ICT-IOT

Intermodal Freight Transportation Market

Intermodal Freight Transportation Market Size, Share, Growth & Industry Analysis, By Component (Solution and Services), By Transportation Mode (Rail-Road, Air-Road, Maritime-Road & Others), By Application (Consumer Goods, Automotive, Oil & Gas, Aerospace & Defense & Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1026

Intermodal Freight Transportation Market Size

The global Intermodal Freight Transportation Market size was valued at USD 59.69 billion in 2023 and is projected to grow from USD 64.65 billion in 2024 to USD 121.60 billion by 2031, exhibiting a CAGR of 9.44% during the forecast period. The expansion of global trade has significantly increased the demand for efficient and cost-effective transportation solutions, thereby driving the growth of the market.

As companies expand into cross-border trade, the need for reliable and scalable logistics systems becomes increasingly paramount. Intermodal freight, which seamlessly integrates multiple modes of transport, including rail, road, and sea, provides a versatile solution for moving goods across vast distances.

In the scope of work, the report includes services and solutions offered by companies such as Deutsche Bahn AG, Korber AG, A.P. Moller – Maersk A/S, J.B. Hunt Transport Services Inc., GE Electric, Evans Delivery Company, Inc., Hub Group, Inc., Trimble Inc., Schneider National, Danser Group, and others.

Moreover, government initiatives and regulatory support are boosting the growth of the intermodal freight transportation market. Numerous countries are investing heavily in infrastructure development, such as the expansion of rail networks and the modernization of ports, to support the increasing demand for intermodal transportation.

Policies that promote sustainable transportation and aim to reduce carbon emissions are fueling the shift towards intermodal solutions, which offer a greener alternative to traditional single-mode transportation. These initiatives enhance the efficiency of freight movement and align with global sustainability goals, making intermodal transportation an attractive option for businesses.

Additionally, technological advancements play a significant role in the expansion of the market. The integration of digital platforms, IoT, and AI in intermodal logistics has revolutionized the industry by enhancing real-time tracking, improving operational efficiency, and enabling better decision-making. These technologies provide greater visibility into the supply chain, allowing companies to monitor shipments across different modes and respond swiftly to disruptions.

Intermodal freight transportation involves the movement of goods using two or more different modes of transportation, such as trucks, trains, ships, or planes, within a single journey. This method utilizes standardized containers that allow for seamless transfer between various transportation modes, eliminating the need to handle the cargo directly.

Intermodal freight transportation optimizes the efficiency of the supply chain by combining the strengths of each mode, resulting in reduced transit times, lower costs, and a minimized environmental impact. It is a key solution for companies seeking to streamline their logistics operations and meet the demands of global trade.

Analyst’s Review

Substantial investments in advanced technologies, including automated cargo handling systems and real-time tracking solutions, are reshaping the movement of goods across various transport modes. These innovations aim to enhance operational efficiency, reduce costs, and improve coordination within intermodal networks.

Strategic partnerships between technology providers and freight companies are further accelerating market growth. For instance, collaborations that offer autonomous trucks with subscription-based self-driving systems illustrate how industry alliances are fostering innovation and driving the adoption of automated freight solutions.

- In June 2024, Uber Freight unveiled a partnership with Aurora Innovation to provide the trucking industry with access to autonomous trucks. This agreement enables qualified carriers to purchase heavy-duty commercial trucks equipped with Aurora’s subscription-based self-driving system.

According to our analysis, strategic partnerships and collaborations are crucial in driving this market evolution. By combining resources and expertise, companies are advancing the development and integration of sophisticated logistics solutions. These alliances address complex logistical challenges and facilitate the adoption of new technologies, thereby fostering market growth and expanding reach.

- For instance, in January 2024, Bison Transport announced a new agreement with Canadian Pacific Kansas City (CPKC) to eliver intermodal transportation services throughout North America. This partnership aims to leverage CPKC’s north-south corridor, which connects Canada, the U.S., and Mexico, along with Bison Transport’s fleet of 3,000 tractors and 10,000 trailers based in Winnipeg, Canada.

To maintain competitiveness, companies in the intermodal freight transportation market should focus on forming strategic partnerships to optimize their networks and integrate cutting-edge technologies. Emphasizing operational efficiency and fostering collaboration are likely to be crucial for addressing the industry's evolving challenges and achieving sustained growth in this dynamic market.

Intermodal Freight Transportation Market Growth Factors

The increasing environmental awareness is fueling the growth of the market. As global concern regarding climate change and sustainability increases, businesses and governments are increasingly prioritizing environmentally friendly transportation solutions. This method reduces the carbon footprint associated with freight transport by leveraging the most efficient mode for each segment of the journey.

Additionally, the use of intermodal containers facilitates smoother transitions between modes, thereby reducing the need for additional handling and further lowering the environmental impact.

Moreover, the growing e-commerce sector is significantly influencing the intermodal freight transportation market. The surge in online shopping has led to an increase in the demand for fast and reliable delivery services. Intermodal transportation offers the necessary flexibility to meet these demands by seamlessly connecting different transportation modes, thereby ensuring both timely and cost-effective delivery.

As e-commerce expand, the need for efficient logistics solutions is expected to boost the adoption of intermodal freight transportation, thereby contributing to the growth of the market.

- According to a study conducted by the International Trade Administration, global B2C e-commerce revenue was valued at USD 3.6 trillion in 2023 and is projected to reach USD 5.5 trillion by 2027, representing a steady compound annual growth rate of 14.4%.

However, the complexity and inefficiency associated with coordinating multiple modes of transport are restraining the expansion of the intermodal freight transportation market. The integration of different transportation methods requires seamless coordination between various stakeholders, including shipping lines, rail operators, trucking companies, and port authorities.

This complexity can lead to delays, increased administrative costs, and logistical challenges, particularly when infrastructure or communication systems are not well-integrated. To mitigate these challenges, companies are investing heavily in advanced technology solutions and improving their infrastructure.

Enhanced digital platforms, such as transportation management systems (TMS) and supply chain management (SCM) software, facilitate better coordination and real-time tracking across different transportation modes. These technologies help streamline operations by providing greater visibility into the entire supply chain, enabling timely decision-making, and reducing administrative burdens.

Intermodal Freight Transportation Market Trends

Significant investments in rail networks, ports, and intermodal terminals are major factors bolstering the growth of the market. The expansion and modernization of these critical infrastructure components enhance the efficiency and capacity of intermodal transportation systems, making them more attractive to businesses seeking optimized logistics solutions.

Investments in rail networks improve connectivity and increase the ability to handle larger volumes of cargo over long distances. Upgraded rail infrastructure facilitates smoother and faster transit, reduces bottlenecks, and enables higher capacity trains. This is particularly important for long-haul segments of intermodal shipments, where rail transport offers a more economical and environmentally friendly alternative to road transport.

Moreover, the advent of digital freight brokerage services and autonomous trucks is contributing significantly to the growth of the intermodal freight transportation market. These innovations are reshaping the logistics landscape by enhancing efficiency, reducing costs, and creating new opportunities for companies within the freight transportation sector.

By utilizing digital platforms, these services facilitate real-time matching of shippers with carriers, thereby improving the efficiency of load management and route planning. The automation of freight brokerage processes reduces administrative overhead, minimizes manual errors, and accelerates the booking and dispatching of shipments. This enhanced efficiency is particularly beneficial in intermodal transportation, where the coordination of multiple modes and stakeholders is crucial.

Segmentation Analysis

The global market is segmented based on component, transportation mode, application, and geography.

By Component

Based on component, the market is segmented into solution and services. The solution segment led the intermodal freight transportation market in 2023, reaching a valuation of USD 34.92 billion. This dominance is attributed to its comprehensive approach in addressing the complexities of multimodal logistics.

This segment includes various technologies, software platforms, and integrated services that ensure the seamless coordination and management of intermodal shipments. From advanced transportation management systems (TMS) to digital freight brokerage platforms, these solutions provide real-time tracking, data analytics, and automation.

They enable companies to optimize routes, reduce costs, and enhance operational efficiency. Additionally, the increasing adoption of digital solutions and technological advancements reinforces the prominence of this segment. Businesses are prioritizing innovation to maintain their competitive edge and meet the growing demand for efficient, reliable intermodal freight services.

By Transportation Mode

Based on transportation mode, the market is classified into rail-road, air-road, maritime-road, and others. The rail-road segment secured the largest revenue share of 49.59% in 2023. This notable growth is primarily fueled by the efficiency, cost-effectiveness, and flexibility that rail-road transportation provides.

Rail transport is highly efficient for long-haul shipments, offering a lower cost per ton-mile compared to road transport. It is particularly advantageous for moving large volumes of cargo over long distances, thereby making it a preferred choice for intermodal transportation. Rail's ability to handle substantial loads with lower fuel consumption aligns with the growing emphasis on sustainability, as it results in fewer greenhouse gas emissions.

On the other hand, road transport provides the crucial flexibility needed for last-mile delivery, connecting rail terminals to final destinations. Trucks are essential for navigating the "first and last mile" of a shipment's journey, enabling door-to-door service that rail alone cannot achieve. This seamless integration of rail for long-haul transport and road for final-mile delivery allows for an optimized logistics solution that balances cost and efficiency.

By Application

Based on application, the intermodal freight transportation market is divided into consumer goods, automotive, oil & gas, aerospace & defense, industrial manufacturing, and others. The consumer goods segment is poised to witness significant growth at a robust CAGR of 10.84% through the forecast period.

This growth is mainly propelled by the rise of e-commerce and the increasing demand for fast, efficient delivery of consumer products, which have significantly influenced the logistics landscape. Consumer goods, including electronics, clothing, and household items, require timely and reliable transportation to meet the expectations of both retailers and end consumers.

Moreover, the consumer goods sector is characterized by intense competition, prompting companies to adopt more efficient and innovative logistics solutions to maintain their market positions. The scalability and adaptability of intermodal transportation allow businesses to respond swiftly to fluctuations in demand, seasonal peaks, and varying geographic needs. This adaptability is critical in a market where the speed and reliability of delivery directly impact consumer satisfaction and brand loyalty.

Intermodal Freight Transportation Market Regional Analysis

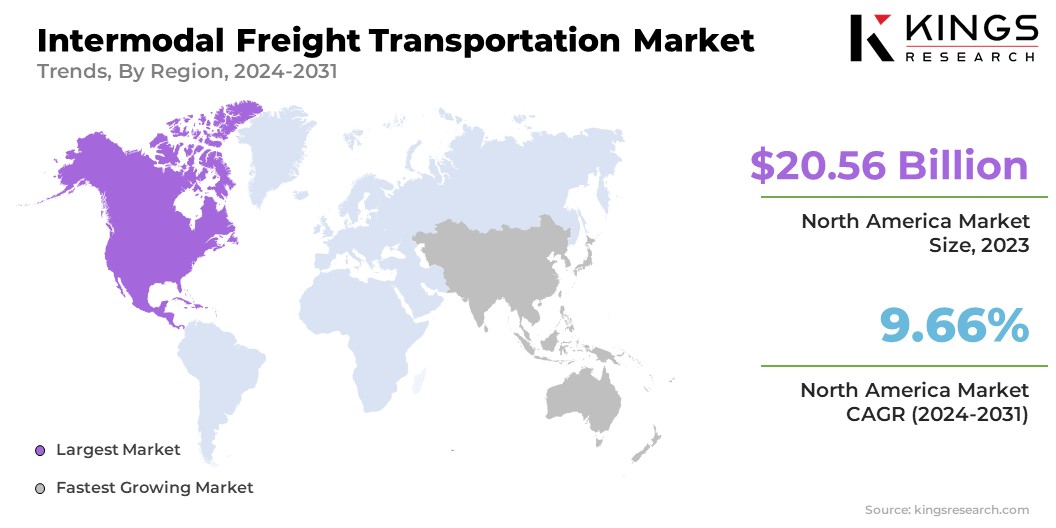

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America intermodal freight transportation market accounted for a share of around 34.44% in 2023, with a valuation of USD 20.56 billion. North America, particularly the United States and Canada, benefits from a well-established transportation infrastructure, characterized by an extensive rail network and numerous intermodal terminals.

Ongoing investments in upgrading rail lines, expanding port capacities, and modernizing intermodal facilities are enhancing the efficiency and capacity of the region's transportation system. These improvements are crucial to accommodate the growing demand for intermodal services, especially in handling the increased flow of goods across borders and within the continent.

Moreover, the rapid growth of the e-commerce sector in North America is fueling the demand for efficient, reliable, and flexible logistics solutions. Intermodal freight transportation offers the versatility needed to meet the high expectations of e-commerce companies and consumers for fast deliveries.

The integration of rail transportation for long-distance hauls with trucking services for final-mile delivery allows for efficient management of North America's vast and diverse landscape, where delivery demands varies significantly between urban centers and rural areas.

- In May 2024, the Census Bureau of the Department of Commerce reported that the U.S. retail e-commerce sales reached USD 291.6 billion in the second quarter of 2024, reflecting a 1.3% increase from the first quarter. Compared to the second quarter of 2023, e-commerce sales grew by 6.7% in 2024, while total retail sales saw a 2.1% rise over the same period..

Asia Pacific is poised to witness significant growth at a robust CAGR of 10.45% over the forecast period. Asia-Pacific is experiencing rapid urbanization and industrialization, particularly in countries such as China, India, and Southeast Asian nations. This growth is leading to a substantial increase in the production and consumption of goods, thereby boosting the demand for efficient transportation solutions.

Intermodal freight transportation is highly effective for managing the large volumes of goods transported across the region's diverse and expanding industrial hubs. Moreover, significant investments in expanding and modernizing rail networks across countries such as China, India, and Japan are enhancing connectivity and increasing the efficiency of cargo movement. These improvements allow for faster and more reliable transportation of goods over long distances, therbey reducing both transit times and costs.

The upgraded railway infrastructure facilitates better integration with other modes of transport, such as road and sea, making intermodal transportation a more attractive option for businesses seeking optimized logistics solutions in the region.

- According to a report by the China State Railway Group Co., Ltd., China's fixed-asset investment in railways reached 65.2 billion yuan in the first two months of 2024, marking a 9.5% increase compared to the same period last year. During this time, several major projects, including the Chongqing-Kunming and Xi'an-Chongqing high-speed railways, progressed significantly as part of ongoing efforts to modernize the country's rail infrastructure. By the end of 2023, the railway network's operating mileage reached 159,000 kilometers, with 45,000 kilometers of high-speed tracks.

Competitive Landscape

The global intermodal freight transportation market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Intermodal Freight Transportation Market

- Deutsche Bahn AG

- Korber AG

- P. Moller – Maersk A/S

- B. Hunt Transport Services Inc.

- GE Electric

- Evans Delivery Company, Inc.

- Hub Group, Inc.

- Trimble Inc.

- Schneider National.

- Danser Group

Key Industry Developments

- June 2024 (Partnership): In June 2024, Deutsche Bahn’s DB Engineering and Consulting (DB E&C) established an exclusive strategic partnership with Thelo Group, a logistics solutions company, to support the development of integrated multi-freight transport corridors across Africa.

- November 2023 (Partnership): J.B. Hunt Transport Services Inc. and BNSF Railway, North America's largest intermodal rail provider, unveiled Quantum, a groundbreaking intermodal service designed to meet the service-sensitivefreight demands of customer supply chains. Quantum delivers the consistency, agility, and speed required to transport service-sensitive highway freight via rail transport.

The global Intermodal Freight Transportation market is segmented as:

By Component

- Solution

- Services

By Transportation Mode

- Rail-Road

- Air-Road

- Maritime-Road

- Others

By Application

- Consumer Goods

- Automotive

- Oil & Gas

- Aerospace & Defense

- Industrial Manufacturing

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership