Food and Beverages

Food Additives Market

Food Additives Market Size, Share, Growth & Industry Analysis, By Type (Emulsifiers, Hydrocolloids, Preservatives, Dietary Fibers, Enzymes, Sweeteners, Flavors, Shelf-life Stabilizers and others), By Source (Natural, Synthetic), and Regional Analysis, 2024-2031

Pages : 148

Base Year : 2023

Release : January 2025

Report ID: KR1158

Global Food Additives Market Size

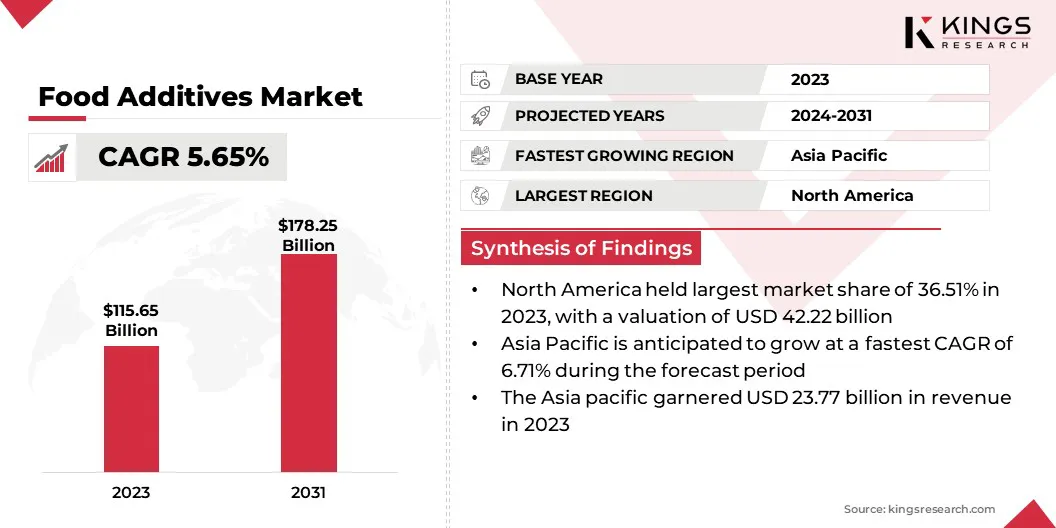

The global food additives market size was recorded at USD 115.65 billion in 2023, which is estimated to be valued at USD 121.34 billion in 2024 and projected to reach USD 178.25 billion by 2031, growing at a CAGR of 5.65% from 2024 to 2031.

The global demand for food additives is driven by rapid urbanization in emerging markets, rising processed food consumption in tier II and tier III cities, evolving consumer preferences, and innovations in food technology. Growing consumer awareness of food safety and quality has led manufacturers to maintain strict quality standards and ensure precise dosing of the additives.

In the scope of work, the report includes products offered by companies such as Cargill, Incorporated, Tate & Lyle, Kerry Group plc., BASF SE, Ajinomoto Co., Darling Ingredients, ADM, Givaudan, Chr. Hansen A/S, IFF, and others.

Food additives such as preservatives, flavor enhancers, sweeteners and emulsifiers are critical components in a wide range of food products, including baked goods, packaged and processed foods, and canned beverages. Manufacturers are leveraging this rising demand by collaborating with biotechnology firms to develop high-quality products that adhere to stringent regulatory standards.

- For instance, December 2024, Tate & Lyle, a global leader in food additives market partnered with biotechnology firm BioHarvest to develop high quality ingredients more sustainably and economically. The collaboration aims to meet consumer preferences while complying with health standards.

Food additives are substances intentionally incorporated to processed foods or other food products for technical purposes such as enhancing taste, extending shelf life, improving food safety, or modifying sensory properties. These additives are classified into categories such as emulsifiers, hydrocolloids, preservatives, sweeteners, and shelf-life stabilizers, based on their functions.

They can be derived from natural sources such as plants, animals, or minerals, or they can be chemically synthesized. Due to their versatility, food additives are widely used across industries such as bakery and confectionery, food and beverage, convenience food, dairy and frozen desserts, and sauces.

Analyst’s Review

The market has witnessed a substantial surge in demand, largely fueled by the rapid expansion of fast-food chains and food franchises. The food and beverage industry relies heavily on food additives such as preservatives, emulsifiers, and flavor enhancers, which are used to enhance the taste, texture, and shelf life of food products.

Manufacturers are actively responding to this increasing demand by developing innovative solutions that comply with rigorous food and drug regulations in various countries.

Rapid urbanization and rising disposable incomes have contributed to a significant increase in the consumption of processed foods. However, the growing awareness of the potential health implications associated with excessive processed food consumption, supported by social media platforms, has prompted consumers to seek healthier and more natural food options.

In response to these evolving consumer preferences, food additive manufacturers are investing in advanced technologies to improve product quality and transparency, providing clear and accurate ingredient information to build trust and meet consumer demands.

To capitalize on the growth potential of emerging markets, food additive companies are actively expanding into countries such as India, China, and Indonesia. Through strategic partnerships, mergers, and acquisitions, these companies are collaborating with local producers to develop products that cater to regional tastes and preferences. These collaborations enable global leaders to penetrate these markets and establish a strong presence.

Food Additives Market Growth Factors

The food additives market is experiencing substantial growth, mainly due to rapid urbanization, technological advancements, and rising demand for fast food and convenience foods. Increasing urbanization and changing consumer lifestyles are fueling the demand for processed and packaged foods, including ready-to-cook meals and ready-to-eat meals.

Furthermore, rising disposable incomes are enabling consumers to purchase more processed foods, creating a demand for food additives such as preservatives, flavor enhancers, and stabilizers.

Furthermore, companies in the food additives industry are investing heavily in advanced technologies to improve product quality, reduce costs, and expand their product portfolios.

Biotechnology companies are at the forefront of innovation, leveraging cutting-edge technologies such as precision fermentation to develop natural, sustainable food additives, including microbial enzymes and proteins. These technologies offer numerous advantages such as improved yield, nutritional value, and shelf life.

- For instance, in August 2023, Novozymes, a global biotechnology company, partnered with Arla Food Ingredients to develop advance protein ingredients using precision fermentation. The initial focus of this collaboration is on disease-specific medical nutrition, with plans for future expansion into other segments.

The food additives market is facing challenges due to stringent food and drug safety policies and rising consumer awareness of health and wellness . To mitigate these challenges, food additive manufacturers are investing in research and development to improve product quality and prioritizing transparency through clear, accurate ingredient labeling

Food Additives Industry Trends

The expansion of the food and beverage industry is fueling the demand for various food additives such as preservatives, food enhancers, emulsifiers, and sweeteners. However, rising concerns over the health risks associated with certain food additives have prompted regulatory bodies worldwide to enforce stricter food safety standards to protect consumer well-being.

- For instance, in July 2024, the U.S. Food and Drug Administration (FDA) banned additives in sport drinks and sodas due to increasing health concerns. Manufacturers of energy drinks and packaged juices had been using brominated vegetable oil to prevent citrus flavor seperation.

Additionally, the growing influence of social media platforms such as Instagram, Facebook, and TikTok has led to increased consumer demand for products with clean labels and natural ingredients. This trend has boosted demand for functional food additives with functional properties, including antioxidants, probiotics, and omega-3 fatty acids. In response to this trend, manufacturers are prioritizing the development of natural, plant-based, and microbial-derived additives.

Advancements in research and development, combined with the integration of cutting-edge technologies, have empowered food additives manufacturers to enhance production efficiency, improve product quality, and reduce operational costs. By leveraging data analytics, these companies gain insights into consumer preferences, allowing them to align product offerings with evolving market demands.

Segmentation Analysis

The global market has been segmented based on type, source, application, and geography.

By Type

Based on the type, the market can be categorized broadly into preservatives, flavors, colors, sweeteners, emulsifiers, and others. The flavors segment led the food additives market in 2023, reaching a valuation of USD 27.84 billion.

Flavoring agents are the most commonly used food additives in the food industry, valued for enhancing sensory properties such as aroma and taste. Natural flavoring agents, including clove, lemon, peppermint, vanillin, and raspberry, along with synthetic flavoring agents such as vanilla extract, ethyl maltol, and benzaldehyde, are extensively used to improve the flavor profile of food products.

- For instance, Lanxess, a leading German company, has , a natural antimicrobial derived from the Sweet Osmanthus Ear mashroom. This innovation extends beverage shelf life without involving chemical modifications

Antioxidants such as Butylated Hydroxytoluene (BHT) and Butylated Hydroxyanisole (BHA) are commonly used to prevent oxidation and rancidity in food products, including cereals, vegetable oils, and chewing gum.

Emulsifiers, which enable the mixing of immiscible liquids such as oil and water, are essential in processed foods such as mayonnaise, ice cream, chocolate, and sauces. Artificial sweeteners, synthetic compounds, provide sweetness to foods and beverages without the calories of natural sugars.

By Source

Based on source, the market can be categorized into natural and synthetic. The natural segment is projected to grow at the fastest CAGR of 5.86% through the forecast period. Natural food additives, sourced from plants, animals, or microorganisms, are increasingly utilized to enhance the flavor, color, and shelf life in food products.

Salt and sugar, for instance, have long been employed as effective natural preservatives to inhibit bacterial growth. Additionally, natural coloring agents derived from plant sources, such as turmeric powder, spinach powder, and beetroot powder, are gaining popularity as healthier alternatives to synthetic dyes.

- In November 2024, Phytolon, an Israeli food tech startup, secured investment from Rich Products Venture to advance its clean-label natural food coloring solution. The company is focused on replacing synthetic food dyes with natural coloring agents derived from plant sources.

By Application

Based on the application, the market has been bifurcated into food and beverages. The beverages segment held the largest share of 57.69% in 2023. The beverage industry, encompassing bakeries and dairy manufacturers, relies heavily on natural flavoring agents derived from plants and other natural sources.

Clove, lemon, and vanillin are widely used favorings that enhance the taste of baked goods, candies, chewing gum, ice cream, yogurt, and beverages. Furthermore, the beverage industry often employs artificial sweeteners such as aspartame to provide a sweetness without added calories.

For instance, the Coca-Cola Company uses Aspartame as a key ingredient in various beverages such as Coke Zero Sugar, Diet Barq’s, Fanta Zero, Fresca, Mello Yello Zero, and Minute Maid Light and others.

Food Additives Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North American food additives market accounted for a notable share of 36.51% and was valued at USD 42.22 billion in 2023. The U.S. remains a significant market for additives despite stringent regulations. The demand for food additives is primarily fueled by growing consumption of processed foods, particularly in the fast-food and convenience food sectors.

Additionally, emerging companies in the U.S. and Canada are introducing healthier ready-to-eat and ready-to-cook meal options. The rapid expansion of fast-food chains and quick-service restaurants further contributes to the growing demand for the market.

- For instance, in January 2024, Blue Apron Holdings, Inc., a U.S.-based meal kit provider, expanded its ready-to-eat category while continuing to deliver fresh, high-quality meal kits that comply with stringent food safety regulations.

The Asia Pacific food additives market is projected to grow at the fastest CAGR of 6.71% over the forecast period. The rapid expansion of the food and beverage industry in countries like China, Japan, India, Malaysia, and Indonesia, coupled with increasing urbanization and changing consumer preferences, has led to a surge in demand for food additives.

Consumers are increasingly favoring convenient and ready-to-consume food products such as ready-to-eat meals, canned goods, and frozen foods. To meet this growing demand, companies are strategically expanding their product offerings in tier-1 and tier-2 cities across the Asia-Pacific region.

Competitive Landscape

The global food additives Market report will provide valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Food Additives Market

- Cargill, Incorporated

- Tate & Lyle

- Kerry Group plc.

- BASF SE

- Ajinomoto Co.

- Darling Ingredients

- ADM

- Givaudan

- Hansen A/S

- IFF

Key Industry Developments

- October 2024 (Acquisition): Tate & Lyle, a global leader in food and beverage solutions, acquired CP Kelco, a nature-based ingredient solutions company headquartered in Georgia, USA. This acquisition strengthens Tate & Lyle's position in the specialty food and beverage solutions industry.

- September 2024 (Partnership): Ajinomoto Co. partnered with Danone to reduce greenhouse gas emissions in the dairy industry. This initiative aims to leverage AjiPro-L, a lysine formulation designed for GHG reduction.

- January 2024 (Merger): Novozymes and Chr. Hansen, leaders in the food additive market, completed the statutory merger. The new entity now employs over 10000 people cross 30 industries globally.

The global food additives market has been segmented as:

By Type

- Preservatives

- Flavors

- Colors

- Sweeteners

- Emulsifiers

- Others

By Source

- Natural

- Synthetic

By Application

- Food

- Dairy & Non-Dairy Products

- Bakery & Confectionery Products

- Supplements & Sports Nutrition

- Meat, Seafood and Meat Alternative Products

- Others

- Beverages

- Juice & Juice Concentrates

- Functional Drinks

- Alcoholic Drinks

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)