers, and even smart clothing.

These devices collect a wide array of data, including heart rate, steps taken, calories burned, sleep patterns, and other vital statistics, which are then synced with fitness apps to provide users with comprehensive health and fitness insights.

- For instance, in April 2024, Zepp Health Corporation unveiled the Amazfit Helio Ring, set for release in the United States on May 15th, 2024. Athletes acquire this smart ring either bundled with the Amazfit Cheetah Pro or Amazfit T-Rex Ultra, or as a standalone purchase through the official Amazfit website in the United States.

This integration allows for real-time monitoring and feedback, enhancing the user experience by offering personalized recommendations and progress tracking. Wearable technology not only motivates users by providing immediate feedback but also encourages adherence to fitness routines through gamification and rewards systems. Moreover, as wearables become more sophisticated, they are offering more precise and diverse metrics, which fitness apps utilize to refine and tailor fitness plans.

The convenience and functionality provided by this integration are driving user engagement and loyalty, contributing significantly to the growth of the fitness app market. Companies are investing heavily in developing and optimizing apps that seamlessly integrate with a wide range of wearable devices, recognizing this trend as a crucial driver of market expansion.

A fitness app is a mobile application designed to assist users in maintaining and improving their physical health and fitness. These apps offer a variety of functionalities, such as workout routines, diet and nutrition plans, activity tracking, and wellness tips, all accessible from a smartphone or tablet. Fitness apps are typically available on major operating systems such as iOS and Android, ensuring broad accessibility. They can be downloaded from app stores and are compatible with various devices, including smartphones, tablets, smartwatches, and fitness trackers.

The core purpose of fitness apps is to provide structured and flexible workout programs that cater to different fitness levels and goals, such as weight loss, muscle gain, or general fitness. Users select from a range of exercises, follow guided video tutorials, and track their progress over time.

Many apps also offer social features, allowing users to connect with friends, share achievements, and participate in challenges. With the integration of technologies such as GPS and sensors in wearable devices, fitness apps deliver precise data on activities including running, cycling, and swimming, enhancing the overall workout experience.

Analyst’s Review

Companies are leveraging advanced technologies such as artificial intelligence, machine learning, and big data analytics to provide personalized user experiences. By analyzing user behavior and preferences, these apps offer tailored workout plans and health insights, significantly improving user engagement and satisfaction.

Additionally, there is a strong emphasis on expanding partnerships with wearable technology manufacturers, enabling seamless integration and data synchronization, which adds substantial value to the user experience. Notably, market growth is fueled by increasing health awareness and the convenience of home-based fitness solutions, which have shifted consumer behavior toward digital fitness options.

However, to sustain this growth, it is imperative for companies to address data privacy concerns, enhance app security, and continuously innovate to stay ahead in a highly competitive market. Expanding into emerging markets and diversifying content to cater to different cultural and linguistic needs are also crucial for capturing a broader user base.

Fitness App Market Growth Factors

The rising popularity of on-demand fitness classes is transforming the fitness landscape, offering unparalleled convenience and flexibility to users. These classes, available through various fitness apps and online platforms, allow users to access a wide range of workout programs at any time, catering to different fitness levels and preferences.

The ability to work out at home or on the go without being tied to a specific class schedule has made on-demand fitness classes particularly appealing, especially for busy professionals and those who prefer the privacy of home workouts.

This trend is driven by the variety and quality of content available, from yoga and pilates to high-intensity interval training (HIIT) and strength training, often led by renowned trainers and fitness influencers. Additionally, interactive features such as live classes, real-time feedback, and community support enhance the user experience, fostering a sense of connection and motivation.

Moreover, developing partnerships with companies to provide fitness app solutions for employee wellness programs presents a lucrative opportunity. By integrating fitness apps into corporate wellness initiatives, companies promote healthier lifestyles among employees, reduce healthcare costs, and enhance overall productivity and job satisfaction.

Growing concerns about data security and privacy pose a significant challenge in the fitness app market. As fitness apps collect a vast amount of personal and sensitive data, including health metrics, location, and daily routines, ensuring the security and privacy of this information is paramount.

Users are becoming increasingly wary of how their data is being used, stored, and shared, especially in the wake of numerous high-profile data breaches and privacy scandals across various industries.

These concerns have led to reluctance among users in adopting new technologies, which is hindering the growth of the fitness app market. Building user trust through proactive communication about data practices and implementing stringent security protocols will be crucial for companies aiming to navigate this challenge and sustain user confidence in their fitness apps.

Fitness App Market Trends

Personalization through AI and machine learning is a transformative trend in the market, and is enhancing user experience by tailoring fitness plans to individual needs and preferences. These technologies analyze vast amounts of data collected from users, such as their fitness goals, performance metrics, and behavioral patterns, to create customized workout routines and nutrition plans.

By continually learning from user interactions, AI-driven fitness apps adapt and refine recommendations in real-time, ensuring that users receive the most effective and relevant guidance.

This level of personalization not only improves workout efficiency and outcomes but also keeps users engaged and motivated by providing a sense of progress and achievement. Furthermore, AI and machine learning enable predictive analytics, which foresee potential health issues or fitness plateaus and suggest proactive measures to address them.

As a result, fitness apps are becoming more intuitive and responsive, meeting the evolving demands of users who seek personalized, data-driven fitness solutions. This trend underscores the importance of continuous innovation and investment in AI capabilities for companies aiming to stay competitive in the dynamic fitness app market.

Segmentation Analysis

The global market is segmented based on operating system, platform, type, and geography.

By Operating System

Based on operating system, the market is categorized into iOS, Android, and others. The Android segment captured the largest fitness app market share of 47.93% in 2023 driven by its widespread adoption and the affordability of Android devices.

Android dominates the global smartphone market, particularly in emerging economies where cost-effective devices are more accessible to the masses. The open-source nature of the Android operating system allows for greater customization and a wide variety of fitness apps, catering to diverse user needs and preferences.

Furthermore, the extensive availability of Android devices from multiple manufacturers ensures that consumers have numerous options at various price points, making it easier for a larger segment of the population to access and use fitness apps. Additionally, partnerships between fitness app developers and Android device manufacturers have enhanced the integration and functionality of these apps, thereby driving user engagement and market penetration.

By Platform

Based on platform, the market is classified into smartphones, wearable devices, and tablets. The smartphones segment is anticipated to witness the highest growth at a CAGR of 25.17% over the forecast period due to the increasing reliance on mobile devices for a wide range of activities, including fitness and health management.

The proliferation of smartphones with advanced features such as high-resolution displays, powerful processors, and extensive app ecosystems has made them an ideal platform for fitness apps. These devices offer convenience and portability, allowing users to access workout routines, track progress, and receive real-time feedback anywhere and anytime.

The continuous improvement in smartphone technology, including better battery life and enhanced sensor capabilities, thereby enhances their suitability for fitness applications.

Moreover, the integration of smartphones with wearable devices, such as smartwatches and fitness trackers, provides a comprehensive fitness solution that appeals to health-conscious consumers. The growing emphasis on health and wellness, coupled with the increasing adoption of digital fitness solutions, is expected to drive significant growth.

By Type

Based on type, the fitness app market is divided into exercise & weight loss, diet & nutrition, and activity tracking. The exercise & weight loss segment garnered the highest revenue of USD 9.78 billion in 2023 propelled by the rising global emphasis on health and fitness. As obesity and related health issues continue to be a major concern worldwide, more individuals are turning to fitness apps for exercise and weight loss solutions.

These apps provide users with structured workout plans, dietary recommendations, and progress tracking features, which help in achieving their fitness goals. The convenience and accessibility of digital exercise programs make them appealing to a broad audience, from beginners to advanced fitness enthusiasts. The increasing popularity of personalized fitness plans, guided video workouts, and real-time virtual coaching has significantly contributed to the segment's revenue growth.

The surge in the demand for effective and engaging exercise and weight loss programs, combined with technological advancements in app functionalities, has driven substantial revenue growth.

Fitness App Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America fitness app market share accounted for 35.72% and valued at USD 7.50 billion in 2023, fueled by high consumer awareness and adoption of health and fitness technologies. The region's strong economic environment supports the widespread use of advanced smartphones and wearable devices, which are integral to the functionality of fitness apps.

Additionally, the prevalence of sedentary lifestyles and related health issues, such as obesity and heart disease, has driven a significant portion of the population to seek out digital health solutions. The presence of major tech companies and fitness app developers in North America is further contributing to regional market growth, as these companies continuously innovate and improve their products.

Moreover, the growing trend of integrating fitness apps with other health-related services, such as telemedicine and wellness programs, has enhanced their appeal. These factors collectively underpin North America's dominant position in the global fitness app market.

Asia Pacific is expected to experience the highest growth at a 26.91% CAGR over 2024-2031 owing to the rapidly increasing penetration of smartphones and internet connectivity in the region. The rising middle class and rising disposable incomes are enabling more consumers to invest in health and fitness technologies.

Additionally, the growing awareness of health and wellness, coupled with the prevalence of lifestyle-related diseases, is driving the demand for fitness solutions. Governments and organizations in the region are also promoting health and fitness initiatives, thereby boosting the adoption of fitness apps. The large and diverse population provides a vast potential user base, while the presence of emerging markets with untapped potential offers significant opportunities for growth.

Moreover, local app developers are creating culturally relevant and language-specific content, making fitness apps more accessible and appealing to a broader audience. The integration of advanced technologies such as AI and machine learning in fitness apps is also attracting tech-savvy consumers, which is aiding the robust growth of the Asia Pacific market.

Competitive Landscape

The global fitness app market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Fitness App Market

- adidas AG

- Google LLC

- Azumio, Inc.

- MyFitnessPal, Inc.

- Nike, Inc.

- Apple Inc.

- Centr

- Alo Moves

- ASICS Canada Corporation

- FITNESS KEEPER

Key Industry Developments

- March 2024 (Launch): Erakulis announced the forthcoming launch of its revolutionary all-in-one wellness app that seamlessly integrates fitness, nutrition, and mental wellness.

- January 2024 (Launch): SUNNY HEALTH & FITNESS launched SunnyFit, a groundbreaking free fitness app aimed to transform how individuals engage with their health and well-being.

- November 2023 (Partnership): Self Esteem Brands, LLC (SEB), the parent company of Anytime Fitness, partnered with Apple Fitness+ to provide members with an unparalleled combination of digital and in-person fitness experiences.

The global fitness app market is segmented as:

By Operating System

By Platform

- Smartphones

- Wearable Devices

- Tablets

By Type

- Exercise & Weight Loss

- Diet & Nutrition

- Activity Tracking

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America