Insulin Glargine Market

Insulin Glargine Market Size, Share, Growth & Industry Analysis, By Type (Single Dose Vial and Pre-Filled Syringe), By Application (Type 2 Diabetes and Type 1 Diabetes), By Distribution Channel (Hospital Pharmacy, Online Sales, Retail Pharmacy, and Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR836

Insulin Glargine Market Size

The global Insulin Glargine Market size was valued at USD 1,330.8 million in 2023 and is projected to grow from USD 1,388.3 in 2024 to USD 2,062.7 million by 2031, exhibiting a CAGR of 5.82% during the forecast period. In the scope of work, the report includes solutions offered by companies such as Novo Nordisk AS, Sanofi Aventis, Biocon, Eli Lilly and Company, Julphar, Gan & Lee Pharmaceuticals USA Corp., Kalbe Pharma, Viatris Inc, WOCKHARDT, Boehringer Ingelheim International GmbH and others.

The growth of the market is driven by several factors such as the rising prevalence of diabetes, technological innovations in diabetes management, increased awareness and early diagnosis, and expanding access to insulin therapies in emerging markets.

The growth of the insulin glargine market is propelled by the increasing diabetes prevalence and advancements in disease management. Global diabetes rates are rising due to lifestyle changes, rapid urbanization, and aging populations, leading to a strong demand for insulin therapies such as insulin glargine. Improved awareness and early diagnosis, along with digital health technologies such as smart pens and mobile apps, are enhancing patient care.

Biosimilar versions of insulin glargine are increasingly available , offering cost-effective alternatives and expanding market access. Strategic investments in distribution and affordability programs aim to improve access in emerging markets, promising sustainable growth and better health outcomes worldwide.

- According to the CDC, a total of 38.4 million people in the United States have diabetes, representing 11.6% of the population. Of these, 29.7 million people have been diagnosed with diabetes, including 29.4 million adults. Additionally, 8.7 million people remain undiagnosed, which accounts for 22.8% of adults with diabetes.

Insulin glargine is a long-acting insulin analog specifically formulated to help manage blood sugar levels in individuals with diabetes mellitus. It works by releasing insulin gradually over an extended period, typically up to 24 hours, providing a stable and consistent insulin supply that mimics the body's natural basal insulin secretion.

This prolonged duration of action helps maintain consistant blood glucose levels throughout both the day and night, thereby reducing episodes of high blood sugar (hyperglycemia) and minimizing blood sugar fluctuations. Insulin glargine is usually administered once daily through a subcutaneous injection. It is prescribed for both Type 1 and Type 2 diabetes patients who need long-term insulin therapy to effectively control their blood sugar levels.

The market includes stakeholders such as pharmaceutical companies, healthcare providers, researchers, and patients. It covers the development of branded and biosimilar versions of insulin glargine, advancements in delivery devices, and regulatory approvals.

Analyst’s Review

The market is witnessing dynamic shifts, influenced by strategic pricing and expansion initiatives by key players.

- For instance, Sanofi's substantial reduction of Lantus' list price by 78% in 2024, coupled with the launch of a competitively priced unbranded insulin glargine, exemplifies a strategic move to bolster market share and enhance affordability for patients.

This aggressive pricing strategy reflects a proactive response to competitive pressures and increasing demand for cost-effective diabetes treatments. Moreover, Julphar made significant strides in its growth strategy by focusing on expanding its market presence in the GCC region through a robust portfolio expansion.

The launch of 20 new products in the UAE and strategic partnerships, such as the licensing agreement with China's HEC Pharma Group for insulin products, highlights the company’s aim to strengthen its diabetes portfolio and broaden access to essential treatments across MENA markets. These strategies highlight a notable trend within the insulin glargine market, where companies are intensifying their efforts to address affordability challenges and expand their geographical reach.

Insulin Glargine Market Growth Factors

The insulin glargine market is expanding due to the growing prevalence of diabetes, fueled by lifestyle changes, rising obesity rates, and an aging population. Demand for effective insulin therapies, particularly insulin glargine known for its long-acting properties in glucose management, is on the rise. Sustained investment in research, development, and production is essential to meet the evolving needs of diabetic patients worldwide.

This commitment ensures the availability of innovative and reliable insulin glargine formulations, addressing the increasing demand during the global diabetes epidemic.

- According to the World Health Organization, diabetes affects approximately 422 million people worldwide, with a significant majority residing in low- and middle-income nations. Each year, diabetes contributes directly to 1.5 million deaths globally. This growing prevalence of diabetes highlights the rising demand for insulin glargine.

A significant opportunity in the insulin glargine market involves expanding access to emerging economies where diabetes prevalence is rapidly increasing. Despite the increasing demand, access to advanced insulin therapies remains constrained in many developing regions, which presents substantial growth prospects for proactive companies.

By accelerating distribution networks, establishing local manufacturing capabilities, and implementing affordability initiatives, manufacturers are effectively entering these underserved markets. Addressing local needs, such as cost constraints and logistical challenges, is crucial for improving accessibility to insulin glargine.

Local production reduces costs and ensures a consistent supply, while affordability programs enhance treatment accessibility for a broader patient demographic. This strategic approach taps into a sizable market with significant unmet needs, thereby fostering improved health outcomes across emerging economies.

Insulin Glargine Market Trends

The proliferation of biosimilar versions is expected to propel the expansion of the market. These biosimilars offer cost-effective alternatives to branded insulin glargine, delivering comparable efficacy and safety profiles at a reduced price point. This development is pivotal in enhancing access to diabetes treatment, particularly in regions where high costs have hindered widespread adoption.

As healthcare systems and patients prioritize affordability without compromising quality, biosimilar uptake is reshaping market dynamics. Increased competition among manufacturers is boosting price competitiveness and expanding patient access to insulin therapies. Furthermore, regulatory endorsements ensure that biosimilars meet stringent standards for effectiveness and safety.

By fostering broader acceptance, biosimilars enhance market competition and contribute significantly to alleviating the global diabetes burden, enabling more economical access to essential long-acting insulin treatments such as insulin glargine.

The market is witnessing a significant shift due to the integration of digital health technologies into diabetes management. Smart insulin pens and mobile health applications are transforming patient care by providing real-time monitoring of blood glucose levels and insulin usage. These innovations enhance treatment adherence through automated dose tracking and personalized reminders, thereby improving overall patient outcomes.

Mobile apps offer comprehensive insights into glucose trends and insulin administration patterns, facilitating informed decision-making by healthcare providers and empowering patients in managing their condition more effectively. This integration enhances patient engagement and satisfaction, leading to increased demand for insulin glargine and associated products.

As the adoption of digital health solutions continues to rise, fueled by advancements in technology and increasing patient preference for connected health solutions, the insulin glargine market is poised to experience sustained growth and innovation.

Segmentation Analysis

The global market is segmented based on type, application, distribution channel, and geography.

By Type

Based on type, the insulin glargine market is categorized into single dose vial and pre-filled syringe. The pre-filled syringe segment garnered the highest revenue of USD 850.3 million in 2023. Prefilled syringes offer advantages such as reduced dosing errors, improved patient adherence, and ease of use compared to traditional vial and syringe methods.

Key market players are actively investing in research and development to innovate syringe designs that enhance usability and safety features. As the global prevalence of diabetes rises and patients seek more efficient treatment options, the prefilled syringe segment is estimated to experience robust growth.

By Application

Based on application, the market is divided into type 2 diabetes and type 1 diabetes. The type 2 diabetes segment captured the largest insulin glargine market share of 91.07% in 2023, mainly due to its high prevalence and increasing demand for effective therapies. Innovations such as insulin glargine and advanced digital health technologies are pivotal in managing blood glucose levels effectively while minimizing complications.

These advancements cater to the specific needs of patients diagnosed with type 2 diabetes thereby improving treatment adherence and outcomes. Pharmaceutical companies' strategic focus on developing targeted therapies and expanding market access further propels segmental growth, supported by regulatory advancements ensuring safety and efficacy.

By Distribution Channel

Based on distribution channel, the market is divided into hospital pharmacy, online sales, retail pharmacy, and others. The retail pharmacy segment is set to garner a substantial revenue of USD 1153.2 million by 2031. Retail pharmacies play a pivotal role in the distribution and accessibility of diabetes treatments such as insulin glargine.

Retail pharmacies serve as primary points of contact for patients, offering convenience, personalized counseling, and a wide range of insulin products. They play a critical role in ensuring timely access to both branded and generic insulin glargine formulations, supporting medication adherence and patient education.

Insulin Glargine Market Regional Analysis

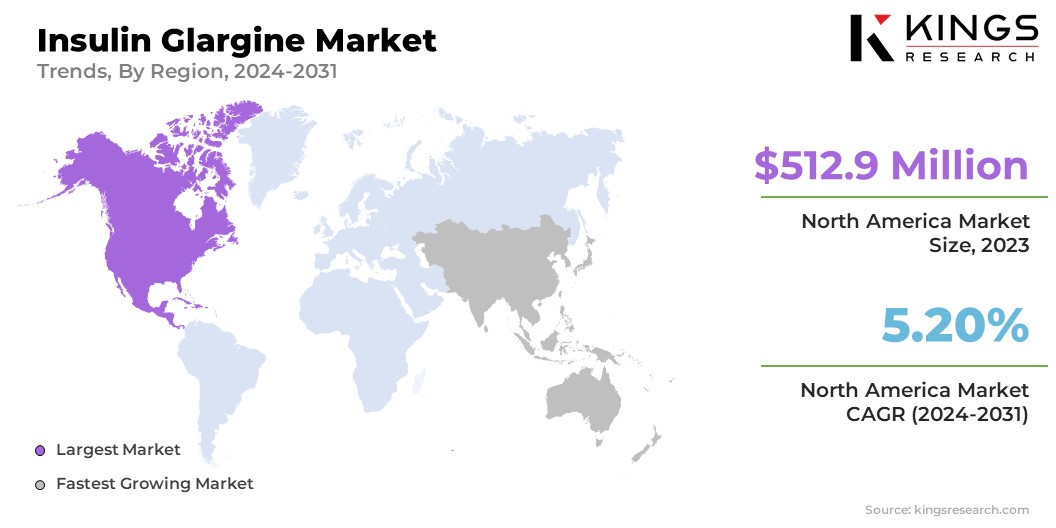

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America insulin glargine market share stood around 38.54% in 2023 in the global market, with a valuation of USD 512.9 million. The regional market growth is augmented by a high prevalence of diabetes, advanced healthcare infrastructure, and extensive adoption of digital health technologies. The region benefits from well-established regulatory frameworks that ensure the safety and efficacy of insulin therapies.

Key factors contributing to domestic market growth include robust patient education programs, continuous innovation in diabetes management solutions, and competitive strategies among pharmaceutical companies. With a rising focus on enhancing patient outcomes through improved treatment adherence and accessibility, North America remains pivotal in shaping the global landscape of insulin glargine and diabetes care.

Asia-Pacific is anticipated to witness the highest growth at a robust CAGR of 7.09% over the forecast period. This notable growth is mainly propelled by a rising prevalence of diabetes and increasing healthcare investments. Rapid urbanization, dietary changes, and aging populations contribute significantly to a significant diabetes burden, thereby increasing the demand for effective treatments such as insulin glargine.

Advancements in healthcare infrastructure and technology adoption further enhance market expansion, improving access to diabetes management solutions across diverse regional markets. Pharmaceutical companies are strategically positioning themselves by engaging in local manufacturing, forming partnerships, and implemeting tailored pricing strategies to meet the specific needs and regulatory requirements of individual countries.

Competitive Landscape

The insulin glargine market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likley to create new opportunities for market growth.

List of Key Companies in Insulin Glargine Market

- Novo Nordisk AS

- Sanofi Aventis

- Biocon

- Eli Lilly and Company

- Julphar

- Gan & Lee Pharmaceuticals USA Corp.

- Kalbe Pharma

- Viatris Inc

- WOCKHARDT

- Boehringer Ingelheim International GmbH.

Key Industry Development

- April 2023 (Product Launch): Eli Lilly and Company launched its insulin glargine biosimilar, Rezvoglar (insulin glargine-aglr), in the US market. This introduction marked a significant development in the market, as Rezvoglar became the second interchangeable insulin biosimilar available to American patients with diabetes.

The global insulin glargine market is segmented as:

By Type

- Single Dose Vial

- Pre-filled Syringe

By Application

- Type 2 Diabetes

- Type 1 Diabetes

By Distribution Channel

- Hospital Pharmacy

- Online Sales

- Retail Pharmacy

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership