Energy and Power

Lithium Thionyl Chloride Battery Market

Lithium Thionyl Chloride Battery Market Size, Share, Growth & Industry Analysis, By Product Type (Bobbin Cylindrical Cells, Spiral Cells, Hybrid Cells), By Battery Capacity, By End-use Industry, and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : March 2025

Report ID: KR1420

Market Definition

The Lithium Thionyl Chloride (Li-SOCl2) battery market involves the production and use of batteries that utilize lithium and thionyl chloride as key components. These batteries are known for their high energy density, long shelf life, and reliability in extreme temperatures, making them ideal for applications in medical devices, military, and remote sensing technologies.

Lithium Thionyl Chloride Battery Market Overview

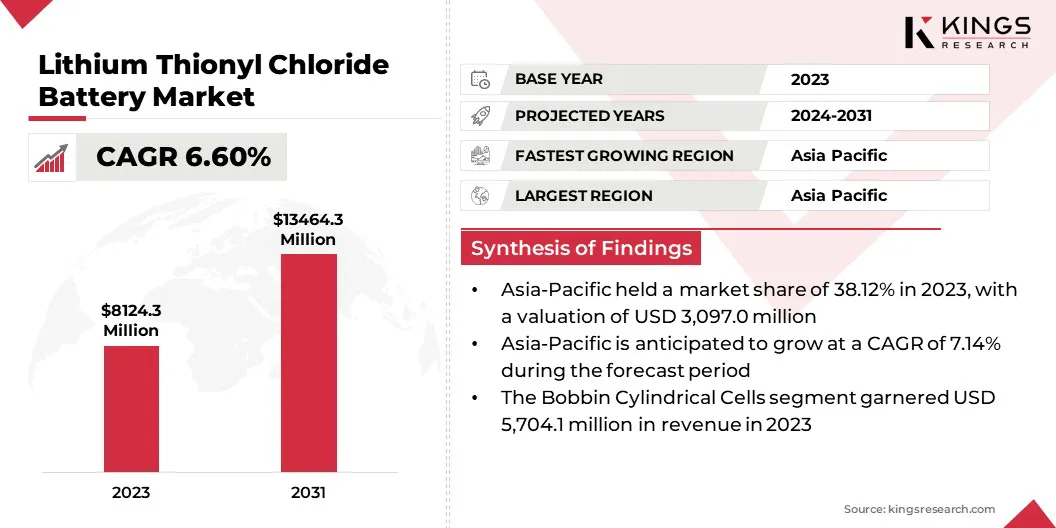

The global lithium thionyl chloride battery market size was valued at USD 8,124.3 million in 2023, which is estimated to be valued at USD 8,606.6 million in 2024 and reach USD 13,464.3 million by 2031, growing at a CAGR of 6.60% from 2024 to 2031.

The growing demand for high-energy density batteries in sectors like medical devices, remote sensing, and military equipment drives the market. These applications require reliable, long-lasting power sources that can perform efficiently in harsh conditions, fueling the market.

Major companies operating in the global lithium thionyl chloride battery industry are Ultralife Corporation, TADIRAN BATTERIES LTD., EVE Energy Co., Ltd., Saft, EaglePicher Technologies, Bren-Tronics, Inc., Hubei Ramway New Energy Technology Co., Ltd, Dongguan Everwin Tech Co., Limited, VITZRO CELL, Maxell, Ltd, Hollingsworth & Vose, Green Energy Battery Co., Ltd,, Shenzhen Malak Industrial Co., Ltd, Konnoc Battery (Taiwan) Co., Ltd, and Ultralife Corporation.

The Lithium Thionyl Chloride (Li-SOCl2) battery market registered significant growth, due to its exceptional energy density, long shelf life, and reliability in extreme conditions. These batteries are increasingly utilized in medical, defense, and remote sensing applications, where consistent and efficient power is crucial.

As technology advances, the market continues to evolve, with improvements in performance and cost-efficiency driving wider adoption of these batteries. The sector is also benefiting from innovations in battery chemistry and design.

- In November 2024, EVE Energy showcased its lithium battery solutions at Gas & Heating China 2024, highlighting high-reliability smart gas meter power solutions. Its lithium thionyl chloride and manganese dioxide batteries offer superior safety, catering to the growing demand for urban safety and smart city infrastructure.

Key Highlights:

- The global lithium thionyl chloride battery market size was valued at USD 8,124.3 million in 2023.

- The market is projected to grow at a CAGR of 6.60% from 2024 to 2031.

- Asia Pacific held a market share of 38.12% in 2023, with a valuation of USD 3,097.0 million.

- The bobbin cylindrical cells segment garnered USD 5,704.1 million in revenue in 2023.

- The up to 5,000 mAh segment is expected to reach USD 5,171.1 million by 2031.

- The automotive electronics segment is anticipated to register the fastest CAGR of 9.01% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 6.98% during the forecast period.

Market Driver

"Rising Need for Compact and Lightweight Power Sources"

The increasing demand for compact, lightweight, and high-performance power sources in consumer electronics and IoT devices is a key growth driver of the Lithium Thionyl Chloride (Li-SOCl2) battery market.

These batteries, known for their high energy density and long shelf life, are ideal for powering small, portable devices that require reliable performance. As IoT and wearable technologies continue to advance, the need for efficient, space-saving energy solutions boosts the adoption of Li-SOCl2 batteries across various consumer applications.

- In October 2023, researchers from the Qingdao Institute of Bioenergy and Bioprocess Technology (QIBEBT) advanced Lithium Thionyl Chloride (Li-SOCl2) batteries by incorporating iodine into the electrolyte, enabling faster discharge rates and making them rechargeable. This innovation enhances the practicality of Li-SOCl2 batteries for consumer electronics and IoT devices, supporting their growth in energy storage applications.

Market Challenge

"High Cost"

One major challenge faced by the Lithium Thionyl Chloride (Li-SOCl2) battery market is the high manufacturing and raw material costs, which make these batteries more expensive than other chemistries. This can limit its adoption, particularly in cost-sensitive applications.

Ongoing research into optimizing production processes, reducing material costs, and improving battery efficiency could help make Li-SOCl2 batteries more affordable. Additionally, scaling up production and exploring alternative, cost-effective materials could drive down overall costs and broaden market accessibility.

Market Trend

"Recycling"

Recycling has emerged as a significant trend in the Lithium Thionyl Chloride (Li-SOCl2) battery market, due to growing environmental concerns and regulatory pressures.

As demand for these batteries increases, efforts are being made to develop more efficient recycling processes to recover valuable materials such as lithium and thionyl chloride. These initiatives not only reduce environmental impact but also address the limited supply of raw materials, contributing to sustainability and resource conservation in the battery industry.

- In October 2024, Cellcycle hosted representatives from Benchmark Mineral Intelligence and Rho Motion at its facilities, showcasing innovative battery recycling processes. The visit highlighted their pioneering bio-based methods for recovering critical minerals like lithium, emphasizing the growing trend of sustainable solutions in the lithium thionyl chloride battery market.

Lithium Thionyl Chloride Battery Market Report Snapshot

|

Segmentation |

Details |

|

By Product Type |

Bobbin Cylindrical Cells (Standard Bobbin Cells, High-capacity Bobbin Cells, Extended Temperature Bobbin Cells), Spiral Cells (High-pulse Spiral Cells, Fast-discharge Spiral Cells, Rechargeable Spiral Cells) Hybrid Cells (Medium-pulse Hybrid Cells, High-pulse Hybrid Cells) |

|

By Battery Capacity |

Up to 5,000 mAh, 5,000 mAh-10,000 mAh, 10,000 mAh-15,000 mAh, Above 15,000 mAh |

|

By End-Use Industry |

Utility Metering, Automotive Electronics, Medical Devices, Military & Aerospace, Consumer Electronics & Industrial Automation |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Bobbin Cylindrical Cells, Spiral Cells, Hybrid Cells): The bobbin cylindrical cells segment earned USD 5,704.1 million in 2023, due to their high energy density, long shelf life, and reliability in critical applications like utility metering and remote sensing.

- By Battery Capacity (Up to 5,000 mAh, 5,000 mAh-10,000 mAh, 10,000 mAh-15,000 mAh, Above 15,000 mAh): The up to 5,000 mAh segment held 38.12% share of the market in 2023, due to its widespread adoption in compact consumer electronics and IoT devices requiring efficient, long-lasting power sources.

- By End-use Industry (Utility Metering, Automotive Electronics, Medical Devices, Military & Aerospace, Consumer Electronics & Industrial Automation,): The utility metering segment is projected to reach USD 4,594.5 million by 2031, owing to the increasing demand for reliable, long-duration power solutions for smart meters and critical infrastructure monitoring.

Lithium Thionyl Chloride Battery Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a lithium thionyl chloride battery market share of around 38.12% in 2023, with a valuation of USD 3,097.0 million. Asia holds a dominant position in the market, driven by the significant demand for high-energy-density batteries in applications such as utility metering, medical devices, and industrial automation in the region.

Countries like China, Japan, and South Korea lead in battery production, research, and development. The region's strong manufacturing capabilities, combined with increasing industrialization and urbanization, support the widespread adoption of Li-SOCl2 batteries, reinforcing Asia's key role in the global market.

- According to the Organization for Research in China and Asia (Feb 2024), China’s control over the lithium supply chain boosts its dominance in the market, securing resources crucial for battery production, EVs, and other applications.

The lithium thionyl chloride battery industry in North America is poised for significant growth at a robust CAGR of 6.98% over the forecast period. North America is emerging as the fastest-growing region in the market, driven by the rapid expansion of smart city initiatives, IoT, and wearable electronics.

The increasing adoption of sustainable and efficient energy storage solutions in sectors like automotive, medical, and defense technology is propelling the market. Furthermore, significant investments in R&D, alongside government initiatives supporting green technologies, are fostering innovation and boosting the demand for high-performance, reliable batteries in North America.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) protects people and the environment from significant health risks, sponsors and conducts research, and develops and enforces environmental regulations.

- The European Union (EU) adopted a new Batteries Regulation in 2023 aimed at reducing the environmental impacts of batteries throughout their lifecycle. This new regulation replaces the 2006 EU Batteries Directive and presents key considerations for U.S. exporters entering or expanding in the EU market.

Competitive Landscape:

The global lithium thionyl chloride battery market is characterized by a large number of participants, including established corporations and rising organizations. Companies in the market often form strategic partnerships to drive innovation, enhance battery performance, recycle, and expand market presence.

- In September 2024, Cellcycle Ltd and Teshub Energy signed an MOU to advance the repurposing and reuse of lithium batteries, focusing on sustainable energy solutions. This strategic partnership aims to enhance lithium battery recycling, reduce environmental impact, and promote economic and resource conservation, especially for lithium thionyl chloride batteries, within various sectors like e-mobility, healthcare, and energy storage.

These collaborations include joint ventures with research institutions for advanced technologies, supply chain alliances for material sourcing, and partnerships with recycling firms to promote sustainability. Such partnerships help companies improve efficiency, navigate regulations, and stay competitive.

List of Key Companies in Lithium Thionyl Chloride Battery Market:

- Ultralife Corporation

- TADIRAN BATTERIES LTD.

- EVE Energy Co., Ltd.

- Saft

- EaglePicher Technologies

- Bren-Tronics, Inc.

- Hubei Ramway New Energy Technology Co., Ltd

- Dongguan Everwin Tech Co., Limited

- VITZRO CELL

- Maxell, Ltd

- Hollingsworth & Vose

- Green Energy Battery Co., Ltd,

- Shenzhen Malak Industrial Co., Ltd

- Konnoc Battery (Taiwan) Co., Ltd

- Ultralife Corporation

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership