ICT-IOT

Managed Network Services Market

Managed Network Services Market Size, Share, Growth & Industry Analysis, By Deployment (On-premises and Cloud-based), By Organization Size (Small and Medium Enterprises, and Large Enterprises), By Service Type, By Vertical, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR241

Managed Network Services Market Size

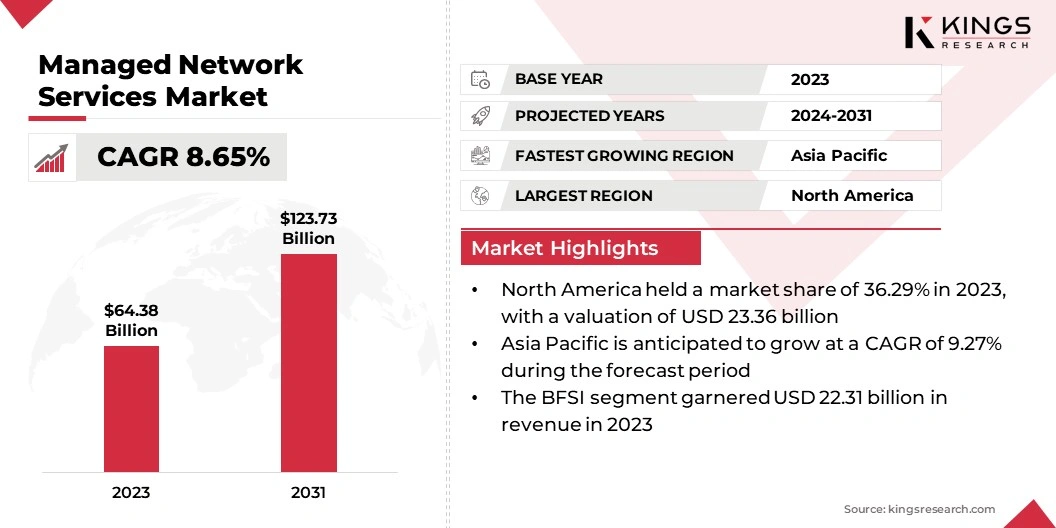

Global Managed Network Services Market size was recorded at USD 64.38 billion in 2023, which is estimated to be at USD 69.23 billion in 2024 and projected to reach USD 123.73 billion by 2031, growing at a CAGR of 8.65% from 2024 to 2031. Rising integration of AI and machine learning in network management is anticipated to offer lucrative opportunities for market development. In the scope of work, the report includes services offered by companies such as Verizon, Telefonaktiebolaget LM Ericsson, Fujitsu, Accenture, Amazon Web Services, Inc., Wipro, Lumen Technologies, Kyndryl Inc., Sierra Wireless, Telstra Corporation Limited, NTT Ltd, and others.

The demand for network security solutions within the managed network services market is surging due to the rising prevalence of cyber threats and attacks. Organizations across all industries are increasingly aware of the critical need to safeguard their sensitive data and maintain robust cybersecurity measures. This increased awareness is further fueled by the significant financial, reputational, and operational damages that cyber breaches can inflict. Due to this, businesses are investing heavily in managed network security services to ensure comprehensive protection against various cyber threats such as malware, ransomware, and phishing attacks.

These services offer continuous monitoring, advanced threat detection, and rapid incident response, all of which are crucial for mitigating risks in real-time. The increasing complexity of network environments, with the integration of IoT devices and cloud-based applications, highlights the need for advanced security solutions to manage potential vulnerabilities effectively. The growing need for robust network security is a major factor influencing the managed network services market.

Managed network services refer to the comprehensive outsourcing of a company’s networking functions to a third-party service provider. These services encompass the complete management, maintenance, and support of network infrastructure, including routers, switches, firewalls, and other critical networking components. Deployment of managed network services typically involves a thorough assessment of the organization's current network architecture, followed by the implementation of customized solutions specifically designed to meet specific operational requirements.

Service providers offer a range of services such as network monitoring, security management, performance optimization, and troubleshooting. These services ensure continuous network uptime, enhance security measures, and improve overall network efficiency. Industries that heavily rely on managed network services include banking and finance, healthcare, manufacturing, retail, and telecommunications. In these sectors, robust and reliable network performance is essential for daily operations, data management, and customer interactions. Managed network services allow organizations to focus on their core business activities while ensuring efficient management and maintenance of their network infrastructure, leading to increased productivity and reduced operational costs.

Analyst’s Review

Key industry players are adopting strategic initiatives to secure their market positions and foster growth. These strategies include innovations and launch to expand their service portfolios and geographical reach.In addition, significant investments in research and development are made to foster innovation and leverage technological advancements.

- For instance, in May 2023, Kyndryl unveiled a new managed Secure Access Service Edge (SASE) solution in collaboration with Fortinet, specifically designed to empower customers in advancing their network security strategies. This solution integrates Fortinet’s top-tier cloud-delivered security and networking solutions with Kyndryl’s expertise in network and security services, facilitating the modernization of critical networking infrastructure across diverse industries.

Companies are further focusing on forming strategic partnerships and alliances to enhance their service offerings and tap into new customer segments. Current growth trends indicate a substantial increase in the adoption of cloud-based and AI-driven managed network services, reflecting the industry's notable shift toward more advanced and efficient network management solutions. The imperatives for key market players include the continuous enhancement of service quality, the ability to provide customized and scalable solutions, and the necessity to maintain high levels of security and compliance with regulatory standards.

Additionally, customer-centric approaches, such as offering flexible pricing models and comprehensive support services, are crucial for retaining clients and attracting new business. The managed network services market is poised to witness robust growth in the forthcoming years, mainly due to ongoing technological advancements and increasing demand for efficient network management solutions.

Managed Network Services Market Growth Factors

The increased adoption of cloud-based services is a significant trend boosting the expansion of the market. Organizations are rapidly shifting to cloud-based solutions to leverage their inherent benefits such as scalability, flexibility, and cost-efficiency. Cloud-based services allow businesses to scale their network infrastructure quickly and easily, without the need for substantial upfront investments in hardware and software. This shift enables companies to respond promptly to changing business demands and market conditions.

Additionally, cloud-based managed network services offer improved disaster recovery capabilities and enhanced collaboration tools, which are vital for modern business operations. The ongoing digital transformation across diverse industries is further propelling the demand for cloud services, as companies increasingly seek to modernize their IT environments and foster innovation. Service providers are capitalizing on this trend by offering a wide array of cloud-managed network solutions that cater to different business needs, from basic network management to advanced security and analytics. The widespread adoption of cloud-based services is significantly contributing to the growth and evolution of the managed network services market, enabling organizations to achieve greater operational efficiency and competitiveness.

High initial investment costs represent a significant restraint in the market, particularly for small and medium-sized enterprises (SMEs). Implementing managed network services often requires substantial capital expenditure on new hardware, software, and infrastructure upgrades. Additionally, the transition to managed services involves extensive planning, integration, and potential disruption to existing operations, further escalating costs. For numerous organizations, especially those with limited financial resources, these upfront expenses act as a major deterrent.

Furthermore, the cost of hiring skilled IT professionals to manage and maintain these services adds to the financial burden. Despite the long-term benefits and cost savings associated with managed network services, the initial outlay can be prohibitively high, making it challenging for smaller businesses to justify the investment. Service providers are aware of this challenge and are increasingly offering flexible pricing models, such as subscription-based or pay-as-you-go plans, to mitigate the financial impact. Nonetheless, the high initial costs remain a significant barrier to entry, slowing down the adoption rate among cost-conscious businesses.

Managed Network Services Market Trends

The emergence of AI and machine learning in network management is a transformative trend within the managed network services market. These advanced technologies are revolutionizing the delivery and optimization of network services. AI and machine learning enable proactive network monitoring and management by predicting potential issues before they occur, thereby minimizing downtime and enhancing overall network reliability. These technologies facilitate automated troubleshooting and resolution, thus reducing the need for human intervention and speeding up response times to network incidents.

Furthermore, AI-driven analytics provide deep insights into network performance, allowing for more informed decision-making and strategic planning. This level of automation and intelligence is particularly valuable in handling the increasing complexity of modern network environments, which include a mix of traditional, cloud-based, and IoT networks. By integrating AI and machine learning into their offerings, service providers are aiming to deliver more efficient, reliable, and scalable solutions to their clients.

Segmentation Analysis

The global market is segmented based on deployment, organization size, service type, vertical, and geography.

By Deployment

Based on deployment, the managed network services market is categorized into on-premises and cloud-based. The cloud-based segment is poised to record a staggering CAGR of 9.18% through the forecast period, reflecting significant momentum and widespread adoption of cloud technologies across various industries. Businesses are increasingly migrating their operations to the cloud to benefit from its scalability, flexibility, and cost-efficiency.

The cloud enables organizations to quickly adapt to changing market demands and scale their IT resources without the need for substantial capital investment in physical infrastructure. The ongoing digital transformation initiatives across diverse sectors such as healthcare, finance, retail, and manufacturing are leading to an increased demand for cloud-based managed network services. These services provide enhanced disaster recovery, data backup, and business continuity capabilities, which are essential in fast-paced business environment.

Additionally, advancements in cloud technologies, including improved security measures and compliance with regulatory standards, are prompting enterprises to adopt cloud solutions. Moreover, service providers are expanding their cloud offerings and investing heavily in advanced technologies such as AI and machine learning to deliver more intelligent and efficient network management.

By Service Type

Based on service type, the market is classified into managed local area network (LAN), managed wide area network (WAN), managed wi-fi, and others. The managed wide area network (WAN) segment captured the largest managed network services market share of 39.67% in 2023, mainly propelled by its critical role in connecting geographically dispersed locations and ensuring seamless communication across large enterprises. Managed WAN services are essential for organizations with multiple branches, remote offices, and data centers to maintain a reliable and secure network infrastructure.

The increasing reliance on cloud applications and services has further emphasized the need for robust WAN solutions to ensure efficient and uninterrupted access to these resources. Additionally, the growing trend of remote work and the need for secure remote access has bolstered the demand for managed WAN services. These services provide optimized connectivity, bandwidth management, and enhanced security features, which are crucial for maintaining the performance and integrity of enterprise networks.

Furthermore, the rise of software-defined WAN (SD-WAN) technology, which offers greater flexibility, cost savings, and improved network performance, has significantly contributed to the growth of the managed WAN segment. By adopting SD-WAN, organizations are achieving better control over their network traffic and ensuring a more efficient use of their network resources.

By Vertical

Based on vertical, the market is divided into BFSI, IT & telecommunication, healthcare, retail, manufacturing, and others. The BFSI segment garnered the highest revenue of USD 22.31 billion in 2023. The BFSI industry is highly data-intensive, requiring a robust and secure network infrastructure to manage vast amounts of sensitive information and facilitate real-time transactions. The increasing digitization of banking services, including mobile banking, online payments, and digital wallets, has spurred the demand for reliable managed network services to ensure seamless and secure operations.

Additionally, the stringent regulatory requirements and compliance standards in the BFSI sector necessitate the implementation of advanced network security measures to protect against cyber threats and data breaches. Managed network services provide the necessary security protocols, continuous monitoring, and threat detection capabilities to safeguard financial data. Furthermore, the growing adoption of cloud computing and fintech solutions within the BFSI sector has further fueled the need for managed network services that possess the ability to support these technologies and ensure efficient connectivity.

Managed Network Services Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America managed network services market share stood around 36.29% in 2023 in the global market, with a valuation of USD 23.36 billion. This substantial growth is mainly augmented by the region's advanced technological infrastructure and the widespread adoption of innovative IT solutions among businesses. North American companies, particularly in the United States and Canada, are early adopters of advanced networking technologies, including cloud computing, IoT, and AI-driven solutions. The high concentration of large enterprises and tech-savvy SMBs in the region further contributes to the rising demand for managed network services to ensure optimal performance, security, and scalability of their network infrastructures.

- For instance, in April 2024, Lumen Technologies secured a USD 73.6 million contract to modernize the network, data, voice, and video connectivity for the U.S. Government Accountability Office (GAO). Under this agreement, Lumen deliver secure managed network services, virtual private network services, ethernet transport services, internet protocol services, videoconferencing services, and voice and toll-free services to support GAO's auditing, evaluation, and investigative functions for Congress.

Moreover, the increasing prevalence of cyber threats and stringent regulatory compliance requirements are compelling organizations to invest in robust managed network security services. The presence of leading managed network service providers and a well-established IT ecosystem in North America further strengthens the region's leading position. These providers offer a wide range of tailored services, catering to the diverse needs of various industries such as healthcare, finance, and retail.

Asia-Pacific is poised to grow at a robust CAGR of 9.27% in the forthcoming years, primarily due to rapid economic development, increasing digital transformation initiatives, and the widespread adoption of advanced technologies across the region. Countries such as China, India, Japan, and South Korea are investing heavily in modernizing their IT and network infrastructures. The proliferation of internet connectivity and mobile devices in these countries is leading to a surge in data traffic, underscoring the necessity for efficient managed network services to meet the increased demand.

Additionally, the rise of smart cities, e-commerce, and digital banking in Asia-Pacific is accelerating the need for reliable and secure network management solutions. Governments and enterprises in the region are increasingly recognizing the importance of robust network services to support their digital agendas and enhance operational efficiencies.

Moreover, the growing presence of multinational corporations and tech startups in Asia-Pacific is boosting the demand for managed network services, as these organizations seek to optimize their network performance and security. With a young and tech-savvy population, along with a favorable regulatory environment, Asia-Pacific is set to emerge as a major hub for managed network services, thereby propelling managed network services market growth in the forthcoming years.

Competitive Landscape

The managed network services market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Managed Network Services Market

- Verizon

- Telefonaktiebolaget LM Ericsson

- Fujitsu

- Accenture

- Amazon Web Services, Inc.

- Wipro

- Lumen Technologies

- Kyndryl Inc.

- Sierra Wireless

- Telstra Corporation Limited

- NTT Ltd

Key Industry Developments

- April 2024 (Partnership): Microland achieved Elite Plus status with Juniper Networks, which acknowledges Microland's strong commitment to Juniper and its potential for sustained growth. Through this program, Microland plans to co-develop a Network as a Service (NaaS) offering, integrating Juniper's AI-Native Networking solutions with Microland's Intelligeni NetOps platform. This collaboration aims to enhance network operations efficiency and user experience for global enterprises.

- March 2024 (Collaboration): Kyndryl and Cloudflare collaborated to facilitate enterprise migration and management of multicloud networks with enhanced security. This partnership leverages Kyndryl's comprehensive consulting services in enterprise networking, security, and resilience, along with Cloudflare's robust connectivity cloud, to deliver integrated solutions that prioritize optimal security, performance, and cloud flexibility.

- August 2023 (Partnership): Verizon Business unveiled a strategic global partnership designating HCLTech as its principal collaborator for managed network services (MNS) in global enterprise networking deployments. This alliance leverages Verizon’s extensive networking capabilities and scalability with HCLTech’s renowned Managed Service expertise, with the aim of revolutionizing large-scale wireline service delivery for enterprise clients.

- July 2023 (Launch): Lumen Technologies introduced a pivotal feature on its Network-as-a-Service (NaaS) platform, marking a significant stride toward its ambitious goal of revolutionizing the telecom sector. This initiative empowers customers with unprecedented flexibility in purchasing, utilizing, and overseeing networking services, effectively transforming conventional telecom into a cloud-centric model.

The global managed network services market is segmented as:

By Deployment

- On-premises

- Cloud-based

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Service Type

- Managed Local Area Network (LAN)

- Managed Wide Area Network (WAN)

- Managed Wi-Fi

- Others

By Vertical

- BFSI

- IT & Telecommunication

- Healthcare

- Retail

- Manufacturing

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)