Managed Wi-Fi Market

Managed Wi-Fi Market Size, Share, Growth & Industry Analysis, By Component (Solutions and Services), By Networking Services (Network Auditing & Testing, Network Consulting, Configuration & Change Management & Others), By Infrastructure Services, By Industrial Vertical and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR877

Managed Wi-Fi Market Size

The global Managed Wi-Fi Market size was valued at USD 3,990.2 million in 2023 and is projected to grow from USD 4,439.5 million in 2024 to USD 10,040.0 million by 2031, exhibiting a CAGR of 12.36% during the forecast period. The expansion of the market is driven by increasing internet penetration, the growing adoption of smart devices, the rise in remote working, and advancements in Wi-Fi technologies such as Wi-Fi 6 and Wi-Fi 6E.

In the scope of work, the report includes solutions offered by companies such as Arista Networks, Cisco Systems, Inc., Comcast Corporation, Fujitsu, Hewlett Packard Enterprise Development LP, Purple, Rogers Communications Inc., Ruckus Commscope, Verizon, Vodafone Idea Limited and others.

The growth of the managed Wi-Fi market is propelled by increasing internet penetration and the growing adoption of smart devices, highlighting the need for robust and reliable network solutions. Businesses are increasingly outsourcing their Wi-Fi management to focus on core operations, thus fueling market growth.

Additionally, the rise in remote working and online learning has surged demand for high-quality wireless connectivity. Managed Wi-Fi services offer scalability, enhanced security, and superior performance, making them appealing to enterprises and educational institutions. The proliferation of the Internet of Things (IoT) devices further highlights the demand for sophisticated network management solutions, thus supporting market expansion. Moreover, advancements in Wi-Fi technologies such as Wi-Fi 6 and Wi-Fi 6E contribute significantly to market development.

- According to the World Bank as of December 2023, global internet penetration reached 63.5%, signifying a vast and growing user base for Wi-Fi services.

The market encompasses service providers who offer comprehensive Wi-Fi management solutions, including design, deployment, and maintenance. This market serves various sectors such as healthcare, retail, hospitality, and education, where seamless connectivity is crucial. North America leads the market due to advanced infrastructure and high technology adoption, followed by Europe and Asia-Pacific.

The market is highly competitive, with major players focusing on technological innovations and strategic partnerships to gain a competitive edge. Small and medium-sized enterprises (SMEs) are increasingly adopting managed Wi-Fi services due to cost-effectiveness and operational efficiency. As digital transformation continues, the demand for managed Wi-Fi services is expected to rise significantly.

Managed Wi-Fi refers to outsourced services wherein a third-party provider manages the end-to-end deployment, operation, and maintenance of Wi-Fi networks. These services include the provision of hardware, software, and technical support, thereby ensuring optimal network performance and security. Managed Wi-Fi solutions are designed to cater to various business environments, from small offices to large enterprises, offering scalability and flexibility.

The service model typically involves a subscription-based pricing structure, enabling businesses to access cutting-edge technology without significant capital expenditure. Managed Wi-Fi differs from traditional Wi-Fi setups due to its proactive monitoring, rapid issue resolution, and enhanced security measures, thereby ensuring uninterrupted and secure connectivity.

Analyst’s Review

Managed Wi-Fi Market manufacturers are intensifying their focus on innovation and new product development. These efforts include the development of AI-driven analytics for proactive network management and the integration of the latest advancements such as Wi-Fi 6E technology to enhance performance and capacity. These advancements cater to the rising demand for reliable, high-speed wireless connectivity across diverse industries.

Moreover, strategic partnerships and acquisitions are pivotal in expanding market reach and capabilities, thus fostering competitive advantage. To capitalize on growth opportunities, manufacturers are recommended to prioritize cybersecurity enhancements and regulatory compliance, given the increasing sophistication of cyber threats.

Additionally, expanding service portfolios to include comprehensive managed Wi-Fi solutions tailored to specific industry needs further bolster market presence. Adopting agile business models and customer-centric strategies is likely to be essential for sustained success in this dynamic market landscape.

- In October 2023, Nokia announced the signing of an agreement with TATA Play Fiber to launch a WiFi6-ready broadband network in India. Nokia supplied Wi-Fi equipment and fiber-to-the-home, including optical network terminal, optical line terminal, Wi-Fi mesh Beacons, and Wi-Fi 6. This deployment offers high-speed internet, enhanced security with WPA3, and low latency for gaming. The Mesh technology ensures seamless coverage, and AI/ML software optimizes network performance and user experience. These strategic partnerships are anticipated to transform the global market.

Managed Wi-Fi Market Growth Factors

A key factor driving the growth of the managed Wi-Fi market is the increasing demand for secure and reliable wireless connectivity across diverse sectors. Organizations are continuously expanding their digital footprint, highlighting the need fro robust Wi-Fi networks that support a growing number of connected devices and applications. Managed Wi-Fi service providers offer expertise in designing and implementing scalable solutions that meet specific business needs.

They ensure continuous monitoring and proactive maintenance, optimizing network performance and enhancing security against evolving cyber threats. This proactive approach boosts operational efficiency and minimizes downtime, enabling businesses to focus on core activities without the concerns of network management complexities.

Ensuring seamless integration of new Wi-Fi technologies with existing IT infrastructures and legacy systems presents a significant challenge. Numerous organizations face compatibility issues when upgrading to managed Wi-Fi solutions, which disrupt operations if not addressed promptly. To overcome this challenge, service providers emphasize comprehensive assessment and planning before implementation. They conduct thorough compatibility tests, to ensure that new Wi-Fi systems seamlessly integrate with existing networks and applications.

Additionally, leveraging interoperable technologies and standards ensures smooth transitions and minimizes disruptions. Continuous communication and collaboration between service providers and clients throughout the integration process are crucial to identifying and resolving compatibility issues promptly, thereby facilitating a smooth deployment of managed Wi-Fi solutions.

Managed Wi-Fi Market Trends

The increasing adoption of cloud-managed Wi-Fi solutions is a prominent trend in the market. Organizations are shifting toward cloud-based management platforms due to their scalability, flexibility, and cost-effectiveness. Cloud solutions enable centralized control and monitoring of Wi-Fi networks across multiple locations, allowing businesses to easily scale their infrastructure as per demand.

Moreover, cloud-managed Wi-Fi offers enhanced security features, such as real-time threat detection and automated updates, ensuring continuous protection against cyber threats. This trend is further driven by the growing need for agile and responsive network management solutions that support digital transformation initiatives and accommodate the growing number of connected devices.

The managed Wi-Fi market is evolving due to the integration of artificial intelligence (AI) and machine learning (ML) technologies. AI-powered analytics and automation capabilities are revolutionizing Wi-Fi network management by providing predictive insights, optimizing performance, and preemptively resolving issues. Machine learning algorithms analyze network data in real-time to identify patterns and anomalies, thereby enhancing network efficiency and reliability.

AI-driven Wi-Fi management systems dynamically adjust network parameters based on usage patterns and environmental factors, aiming to improve optimal performance and user experience. This trend is fueled by the pressing need to minimize downtime, improve operational efficiency, and deliver seamless connectivity in increasingly complex and demanding environments.

Segmentation Analysis

The global market is segmented based on component, networking services, infrastructure services, industrial vertical, and geography.

By Component

Based on component, the market is categorized into solutions and services. The solutions segment led the managed Wi-Fi market in 2023, reaching a valuation of USD 2,335.5 million. This growth is attributed to the increasing demand for comprehensive Wi-Fi management solutions that encompass hardware, software, and cloud-based platforms.

Organizations increasingly prefer integrated solutions that offer scalability, enhanced security features, and centralized management capabilities. Solution providers focus on innovation by introducing advanced technologies such as AI-driven analytics and Wi-Fi 6E compatibility, tailored to cater to evolving business needs. Moreover, the growing shift toward managed services models prompts businesses to invest in robust Wi-Fi solutions to streamline operations and ensure seamless connectivity across diverse environments.

By Networking Services

Based on networking services, the market is classified into network auditing & testing, network consulting, configuration & change management, network security, and network planning & designing. The network security segment is poised to witness significant growth at a CAGR of 13.70% through the forecast period (2024-2031). This expansion is propelled by rising cybersecurity threats and stringent regulatory requirements, prompting organizations to prioritize robust security measures for their Wi-Fi networks.

Managed Wi-Fi service providers offer advanced security solutions, including intrusion detection systems, encryption protocols, and real-time threat intelligence. The widespread adoption of AI and machine learning for threat detection and mitigation further enhances the appeal of managed security services, ensuring proactive defense against evolving cyber threats.

By Industrial Vertical

Based on infrastructure services, the market is segmented into survey and analysis, installation and provisioning, wireless infrastructure maintenance and management, system integration and upgradation, and training and support. The wireless infrastructure maintenance and management segment secured the largest managed Wi-Fi market share of 31.98% in 2023.

This growth is facilitated by the increasing deployment of wireless networks across various sectors, highlighting the need for regular maintenance and efficient management to ensure optimal performance and reliability. Managed service providers offer proactive monitoring, periodic updates, and troubleshooting services to minimize downtime and maximize network uptime. Additionally, the demand for scalable and cost-effective solutions fuels the adoption of managed Wi-Fi services for comprehensive infrastructure management and support.

Managed Wi-Fi Market Regional Analysis

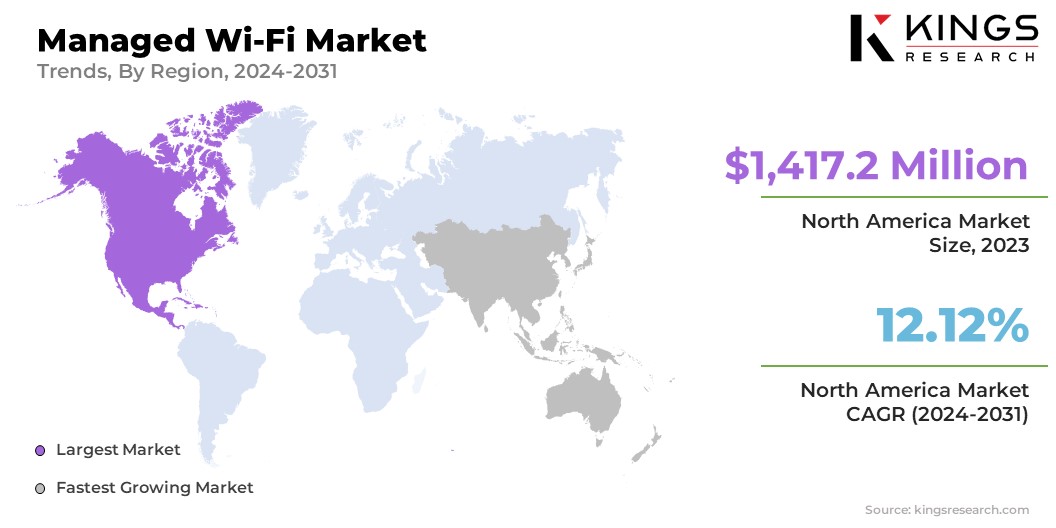

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America managed Wi-Fi market market held a share of around 35.52% in 2023, with a valuation of USD 1,417.2 million. This region's dominance is attributed to advanced technological infrastructure, widespread adoption of digital transformation initiatives, and high internet penetration rates.

Enterprises in North America prioritize seamless connectivity and robust network management solutions to support diverse operations across diverse industries such as healthcare, finance, and retail. Moreover, the presence of key market players and ongoing investments in research and development further bolster the growth of the North America market.

Asia-Pacific is set to experience significant growth at a robust CAGR of 14.42% through the projection period. This rapid growth is fostered by increasing digitalization initiatives, rapid urbanization, and expanding internet access across emerging economies such as China, India, and Southeast Asia. Organizations in Asia-Pacific are increasingly adopting managed Wi-Fi services to enhance operational efficiency, accommodate remote work trends, and support burgeoning e-commerce activities.

Furthermore, government initiatives promoting smart city developments and investments in 5G infrastructure contribute to the growing adoption of advanced Wi-Fi technologies. The rising demand for reliable and scalable network solutions, fueled by digital transformation, is supporting the rapid growth of the Asia-Pacific market.

Competitive Landscape

The managed Wi-Fi market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Managed Wi-Fi Market

- Arista Networks

- Cisco Systems, Inc.

- Comcast Corporation

- Fujitsu

- Hewlett Packard Enterprise Development LP

- Purple

- Rogers Communications Inc.

- Ruckus Commscope

- Verizon

- Vodafone Idea Limited

Key Industry Developments

- October 2023 (Launch): Sparklight Business launched Business Wi-Fi Plus, a mesh Wi-Fi solution tailored for small-to-medium-sized businesses. Developed iIn collaboration with eero, this service utilized Wi-Fi 6 technology and eero Pro6E to ensure seamless coverage and reliable connectivity, supporting speeds up to 1 Gigabytes. TrueMesh technology optimized data transmission, enhancing performance across various business environments.

- March 2024 (Launch): Airties announced the commercial launch of Orbit, a continuous test automation platform. It aimed to address industry challenges by ensuring consistent data accuracy and performance across various embedded software, Wi-Fi chipsets, and hardware such as extenders and gateways. Orbit enables broadband operators and suppliers to resolve Wi-Fi performance issues, validate data during software updates, and expedite managed Wi-Fi deployments through self-certification.

The global managed Wi-Fi market is segmented as:

By Component

- Solutions

- Services

By Networking Services

- Network Auditing & Testing

- Network Consulting

- Configuration & Change Management

- Network Security

- Network Planning & Designing

By Infrastructure Services

- Survey and Analysis

- Installation and Provisioning

- Wireless Infrastructure Maintenance and Management

- System Integration and Upgradation

- Training and Support

By Industrial Vertical

- IT and Telecommunications

- Retail

- Banking, Financial Services, and Insurance

- Government and Public Sector

- Healthcare

- Transportation, Logistics, and Hospitality

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership