Hydrogen Fuel Cell Market

Hydrogen Fuel Cell Market Size, Share, Growth & Industry Analysis, By Product (Proton Exchange Membrane Fuel Cell (PEMFC), Solid Oxide Fuel Cell (SOFC), Alkaline Fuel Cell (AFC), Phosphoric Acid Fuel Cell (PAFC), Others), By Application, By End Use and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR1005

Hydrogen Fuel Cell Market Size

The global Hydrogen Fuel Cell Market size was valued at USD 2,907.0 million in 2023 and is projected to grow from USD 3,495.7 million in 2024 to USD 13,549.6 million by 2031, exhibiting a CAGR of 21.35% during the forecast period. Stringent environmental regulations, technological advancements, increasing demand for sustainable energy solutions, and substantial investments in hydrogen infrastructure are driving the market.

In the scope of work, the report includes products and solutions offered by companies such as AFC Energy, Ballard Power Systems., Bloom Energy, Ceres, Doosan Fuel Cell Co., Ltd., Fuel Cell Technologies. Inc., Intelligent Energy Limited, Nedstack Fuel Cell Technology, Panasonic Holdings Corporation, Plug Power Inc., and others.

The hydrogen fuel cell market is propelled by environmental regulations and policies aimed at reducing carbon emissions. These regulations are encouraging the adoption of cleaner energy alternatives. Technological advancements have led to the development of more efficient and cost-effective fuel cell systems, making them more competitive with traditional energy sources.

- For instance, in February 2024, Plug Power Inc. and Uline expanded their partnership to implement Plug’s fuel cell solutions and hydrogen infrastructure at Uline’s new campus in Kenosha, Wisconsin. This included an 18,000-gallon hydrogen storage tank, 17 dispensers, and 250 fuel cell forklifts.

Additionally, the growing demand for sustainable energy solutions in transportation, stationary power, and portable power applications is boosting the market. Investments from governments and the private sector in hydrogen infrastructure, along with increasing consumer awareness about the environmental benefits of hydrogen fuel cells are further supporting the market.

The hydrogen fuel cell market is experiencing robust growth, driven by the need for cleaner energy solutions across various industries. In transportation, hydrogen fuel cells are being integrated into vehicles, from passenger cars to heavy-duty trucks, offering a zero-emission alternative to conventional fuels. Stationary power applications, including backup power systems and distributed generation, are also adopting hydrogen fuel cells for their reliability and environmental benefits.

The market is characterized by a competitive landscape with key players focusing on innovation and strategic partnerships. Despite challenges such as high production costs and infrastructure complexities, the market is expected to register significant expansion, supported by favorable policies and technological advancements.

Hydrogen fuel cells are electrochemical devices that convert hydrogen into electricity, emitting only water and heat as byproducts. These cells consist of an anode, cathode, and an electrolyte membrane. Hydrogen molecules are split into protons and electrons at the anode, with electrons flowing through an external circuit to generate electricity, while protons pass through the electrolyte to the cathode, where they combine with oxygen to form water.

Hydrogen fuel cells are classified into various types, such as solid oxide fuel cells (SOFC), proton exchange membrane fuel cells (PEMFC), and alkaline fuel cells (AFC), each providing efficiency, operating temperature, and cost benefits in different applications.

Analyst’s Review

The hydrogen fuel cell market is witnessing significant advancements with manufacturers investing in research and development to enhance efficiency and reduce costs. Key players are introducing innovations, such as more durable and higher-performing fuel cell systems, to meet the growing demand various end-use industries.

- For instance, in April 2024, SFC Energy AG launched its new EFOY H₂PowerPack offering up to 200 kW cluster power output. This emission-free energy solution was designed for mobile and stationary use and included standard 400 V AC connections, a user-friendly control panel, and an integrated lithium battery. The product aims to replace diesel generators in construction sites, emergency power supplies, and self-sufficient companies, with series production planned for early 2025.

Collaboration between automotive giants and hydrogen technology firms are driving the development of new fuel cell vehicles, expanding their presence in the market. Additionally, the establishment of hydrogen refueling infrastructure is accelerating adoption. To capitalize on market opportunities, companies should focus on technological innovation, strategic partnerships, and scaling up production capabilities.

Governments continue to support through incentives and infrastructure investments, ensuring a sustainable and robust growth trajectory for the market.

Hydrogen Fuel Cell Market Growth Factors

The efforts to reduce greenhouse gas emissions are driving the hydrogen fuel cell market. Governments around the world are implementing stringent environmental regulations and policies to combat climate change. These policies are encouraging the adoption of hydrogen fuel cells as a cleaner alternative to fossil fuels.

However, high production costs are posing a significant challenge to the widespread adoption of hydrogen fuel cells. The materials used in fuel cells, such as platinum, are expensive, which adds to the overall costs. To overcome this challenge, companies are using research and development to focus on finding alternative materials and improving manufacturing processes. Scaling up production helps reduce costs through economies of scale.

Additionally, government subsidies and incentives are playing a crucial role in offsetting initial costs and making hydrogen fuel cells more accessible to companies. Collaborations between public and private sectors are also essential in advancing technology and infrastructure, ultimately cutting down costs and driving market growth.

Hydrogen Fuel Cell Market Trends

The transportation sector is increasingly adopting hydrogen fuel cells as a viable alternative to traditional internal combustion engines. Fuel cell vehicles, including cars, buses, and trucks, are becoming more prevalent due to their zero-emission capabilities and longer driving ranges compared to battery-powered electric vehicles. Automakers are investing heavily in fuel cell technology, developing new models, and expanding refueling infrastructure.

Public transportation systems in several cities are integrating fuel cell buses to reduce pollution and improve air quality. This trend is supported by governmental policies that are promoting green transportation solutions, which is helping to drive the hydrogen fuel cell market forward.

The expansion of hydrogen infrastructure is a significant trend impacting the market. Governments and private companies are investing in the development of hydrogen refueling stations and production facilities. This growing infrastructure is crucial for supporting the widespread adoption of hydrogen fuel cell vehicles and other applications.

Innovations in hydrogen production, such as electrolysis powered by renewable energy sources, are making hydrogen more sustainable and cost-effective. Collaborative efforts between countries and industries are facilitating the creation of international hydrogen supply chains, ensuring a steady and reliable supply of hydrogen for various uses, thereby driving market growth.

Segmentation Analysis

The global market has been segmented on the basis of product, application, end use, and geography.

By Product

Based on product, the market has been categorized into proton exchange membrane fuel cell (PEMFC), solid oxide fuel cell (SOFC), alkaline fuel cell (AFC), phosphoric acid fuel cell (PAFC), and others. The proton exchange membrane fuel cell (PEMFC) segment led the hydrogen fuel cell market in 2023, reaching the valuation of USD 1,855.2 million.

The PEMFC segment is expanding due to its versatility and efficiency in various applications. PEMFCs are favored for their low operating temperatures and quick startup times, making them suitable for transportation and portable power applications. Their ability to deliver high power density and their compact size offer significant advantages, especially in automotive and portable electronic sectors.

Additionally, ongoing technological advancements are improving PEMFC performance and reducing costs. The growing emphasis on clean energy solutions and the increasing number of partnerships and collaborations in the hydrogen sector are further driving the adoption and expansion of PEMFCs in the market.

By Application

Based on application, the market has been classified into stationary power generation, portable power generation, transport, and others. The transport segment is poised for significant growth at a CAGR of 22.06% through the forecast period from 2024 to 2031. The transport segment is experiencing significant growth due to the increasing demand for zero-emission vehicles.

Hydrogen fuel cells offer a compelling alternative to traditional fuels, providing longer ranges and faster refueling times compared to battery-powered vehicles. Governments are supporting this shift with incentives and stringent emission regulations, pushing manufacturers to develop more competent fuel cell vehicles.

Advancements in fuel cell technology and expanding hydrogen refueling infrastructure are making fuel cell vehicles more viable for consumers and businesses.

By End Use

Based on end use, the market has been segmented into automotive, aerospace, telecommunications, utilities, industrial, and others. The automotive segment held the largest hydrogen fuel cell market share of 41.59% in 2023. The automotive segment is leading the market due to the industry's strong focus on sustainable and emission-free technologies. Hydrogen fuel cell vehicles (FCVs) are gaining traction as a viable solution to reduce the carbon footprint of the transportation sector.

Automakers are investing heavily in fuel cell technologies and launching new FCV models to meet consumer demand and regulatory requirements. The automotive sector's focus on innovation and partnerships is accelerating the development and deployment of fuel cell technologies.

Hydrogen Fuel Cell Market Regional Analysis

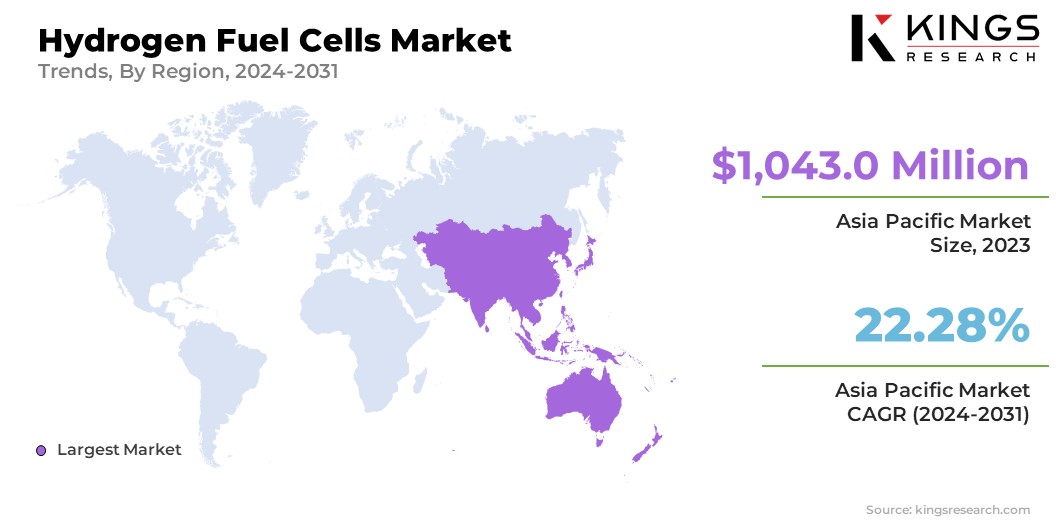

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific hydrogen fuel cell market share stood at 35.88% in 2023 in the global market, with a valuation of USD 1,043.0 million. This region is dominating the market due to several factors. Countries such as Japan, South Korea, and China are investing heavily in hydrogen infrastructure and technology. Government policies and incentives are strongly aiding the adoption of hydrogen fuel cells, particularly in transportation and stationary power applications.

- In December 2023, India's Ministry of New and Renewable Energy implemented the National Green Hydrogen Mission, approved in January 2023 with an allocation of approximately USD 2.4 billion, to position India as a global hub for green hydrogen. Public sector initiatives included blending hydrogen in gas grids and pilot projects for hydrogen fuel cell vehicles.

The presence of major automotive manufacturers and their commitment to developing efficient hydrogen fuel cell vehicles are also contributing to the region's market share. Additionally, ongoing research and development efforts and strategic partnerships between public and private sectors are accelerating technological advancements, making hydrogen fuel cells more accessible and affordable in the region.

Europe is also anticipated to experience significant growth over the forecast period at a CAGR of 21.55%. The region is experiencing growth in the market, mainly due to robust government initiatives and stringent emission regulations. The European Union's Green Deal and various other policies are promoting hydrogen as a key component in the region's energy transition.

Investments in hydrogen infrastructure, such as refueling stations and production facilities, are also increasing. Collaboration between industries and governments is fostering innovation and scaling up production capabilities. The automotive sector, in particular, is seeing substantial advancements with leading car manufacturers developing innovative fuel cell vehicles.

Competitive Landscape

The global hydrogen fuel cell market report will provide valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market position.

List of Key Companies in Hydrogen Fuel Cell Market

- AFC Energy

- Ballard Power Systems.

- Bloom Energy

- Ceres

- Doosan Fuel Cell Co., Ltd.

- Fuel Cell Technologies. Inc.

- Intelligent Energy Limited

- Nedstack Fuel Cell Technology

- Panasonic Holdings Corporation

- Plug Power Inc.

Key Industry Developments

- April 2024 (Product Launch): Panasonic Corporation announced that its Electric Works Company launched a new pure hydrogen fuel cell generator in Australia, Europe, and China. The PH3 cogeneration system produces approximately 8.2 kW of heat and up to 10 kW of DC power, supporting flexible power generation plans. The product has been designed for various installation environments can achieve 57% electrical efficiency and 104% total efficiency with a 15-year overhaul period to reduce lifecycle costs.

- January 2024 (Partnership): Ceres Power Holdings plc and Delta Electronics signed a long-term agreement for the manufacturing and licensing of solid oxide electrolysis and fuel cell stacks. The agreement included USD 47.0 million in revenue for Ceres from technology transfer, development fees, and engineering services, with further potential revenue from stack sales and royalties. The technology introduction and factory construction has been set to begin in 2024, with initial production expected by late 2026.

The global hydrogen fuel cell market has been segmented as follows:

By Product

- Proton Exchange Membrane Fuel Cell (PEMFC)

- Solid Oxide Fuel Cell (SOFC)

- Alkaline Fuel Cell (AFC)

- Phosphoric Acid Fuel Cell (PAFC)

- Others

By Application

- Stationary Power Generation

- Portable Power Generation

- Transport

- Others

By End Use

- Automotive

- Aerospace

- Telecommunications

- Utilities

- Industrial

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership