Semiconductor and Electronics

Hybrid Fiber Coaxial Market

Hybrid Fiber Coaxial Market Size, Share, Growth & Industry Analysis, By Component (CMTS/CCAP, Fiber Optic Cable, Amplifier, Optical Node, Optical Transceivers, Splitter, CPE), By Technology (DOCSIS 3.0 & Below, DOCSIS 3.1), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR996

Hybrid Fiber Coaxial Market Size

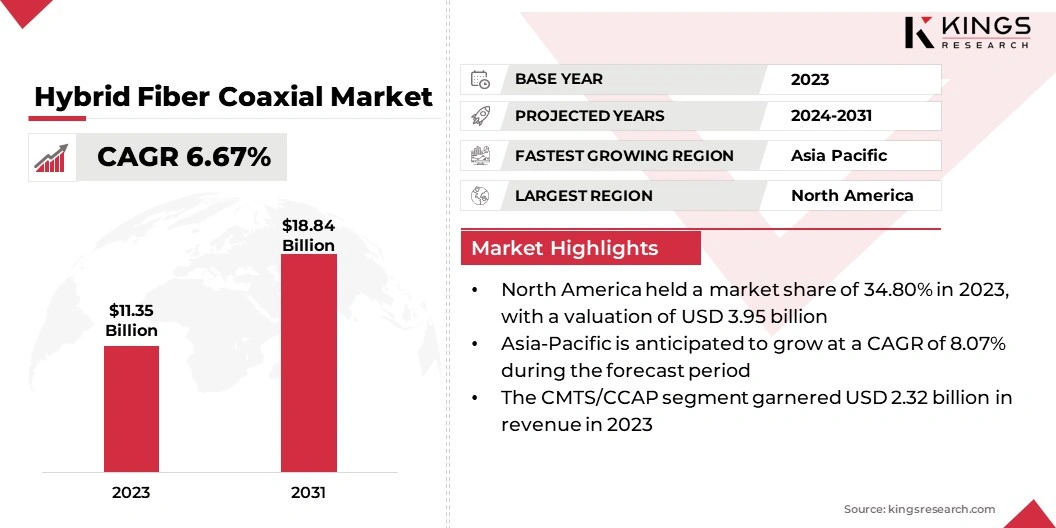

The global Hybrid Fiber Coaxial Market size was valued at USD 11.35 billion in 2023 and is projected to grow from USD 11.99 billion in 2024 to USD 18.84 billion by 2031, exhibiting a CAGR of 6.67% during the forecast period. The market is experiencing robust growth, fueled by the increasing demand for high-speed internet and advancements in technology, such as DOCSIS 3.1, which enhance network capacity and performance.

Additionally, expanding into emerging markets presents significant opportunities for service providers to capitalize on rising internet penetration and the growing need for reliable connectivity solutions.

In the scope of work, the report includes services and solutions offered by companies such as ARRIS International Limited, Huawei Investment and Holding Co., Ltd., Nokia, Cisco Systems, Inc., Corning Incorporated, PCT International, Inc., CommScope, Ciena, Comcast, Teleste Corporation, and others.

The growth of the hybrid fiber coaxial market is significantly driven by the cost-effectiveness of these cables, which provide a budget-friendly solution for broadband connectivity. This affordability appeals to service providers aiming to optimize their infrastructure expenses while maintaining competitive pricing for their customers. Additionally, the relentless increase in consumer demand for higher bandwidth creates a strong impetus for hybrid fiber coaxial networks, as they are capable of delivering the necessary speeds and capacity.

- In 2022, the International Telecommunication Union (ITU) reported that international bandwidth usage grew by 25%, with a CAGR of 33% over 2017-2022. This significant increase underscores the rising need for higher data capacity as more users connect to the internet.

Technological advancements, particularly the implementation of DOCSIS 3.1, further enhance the performance of hybrid fiber coaxial systems, allowing providers to meet the growing data needs of users. These factors collectively position hybrid fiber coaxial as a vital technology in the evolving landscape of telecommunications.

Hybrid fiber coaxial (HFC) is a telecommunications technology that combines fiber optic and coaxial cable to deliver high-speed internet, television, and telephony services. The fiber optic component transmits data over long distances with minimal signal loss, while the coaxial cable efficiently distributes the signals to end-users, making HFC a cost-effective solution for broadband connectivity.

HFC is widely used in cable television networks, internet service providers, and digital telephony, enabling reliable and high-capacity data transmission. Regulatory frameworks, such as those set by the Federal Communications Commission (FCC) in the U.S., govern the deployment and operation of HFC networks. These regulations are designed to ensure fair access, foster competition, and enforce adherence to technical standards, thereby promoting consumer protection and maintaining service quality in the telecommunications industry.

Analyst’s Review

Key players in the global market are focusing on expanding infrastructure, enhancing service quality, and addressing the digital divide to remain competitive and foster growth.

- According to the International Telecommunication Union (ITU), monthly internet traffic per fixed-broadband subscription varies significantly based on income levels, ranging from 161 GB in low-income economies to 347 GB in high-income economies. This data highlights the significant disparities in access to high-speed internet.

To sustain growth, companies are prioritizing substantial investments in network upgrades, particularly in underserved regions that lack reliable connectivity. Adopting innovative technologies such as 5G, fiber optics, and satellite internet helps meet increasing bandwidth demands and improve service reliability. Furthermore, forming strategic partnerships with local governments, tech startups, and community organizations facilitates outreach, promotes digital literacy, and ensures inclusive growth.

The hybrid fiber coaxial market players are emphasizing affordable pricing models and flexible payment plans to ensure equitable access, aiming to bridge the gap between varying income levels while enhancing the overall user experience. By focusing on these imperatives, key companies are fostering sustained growth and playing a pivotal role in transforming the digital landscape globally.

Hybrid Fiber Coaxial Market Growth Factors

The growth of the market is propelled by the proliferation of Internet of Things (IoT) devices and smart city initiatives, which demand robust and reliable communication networks. These networks are essential for managing the vast amounts of data generated by IoT devices and for ensuring seamless connectivity in smart city environments.

Additionally, the deployment of 5G networks further amplifies the need for HFC technologies. With 5G's ability to support higher data rates, lower latency, and increased connectivity, HFC networks are well-positioned to handle the surge in data traffic and connectivity demands. Furthermore, technological advancements play a critical role in supporting market growth. Innovations such as fiber deep architectures significantly enhance the performance and capacity of HFC networks, making them more efficient and appealing to network operators.

- According to the 5G Americas organization, 5G global connections reached nearly 2 billion in Q1 2024, with an addition of 185 million new connections. This figure is projected to hit 7.7 billion by 2028.

This rapid expansion underscores the increasing reliance on advanced HFC solutions to meet the evolving communication needs of the future.

However, the hybrid fiber coaxial market faces challenges related to the proactive monitoring and maintenance of HFC networks, potentially affecting service reliability and customer satisfaction. These networks require constant surveillance and timely interventions to prevent disruptions.

However, their intricate structure makes this a demanding task. Additionally, navigating the ever-evolving telecommunications regulations is impacting the deployment and operational efficiency of HFC technologies. Market participants are focusing on remaining updated with regulatory changes and ensuring compliance, which is resource-intensive and time-consuming.

These challenges necessitate the use of advanced monitoring tools and robust compliance strategies to maintain network performance and meet legal requirements, thereby ensuring the successful implementation and operation of HFC networks in a competitive market landscape.

Hybrid Fiber Coaxial Market Trends

The hybrid fiber coaxial market is witnessing several significant trends that are influencing its growth and development. One prominent trend is the widespread adoption of DOCSIS 3.1 technology. This transition enhances the capacity and speed of HFC networks, enabling service providers to offer superior services.

- According to the Federal Communications Commission (FCC), DOCSIS 3.1 allows cable operators to deliver internet speeds of up to 10 Gbps downstream and 1-2 Gbps upstream, representing a substantial improvement over DOCSIS 3.0.

This technological upgrade is crucial for meeting the increasing demand for high-speed internet and bandwidth-intensive applications.

- In 2023, the National Cable and Telecommunications Association (NCTA) reported that over 90% of U.S. homes have access to DOCSIS 3.1 technology, which facilitates faster and more reliable internet services.

Additionally, the integration of fiber optic technologies with coaxial systems provides a versatile solution that meets diverse connectivity needs, offering the high bandwidth and low latency of fiber optics combined with the extensive reach and cost-effectiveness of coaxial cables. This approach ensures that service providers deliver high-quality services to both urban and rural areas, effectively addressing the digital divide and expanding their market reach.

Moreover, sustainability initiatives are becoming increasingly important within the telecommunications industry. There is a growing emphasis on adopting sustainable practices, leading to innovations in HFC technologies that are more environmentally friendly. Companies are actively seeking methods to reduce the carbon footprint of their operations.

These efforts include improving energy efficiency, using recyclable materials, and minimizing waste. These initiatives are supported by both regulatory requirements and a rising consumer preference for eco-friendly products and services.

Segmentation Analysis

The global market is segmented based on component, technology, and geography.

By Component

Based on component, the market is segmented into CMTS/CCAP, fiber optic cable, amplifier, optical node, optical transceivers, splitter, and CPE. The CMTS/CCAP segment led the hybrid fiber coaxial market in 2023, reaching a valuation of USD 2.32 billion. This dominance is attributed to the critical role CMTS (Cable Modem Termination Systems) and CCAP (Converged Cable Access Platforms) play in managing and optimizing data traffic over HFC networks.

These technologies enable efficient delivery of high-speed internet, video, and voice services, supporting the increasing demand for bandwidth-intensive applications. Additionally, the transition to DOCSIS 3.1 has led to the widespread adoption of advanced CMTS/CCAP solutions, as they are essential for maximizing the benefits of this technology. Their ability to enhance network performance and capacity has made them a vital component in modern HFC infrastructure, thereby aiding segmental growth.

By Technology

Based on technology, the market is bifurcated into DOCSIS 3.0 & Below and DOCSIS 3.1. The DOCSIS 3.1 segment is poised to grow at a staggering CAGR of 7.93% over the forecast period. DOCSIS 3.1 enables cable operators to deliver ultra-high-speed internet, with downstream speeds of up to 10 Gbps and upstream speeds of 1-2 Gbps, thereby addressing the rising demand for faster and more reliable internet services.

This technology supports higher bandwidth, improved network efficiency, and reduced latency, making it ideal for handling the growing number of connected devices and bandwidth-intensive applications such as 4K video streaming, online gaming, and IoT. Additionally, the widespread deployment of DOCSIS 3.1 infrastructure in urban and suburban areas further fuel its rapid adoption.

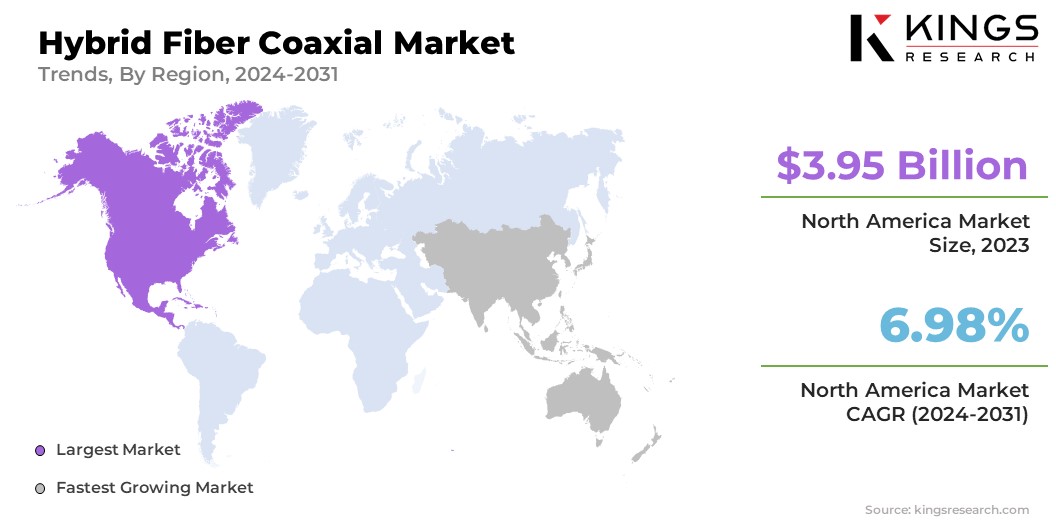

Hybrid Fiber Coaxial Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America hybrid fiber coaxial market share stood around 34.80% in 2023 in the global market, with a valuation of USD 3.95 billion. This notable expansion is propelled by the region's growing adoption of advanced technologies, particularly 5G.

- According to data from 5G Americas, North America accounts for 32% of all 5G connections, nearly equaling the number of 4G LTE networks. The presence of 17 commercial 5G networks out of 316 worldwide underscores North America's significant investment in 5G infrastructure.

These developments increase the demand for robust HFC networks to support high-speed connectivity and data-intensive applications. The region's technological advancement and substantial infrastructure investments further solidify North America's position.

Asia-Pacific is poised to grow at a robust CAGR of 8.07% over the forecast period. This rapid expansion is stimulated by the region's substantial investments in telecommunications infrastructure and the widespread adoption of advanced technologies. Countries such as China, Japan, and South Korea are investing heavily in 5G networks and smart city projects.

- In 2023, the International Data Corporation (IDC) reported receiving 336 project nominations for smart city initiatives across the Asia-Pacific, representing nearly double the number of nominations received in 2022.

Moreover, the increasing demand for high-speed internet and broadband services fuels the need for robust HFC solutions in the region. The region's large and growing population, coupled with rapid urbanization, propels the demand for enhanced connectivity. Government initiatives and favorable policies that support digitalization and technological advancements further contribute to the growth of the Asia-Pacific market.

Competitive Landscape

The global hybrid fiber coaxial market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Hybrid Fiber Coaxial Market

- ARRIS International Limited

- Huawei Investment and Holding Co., Ltd.

- Nokia

- Cisco Systems, Inc.

- Corning Incorporated

- PCT International, Inc.

- CommScope

- Ciena

- Comcast

- Teleste Corporation

Key Industry Developments

- May 2024 (Technological Advancement): Sunrise doubled the speed of its hybrid fiber-coaxial cable network from 1 Gbps to 2.5 Gbps for around 80% of Swiss households at no additional cost. This upgrade enhanced internet connectivity, particularly benefiting rural areas. Sunrise aimed to maintain a competitive edge and support digital growth across Switzerland with this significant speed boost.

- January 2024 (Milestone Achievement): Orange Belgium achieved 95% gigabit coverage across Belgium using its Hybrid Fiber Coaxial (HFC) network, becoming the first nationwide gigabit network provider in the country. This milestone was reached six months ahead of schedule, following the acquisition of Voo, a wholesale agreement with Wyre, and the launch of its ‘Lead the Future’ strategy.

- November 2023 (Service Launch Announcement): Comcast announced the launch of a 2 Gbps symmetrical broadband service using DOCSIS 4.0 technology. This new offering, designed to provide faster and more reliable internet, is priced at USD 299.95 per month. The DOCSIS 4.0 standard enables high-speed data transmission over hybrid fiber-coaxial networks, thereby enhancing bandwidth and performance for users.

The global hybrid fiber coaxial market is segmented as:

By Component

- CMTS/CCAP

- Fiber Optic Cable

- Amplifier

- Optical Node

- Optical Transceivers

- Splitter

- CPE

By Technology

- DOCSIS 3.0 & Below

- DOCSIS 3.1

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)