Herbal Medicine Market

Herbal Medicine Market Size, Share, Growth & Industry Analysis, By Source (Leaves, Roots and Barks, Fruits, and Whole plants), By Application (Pharmaceuticals & Nutraceuticals, Food & Beverages, and Personal Care & Beauty Products), By Form, By Distribution Channel, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR816

Herbal Medicine Market Size

The global Herbal Medicine Market size was valued at USD 214.75 billion in 2023 and is projected to grow from USD 231.87 billion in 2024 to USD 428.08 billion by 2031, exhibiting a CAGR of 9.15% during the forecast period. In the scope of work, the report includes products offered by companies such as Blackmores Limited, Cultivator Natural Product, ZeinPharma, Herbalife International of America, Inc, Himalaya Wellness Company, Emami Limited, Nature's Answer, Patanjali Ayurved Limited, 21ST Century HealthCare, Inc., Dabur India Ltd and others.

The growth of the herbal medicine market is driven by increasing consumer demand for natural and organic products, growing awareness regarding the benefits of herbal remedies, and a rising preference for sustainable and environmentally friendly health solutions. Additionally, cultural shifts toward holistic wellness and the integration of herbal medicine into mainstream healthcare fuel market growth.

The market is experiencing robust growth, largely attributable to by increasing consumer demand for natural and holistic health solutions. This market expansion is fueled by rising health consciousness, a growing preference for alternatives to synthetic drugs, and the integration of herbal remedies into mainstream healthcare. Innovations in product formulations and delivery methods, along with advancements in extraction technologies and bioavailability enhancement, are making herbal products more accessible and effective.

Additionally, the rising emphasis on scientific validation and stringent quality control measures is bolstering consumer trust and ensuring product safety and efficacy. Major players in the market are investing heavily in clinical research and adhering to high-quality standards to differentiate their products and meet regulatory requirements. The herbal medicine market is poised to witness sustained growth, propelled by consumer trends, technological advancements, and increased acceptance in the healthcare industry.

- The WHO Traditional Medicine Programme, initiated in 1976, works in collaboration with countries through its Traditional, Complementary, and Integrative Medicine Unit. Its objectives include developing training standards, defining practice benchmarks, and promoting evidence-based integration of traditional medicine within the framework of the International Classification of Diseases (ICD).

Herbal medicine, also known as botanical medicine or phytotherapy, is the practice of using plant-derived substances to treat and prevent various health conditions. It involves the use of herbs, which include leaves, flowers, roots, seeds, and bark, to create remedies in various forms such as teas, capsules, extracts, and topical applications.

Herbal medicine relies on the therapeutic properties of natural compounds found in plants to promote healing and maintain overall well-being. This practice has a long history and is deeply rooted in traditional medicine systems around the world, such as Traditional Chinese Medicine (TCM) and Ayurveda. Herbal medicine is increasingly integrated into modern healthcare due to its perceived safety, efficacy, and minimal side effects compared to synthetic drugs.

Analyst’s Review

The increasing inclination towards natural health solutions, coupled with regulatory support and advancements in research and development, propels market expansion. Key players are actively leveraging these trends by investing in innovative formulations, expanding market presence, and enhancing consumer education.

Additionally, government initiatives supporting traditional medicine and regulatory frameworks ensure product safety and efficacy, thus stimulating market growth. Companies are expanding their market reach by entering new regions and utilizing e-commerce platforms and online marketing strategies. Educational initiatives and transparent labeling enhance consumer confidence, thereby ensuring the proper use of herbal medicines.

- For instance, the International Organization for Standardization (ISO) has released the first ISO standard technical report titled "ISO/TR 4421:2023 Health informatics- Introduction to Ayurveda informatics".

This report provides a foundational understanding of the Ayurvedic medicine system, introducing numerous aspects and processes necessary for Ayurvedic diagnosis and treatment. Key players can leverage this opportunity by investing in innovative formulations, expanding market presence through e-commerce, and promoting consumer education on herbal medicines. Transparent labeling and adherence to regulatory standards is likely to build trust and drive market growth.

Herbal Medicine Market Growth Factors

The rising health consciousness and preference for natural remedies are propelling the expansion of the herbal medicine market. As consumers become more informed about their health, there is a noticeable shift toward natural and holistic health solutions. This trend is fueled by a growing awareness regarding the potential side effects associated with synthetic drugs, leading individuals to seek safer alternatives.

Herbal medicines, which are derived from natural sources and perceived as more compatible with the body's natural processes, are increasingly favored. This preference is especially pronounced among individuals looking to manage chronic conditions, such as arthritis, diabetes, and cardiovascular diseases, through natural means. Additionally, those aiming to maintain overall well-being are turning to herbal products for their preventive health benefits.

The trust in herbal remedies is further bolstered by their long history of use in traditional medicine systems across various cultures, reinforcing their reputation as safe and effective alternatives to conventional pharmaceuticals. This is leading to increased demand for herbal medicines, thereby augmenting growth and promoting further innovation and product development to meet evolving consumer needs.

One of the significant challenges impeding the development of the herbal medicine market is the issue of product adulteration and contamination, which undermines consumer confidence and poses potential health risks. To address this challenge, key players are implementing strategic measures to ensure product quality and safety. Companies are investing heavily in advanced quality control laboratories to conduct comprehensive testing for contaminants and verify the authenticity and potency of herbal ingredients.

They are further obtaining certifications from reputable third-party organizations, such as Good Manufacturing Practices (GMP) and the United States Pharmacopeia (USP), to assure consumers of their high-quality standards and regulatory compliance. Transparent sourcing practices and traceability systems are being adopted to ensure reliable and certified suppliers, allowing consumers to track the origin of each ingredient.

Additionally, leading manufacturers are investing in research and development to conduct clinical trials and publish scientific evidence that supports the efficacy and safety of their products. By addressing these challenges through rigorous quality control, certifications, transparent sourcing, and robust R&D, key players are enhancing product safety, fostering greater consumer trust, and boosting the sustainable growth of the market.

Herbal Medicine Market Trends

A significant trend in the herbal medicine market is the innovation in product formulations and delivery methods. Manufacturers are continuously developing new and convenient forms of herbal medicines, including capsules, tablets, teas, extracts, and topical applications, to cater to diverse consumer preferences. These innovations aim to make herbal products more user-friendly and accessible, thereby increasing their appeal to a wider audience.

Advancements in extraction technologies, such as supercritical fluid extraction and ultrasound-assisted extraction, are enhancing the potency and purity of herbal extracts. Additionally, techniques to improve bioavailability, such as nanoparticle encapsulation and the use of natural absorption enhancers, are making these products more effective. This trend appeals particularly to younger demographics and busy individuals who seek quick, efficient health solutions without compromising on quality.

The enhanced convenience, combined with improved effectiveness, meets the needs of existing herbal medicine users and attracts new consumers who may have previously relied on synthetic pharmaceuticals. This is contributing significantly to the expansion of the herbal medicine market, mainly due to innovations that align with contemporary lifestyles and health consciousness.

- In 2022, with the support of the Government of India, WHO established the WHO Global Traditional Medicine Centre to address the growing global interest and demand for evidence-based traditional medicine. It is the first and only WHO global centre dedicated to traditional medicine. This knowledge hub focuses on partnership, evidence, data, biodiversity, and innovation to optimize the contribution of traditional medicine to global health, universal health coverage, and sustainable development, guided by respect for local heritages, resources, and rights.

With the growing consumer interest in herbal medicine, there is increased demand for transparency and scientific validation of herbal products. Market leaders are responding to this surging demand by investing heavily in clinical research to substantiate the efficacy and safety of various herbal ingredients. These efforts are crucial in building consumer trust and differentiating credible products from less reliable alternatives.

Companies are conducting rigorous clinical trials and publishing their findings in reputable scientific journals to provide concrete evidence that support their products' health benefits. Additionally, stricter quality control measures are being implemented throughout the herbal medicine supply chain. These measures include standardized testing for purity, potency, and authenticity to ensure product consistency and to address concerns regarding potential adulteration or contamination.

By adhering to stringent quality control protocols and obtaining certifications from recognized health authorities, manufacturers are aiming to reassure consumers about the reliability and safety of their products. This emphasis on scientific validation and quality control enhances the credibility of herbal medicines and fosters a more transparent and trustworthy market environment, leading to broader acceptance and usage among health-conscious consumers.

Segmentation Analysis

The global market is segmented based on source, application, form, distribution channel, and geography.

By Application

Based on application, the herbal medicine market is categorized into pharmaceuticals & nutraceuticals, food & beverages, personal care & beauty products. The pharmaceuticals & nutraceuticals segment garnered the highest revenue of USD 97.39 billion in 2023, mainly due to increasing consumer demand for natural and plant-based health solutions.

Consumers are increasingly opting for natural remedies perceived as safer and more compatible with the body's processes compared to synthetic pharmaceuticals, particularly for managing chronic conditions and overall wellness. Regulatory frameworks are evolving to support the use of herbal ingredients, leading to greater acceptance and integration into mainstream healthcare systems.

Companies are heavily investing in research and development to innovate and enhance the bioavailability and potency of herbal ingredients through advanced extraction and formulation technologies, resulting in more effective and appealing products.

By Form

Based on form, the market is divided into powders, liquids & gels, and tablets & capsules. The tablets & capsules segment captured the largest herbal medicine market share of 41.38% in 2023. The segment is growing rapidly owing to its convenience, extended shelf life, and precise dosage. Preferred by consumers for their ease of use, these forms enhance treatment adherence.

Advances in pharmaceutical technology, such as microencapsulation and sustained-release formulations, maximize the bioavailability of herbal ingredients. Regulatory acceptance is higher for tablets and capsules, thereby facilitating market entry. This segment covers a wide range of health applications, including dietary supplements and managing specific conditions.

Key players are expanding their product lines and investing heavily in marketing and consumer education, thereby supporting the growth of the segment.

By Distribution Channel

Based on distribution channel, the market is categorized into hospitals & retail pharmacies, specialized herbal shops, online retailers. The hospitals & retail pharmacies segment garnered the highest revenue of USD 88.58 billion in 2023. Hospitals are increasingly integrating herbal medicines with conventional treatments, especially for managing chronic conditions and enhancing overall well-being, reflecting a holistic approach to patient care.

Retail pharmacies, trusted for their quality assurance and professional advice, boost consumer confidence and sales of herbal products. Stringent regulatory compliance for products sold in these settings ensures safety and efficacy, further enhancing consumer trust. The wide range of available herbal products caters to diverse consumer needs, making herbal medicines more accessible.

Key market players are expanding their presence in hospitals and retail pharmacies through strategic partnerships, product innovations, and targeted marketing campaigns, effectively reaching a larger consumer base.

Herbal Medicine Market Regional Analysis

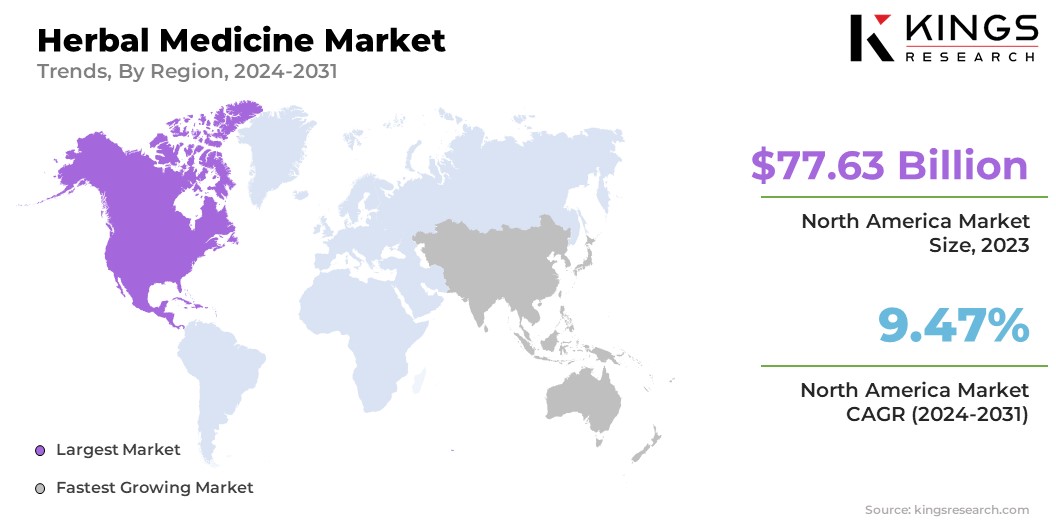

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America herbal medicine market share stood around 36.15% in 2023 in the global market, with a valuation of USD 77.63 billion. North America dominates the market due to its increasingly healthconscious population and growing preference for natural remedies. The region's stringent yet supportive regulatory environment ensures product safety and efficacy, thereby boosting consumer confidence.

The presence of key market players, extensive R&D, and strong marketing campaigns further boost regional market growth. The robust healthcare infrastructure supports the integration of herbal medicine into conventional practices, with hospitals and retail pharmacies widely distributing these products.

Additionally, trends toward personalized medicine and preventive health care, along with high disposable income levels, contribute significantly to the dominance of North America market.

Asia-Pacific is anticipated to witness the highest growth at a CAGR of 10.27% over the forecast period. The Asia Pacific region presents significant opportunities in the herbal medicine market, mainly attributable to several factors such as traditional medicine practices, rising health consciousness, government support, a large population base, and technological advancements.

With a rich history of traditional medicine systems such as Ayurveda and Traditional Chinese Medicine (TCM), the region has a strong cultural acceptance and usage of herbal remedies. Increasing health consciousness and a preference for natural health solutions are fueling the demand for herbal products, supported by government initiatives aimed at promoting traditional medicine. The region's large and diverse population, coupled with rising disposable incomes, offers a vast consumer base for herbal medicine products, particularly in emerging economies such as China and India.

- Additionally, the 11th revision of ICD (ICD-11) by WHO, effective from January 1, 2022, which includes traditional medicine for dual and optional coding, further promotes the integration and recognition of these practices.

Technological advancements in extraction techniques and product formulation are further enhancing the efficacy and safety of herbal products, thus fostering regional market expansion.

Competitive Landscape

The herbal medicine market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Herbal Medicine Market

- Blackmores Limited

- Cultivator Natural ProductS

- ZeinPharma

- Herbalife International of America, Inc

- Himalaya Wellness Company.

- Emami Limited

- Nature's Answer

- Patanjali Ayurved Limited

- 21ST Century HealthCare, Inc.

- Dabur India Ltd.

Key Industry Development

- June 2023 (Expansion): Traditional Medicinals announced the expansion of its product line in Canada with the launch of its new Organic Lemon Ginger tea. This innovative blend promises a sweet, zesty, and spicy taste, catering to consumers looking for flavorful and healthful beverage options. Made from responsibly sourced organic herbs, the tea features a well-curated mix of ginger, lemon peel, lemongrass, and hibiscus. This product introduction underscores the growing demand for organic and responsibly sourced herbal products in the market, aligning with consumer preferences for natural and sustainable health solutions.

The global herbal medicine market is segmented as:

By Source

- Leaves

- Roots and Barks

- Fruits

- Whole plants

By Application

- Pharmaceuticals & Nutraceuticals

- Food & Beverages

- Personal Care & Beauty Products

By Form

- Powders

- Liquids & Gels

- Tablets & Capsules

By Distribution Channel

- Hospitals & Retail Pharmacies

- Specialized Herbal Shops

- Online Retailers

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership