IoT Connectivity Market

IoT Connectivity Market Size, Share, Growth & Industry Analysis, By Component (Platform and Services), By Application (Smart Retail, Smart Manufacturing, Connected Health, Building and Home Automation and Others), By End User, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR841

IoT Connectivity Market Size

Global IoT Connectivity Market size was valued at USD 7,788.2 million in 2023 and is projected to grow from USD 9,274.2 million in 2024 to USD 34,371.2 million by 2031, exhibiting a CAGR of 20.58% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Cisco Systems, Inc., emnify, Hologram, Huawei Technologies Co., Ltd., Orange Business, Particle Industries, Inc., Semtech, Telefonaktiebolaget LM Ericsson, Telefónica, Global Solutions, Verizon and others.

The increasing adoption of smart devices, advancements in wireless technology such as 5G, and the growing demand for real-time data analytics across diverse industries are driving the growth of the market. The expansion of the IoT connectivity market is propelled by the widespread adoption of smart devices and the growing trend toward automation. Additionally, advancements in wireless technology, such as 5G, enhance connectivity capabilities, making IoT solutions more efficient.

The increasing need for real-time data analytics and monitoring across various industries, including healthcare, automotive, and manufacturing, further fuels market growth. Furthermore, the integration of AI and machine learning with IoT systems enhances decision-making processes and operational efficiency. Moreover, government initiatives promoting smart infrastructure and investments in smart city projects contribute significantly to market expansion.

- In February 2024, Kyndryl, a prominent IT infrastructure services provider, announced a global strategic partnership with Hewlett Packard Enterprise (HPE). They collaborated with a Hewlett Packard Enterprise company viz. Athonet, to jointly develop and deliver 5G private wireless and LTE services worldwide. This partnership integrated private 5G/ LTE with enterprise campus wired and WLAN (Wi-Fi 6) solutions from HPE Aruba Networking, enabling Kyndryl to offer enhanced connectivity and business agility to enterprise customers. The alliance further included Kyndryl Bridge in order to provide actionable network insights along with AIOps integration to automate IT infrastructure and improve operational efficiency.

The IoT connectivity market is experiencing rapid growth due to ongoing technological advancements and increasing demand for interconnected devices. Major industry players are focusing on developing innovative and scalable connectivity solutions to meet the diverse needs of different sectors. Furthermore, the market is witnessing significant investments in research and development to improve connectivity standards and protocols.

As industries continue to adopt digital transformation, the demand for reliable and efficient IoT connectivity solutions is anticipated to rise, leading to substantial market growth in the coming years.

IoT connectivity refers to the infrastructure and technologies that enable devices to communicate and exchange data over the internet. This market includes various connectivity solutions such as cellular networks, Wi-Fi, Bluetooth, and LPWAN, which facilitate seamless communication between IoT devices and central systems.

These solutions are critical for supporting a wide range of applications, from smart homes and wearable devices to industrial automation and smart cities. The market further involves the development of hardware components, software platforms, and services that ensure secure and efficient data transmission.

Analyst’s Review

Manufacturers in the IoT connectivity market are actively engaged in developing innovative solutions to meet evolving consumer demands. These include the integration of advanced technologies such as AI and edge computing to enhance connectivity and data processing capabilities. Additionally, manufacturers are focusing on improving interoperability among devices and platforms to ensure seamless communication in IoT ecosystems.

New products, including IoT-enabled sensors and gateways, are being introduced to address specific industry needs, thereby augmenting market growth. Manufacturers should continue to prioritize research and development to maintain leading position in this competitive landscape.

- In May 2024, Myriota launched Myriota FlexSense, a hardware platform designed for rapid deployment of sensor-based solutions. It featured advanced bluetooth low energy and multi-sensor capabilities, leveraging Myriota’s low-power satellite connectivity. The product lifespan exceeded ten years on four AA batteries. Furthermore, FlexSense offered quick deployment and supported various applications including environmental sensing and location monitoring.

IoT Connectivity Market Growth Factors

The increasing demand for IoT applications across various industries is fostering market growth. Businesses are continually striving to improve efficiency, streamline processes, and enhance decision-making through the implementation of IoT solutions. This demand is further fueled by the need for real-time data analytics, remote monitoring, and predictive maintenance.

As companies recognize the potential benefits of IoT technology, they are investing heavily in scalable connectivity solutions to support their initiatives. Moreover, the proliferation of connected devices, coupled with advancements in sensor technology, facilitates the expansion of the IoT connectivity market.

A key challenge hindering the development of the IoT connectivity market is ensuring interoperability among different devices and platforms. The solution lies in establishing industry standards and protocols that enable seamless communication between diverse IoT systems. Development of standardized interfaces and protocols, helps manufacturers ensure compatibility and interoperability across various devices and networks.

Additionally, investing in robust testing and certification processes enables the identification and resolution of interoperability issues early in the product development lifecycle. Furthermore, promoting collaboration among industry stakeholders and participating in industry consortia facilitates the development and adoption of interoperable IoT solutions, thereby effectively overcoming this challenge.

IoT Connectivity Market Trends

Edge computing is a burgeoning trend significantly influencing the IoT connectivity market, characterized by the proximity of data processing to its source of generation, thus reducing latency and bandwidth usage. This trend is further fueled by the growing need for real-time data analysis and decision-making in IoT applications. Moving computational tasks closer to IoT devices helps organizations achieve faster response times and improved efficiency.

Additionally, edge computing enables better data privacy and security by minimizing data transmission to centralized cloud servers. The widespread adoption of edge computing is reshaping the architecture of IoT systems and fostering innovation in connectivity solutions.

The integration of artificial intelligence (AI) and machine learning (ML) technologies is shaping the market landscape. Companies are leveraging AI and ML algorithms to analyze vast amounts of IoT data and extract valuable insights in real-time. This trend enables predictive maintenance, anomaly detection, and automated decision-making, thereby enhancing operational efficiency and reducing downtime.

By integrating AI and ML capabilities into IoT connectivity solutions, organizations are optimizing resource utilization, improving scalability, and delivering more personalized experiences to end-users. Moreover, advancements in AI and ML algorithms continue to foster innovation in IoT connectivity, enabling smarter and more autonomous IoT systems across various industries.

Segmentation Analysis

The global market is segmented based on component, application, end user, and geography.

By Component

Based on component, the market is categorized into platform and services. The platform segment led the IoT connectivity market in 2023, reaching a valuation of USD 4,811.5 million. This expansion is attributed to several factors such as the increasing adoption of IoT technology across various industries, resulting in the surging demand for customized platforms that integrate hardware, software, and services.

Organizations increasingly seek end-to-end IoT solutions to address their specific needs, thereby supporting the expansion of the segment. Additionally, the complexity of IoT deployments necessitates specialized expertise and ongoing support, further boosting demand for IoT services.

By Application

Based on application, the market is classified into smart retail, smart manufacturing, connected health, building and home automation, smart transportation, and others. The smart retail segment is poised to witness significant growth at a CAGR of 24.20% through the forecast period (2024-2031). This expansion is bolstered by several factors such as retailers increasingly leveraging IoT technology to enhance the customer experience, optimize operations, and boost sales.

IoT-enabled solutions such as smart shelves, inventory management systems, and personalized marketing tools enable retailers to offer seamless and personalized shopping experiences. Moreover, the growing emphasis on data-driven decision-making in the retail industry fuels the adoption of IoT applications designed for analytics and insights. Additionally, the proliferation of connected devices and sensors enables retailers to gather real-time data, thereby improving inventory visibility and supply chain efficiency.

By End User

Based on end user, the market is segmented into BFSI, healthcare, travel and hospitality, defense & aerospace, IT & telecommunication, and others. The IT & telecommunication segment secured the largest IoT connectivity market share of 31.53% in 2023. This expansion is stimulated by the telecommunications industry's pivotal role in enabling IoT connectivity by providing the infrastructure and networks necessary for seamless data transmission.

Moreover, telecommunications companies are actively investing in IoT platforms and solutions to capitalize on new revenue streams and address evolving customer demands. Additionally, the increasing adoption of IoT devices in the IT sector, including network infrastructure and data centers, boosts demand for connectivity solutions. As IoT continues to reshape the IT and telecommunications landscape, this segment is set to experience sustained growth and innovation.

IoT Connectivity Market Regional Analysis

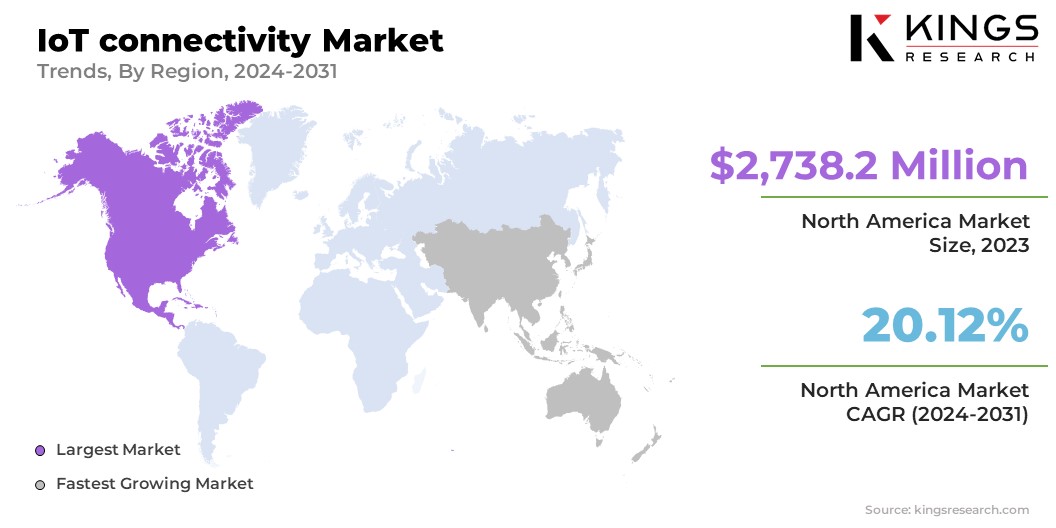

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America IoT connectivity market accounted for a significant share of around 35.16% in 2023, with a valuation of USD 2,738.2 million. This dominance is due to the region's mature and advanced technological infrastructure, which facilitates the widespread adoption of IoT solutions across various industries. Additionally, the region is home to numerous tech giants and innovative startups that are fostering innovation and development in the field of IoT.

Moreover, favorable government policies and regulations support IoT deployment and investment in North America, contributing significantly to its market dominance. Ongoing technological advancements and strategic investments in the region are expected to strengthen its leading position in the IoT connectivity market.

Asia-Pacific is likely to experience robust growth at a CAGR of 22.04% through the estimated timeframe. This rapid expansion is propelled by the region's status as home to some of the world's fastest-growing economies, thereby creating vast opportunities for IoT adoption across various sectors. Moreover, the region's large population and rapid urbanization spur the demand for smart infrastructure and connected devices.

Additionally, supportive government initiatives and increased investments in digital transformation further facilitate IoT adoption in Asia-Pacific. The region is anticipated to emerge as a key hub for IoT innovation and growth in the forecast years, thereby supporting regional market growth.

Competitive Landscape

The IoT connectivity market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in IoT Connectivity Market

- Cisco Systems, Inc.

- emnify

- Hologram

- Huawei Technologies Co., Ltd.

- Orange Business

- Particle Industries, Inc.

- Semtech

- Telefonaktiebolaget LM Ericsson

- Telefónica Global Solutions

- Verizon

Key Industry Developments

- March 2024 (Partnership): XL Axiata partnered with Cisco to launch a cloud-based IoT Connectivity Management Platform in Indonesia, aimed at helping customers securely innovate and scale their IoT businesses. This platform, IoT Connectivity+, offers AI-powered anomaly detection, enterprise-grade security, and cost management features, addressing the complexity of managing diverse IoT endpoints and improving service reliability. The platform supports Indonesia's forecasted growth in IoT connections, expected to reach 404 million by 2028.

- February 2024 (Partnership): Tunstall Healthcare and Telenor IoT partnered to bolster connectivity resilience for Tunstall’s telecare hubs in Europe. Tunstall provided digital care solutions that support millions globally, address challenges in aging populations through streamlined care. The Lifeline Digital telecare hub ensures 24/7 monitoring and assistance, compatible with various sensors to provide personalized care. It detects emergencies for prompt response, thereby enhancing preventive and efficient care delivery.

The global IoT connectivity market is segmented as:

By Component

- Platform

- Services

By Application

- Smart Retail

- Smart Manufacturing

- Connected Health

- Building and Home Automation

- Smart Transportation

- Others

By End User

- BFSI

- Healthcare

- Travel and Hospitality

- Defense & Aerospace

- IT & Telecommunication

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership