Hydropower Market Size

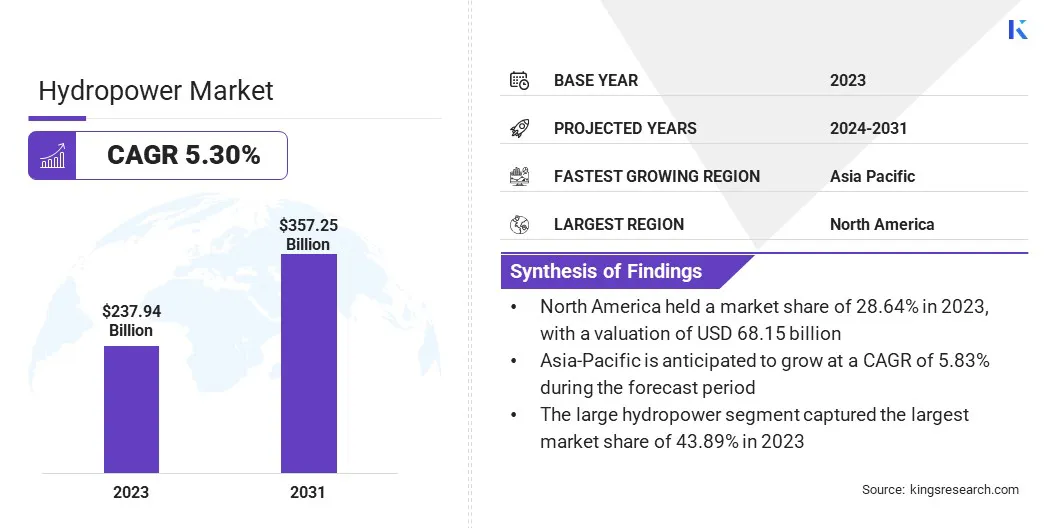

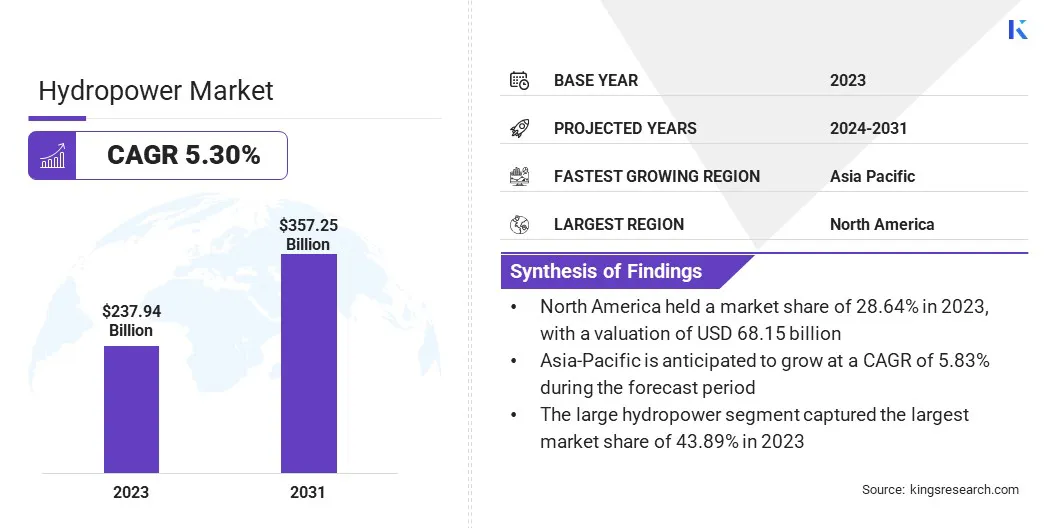

The global Hydropower Market size was valued at USD 237.94 billion in 2023 and is projected to grow from USD 248.85 billion in 2024 to USD 357.25 billion by 2031, exhibiting a CAGR of 5.30% during the forecast period. In the scope of work, the report includes services offered by companies such as Alstom, Siemens, PowerChina, China Three Gorges Corporation, Tata Power, Voith GmbH & Co. KGaA, ABB, ALFA LAVAL, ANDRITZ AG, General Electric and others.

Rising investments in pumped storage projects for grid stabilization are foreseen to offer lucrative opportunities for the market. Pumped storage projects present significant opportunities in the hydropower market, particularly for grid stabilization and energy storage capabilities. These systems function by pumping water from a lower reservoir to an upper reservoir during periods of low electricity demand, using surplus energy.

During peak demand, the stored water is released back to the lower reservoir through turbines, generating electricity. This ability to store and release energy on demand makes pumped storage a valuable asset for balancing supply and demand, integrating variable renewable energy sources like wind and solar, and enhancing grid reliability. Additionally, pumped storage projects are providing ancillary services such as frequency regulation, voltage control, and reserve generation, further contributing to grid stability.

With growing concerns over energy security and the increasing penetration of intermittent renewable energy sources, the demand for efficient energy storage solutions is rising. Governments and utilities are recognizing the strategic importance of pumped storage in achieving renewable energy targets and ensuring a stable and resilient energy infrastructure. This has led to supportive policies and investment incentives aimed at expanding pumped storage capacities globally.

Hydropower, or hydroelectric power, is the process of generating electricity by harnessing the energy of flowing water. It is one of the oldest and most established forms of renewable energy, utilizing the kinetic and potential energy of water in rivers, streams, or man-made installations.

There are several types of hydropower systems, including run-of-the-river, storage (reservoir), and pumped storage. Run-of-the-river systems generate power by diverting a portion of a river’s flow through a canal or penstock, without significant water storage. Storage systems, on the other hand, involve the construction of dams to create large reservoirs, allowing for greater control over water flow and the ability to generate electricity on demand.

Pumped storage is a type of storage system that acts as a giant battery, storing energy in the form of water at a higher elevation. In terms of capacity, hydropower plants range from small micro-hydro installations, which generate less than 100 kilowatts, to large-scale projects that produce thousands of megawatts. The flexibility and scalability of hydropower make it a vital component of the global energy mix, contributing significantly to electricity generation in many countries.

Analyst’s Review

In the dynamic landscape of the hydropower market, companies are strategically focusing on modernization, sustainability, and technological innovation to maintain and enhance their competitive edge. Current growth trends indicate robust investments in upgrading existing infrastructure to boost efficiency and capacity. This includes retrofitting older plants with advanced turbines and control systems, integrating digital technologies for real-time monitoring and predictive maintenance, and adopting eco-friendly practices to mitigate environmental impacts.

Companies are also exploring hybrid solutions that combine hydropower with other renewable energy sources, such as solar and wind, to ensure a more stable and reliable energy supply. Strategic partnerships and collaborations with government bodies and research institutions are being leveraged to secure funding, navigate regulatory challenges, and drive innovation.

- For instance, in April 2024, Orron Energy AB agreed to sell its 50% interest in the Leikanger hydropower plant to Sognekraft Produksjon AS. This sale aligned with Orron Energy’s strategy to capitalize on market conditions and focus on profitable investments.

Additionally, hydropower market key players are expanding their footprint in emerging markets with untapped hydropower potential, capitalizing on the growing energy demand and supportive regulatory frameworks in these regions. The imperatives for these companies include maintaining operational excellence, ensuring compliance with environmental standards, and continuously innovating to stay ahead in the competitive landscape. By aligning their strategies with global energy transition goals, these companies are well-positioned to contribute to a sustainable and resilient energy future.

Hydropower Market Growth Factors

Government support and policies play a crucial role in driving the expansion of the global hydropower market. Favorable regulatory frameworks, financial incentives, and strategic initiatives are essential in promoting hydropower as a sustainable and reliable energy source. governments worldwide are implementing policies to encourage investment in hydropower projects, such as subsidies, tax breaks, and grants. Additionally, streamlined permitting processes and environmental regulations tailored to support hydropower development are further bolstering its adoption.

- For instance, in May 2024, the EU and Nepal launched an energy flagship project to support rural electrification, inaugurating a 28 km extension of the Chilime-Trishuli 220 kV transmission line and substations. This project is purposed to provide clean, affordable, and reliable energy to rural Nepali households.

Government-backed research and development programs are also fostering innovation in hydropower technologies, improving efficiency, and reducing environmental impacts. These supportive measures are vital in attracting private sector investments, ensuring project feasibility, and mitigating financial risks associated with large-scale hydropower projects. By prioritizing hydropower in national energy plans and setting ambitious renewable energy targets, governments are driving the transition to cleaner energy systems.

Furthermore, international cooperation and funding from multilateral organizations are boosting hydropower development in emerging markets, addressing energy security concerns, and supporting sustainable economic growth.However, hydropower development faces significant challenges related to habitat disruption, fish migration, and ecosystem impacts, which is constraining hydropower market growth. The construction of dams and reservoirs alters natural water flow, inundates large areas of land, and disrupts local ecosystems. This is leading to the displacement of communities, loss of biodiversity, and changes in water quality.

One of the most critical issues is the impact on fish populations, particularly migratory species that rely on free-flowing rivers for spawning. Dams block migration routes, leading to decline in fish populations and affecting the livelihoods of communities’ dependent on fishing. Mitigation measures, such as fish ladders and bypass systems, are often implemented but may not fully address the problem.

Additionally, changes in sediment transport affect downstream habitats and agricultural productivity. Balancing hydropower development with environmental sustainability requires comprehensive planning, stringent environmental assessments, and the incorporation of innovative design and operational practices. Stakeholder engagement and collaboration with environmental organizations are essential to identify and mitigate adverse impacts, ensuring that hydropower projects contribute to sustainable development without compromising ecological integrity.

Hydropower Market Trends

The integration of digital technologies is a transformative trend in the hydropower market, significantly enhancing operational efficiency, reliability, and sustainability. Advanced digital tools, such as artificial intelligence (AI), the Internet of Things (IoT), and big data analytics, are being increasingly adopted to optimize various aspects of hydropower operations. AI-driven predictive maintenance systems monitor the condition of equipment in real-time, identifying potential issues before they lead to costly failures and downtime.

IoT sensors provide continuous data on water flow, reservoir levels, and turbine performance, enabling more precise control and efficient use of water resources. Big data analytics process vast amounts of operational data to uncover patterns and insights, informing decision-making and improving overall performance.

Additionally, digital twin technology allows operators to create virtual models of hydropower plants, simulating different scenarios to enhance planning and response strategies. These technologies not only improve operational efficiency but also contribute to environmental sustainability by optimizing water usage and reducing waste. The integration of digital technologies represents a significant advancement in the hydropower sector, driving innovation and ensuring the long-term viability of this renewable energy source.

Segmentation Analysis

The global market is segmented based on type and geography.

By Type

Based on type, the market is segmented into large hydropower, micro hydropower, and small hydropower. The large hydropower segment captured the largest hydropower market share of 43.89% in 2023 on account of its ability to generate significant amounts of electricity efficiently and reliably. Large hydropower projects, typically those with capacities exceeding 30 MW, benefit from economies of scale, which result in lower per-unit costs of electricity generation. These projects are crucial for meeting the base load power demand and providing grid stability, which makes them attractive for both developed and developing nations.

Additionally, the substantial investment in upgrading and modernizing aging infrastructure has bolstered the capacity and efficiency of existing large hydropower plants. Governments around the world have been increasingly supportive of large hydropower projects due to their ability to provide renewable energy at a large scale, which is essential for achieving national and international climate goals.

- For instance, according to a 2023 report by the International Energy Agency (IEA) hydropower will continue to be the largest source of renewable electricity. However, many countries would need to accelerate the expansion of renewable electricity generation to meet growing energy demands by 2028.

Furthermore, large hydropower projects often come with multipurpose benefits, such as flood control, irrigation, and water supply, which add to their overall value proposition. These factors are facilitating the dominance of the large hydropower segment in the global market.

Hydropower Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America hydropower market share reached 28.64% and was valued at USD 68.15 billion in 2023, owing to the region’s strong commitment to renewable energy and sustainable power generation. This substantial market share is driven by several factors, including the presence of extensive hydropower infrastructure, supportive government policies, and significant investments in modernization and capacity expansion.

- For instance, in 2022, according to the U.S. Energy Information Administration (EIA), hydroelectricity represented approximately 6.2% of total U.S. utility-scale electricity generation and 28.7% of total utility-scale renewable electricity generation.

The United States and Canada, in particular, have a long history of hydropower development, with numerous large-scale projects contributing to a reliable and low-carbon electricity supply. The region’s regulatory environment is favorable, with incentives and subsidies that encourage the development and upgradation of hydropower facilities.

Moreover, advancements in technology and digital integration have improved the efficiency and environmental performance of hydropower plants in North America. Mounting emphasis on reducing greenhouse gas emissions and transitioning to cleaner energy sources is further propelling hydropower market growth. North America’s robust grid infrastructure and the ability to integrate hydropower with other renewable energy sources like wind and solar are enhancing the region’s overall energy resilience and sustainability.

Asia-Pacific hydropower market is projected to grow at the highest CAGR of 5.83% in the forthcoming years, backed by rising energy demand, presence of abundant water resources, and increasing investment in renewable energy infrastructure. Countries like China, India, and Southeast Asian nations are witnessing rapid industrialization and urbanization, leading to a surge in electricity consumption.

Hydropower is seen as a key solution to meet the growing energy demand sustainably. The region boasts significant untapped hydropower potential, with numerous river systems and favorable geographical conditions for hydropower development. Governments in the Asia-Pacific region are implementing supportive policies, providing incentives, and streamlining regulatory processes to attract investments in hydropower projects. Furthermore, international funding and technical assistance from multilateral organizations are facilitating the development of large and small-scale hydropower projects.

- For instance, in November 2023, the Government of India and the World Bank signed a USD 200 million project for the advancement of power sector reforms and boosting renewable energy capacity in Himachal Pradesh, India. This initiative aimed to add 10 gigawatts of renewable energy, enhancing the state's green power supply.

High emphasis on reducing reliance on fossil fuels and curbing carbon emissions aligns with global climate goals, driving the expansion of hydropower capacity. Technological advancements and improved project management practices are also enhancing the feasibility and efficiency of hydropower projects in the region.

Competitive Landscape

The hydropower market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Hydropower Market

- Alstom

- Siemens

- PowerChina

- China Three Gorges Corporation

- Tata Power

- Voith GmbH & Co. KGaA

- ABB

- ALFA LAVAL

- ANDRITZ AG

- General Electric

Key Industry Development

- November 2023 (Expansion): GE Vernova's Hydro Power division was awarded a contract by Tacoma Power to refurbish two of the three installed turbine and generator units at the Cushman II hydropower plant, each with a capacity of 27 MW/33 MVA.

The global hydropower market is segmented as:

By Type

- Large Hydropower

- Micro Hydropower

- Small Hydropower

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America