Healthcare Medical Devices Biotechnology

In Vitro Fertilization Market

In Vitro Fertilization Market Size, Share, Growth & Industry Analysis, By Procedure Type (Frozen Non-donor, Fresh Non-donor, Frozen Donor, Fresh Donor), By Instruments (Disposable Devices, Culture Media, Equipment), By End User (Fertility Clinics, Hospitals, Research Institutes), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : February 2025

Report ID: KR1333

Market Definition

In vitro fertilization (IVF) is a medical procedure in which an egg and sperm are combined outside the body in a laboratory setting to create an embryo, which is then implanted into the uterus for pregnancy.

In Vitro Fertilization Market Overview

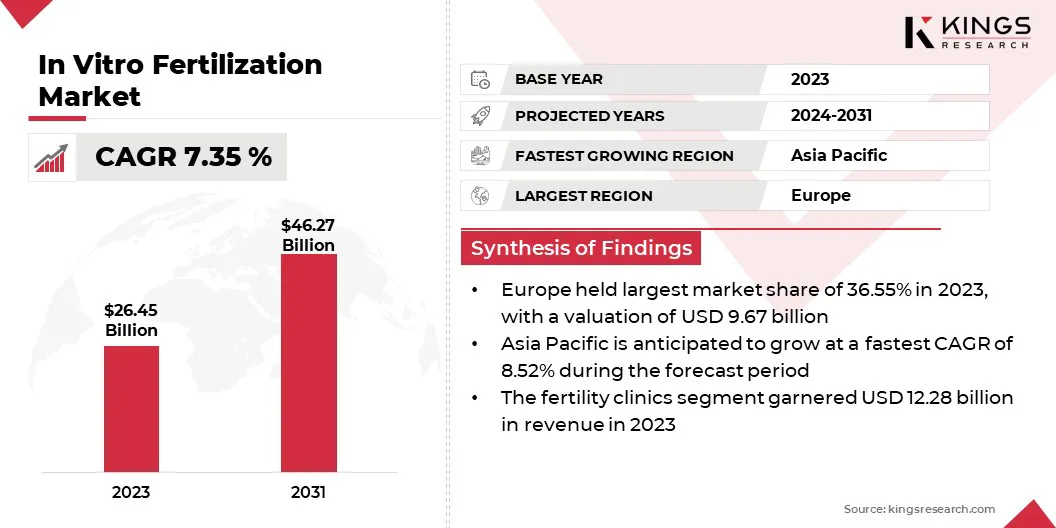

The global in vitro fertilization market size was valued at USD 26.45 billion in 2023 and is projected to grow from USD 28.16 billion in 2024 to USD 46.27 billion by 2031, exhibiting a CAGR of 7.35% during the forecast period.

The market has registered significant growth over recent years, driven by rising infertility rates, advances in reproductive technologies, and increasing awareness of assisted reproductive techniques. Societal and lifestyle factors contribute to delayed pregnancies, hence many individuals and couples are seeking in vitro fertilization (IVF) as a viable solution to overcome fertility challenges.

Major companies operating in the in vitro fertilization market are The Cooper Companies, Inc., Vitrolife, FUJIFILM Corporation (Irvine scientific), Thermo Fisher Scientific Inc., Merck KGaA, Boston IVF, Cook Group, Genea BIOMEDX, Esco Micro Pte. Ltd., IVIRMA Global, IVFtech ApS, Memmert GmbH + Co.KG, NidaCon International AB., astec co.,ltd., and VITROMED GmbH.

Innovations such as embryo freezing, genetic testing, and improvements in IVF success rates have made the IVF procedure more accessible and effective. Additionally, the rise in healthcare spending, availability of fertility clinics, and growing acceptance of IVF in various countries are contributing to the overall market expansion.

- In December 2024, Gameto announced the world’s first live birth using its Fertilo procedure, which matures eggs outside the body using ovarian support cell (OSC) technology. This breakthrough reduces hormone injections by 80%, shortens treatment cycles to three days, and minimizes risks like ovarian hyperstimulation syndrome.

Key Highlights:

- The in vitro fertilization industry size was valued at USD 26.45 billion in 2023.

- The market is projected to grow at a CAGR of 7.35% from 2024 to 2031.

- Europe held a market share of 36.55% in 2023, with a valuation of USD 9.67 billion.

- The frozen non-donor segment garnered USD 10.17 billion in revenue in 2023.

- The culture media segment is expected to reach USD 19.56 billion by 2031.

- The fertility clinics segment is expected to reach USD 20.75 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.52% during the forecast period.

Market Driver

"Advancements in Technology and Growing Prevalence of Infertility"

Advancements in reproductive technology, rising infertility rates, and increasing government support are driving significant growth in the in vitro fertilization market. Innovations such as genetic screening, improved cryopreservation, and better embryo culture techniques are enhancing success rates and encouraging more individuals and couples to pursue IVF treatments.

At the same time, the growing prevalence of infertility, due to factors like delayed childbirth and lifestyle changes, is driving the demand for assisted reproductive technologies. Additionally, expanding insurance coverage and government financial support for IVF procedures are making treatments more accessible and affordable, further fueling the market growth.

- In March 2024, the Department of Veterans Affairs announced that it will expand access to in vitro fertilization for eligible unmarried veterans, veterans in same-sex marriages, and those requiring donated sperm or eggs. This expansion will allow veterans with service-connected injuries or health conditions that prevent them from producing their own gametes to receive IVF treatment.

Market Challenge

"High Cost of IVF Procedure and Low Success Rate"

IVF continues to face several key challenges within the fertility treatment market. One of the primary obstacles is the high cost of IVF procedures. This financial burden limits accessibility for many potential patients, particularly in regions where insurance coverage for IVF is limited or non-existent.

Several fertility clinics are exploring bundled pricing models and offering financing options to make treatments more affordable. Another challenge is the relatively low success rate of IVF, which depends on age and other factors. This has led to increased demand for improved IVF technologies and more personalized treatment plans.

The industry is responding by investing in advanced genetic screening, embryo freezing techniques, and AI-driven solutions to enhance success rates. Additionally, the risk of multiple pregnancies, associated with transferring multiple embryos, remains a concern.

In response, clinics are increasingly adopting single embryo transfer (SET) protocols, which reduce the incidence of multiple births and related health risks.

Market Trend

"Increasing Adoption of Genetic Screening and AI Integration"

A key trend in the IVF market is the move toward personalized and precision medicine, with clinics offering tailored treatment plans based on genetic testing, hormone levels, and other individual factors to improve success rates.

Additionally, there is an increasing adoption of genetic screening, particularly preimplantation genetic testing, as patients aim to reduce the risk of genetic disorders and enhance the likelihood of a healthy pregnancy.

The integration of Artificial Intelligence (AI) and automation in IVF laboratories is also gaining momentum, allowing for more accurate embryo selection, better monitoring of lab conditions, and improved decision-making, which leads to more efficient IVF procedures and better clinical outcomes.

- In March 2024, Siemens Healthineers launched the Anti-Müllerian Hormone (AMH) Assay, designed to evaluate ovarian reserve and guide IVF decisions. The AMH test helps physicians assess a patient's egg quantity, enabling better-informed decisions on whether to pursue or continue IVF, potentially reducing the number of IVF cycles and associated costs.

In Vitro Fertilization Market Report Snapshot

|

Segmentation |

Details |

|

By Procedure Type |

Frozen Non-donor, Fresh Non-donor, Frozen Donor, Fresh Donor |

|

By Instruments |

Disposable Devices, Culture Media (Cryopreservation Media, Embryo Culture Media, Ovum Processing Media, Sperm Processing Media), Equipment (Sperm Analyzer Systems, Imaging Systems, Ovum Aspiration Pumps, Micromanipulator Systems, Incubators, Others) |

|

By End User |

Fertility Clinics, Hospitals, Research Institutes |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Procedure Type (Frozen Non-donor, Fresh Non-donor, Frozen Donor, Fresh Donor): The frozen non-donor segment earned USD 10.17 billion in 2023, due to its increased adoption driven by improved success rates and greater affordability.

- By Instruments (Disposable Devices, Culture Media, and Equipment): The culture media segment held 43.41% share of the market in 2023, due to its essential role in supporting embryo development and improving IVF success rates.

- By End User (Fertility Clinics, Hospitals, and Research Institutes): The fertility clinics segment is projected to reach USD 20.75 billion by 2031, owing to the increasing demand for specialized IVF treatments and personalized care in fertility clinics.

In Vitro Fertilization Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe accounted for around 36.55% share of the in vitro fertilization market in 2023, with a valuation of USD 9.67 billion. This growth is driven by the high prevalence of infertility issues, advanced healthcare infrastructure, and widespread access to specialized fertility treatments.

Additionally, the growing acceptance of assisted reproductive technologies (ART) and supportive government initiatives in several European countries are contributing to the strong market presence in the region.

The in vitro fertilization industry in Asia Pacific is poised for significant growth at a robust CAGR of 8.52% over the forecast period. This growth is attributed to the rising incidence of infertility, improvements in healthcare systems, and increasing disposable income, especially in countries like China, India, and Japan.

The growing demand for IVF treatments in these countries, alongside a rising number of fertility clinics and increasing awareness about ART options, is expected to propel the market in the region.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the FDA approves and regulates drugs and devices in all areas of medicine, including those used during the IVF process.

- In Europe, the primary regulatory body overseeing IVF is the European Society of Human Reproduction and Embryology (ESHRE), which collects and analyzes data on IVF practices across different countries, providing guidelines and acting as a kind of fertility watchdog within the region.

- In China, the primary regulatory body overseeing in vitro fertilization (IVF) is the National Health Commission (NHC), which sets standards and licenses clinics providing assisted reproductive technology (ART) services, including IVF.

- In Japan, the Ministry of Health, Labour and Welfare oversees ART procedures. The Pharmaceuticals and Medical Devices Agency (PMDA) regulates medical devices and pharmaceuticals used in ART.

- In India, the State Board headed by the Health Minister and an appropriate authority headed by the Additional Secretary (Health) scrutinises all matters under the Surrogacy and ART Acts.

Competitive Landscape:

The in vitro fertilization industry is characterized by a large number of participants, including both established corporations and rising organizations. Leading companies in the market focus on offering advanced IVF technologies, including cutting-edge instruments, culture media, and diagnostic tools, while also expanding their global presence through strategic partnerships and collaborations.

Additionally, key market players are investing in the development of innovative and cost-effective treatment options to cater to the growing demand for fertility treatments globally.

Competition is also driven by factors such as the availability of trained professionals, success rates of IVF treatments, and customer satisfaction, with companies continuously improving their services to gain a competitive edge.

With the increasing number of IVF treatments being sought globally, the market is expected to continue evolving, with companies adapting to new technologies and patient needs to maintain their positions in the market.

- In January 2025, Hamilton Thorne Ltd. announced its agreement to acquire FUJIFILM Irvine Scientific’s ART and cytogenetics product offerings. This strategic acquisition brings together Hamilton Thorne, FUJIFILM Irvine Scientific, and Cook Medical Reproductive Health, forming a powerful partnership in the field of assisted reproductive technology.

List of Key Companies in In Vitro Fertilization Market:

- The Cooper Companies, Inc.

- Vitrolife

- FUJIFILM Corporation (Irvine scientific)

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Boston IVF

- Cook Group

- Genea BIOMEDX

- Esco Micro Pte. Ltd.

- IVIRMA Global

- IVFtech ApS

- Memmert GmbH + Co.KG

- NidaCon International AB.

- astec co.,ltd.

- VITROMED GmbH

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, Alife Health announced a partnership with US Fertility to pilot its Embryo Assist software in US Fertility’s IVF clinics. The AI tool integrates with laboratory microscopes to enhance embryo cataloging, quality control, and real-time data updates, improving laboratory operations and providing patients with advanced insights into their IVF treatments.

- In September 2024, Indian Immunologicals (IIL) launched ‘Shashthi’, an indigenous IVF media developed with the National Dairy Development Board (NDDB). The new media reduces IVF costs by 33%, making the technology more affordable for farmers and supporting the growth of animal husbandry in India.

- In May 2024, Birla Fertility & IVF, part of the C K Birla Group, announced the acquisition of ARMC IVF Fertility Centre, marking its entry into South India. This acquisition expands Birla Fertility & IVF’s presence to 37 with plans to expand to 100 clinics.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)