Advanced Materials and Chemicals

Iron and Steel Market

Iron and Steel Market Size, Share, Growth & Industry Analysis, By Product Type (Iron Products, Steel Products), By Process [Blast Furnace - Basic Oxygen Furnace (BF-BOF), Electric Arc Furnace (EAF), Open Hearth Furnace (OHF), Others], By Application, and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : January 2025

Report ID: KR1254

Market Definition

The market refers involves the production, distribution, and consumption of iron and steel products. It encompasses the extraction of raw materials, manufacturing of various steel forms, and their use in industries such as construction, transportation, and manufacturing. This market is influenced by factors like supply-demand dynamics, raw material costs, and global economic trends.

Iron and Steel Market Overview

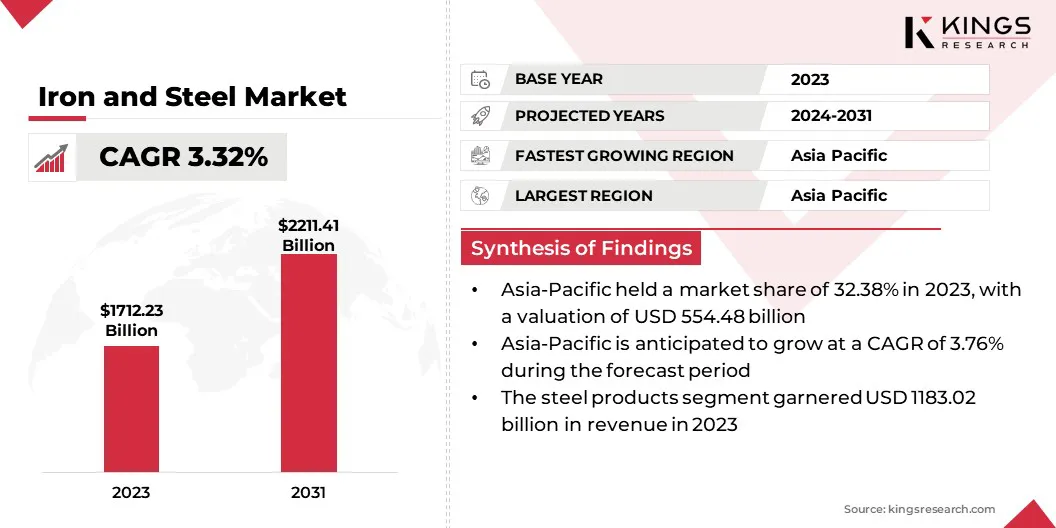

Global iron and steel market size was valued at USD 1712.23 billion in 2023, which is estimated to be valued at USD 1759.09 billion in 2024 and reach USD 2211.41 billion by 2031, growing at a CAGR of 3.32% from 2024 to 2031.

Infrastructure development is a key growth driver for the market, as rising investments in construction and infrastructure projects, particularly in emerging economies, create strong demand for steel in the building of roads, bridges, and urban infrastructure.

Major companies operating in the market are ArcelorMittal S.A, BaoWu Steel Group Corporation Limited, NIPPON STEEL CORPORATION, HBIS GROUP, SHAGANG GROUP Inc, POSCO HOLDINGS., Tata Steel, JFE Steel Corporation, Nucor Corporation, Ansteel Group Corporation Limited, JSW, SAIL, NLMK, Rio Tinto, Vale, and others.

The iron and steel market is a vital component of the global economy, marked by its continuous demand driven by industrial applications. It is highly sensitive to global economic shifts, production efficiency, and environmental regulations.

- In October 2024, South Korea launched an anti-dumping probe into Chinese steel plates, underscoring the market's vulnerability to global economic shifts. According to SEAISI (South East Asia Iron and Steel Institute), the rise in trade investigations reflects concerns over production efficiency and changing trade dynamics.

The market is influenced by factors such as technological innovations, cost fluctuations, and sustainability efforts. As an integral part of global supply chains, it plays a central role in shaping industrial growth, infrastructure development, and the overall economic landscape across regions.

Key Highlights:

- The global iron and steel industry size was recorded at USD 1712.23 billion in 2023.

- The market is projected to grow at a CAGR of 3.32% from 2024 to 2031.

- Asia Pacific held a market share of 32.38% in 2023, with a valuation of USD 554.48 billion and is anticipated to grow at a CAGR of 3.76% during the forecast period

- The steel products segment garnered USD 1183.02 billion in revenue in 2023.

- The blast furnace - basic oxygen furnace (BF-BOF) segment is expected to reach USD 1152.29 billion by 2031.

- The construction and infrastructure segment is anticipated to witness the fastest CAGR of 3.95% during the forecast period

Market Driver

"Urbanization as a Growth Driver in the Iron and Steel Market"

Urbanization significantly drives the demand for iron and steel, as growing urban populations necessitate more infrastructure development. The need for steel in the construction of buildings, roads, bridges, and transportation systems increases in rapidly developing cities.

As more people move to urban areas, there is also a surge in industrial activities that require steel for machinery and production. This trend leads to a continuous rise in steel demand, propelling growth in the iron and steel industry.

- According to projections from the United Nations Population Fund, the global rural population has reached its peak, while urban populations are set to increase by nearly 500 million over the next 15 years and by 2 billion by 2050. The ability to create sustainable cities will be closely linked to the urbanization process and will play a crucial role in determining its overall success.

Market Challenge

"Environmental Regulations"

Environmental regulations present a significant challenge for the iron and steel market, as rising pressure to reduce carbon emissions and adopt sustainable practices can lead to higher production costs and require substantial technological investments. The market can adopt cleaner production technologies, which reduce emissions.

Additionally, increasing the use of recycled steel, government support, and transitioning to renewable energy sources can help lower environmental impact while maintaining cost-efficiency, ensuring long-term sustainability in the industry.

- In May 2024, the Ministry of Steel in India organized a National Workshop on "Forging Sustainability in the Steel Sector," focusing on emission reduction, green hydrogen, carbon capture, and water conservation. The Marginal Abatement Cost tool was introduced to aid companies in prioritizing sustainable technologies.

Market Trend

"Sustainability Initiatives in the Iron and Steel Industry"

A significant trend in the iron and steel market is the growing focus on sustainability initiatives, with increasing emphasis on environmentally friendly production methods. Companies are adopting recycled steel production techniques and exploring low-carbon technologies like green hydrogen and carbon capture.

This shift is driven by both regulatory pressures and consumer demand for more sustainable products. As a result, the market is registering greater investments in green technologies, promoting environmentally conscious practices while spurring market growth in the long term.

- In December 2024, Electra, a low-carbon iron producer, partnered with Interfer Edelstahl Group to advance clean iron production for specialty steel. This collaboration aims to support decarbonization goals, reduce emissions, and promote sustainable, scalable low-carbon iron production for green steel manufacturing.

Iron and Steel Market Report Snapshot

| Segmentation | Details |

| By Product Type | Iron Products (Pig Iron, Direct Reduced Iron (DRI), Cast Iron, Others) and Steel Products (Carbon Steel, Alloy Steel, Stainless Steel, Tool Steel, Others) |

| By Process | Blast Furnace - Basic Oxygen Furnace (BF-BOF), Electric Arc Furnace (EAF), Open Hearth Furnace (OHF), Others |

| By Application | Construction and Infrastructure (Buildings, Bridges, Roads, Airports, Others), Automotive and Transportation (Passenger Vehicles, Commercial Vehicles, Railway Equipment, Aerospace, Others), Industrial Equipment (Machinery, Tools, Equipment Manufacturing, Others), Energy (Power Plants, Oil and Gas, Others), Consumer Goods (Appliances, Furniture, Electronics, Others) & Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Iron Products,Steel Products): The steel products segment earned USD 1183.02 billion in 2023, due to the increasing demand for construction, infrastructure development, and industrial applications, driving higher steel consumption globally.

- By Process [Blast Furnace - Basic Oxygen Furnace (BF-BOF), Electric Arc Furnace (EAF), Open Hearth Furnace (OHF),Others]: The BF-BOF segment held 51.32% share of the market in 2023, due to its cost-effectiveness, high production capacity, and dominance in large-scale steel production.

- By Application (Construction And Infrastructure, Automotive And Transportation, Industrial Equipment, Energy, Consumer Goods, Others): The construction and infrastructure segment is projected to reach USD 947.41 billion by 2031, owing to rapid urbanization, increased government spending on infrastructure projects, and growing demand for sustainable building materials.

Iron and Steel Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 32.38% market share in 2023, with a valuation of USD 554.48 billion. Asia Pacific dominates the global iron and steel market, driven by major production hubs like China, Japan, and India.

China, as the world’s largest producer and consumer of steel, plays a pivotal role in shaping market dynamics. The region’s rapid industrialization, urbanization, and infrastructure development significantly contribute to high demand for steel in sectors such as construction, automotive, and manufacturing.

Additionally, favorable government policies, technological advancements, and investments in sustainable practices further solidify Asia Pacific's leadership in the market.

- According to the World Steel Organization in September 2024, Indonesia’s new capital city, Nusantara, requires 9.5 million tons of steel for its development. Steel will play a crucial role in constructing sustainable infrastructure, including the iconic Garuda Palace.

The market in Europe is poised for significant growth at a robust CAGR of 3.55% over the forecast period. Europe is emerging as a fast-growing region in the iron and steel market, driven by the increasing demand for sustainable steel production and green technologies.

The region is prioritizing eco-friendly manufacturing methods, such as hydrogen-based steelmaking and carbon capture technologies, to meet stringent environmental regulations.

Countries like Germany, Italy, and France are leading the charge in adopting innovative steel production processes, while investments in infrastructure, automotive, and energy sectors continue to fuel growth. Europe’s commitment to sustainability is positioning it as a key player in the evolving global market.

- In February 2024, thyssenkrupp Steel, a Germany-based company, launched a call for tenders to supply hydrogen to its first direct reduction plant as part of its tkH2Steel project. This milestone will help decarbonize steel production, aiming for full hydrogen operation by 2029, significantly reducing CO2 emissions.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In India, the Ministry of Steel provides a set of common minimum guidelines for safety which can act as a minimum safety benchmark for adoption by the Indian steel industry. The Ministry of Steel constituted a core team of experts in the form of a Working Group comprising experts from the stakeholders to facilitate the formulation of these guidelines.

- In the U.S., the Environmental Protection Agency (EPA) governs the iron and steel industry. The regulation covers any facility that is engaged in iron or steel manufacturing, forming, and finishing, including coke manufacturing.

- The European Agency for Safety and Health at Work is a code of practice on safety and health in the market.

Competitive Landscape:

The global iron and steel market is characterized by a number of participants, including both established corporations and rising organizations. Government support plays a crucial role in the growth of the iron and steel industry by offering incentives for green technologies, implementing favorable policies, and funding infrastructure projects.

These initiatives foster innovation, reduce production costs, and promote sustainable practices, enabling the industry to expand and meet future demands efficiently.

- In January 2025, the Union Minister of Steel and Heavy Industries launched Production Linked Incentives (PLI) Scheme 1.1 for specialty steel, aiming to strengthen domestic production, reduce imports, and position India as a global steel powerhouse. The scheme includes five product categories and invites active industry participation to enhance investment and innovation.

List of Key Companies in Iron and Steel Market:

- ArcelorMittal S.A

- BaoWu Steel Group Corporation Limited

- NIPPON STEEL CORPORATION

- HBIS GROUP

- SHAGANG GROUP Inc

- POSCO HOLDINGS.

- Tata Steel

- JFE Steel Corporation

- Nucor Corporation

- Ansteel Group Corporation Limited

- JSW

- SAIL

- NLMK

- Rio Tinto

- Vale

Recent Developments:

- In January 2025, AM/NS India announced that it commissioned two state-of-the-art automotive steel facilities in Hazira, Gujarat, India. These lines will produce advanced, high-strength steel domestically, replacing imports, supporting ‘Atmanirbhar Bharat,’ and meeting the growing demand for quality, value-added steel in the automotive sector.

- In August 2024, AM/NS India launched Optigal, a high-quality colour-coated steel product with a 25-year warranty. Produced domestically in line with the ‘Make in India’ initiative, Optigal offers exceptional corrosion resistance and durability for diverse construction applications.

- In May 2024, Tosyali Algeria announced the operation of its flat steel production plant in Oran Province, Algeria. This first phase of investment will meet national flat steel needs, boost export revenues, and contribute to Algeria’s industrial integration and non-oil exports.

- In October 2024, ArcelorMittal reached an agreement with Nippon Steel to acquire its 50% stake in the AM/NS Calvert Joint Venture. This move follows regulatory concerns related to Nippon Steel’s acquisition of US Steel and aims to strengthen the Calvert facility’s capabilities.

- In August 2024, ArcelorMittal successfully acquired approximately 28.4% of Vallourec’s equity for USD 992 million, following antitrust approval. This strategic investment strengthens ArcelorMittal’s position in the global market, enhancing its long-term growth prospects while fostering synergies within the steel and energy sectors.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership