Energy and Power

Hydraulic Fracturing Market

Hydraulic Fracturing Market Size, Share, Growth & Industry Analysis, By Technology (Plug & Perf and Sliding Sleeve), By Well Type (Horizontal and Vertical), By Application (Shale Gas, Tight Gas, Tight Oil, and Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR876

Hydraulic Fracturing Market Size

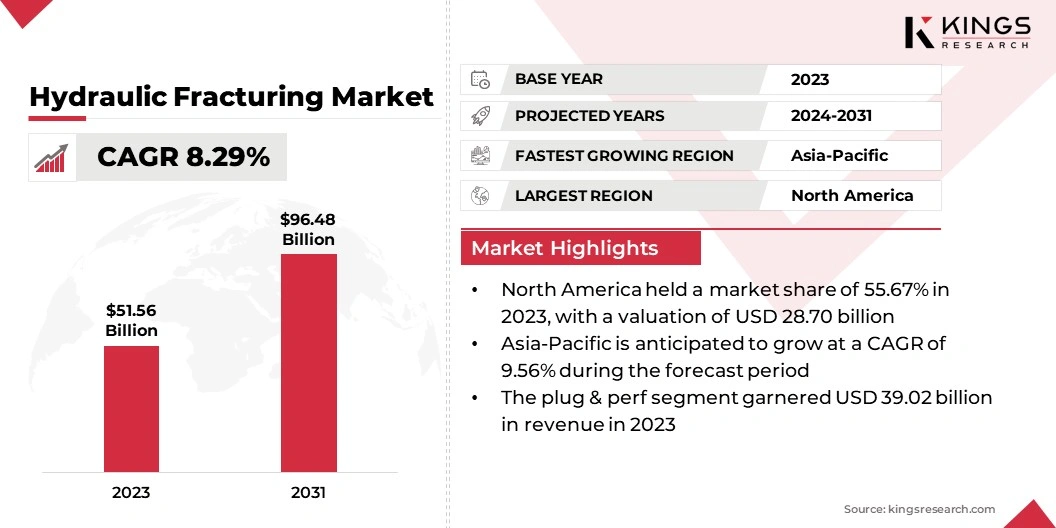

The global Hydraulic Fracturing Market size was valued at USD 51.56 billion in 2023 and is projected to grow from USD 55.25 billion in 2024 to USD 96.48 billion by 2031, exhibiting a CAGR of 8.29% during the forecast period.

Major factors propelling the growth of the market include rising energy demand, advancements in drilling technologies, government policies that support domestic energy production, and the expansion of unconventional oil and gas resources.

In the scope of work, the report includes products offered by companies such as AFG Holdings, Inc, Baker Hughes Company, Calfrac Well Services Ltd., Halliburton, Liberty Energy, Inc., Patterson-UTI Energy, Inc., Profrac, Schlumberger Limited., Trican, STEP ENERGY SERVICES, and others.

Rising energy demand and the depletion of conventional oil and gas reserves have increased the need for alternative extraction methods, such as hydraulic fracturing. Technological advancements in drilling techniques have significantly improved operational efficiency and reduced costs, making hydraulic fracturing more economically viable.

Additionally, government policies and incentives aimed at boosting domestic energy production contribute to market growth.

The increasing reliance on natural gas, which is considered as a cleaner alternative to coal, is further fueling demand. Moreover, the development of unconventional resources, such as shale gas and tight oil, has expanded the scope of hydraulic fracturing operations globally, thus influencing the market landscape.

- The EIA projected that global transportation-sector energy consumption is anticipated to increase by 8% to 41%, while industrial-sector energy consumption is expected to rise by 9% to 62% between 2022 and 2050. Growing income and rapid population growth, particularly in Africa, India, and other Asia-Pacific countries, has significantly contributed to the continued surge in buildings' energy consumption. In India, energy consumption in residential and commercial buildings is projected to potentially triple between 2022 and 2050.

The hydraulic fracturing market encompasses various activities and technologies essential for the extraction of oil and gas from subterranean rock formations. This market is experiencing robust growth due to the surging demand for energy and the continuous advancement of fracturing technologies. North America, particularly the United States, dominates the market due to its substantial shale reserves and established infrastructure.

Other regions, including Asia-Pacific and Europe, are witnessing increased hydraulic fracturing activities. Despite environmental concerns and regulatory challenges, the market outlook remains positive, attributed to the growing need for efficient energy solutions.

Hydraulic fracturing, commonly known as fracking, is a method used to extract oil and natural gas from deep underground formations. The process involves injecting high-pressure fluid, composed of water, sand, and chemicals, into rock formations to create fractures. These fractures enable the release of hydrocarbons trapped in the rock, facilitating their extraction.

The market includes equipment manufacturers, service providers, and technology developers that support these operations. This sector is crucial for tapping into unconventional energy resources, such as shale gas and tight oil, which are otherwise challenging to extract. As energy demands grow, hydraulic fracturing remains a pivotal technique in the global energy landscape.

Analyst’s Review

Manufacturers in the hydraulic fracturing market are prioritizing technological innovation and sustainability. Major players are investing heavily in advanced fracturing techniques and digital technologies to enhance efficiency and reduce environmental impact. New products are being introduced into the market, reflecting a significant shift toward eco-friendly practices.

To maintain a competitive edge, companies are recommended to continue their focus on reducing operational costs and improving environmental compliance.

Collaboration with technology providers and continuous investment in research and development are essential to foster innovation. Additionally, expanding into emerging markets with untapped resources is anticipated to play a crucial role in sustaining growth and addressing the increasing global energy demand.

Hydraulic Fracturing Market Growth Factors

Ongoing technological advancements positively impacts the hydraulic fracturing market. Innovations in drilling and fracturing techniques are continuously enhancing efficiency and reducing costs. Modern technologies, such as horizontal drilling and multi-stage fracturing, are increasing the productivity of oil and gas wells. These advancements are making it economically feasible to tap into previously inaccessible reserves, such as shale formations.

Additionally, improvements in real-time data monitoring and analysis are optimizing operations, leading to better resource management and lower environmental impact. As these technologies evolve, they are influencing the market by making hydraulic fracturing a more viable and attractive option for energy companies worldwide.

Environmental concerns, particularly related to water usage and contamination, present key challenges to market development. Public opposition and stringent regulations are on the rise due to the perceived risks to water resources and ecosystems. To overcome this challenge, the industry is adopting more sustainable practices.

Recycling and reusing wastewater reduce the need for fresh water and minimize environmental footprint. Additionally, the development of less harmful chemical additives and the use of alternative fluids, such as liquid propane, are supporting the reduction of environmental impacts.

By investing in greener technologies and maintaining strict adherence to environmental regulations, market players are addressing these concerns and ensuring sustainable growth.

Hydraulic Fracturing Industry Trends

The increasing adoption of digital technologies is propelling the expansion of the hydraulic fracturing market. Companies are integrating advanced analytics, artificial intelligence, and the Internet of Things (IoT) to optimize fracturing operations.

These technologies enable real-time monitoring and predictive maintenance, thereby enhancing operational efficiency and reducing downtime. By leveraging big data, companies are making informed decisions to maximize resource extraction and minimize costs.

Additionally, digital twin technology is being used to create virtual models of drilling operations, allowing for better planning and risk management. This digital transformation is revolutionizing the industry by making hydraulic fracturing processes more efficient, cost-effective, and environmentally friendly.

- Luxoft collaborated with industry & technology experts and utilized Agile methodology to develop hardware controls for an end-to-end hydraulic fracturing and automation software suite. This initiative encompassed IoT architecture development, cloud architecture development, visualization and data gathering development, and automated and manual testing. The solution further provided ongoing support for the hydraulic fracturing software. The solution monitored equipment usage by using big data and IoT, enabling preemptive alerts for maintenance and significantly enhancing operational efficiency.

As environmental concerns grow, companies are focusing on reducing their ecological footprint. This includes the use of biodegradable fracturing fluids and advancements in water recycling technologies. Moreover, there is a growing emphasis on reducing methane emissions through improved sealing and monitoring techniques.

Industry players are increasingly investing in research and development to create eco-friendlier solutions that comply with stringent environmental regulations. By prioritizing sustainability, the market is addressing public concerns and ensuring long-term viability in an increasingly environmentally conscious world.

Segmentation Analysis

The global market is segmented based on technology, well type, application, and geography.

By Technology

Based on technology, the market is categorized into plug & perf and sliding sleeve. The plug & perf segment led the hydraulic fracturing market in 2023, reaching a valuation of USD 39.02 billion. This notable expansion is largely attributable to its widespread adoption and proven effectiveness.

This method is highly flexible and allows for precise targeting of fracturing zones, making it suitable for complex well geometries and varying geological conditions.

The technique’s compatibility with both vertical and horizontal wells adds to its versatility. Additionally, continuous advancements in plug & perf technology are enhancing its efficiency and reducing operational costs. As energy demands grow, the preference for reliable and adaptable technologies such as plug & perf is expected to remain strong in the near future.

By Well Type

Based on well type, the market is classified into horizontal and vertical. The horizontal segment is poised to witness significant growth at a robust CAGR of 8.53% through the forecast period (2024-2031). This robust growth is mainly stimulated by its ability to maximize resource extraction. Horizontal drilling increases the contact area with the reservoir, significantly boosting production rates compared to vertical wells.

This technique is particularly effective in accessing unconventional resources, such as shale formations, where extensive lateral reach is crucial. Additionally, advancements in drilling technology are reducing costs and improving success rates, further promoting the adoption of horizontal drilling.

By Application

Based on application, the market is segmented into shale gas, tight gas, tight oil, and others. The shale gas segment secured the largest hydraulic fracturing market share of 42.34% in 2023, due to the abundant availability of shale reserves and the increasing demand for cleaner energy sources.

Shale gas, which is considered as a lower-emission alternative to coal, is gaining significant traction as countries increasingly strive to reduce their carbon footprints.

Furthermore, supportive government policies and incentives for unconventional energy sources are promoting exploration and production activities in shale formations, thereby solidifying the segment’s leading position.

Hydraulic Fracturing Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America hydraulic fracturing market share stood around 55.67% in 2023 in the global market, with a valuation of USD 28.70 billion. This dominance is augmented by the extensive presence of shale gas and tight oil reserves, particularly in the United States and Canada. The region benefits from its well-established infrastructure, advanced technology, and significant investment in research and development.

Additionally, supportive government policies and regulatory frameworks are fostering growth in hydraulic fracturing activities. The mature market landscape, combined with a skilled workforce and strong industry expertise, positions North America as a leading market for hydraulic fracturing.

- In 2023, shale formations contributed approximately 77% (29.35 trillion cubic feet) of the total U.S. dry natural gas production, highlighting the significant role of shale gas in the country's energy supply.

Asia-Pacific is poised to experience a robust growth at a CAGR of 9.56% through the projection period. This rapid expansion is fueled by increasing energy demand from emerging economies such as China and India, which are seeking to diversify their energy sources and reduce dependence on coal. The region's abundant untapped shale gas reserves present significant opportunities for development.

Additionally, government initiatives and investments in energy infrastructure are leading to the widespread adoption of hydraulic fracturing technology. As countries in Asia-Pacific prioritize energy security and cleaner alternatives, the regional market is set to witness substantial growth.

Competitive Landscape

The hydraulic fracturing market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Hydraulic Fracturing Market

- AFG Holdings, Inc

- Baker Hughes Company

- Calfrac Well Services Ltd.

- Halliburton

- Liberty Energy, Inc.

- Patterson-UTI Energy, Inc.

- Profrac

- Schlumberger Limited.

- Trican

- STEP ENERGY SERVICES

Key Industry Developments

- May 2024 (Launch): ITASCA released XSite 4.0, an advanced hydraulic fracturing simulation software. This update included features such as convective heat transfers and heat advection, enhanced matrix flow calculations, and improved fluid flow analysis. It aimed to optimize fracture design, support cost-effective operations, and boost reserve recovery in unconventional geothermal, oil & gas, and mining sectors. Additionally, the redesigned user interface improved usability and efficiency, meeting industry demands for thorough reservoir analysis and faster simulations.

- January 2024 (Launch): Halliburton launched a series of technologies aimed at optimizing fracture operations. The ZEUSTM electric fracturing system reduced emissions, slashed fuel costs, and amplified efficiency to lower operational costs for operators. The Octiv intelligent fracturing platformfacilitated the development of digital frac sites, increasing reliability and consistency across operations. The SmartFleet fracture monitoring system streamilned the evaluation of fracture performance by providing real-time, actionable insights.

The global hydraulic fracturing market is segmented as:

By Technology

- Plug & Perf

- Sliding Sleeve

By Well Type

- Horizontal

- Vertical

By Application

- Shale Gas

- Tight Gas

- Tight Oil

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership