Advanced Materials and Chemicals

Gallium Oxide Market

Gallium Oxide Market Size, Share, Growth & Industry Analysis, By Application Type (Power & High Voltage Devices, Electroluminescent Devices, Gas Sensors, Others), By Technology (Molecular Beam Epitaxy, Chemical Vapor Deposition, Chemical Synthesis, Thermal Vaporization and Sublimation, Others) and Regional Analysis, 2023-2030

Pages : 120

Base Year : 2022

Release : March 2024

Report ID: KR557

Gallium Oxide Market Size

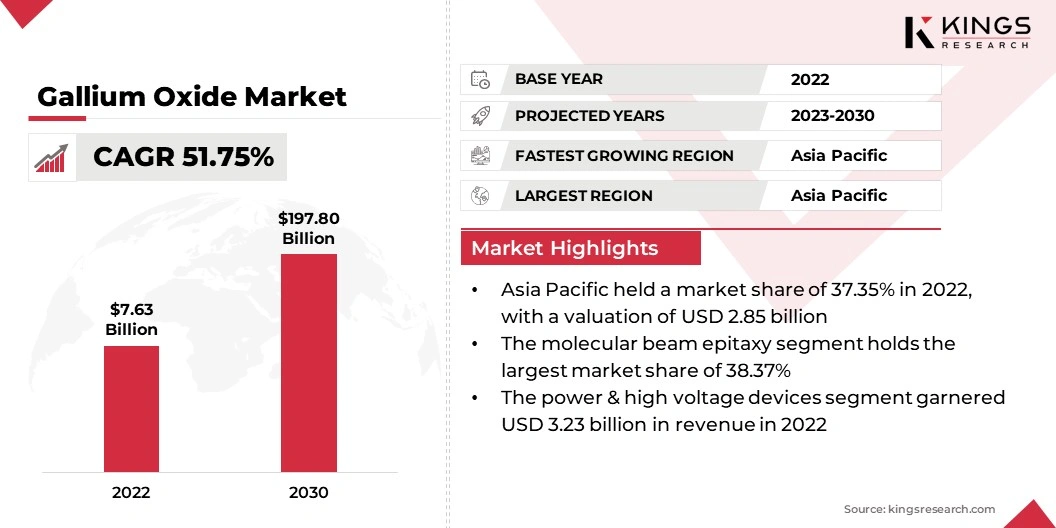

The global Gallium Oxide Market size was valued at USD 7.63 billion in 2022 and is projected to reach USD 197.80 billion by 2030, growing at a CAGR of 51.75% from 2023 to 2030. The exceptional properties of gallium oxide, including high electron mobility and efficiency in power devices, are driving its demand across the semiconductor industry.

As advancements in electronic components such as power transistors and high-frequency devices continue, the need for materials capable of delivering superior performance and energy efficiency is intensifying. Gallium oxide’s ability to support next-generation semiconductor innovations is accelerating its adoption, fueling market demand.

In the scope of work, the report includes products offered by companies such as Mitsubishi Chemical Corporation, AGC Inc., Aluminum Corporation of China Limited, Merck KGAA, ThermoFisher Scientific Inc., American Elements, ABSCO Limited, Kyma Technologies Inc., Strem Chemicals Inc., FLOSFIA Inc., and Others.

Gallium oxide exhibits a wide bandgap and high breakdown voltage, ideal for high-power electronics and optoelectronic applications. The increasing demand for energy-efficient power conversion technologies, particularly in electric vehicles (EVs), is expected to drive the demand for gallium oxide over the forecast period.

- According to the International Energy Agency (IEA), in the first quarter of 2024, global sales of electric cars exceeded 3 million, representing a 25% increase compared to 2023. Forecasts predicted that around 17 million electric vehicles to be sold by the end of 2024, marking a notable y-o-y rise of over 20%.

The growing adoption of gallium oxide in ultraviolet (UV) optoelectronics, including UV LEDs and photodetectors, is further expanding its application scope. Additionally, advancements in semiconductor research and increased investments in material innovation are accelerating market growth. Moreover, rising regulatory emphasis on energy efficiency and sustainability, coupled with the need for compact and reliable devices, is fueling the demand for gallium oxide across industries.

Gallium oxide is a semiconductor material. It offers a wide bandgap and excellent thermal and electrical properties, and therefore, finds applications in power electronics, optoelectronics, energy storage systems, and other industries. Gallium oxide is widely used in power devices and integrated circuits. Its high breakdown voltage and low resistance fuel its demand in the power electronics industry. Optoelectronics utilizes its optical properties for devices like LEDs and photodetectors.

Gallium oxide is used in the development of high-performance and efficient energy storage systems. By using gallium oxide in batteries and supercapacitors, manufacturers can enhance energy density and prolong the lifespan of these systems.

This creates opportunities for key players to cater to the growing demand for renewable energy integration, grid stabilization, and electric vehicles. Adopting gallium oxide in energy storage systems contributes to the global transition toward clean and efficient energy utilization.

Analyst’s Review

Analyst’s Review

The gallium oxide market is being driven by strategic partnerships and collaborations to advance power electronics technologies.

- In March 2024, Navitas Semiconductor partnered with GaN Systems to enhance the efficiency of its power conversion systems using gallium oxide. This collaboration will use gallium oxide’s high breakdown voltage and thermal stability to develop next-generation power electronics for automotive and consumer applications.

These efforts, along with extensive investments in R&D and production scaling, are expected to drive market demand in the coming years.

Gallium Oxide Market Growth Factors

The gallium oxide market is experiencing strong demand due to its wide bandgap (4.8 eV) and superior thermal stability. GaN is widely used for high-power and high-voltage applications. It is also used in power electronics for efficient energy conversion in transistors and diodes. The growing adoption of electric vehicles (EVs) and the expansion of renewable energy systems are boosting product demand, as gallium oxide components offer compact designs with minimal energy loss.

- According to the International Energy Agency (IEA), nearly 3,700 GW of new renewable capacity is projected to come online between 2023 and 2028, supported by policies in over 130 countries.

Additionally, stricter energy-efficiency regulations are further accelerating its adoption across industries. With advancements in material synthesis and device fabrication, gallium oxide is emerging as a critical material, driving innovation and growth in the semiconductor and power electronics sector, which is driving the market demand.

The growth of gallium oxide market can be hampered due to Gallium, a crucial raw element for gallium oxide, is scarce and often a byproduct of aluminum and zinc manufacturing. Supply limits and potential increases in material costs can largely impact availability and restrict market growth.

The scarcity of gallium limits market expansion in developing regions. In addition, poor infrastructure, trade restrictions, and reduced investment in gallium mining and refining facilities in developing regions make it challenging to obtain gallium. These factors hinder the implementation of gallium oxide-based technologies and applications.

Gallium Oxide Market Trends

The adoption of gallium oxide in power electronics is driving market growth by addressing the rising demand for high-performance and energy-efficient components across multiple industries. Its unique properties, such as high breakdown voltage and superior thermal stability, enable the development of compact, reliable devices that enhance energy management systems.

With expanding applications in renewable energy, electric vehicles, and industrial automation, gallium oxide is supporting advancements in energy-efficient technologies, reducing power losses and operational costs. This growing reliance on gallium oxide for next-generation power devices is fostering increased production, research investments, and adoption across global markets, thereby driving market demand.

The semiconductor industry's transition toward high-performance materials are significantly boosting the market growth of gallium oxide. Its integration into advanced transistors and diodes is driven by the need for materials that can deliver superior efficiency, thermal stability, and miniaturization in modern electronic devices.

Gallium oxide’s unique properties are enabling the development of power components capable of operating under higher voltages and temperatures, addressing critical performance challenges in sectors such as renewable energy, automotive, and telecommunications.

Additionally, advancements in material synthesis and deposition techniques are streamlining production processes, reducing costs, and improving scalability. This technological progress, coupled with the rising demand for energy-efficient semiconductor solutions, is propelling the adoption of gallium oxide and driving robust market expansion.

Segmentation Analysis

The global market has been segmented based on application type, technology, and geography.

By Application Type

Based on application type, the market has been bifurcated into power & high voltage devices, electroluminescent devices, gas sensors, and others. Power & high voltage devices emerged as the largest segment in the gallium oxide market, with a revenue of USD 3.23 billion in 2022. This segment denotes various applications of gallium oxide in high-power electronic systems.

The demand for gallium oxide in this segment is fueled by its wide bandgap and high breakdown voltage, which support efficient power management and high-performance electronic devices. The growing demand for energy-efficient and high-performance devices is driving the adoption of gallium oxide in this segment. As industries focus on sustainability and energy efficiency, the power & high voltage devices segment is expected to continue its dominance in the gallium oxide market.

By Technology

Based on technology, the market has been bifurcated into molecular beam epitaxy, chemical vapor deposition, chemical synthesis, thermal vaporization and sublimation, and others. The molecular beam epitaxy segment held the largest market share of 38.37% in the gallium oxide market in 2023.

It is a widely used technique for growing high-quality gallium oxide thin films and producing gallium oxide-based devices. This process offers precise control over film thickness and composition, ensuring superior material properties that are crucial for high-performance applications.

As a key technology in fabricating gallium oxide semiconductors, MBE plays a significant role in advancing the capabilities of power electronics and optoelectronics in industrial applications. The growing demand for high-efficiency and reliable electronic devices is driving the segment growth.

Gallium Oxide Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia Pacific Gallium Oxide market share stood at around 37.35% in 2022 in the global market, with a valuation of USD 2.85 billion. Asia Pacific is the fastest-growing region in the market and is set to expand at a CAGR of 57.12% over the forecast period.

Asia Pacific Gallium Oxide market share stood at around 37.35% in 2022 in the global market, with a valuation of USD 2.85 billion. Asia Pacific is the fastest-growing region in the market and is set to expand at a CAGR of 57.12% over the forecast period.

Electronic manufacturing hubs in the Asia Pacific utilize gallium oxide in power electronics and optoelectronics. Moreover, manufacturers are investing heavily in R&D, fostering technological advancements in gallium oxide products.

Favorable government initiatives and policies in Asia Pacific have also accelerated the semiconductor market. The presence of a robust industrial infrastructure, skilled workers, and an expanding consumer electronics market are positioning the region as the fastest-growing market for gallium oxide.

North America is anticipated to witness a significant growth at a CAGR of 51.07% over the forecast period. The market is experiencing significant growth due to increasing demand for high-performance power electronics in sectors like automotive, renewable energy, and consumer electronics. Strong focus on sustainability and energy efficiency, along with the rise of EVs, is fueling the need for advanced power conversion technologies.

Companies in North America are actively investing in research and development to enhance gallium oxide’s applications, particularly in high-voltage power devices. Additionally, partnerships and collaborations among key players, such as Navitas Semiconductor and GaN Systems, are accelerating innovation in the market.

With robust support from governments for clean energy initiatives and stringent energy-efficiency regulations, the gallium oxide market in the region is poised for steady expansion in the coming years.

Competitive Landscape

The global gallium oxide market report provides valuable insights with a focus on the consolidated nature of the global market. Prominent players are leveraging several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their respective market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, such as investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Gallium Oxide Market

- Mitsubishi Chemical Corporation

- AGC Inc.

- Aluminum Corporation of China Limited

- Merck KGAA

- ThermoFisher Scientific Inc.

- American Elements

- ABSCO Limited

- Kyma Technologies Inc.

- Strem Chemicals Inc.

- FLOSFIA Inc.

Key Industry Developments

- June 2024 (Product Launch): Infineon Technologies AG introduced the CoolGaN Transistor 700 V G4 product family, which offers a 20% improvement in performance over other GaN products, reducing power losses and providing cost-effective solutions.

The Global Gallium Oxide Market is Segmented as:

By Application Type

- Power & High Voltage Devices

- Electroluminescent Devices

- Gas Sensors

- Others

By Technology

- Molecular Beam Epitaxy

- Chemical Vapor Deposition

- Chemical Synthesis

- Thermal Vaporization and Sublimation

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)