Hydrogen Electrolyzer Market

Hydrogen Electrolyzer Market Size, Share, Growth & Industry Analysis, By Technology (Alkaline, Proton Exchange Membrane, Solid Oxide Electrolyzer & Others), By Capacity (Small-Scale, Medium-Scale, Large-Scale), By Application (Power Generation, Transportation, Industrial Applications & Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1047

Hydrogen Electrolyzer Market Size

The global Hydrogen Electrolyzer Market size was valued at USD 615.3 million in 2023 and is projected to grow from USD 764.2 million in 2024 to USD 3,791.6 million by 2031, exhibiting a CAGR of 25.71% during the forecast period. The expansion of the market is driven by the growing demand for clean energy, supportive government policies, technological advancements, and increasing industrial adoption of green hydrogen for decarbonization.

In the scope of work, the report includes solutions and products offered by companies such as Cummins Inc., Enapter S.r.l., John Cockerill, McPhy Energy S.A., Nel ASA, Plug Power Inc., Siemens AG, thyssenkrupp Uhde GmbH, ITM Power PLC, TOPSOE, and others.

The growth of the market is primarily driven by the rising global demand for clean energy solutions and the urgent need to reduce greenhouse gas emissions. Governments worldwide are implementing supportive policies, subsidies, and investment initiatives to promote hydrogen production as a sustainable energy source.

Technological advancements in electrolyzer efficiency and the declining cost of renewable energy, such as wind and solar, are further supporting market growth.

- For instance, in December 2023, SANY Hydrogen launched a new single hydrogen electrolyzer, which produced 3,000 standard cubic meters of hydrogen per hour. This development featured improved efficiency, lower system costs, and reduced maintenance. The company further established a 1.5GW alkaline electrolyzer production line and introduced a 20MW test platform for product development.

The shift toward energy security and diversification, coupled with the increasing adoption of hydrogen in transportation and power generation, is propelling market expansion. Growing corporate investments in green hydrogen projects, particularly in Europe and Asia-Pacific, underscore the increasing interest and confidence in the market.

The hydrogen electrolyzer market is experiencing significant growth, mainly due to the increasing focus on achieving net-zero carbon emissions. The market includes various types of electrolyzers, such as proton exchange membrane (PEM), solid oxide, and alkaline electrolyzers, each with distinct advantages and applications.

Europe is witnessing increasing adoption, propelled by ambitious hydrogen strategies and robust investment frameworks, while Asia-Pacific is advancing through extensive green hydrogen projects. Key industry players are focusing on increasing production capacities, enhancing electrolyzer efficiency, and forging strategic partnerships to strengthen their market presence.

Despite high initial costs and technological challenges, the market is poised to observe robust growth, supported by continuous research and development, favorable regulatory landscapes, and rising global energy demands.

The market involves the production and distribution of devices that use electricity to separate water into hydrogen and oxygen. These electrolyzers are pivotal for generating green hydrogen when powered by renewable energy sources, offering a zero-emission alternative to traditional hydrogen production methods.

The market encompasses different technologies, including alkaline, PEM, and solid oxide electrolyzers, each catering to specific industrial applications. Electrolyzers are integral to sectors such as transportation, chemical manufacturing, and energy storage, where hydrogen is utilized as a clean fuel or feedstock.

Analyst’s Review

The hydrogen electrolyzer market is witnessing strategic efforts by manufacturers to enhance product efficiency and reduce costs. Key players are focusing on increasing production capacities and launching next-generation electrolyzers that offer higher efficiency and lower energy consumption.

New product developments, such as compact and modular electrolyzers, are making hydrogen production more adaptable across various industries. Companies are further entering into strategic partnerships and joint ventures to accelerate technological advancements and expand their market reach.

- For instance, in April 2024, Stiesdal Hydrogen and Danfoss signed a commercial agreement to produce a new hydrogen electrolyzer utilizing a heat exchanger design. This collaboration introduced an advanced, scalable electrolysis cell stack, to address the rising global demand for green hydrogen. The development supported efforts to decarbonize industries difficult to electrify and facilitates clean fuel production for transportation and heavy industry.

To sustain growth, manufacturers are recommended to continue investing in research and development and explore opportunities in emerging markets.

Hydrogen Electrolyzer Market Growth Factors

The increasing adoption of green hydrogen in industrial applications is propelling the growth of the market. Industries such as steel, chemicals, and refining are actively transitioning to green hydrogen as a cleaner alternative to fossil fuels. This shift is fueled by stringent environmental regulations and the growing need to decarbonize industrial processes.

Green hydrogen helps industries reduce carbon footprints, comply with emission targets, and enhance sustainability profiles, making it a preferred choice for forward-looking companies. Additionally, technological advancements are continuously improving electrolyzer efficiency, thereby reducing the cost of green hydrogen productions.

Governments are supporting this transition by offering tax incentives and subsidies, which promote industrial sectors to adopt electrolyzers for on-site hydrogen generation and achieve sustainability goals.

A major challenge impeding the development of the hydrogen electrolyzer market is the high initial investment cost, which limits widespread adoption, particularly among small and medium-sized enterprises (SMEs). This cost is largely attributed to the expensive materials and complex manufacturing processes required for electrolyzers.

To overcome this challenge, industry players are increasing production to reduce costs through economies of scale. Collaborative efforts in research and development aimed at discovering cost-effective materials and improving electrolyzer designs. Governments and financial institutions are increasingly offering funding, grants, and subsidies to reduce the financial burden on companies.

By enhancing access to affordable financing options and promoting public-private partnerships, industry participants are mitigating cost barriers and promoting broader adoption of electrolyzer technology.

Hydrogen Electrolyzer Market Trends

The integration of hydrogen electrolyzers with renewable energy sources, such as solar and wind power, is emerging as a significant trend in the market. This integration is facilitating the production of green hydrogen, a key element in the global energy transition.

Companies are increasingly establishing electrolyzer facilities near renewable energy sites to capitalize on low-cost electricity and enhance the economics of green hydrogen production. This trend is further supported by the rising need to develop sustainable energy systems that reduce reliance on fossil fuels and minimize carbon emissions.

As grid-scale renewable projects expand, the integration of electrolyzers is essential for balancing intermittent energy supply and supporting the development of a low-carbon economy.

- For instance, in November 2023, GE Vernova’s Power Conversion and Next Hydrogen Solutions Inc. signed a memorandum of understanding to combine GE Vernova’s power systems with Next Hydrogen’s electrolysis technology. This collaboration aimed to produce green hydrogen through electrolysis by splitting water into hydrogen and oxygen using efficient electricity. GE Vernova’s technology supplied Next Hydrogen’s electrolyzers with DC power from renewable sources and integrated power quality components.

The growing focus on large-scale electrolyzer projects is emerging as a prominent trend in the hydrogen electrolyzer market. Industry leaders and energy companies are investing heavily in gigawatt-scale electrolyzer facilities to meet the rising demand for green hydrogen across various sectors.

These large-scale projects are designed to achieve economies of scale by significantly reducing the cost of hydrogen production. The trend is further supported by increasing government funding and policy initiatives that emhasize hydrogen as a key component of future energy strategies.

Moreover, collaborations between technology providers, energy firms, and industrial players are accelerating the implemetation of these projects.

Segmentation Analysis

The global market has been segmented based on technology, capacity, application, and geography.

By Technology

Based on technology, the market has been categorized into alkaline, proton exchange membrane, solid oxide electrolyzer, and anion exchange membrane. The alkaline segment led the hydrogen electrolyzer market in 2023, reaching a valuation of USD 343.1 million. This growth is attributed to its established technology, cost-effectiveness, and reliability.

Alkaline electrolyzers are widely adopted for large-scale hydrogen production due to their use of abundant and relatively inexpensive materials. This growth is further fostered by its ability to operate at lower pressures and temperatures, which enhances operational safety and reduces maintenance requirements. Alkaline electrolyzers are particularly ideal for industrial applications where high purity hydrogen is essential, such as chemical manufacturing and refining.

Continuous improvements in alkaline technology, including better efficiency and enhanced durability, are further boosting its appeal. Supportive government policies and increasing investments in hydrogen infrastructure are further contributing to the expansion of the segment.

By Capacity

Based on capacity, the market has been classified into small-scale, medium-scale, and large-scale. The large-scale segment is poised to witness significant growth at a staggering CAGR of 26.61% through the forecast period (2024-2031). This expansion is spurred by the rising demand for high-volume hydrogen production to support industrial decarbonization and large-scale energy projects.

Large-scale electrolyzers offer enhanced economies of scale, making green hydrogen production more cost-competitive compared to smaller systems. Large-scale electrolyzers are increasingly adopted by major energy companies and industrial players looking to integrate green hydrogen and meet emission reduction targets.

Technological advancements are enabling the development of more efficient, high-capacity electrolyzers that can operate continuously, thereby supporting the expansion of large-scale hydrogen plants. Strategic partnerships, government funding, and policy support are also accelerating investments in large-scale projects, propelling the growth of the segment.

By Application

Based on application, the market has been segmented into power generation, transportation, industrial applications, ammonia production, and others. The power generation segment secured the largest hydrogen electrolyzer market share of 40.92% in 2023. This notable growth is fostered by the increasing demand for renewable energy storage and grid balancing solutions.

Hydrogen produced through electrolyzers is used to store excess renewable energy, providing a flexible and sustainable solution for electricity generation. Power companies are increasingly utilizing green hydrogen alongside wind and solar power to mitigate intermittency issues and enhance grid stability. Additionally, hydrogen’s ability to be converted into electricity through fuel cells or turbines makes it a versatile energy carrier.

The growing focus on decarbonizing the power sector, along with supportive regulations and funding for clean energy projects, is stimulating the expansion of the segment. Continued innovation in power-to-hydrogen and hydrogen-to-power technologies is further boosting its share.

Hydrogen Electrolyzer Market Regional Analysis

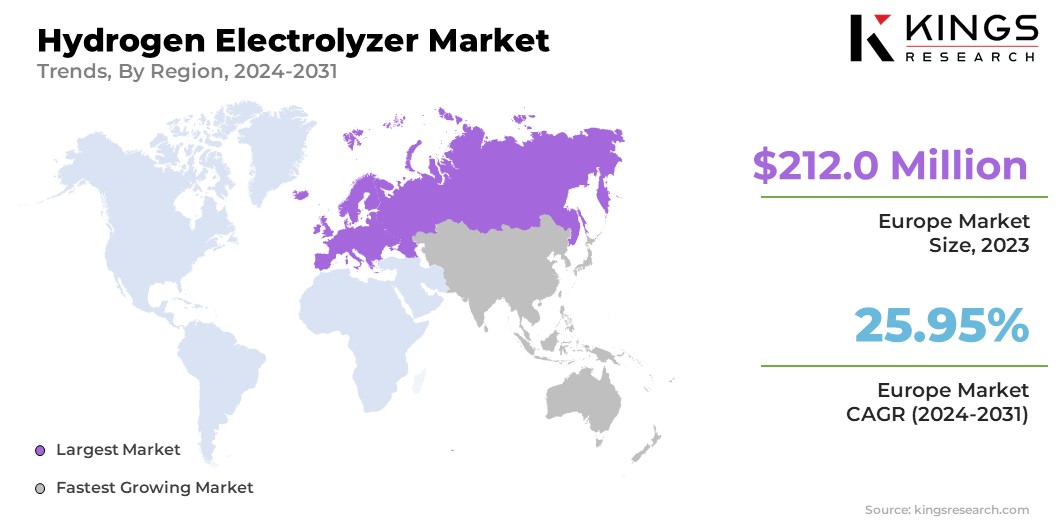

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe hydrogen electrolyzer market held a substantial share of around 34.46% in 2023, with a valuation of USD 212.0 million. This dominance is reinforced by the region's strong commitment to decarbonization and leadership in green energy initiatives. The European Union's ambitious climate goals, including achieving carbon neutrality by 2050, are increasing investments in hydrogen infrastructure.

Europe hosts numerous large-scale green hydrogen projects, backed by favorable policies, subsidies, and funding from both public and private sectors. The region’s well-established industrial base, particularly in Germany, the Netherlands, and France, is increasingly integrating hydrogen into its energy mix to reduce carbon emissions.

Additionally, Europe’s advanced technological expertise and collaborative approach to research and development are fostering innovation in electrolyzer technology, solidifying the region’s leading market position.

Asia-Pacific is poised to experience fastest growth at a remarkable CAGR of 27.12% over the forecast period. This rapid growth is propelled by the region’s increasing focus on energy security and clean energy transitions. Countries such as China, Japan, India, and South Korea are heavily investing in green hydrogen projects to reduce their reliance on fossil fuels and meet their ambitious carbon reduction targets.

- For instance, in March 2024, Larsen & Toubro (L&T) announced the commissioning of a domestically manufactured electrolyzer at its Green Hydrogen Plant situated in Gujarat. The electrolyzer, with a capacity of 1 MW (expandable to 2 MW), produces 200 Nm³/hr of hydrogen and features advanced flexibility and thermal stability. This development highlights L&T Electrolysers Limited’s commitment to domestic manufacturing and sustainable energy solutions.

Leading industries in the region are increasingly adopting hydrogen technologies to decarbonize sectors such as transportation and manufacturing. Favorable government policies, substantial funding, and strategic collaborations with global technology providers are accelerating the deployment of hydrogen infrastructure.

The region’s abundant renewable energy resources, combined with growing domestic demand for clean energy, are further the establishing Asia-Pacific as the fastest-growing market for hydrogen electrolyzers.

Competitive Landscape

The global hydrogen electrolyzer market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Hydrogen Electrolyzer Market

- Cummins Inc.

- Enapter S.r.l.

- John Cockerill

- McPhy Energy S.A.

- Nel ASA

- Plug Power Inc.

- Siemens AG

- thyssenkrupp Uhde GmbH

- ITM Power PLC

- TOPSOE

Key Industry Developments

- July 2024 (Expansion): Ohmium International, a leading green hydrogen company specializing in proton exchange membrane (PEM) electrolyzers, inaugurated a gigafactory in Doddaballapura, India. The 14,000 square meter facility began production to deliver 2 gigawatts (GW) of electrolyzer systems for international projects.

- December 2023 (Partnership): Bloom Energy and SK ecoplant announced the sale of Bloom’s proprietary electrolyzer technology for large-scale green hydrogen project with Korea Southern Power Co. and other local authorities. This project aims to utilize 1.8 MW of Bloom’s solid oxide electrolyzer (SOEC) technology to produce green hydrogen for transport fuel on Jeju Island. Bloom and SK, are collaborating on various South Korean projects, integrating SK’s infrastructure with Bloom’s technology to enhance hydrogen production efficiency.

The global hydrogen electrolyzer market is segmented as:

By Technology

- Alkaline

- Proton Exchange Membrane

- Solid Oxide Electrolyzer

- Anion Exchange Membrane

By Capacity

- Small-Scale

- Medium-Scale

- Large-Scale

By Application

- Power Generation

- Transportation

- Industrial Applications

- Ammonia Production

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership