Gas Detection Equipment Market

Gas Detection Equipment Market Size, Share, Growth & Industry Analysis, By Type (Fixed Gas Detector and Portable Gas Detector), By Technology (Semiconductor, Infrared (IR), Laser-based Detection, Catalytic and Others), By End Use, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR791

Gas Detection Equipment Market Size

Global Gas Detection Equipment Market size was recorded at USD 5,340.0 million in 2023, which is estimated to be at USD 5,913.3 million in 2024 and projected to reach USD 13,356.0 million by 2031, growing at a CAGR of 12.34% from 2024 to 2031. In the scope of work, the report includes services offered by companies such as MSA Safety Incorporated, Fluke Corporation, Honeywell International Inc, Lynred, Opgal, Thermo Fisher Scientific Inc., Siemens, AirTest Technologies Inc., Teledyne FLIR, ABB and others.

Gas detection equipment is increasingly leveraging IoT and AI technologies for real-time monitoring, predictive maintenance, and data analytics. Integration of IoT allows gas detectors to be connected to a network, enabling remote monitoring and control from centralized systems. This connectivity facilitates instant alerts and notifications in case of gas leaks or abnormal conditions, thereby enhancing response times and overall safety.

Additionally, AI algorithms enable advanced analytics on collected data, aiding in the detection of patterns or anomalies that indicate potential hazards or equipment malfunctions. Predictive maintenance capabilities powered by AI anticipate equipment failures before they occur, optimizing maintenance schedules and minimizing downtime.

Furthermore, AI-driven data analytics provide valuable insights into gas concentration trends, emission patterns, and environmental impacts, assisting organizations in making informed decisions regarding safety protocols, resource allocation, and regulatory compliance. The synergy between IoT and AI technologies enhances the effectiveness and efficiency of gas detection systems, positioning them as integral components of modern safety infrastructure across diverse industries.

Gas detection equipment refers to devices designed to detect the presence of hazardous gases in various environments. These devices come in various types, including fixed, portable, and transportable units, each tailored to specific applications and operational requirements. Gas detectors utilize a range of sensing technologies such as electrochemical, infrared, catalytic bead, and photoionization detectors to detect different types of gases accurately.

Fixed gas detectors are commonly installed in stationary positions within industrial facilities to continuously monitor gas levels in confined spaces or hazardous areas. Portable gas detectors, on the other hand, offer flexibility and mobility, allowing personnel to monitor gas concentrations in diverse settings, including remote locations, confined spaces, and emergency response scenarios.

Gas detection equipment finds applications across various industries such as oil and gas, chemical manufacturing, mining, firefighting, and environmental monitoring. These devices play a critical role in ensuring workplace safety, environmental protection, and regulatory compliance by alerting personnel to the presence of harmful gases and facilitating prompt responses to mitigate risks and prevent accidents.

Analyst’s Review

The global gas detection equipment market is poised to witness substantial growth, mainly due to increasing regulatory mandates for workplace safety, rising awareness regarding environmental pollution, and technological advancements in gas detection technologies. Integration of IoT and AI technologies is revolutionizing the market landscape, enabling real-time monitoring, predictive maintenance, and data analytics capabilities.

However, challenges such as high initial investment costs and global supply chain disruptions necessitate strategic approaches for key players to capitalize on emerging opportunities. Market participants are increasingly focusing on innovation, product differentiation, and strategic collaborations to gain a competitive edge. Expansion into emerging markets, diversification of product portfolios, and rising emphasis on customer-centric solutions are imperative for sustained growth and market leadership.

Furthermore, key players are investing heavily in research and development to enhance sensor technologies, improve detection accuracy, and develop cost-effective solutions to address evolving customer needs. In the rapidly evolving market dynamics and intense competition, agility, flexibility, and responsiveness to changing regulatory frameworks and customer demands are critical for success in the gas detection equipment market.

Gas Detection Equipment Market Growth Factors

The growing preference for wireless gas detection systems is attributed to their inherent advantages in terms of installation flexibility, scalability, and ease of maintenance. Unlike traditional wired systems, wireless gas detection solutions eliminate the need for complex wiring infrastructure, thereby reducing installation time and costs. This makes them particularly suitable for retrofitting existing facilities or deploying in remote or temporary work sites where wired installations may be impractical.

Moreover, wireless systems offer greater flexibility in sensor placement, enabling optimal coverage of hazardous areas without being constrained by physical cabling limitations. The scalability of wireless systems allows for seamless expansion or modification of monitoring networks to accommodate evolving operational needs. Additionally, wireless gas detection systems facilitate remote monitoring and control through centralized software platforms, enhancing real-time situational awareness and enabling prompt response to gas leaks or abnormal conditions.

- As industries increasingly prioritize efficiency, safety, and agility, the demand for wireless gas detection solutions is expected to continue to grow, fostering innovation and stimulating market expansion in the coming years.

The high cost associated with gas detection equipment poses a significant challenge to its widespread adoption, particularly for small and medium-sized enterprises (SMEs) and industries where cost sensitivity is a critical concern. The initial investment required for procuring and installing gas detection systems, including sensors, control panels, and related infrastructure, is substantial, thereby impacting budget allocations for safety measures.

Moreover, ongoing maintenance, calibration, and replacement costs contribute to the total cost of ownership over the equipment's lifecycle. For SMEs with limited resources, the high upfront costs act as a deterrent to investing in comprehensive gas detection solutions, potentially exposing workers to safety risks and regulatory non-compliance. To address this challenge, manufacturers and suppliers are exploring cost-effective design approaches, offering flexible pricing models, and providing value-added services such as leasing or subscription-based solutions.

Additionally, increasing awareness regarding the long-term benefits of gas detection equipment in terms of safety, productivity, and regulatory compliance helps mitigate cost concerns and stimulate market development.

Gas Detection Equipment Market Trends

The rising adoption of multi-gas detectors reflects the increasing recognition of the need for comprehensive gas monitoring solutions to mitigate risks effectively. Multi-gas detectors are capable of simultaneously detecting and measuring multiple types of gases, thereby enhancing safety and versatility across diverse industrial environments.

This capability is particularly beneficial in industries where workers may exposed to various hazardous gases or volatile organic compounds (VOCs) simultaneously, such as in the oil and gas, chemical manufacturing, and mining industries. By consolidating multiple sensors into a single device, multi-gas detectors streamline monitoring operations, reduce equipment clutter, and simplify maintenance requirements.

Moreover, advancements in sensor technologies have improved the accuracy, sensitivity, and reliability of multi-gas detectors, making them indispensable tools for ensuring workplace safety and regulatory compliance. As organizations prioritize proactive risk management and operational efficiency, the demand for multi-gas detection solutions is expected to continue to grow, thereby fostering innovation and market penetration in the gas detection equipment sector.

Segmentation Analysis

The global market is segmented based on type, technology, end use, and geography.

By Type

Based on component, the market is categorized into fixed gas detector and portable gas detector. The fixed gas detector segment captured the largest gas detection equipment market share of 68.34% in 2023, largely attributed to its widespread adoption across various industries for continuous monitoring of gas levels in stationary positions.

Fixed gas detectors are typically installed in critical areas within industrial facilities, such as production floors, storage areas, and processing plants, where the risk of gas leaks or accumulation is high. These detectors provide constant surveillance and early warning alerts in the event of gas leaks or abnormal conditions, enabling prompt responses to mitigate risks and prevent accidents.

The dominance of the fixed gas detector segment is further bolstered by stringent safety regulations mandating the installation of gas detection systems in industrial settings to ensure workplace safety and regulatory compliance. Additionally, advancements in sensor technologies, increased awareness regarding occupational hazards, and growing emphasis on proactive risk management practices have contributed to the sustained demand for fixed gas detectors in the global market.

By Technology

Based on technology, the gas detection equipment market is classified into semiconductor, infrared (IR), laser-based detection, catalytic, photoionization detector (PID), and others. The semiconductor segment is poised to record a staggering CAGR of 17.11% through the forecast period owing to the surging demand for semiconductor gas detection devices.

Semiconductors play a crucial role in gas detection technology, particularly in sensors utilized for detecting gases such as carbon monoxide, methane, and volatile organic compounds (VOCs). This growth is further attributed to the expanding applications of gas detection systems across various industries, including oil and gas, petrochemicals, automotive, and environmental monitoring.

Additionally, continuous advancements in semiconductor manufacturing processes, coupled with innovations in sensor designs and materials, are enhancing the performance, sensitivity, and reliability of gas detection devices. Furthermore, increasing awareness regarding the importance of gas detection for safety, environmental protection, and regulatory compliance is leading to increased investments in semiconductor-based gas sensing technologies, thereby fueling the expansion of the segment.

By End Use

Based on end use, the market is divided into healthcare, building automation & domestic appliances, environmental, petrochemical, automotive, industrial, and others. The industrial sector garnered the highest revenue of USD 1,359.0 million in 2023, propelled by the increasing emphasis on workplace safety, regulatory compliance, and risk management practices across industrial facilities worldwide.

Industrial establishments, including manufacturing plants, refineries, chemical processing facilities, and utilities, represent the largest end-user segment for gas detection equipment due to the inherent risks associated with industrial operations involving hazardous gases. The demand for gas detection systems in the industrial sector is spurred by stringent safety regulations mandating the implementation of gas monitoring solutions to prevent accidents, protect personnel, and safeguard critical infrastructure.

Additionally, growing awareness regarding the potential health and environmental hazards posed by toxic gases, combustible vapors, and oxygen deficiency in industrial settings is fostering investments in advanced gas detection technologies. Furthermore, the widespread adoption of Industry 4.0 initiatives, such as IoT integration and predictive maintenance strategies, is supporting segmental growth by enhancing the efficiency, reliability, and effectiveness of gas detection systems in industrial applications.

Gas Detection Equipment Market Regional Analysis

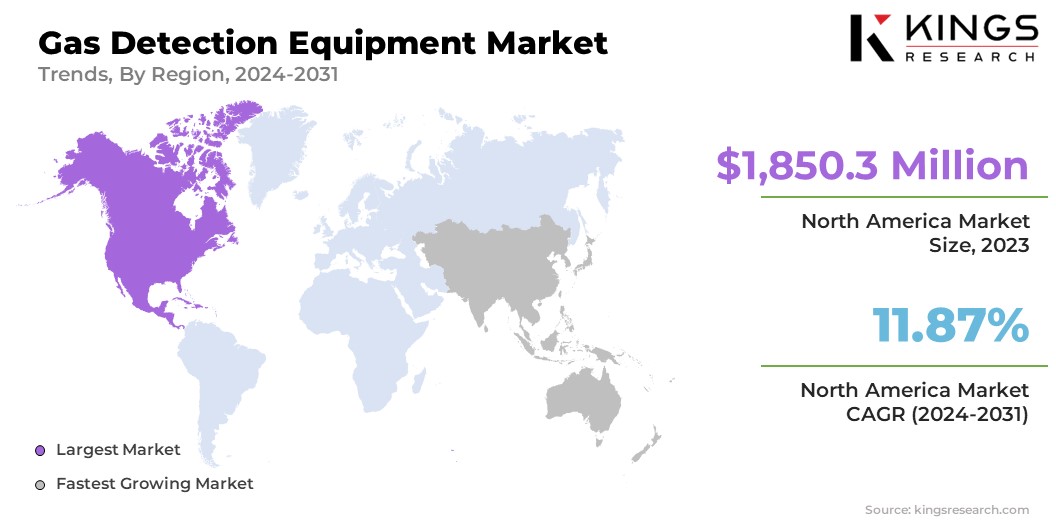

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Gas Detection Equipment Market share stood around 34.65% in 2023 in the global market, with a valuation of USD 1,850.3 million. This considerable expansion is propelled by several factors, including stringent safety regulations, increasing awareness regarding workplace safety standards, and the presence of a mature industrial sector. The region's robust manufacturing base, particularly in sectors such as oil and gas, chemicals, and manufacturing, boosts the demand for gas detection equipment to ensure compliance with regulatory requirements and mitigate operational risks.

Additionally, advancements in gas detection technologies, coupled with the widespread adoption of IoT and AI-driven solutions, propel regional market growth. Moreover, increasing investments in infrastructure development, particularly in sectors such as construction, utilities, and transportation, contribute to the demand for gas detection systems to maintain safety standards and prevent accidents, thus supporting domestic market progress.

Asia-Pacific is expected to grow at a staggering CAGR of 13.65% in the forthcoming years due to rapid industrialization, urbanization, and infrastructure development in emerging economies such as China, India, and Southeast Asian countries. The region's expanding industrial base, particularly in sectors such as manufacturing, oil and gas, chemicals, and construction, presents significant opportunities for gas detection equipment providers. Increasing awareness regarding workplace safety standards, coupled with stringent regulatory mandates aimed at enhancing occupational safety and environmental protection, fuels the adoption of gas detection systems in Asia-Pacific.

Furthermore, rising investments in healthcare infrastructure, environmental monitoring, and public safety initiatives contribute to the growing demand for gas detection equipment in the region. Additionally, advancements in sensor technologies, affordability of gas detection solutions, and the emergence of innovative applications such as smart cities and industrial automation augment Asia-Pacific gas detection equipment market growth.

Competitive Landscape

The gas detection equipment market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Gas Detection Equipment Market

- MSA Safety Incorporated

- Fluke Corporation

- Honeywell International Inc

- Lynred

- Opgal

- Thermo Fisher Scientific Inc.

- Siemens

- AirTest Technologies Inc.

- Teledyne FLIR

- ABB

Key Industry Developments

- March 2024 (Launch): Teledyne Gas and Flame Detection introduced the advanced OLCT 100-XP-MS range of flammable gas detectors, featuring state-of-the-art MEMS (Micro-ElectroMechanical Systems) sensor technology. This innovative device combines catalytic oxidation, IR, and MEMS sensors in a single unit, offering a comprehensive solution for flammable gas detection across diverse environments and operational conditions.

- September 2023 (Launch): DOD Technologies launched the ChemLogic Revive CL4R Four-Point Toxic Gas Detection System, specifically tailored for upgrading and replacing fixed four-point legacy monitors. This cutting-edge gas detector is mainly designed to retrofit seamlessly into existing monitor racks, providing a seamless replacement and enhancement for older units.

- August 2023 (Launch): MSA Safety introduced the ALTAIR io 4, their latest portable gas detector and the first fully-connected device in the MSA Connected Work Platform. Engineered from scratch, it offers seamless connectivity and intuitive operation, delivering a comprehensive safety solution for businesses.

The global gas detection equipment market is segmented as:

By Type

- Fixed Gas Detector

- Portable Gas Detector

By Technology

- Semiconductor

- Infrared (IR)

- Laser-based Detection

- Catalytic

- Photoionization Detector (PID)

- Others

By End Use

- Healthcare

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)