Healthcare Medical Devices Biotechnology

Medical Device Testing Market

Medical Device Testing Market Size, Share, Growth & Industry Analysis, By Service (Testing, Inspection, Certification, Others), By Sourcing (In-house, Outsourced), By Device Class (Class I, Class II, Class III), By Technology, and Regional Analysis, 2024-2031

Pages : 148

Base Year : 2023

Release : October 2024

Report ID: KR147

Medical Device Testing Market Size

The global Medical Device Testing Market size was valued at USD 11.44 billion in 2023 and is projected to grow from USD 12.03 billion in 2024 to USD 17.71 billion by 2031, exhibiting a CAGR of 5.68% during the forecast period. The market is expanding due to rapid technological innovations and the increasing complexity of medical devices. This growth is further driven by the rise in regulatory scrutiny for safety and quality, especially in emerging markets.

Additionally, the rising focus on personalized medicine and the integration of IoT in healthcare devices are boosting the demand for precise and thorough testing, ensuring compliance with evolving industry standards.

In the scope of work, the report includes solutions offered by companies such as SGS Société Générale de Surveillance SA, Laboratory Corporation of America Holdings, Nelson Laboratories, LLC, TÜV SÜD, Charles River Laboratories., North American Science Associates, LLC, Eurofins Scientific, Pace Analytical Services LLC, Intertek Group Plc, WuXi AppTec, and others.

The medical device testing market is experiencing significant growth, driven by the rising demand for advanced devices due to the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions.

- As of 2023, the Institute for Health Metrics and Evaluation (IHME) reports that more than half a billion people worldwide have diabetes, a number projected to exceed 1.3 billion within the next 30 years, affecting every country. The current global prevalence rate is 6.1%, with North Africa and the Middle East having the highest rate at 9.3%, anticipated to increase to 16.8% by 2050. Additionally, Latin America and the Caribbean are expected to see their rates rise to 11.3%.

Healthcare systems are facing challenges in managing these long-term conditions, which highlights the need for reliable, high-quality medical devices. Stricter regulatory requirements for device safety and efficacy, along with technological advancements in AI and automation, are propelling market growth.

The shift toward patient-centric testing and the global focus on improving healthcare infrastructure are further contributing to the growing demand for comprehensive medical device testing services.

Medical device testing refers to the comprehensive evaluation processes conducted to ensure the safety, functionality, and compliance of devices before they are introduced to the market. This testing includes various assessments such as performance testing, biocompatibility, mechanical integrity, and sterilization validation to meet regulatory standards set by authorities such as the FDA and EMA.

It ensures that devices operate effectively in medical environments, addressing both patient safety and product reliability. As medical technology become increasingly complex, rigorous testing is essential to prevent malfunctions and ensure devices meet quality and regulatory requirements throughout their lifecycle.

Analyst’s Review

Rising partnerships and the establishment of new laboratories by key players are set to foster the growth of the medical device testing market in the coming years.

- In June 2023, TÜV SÜD, a prominent provider of certification, auditing, and testing services, opened a new state-of-the-art laboratory in New Brighton, Minnesota. This facility is accredited to ISO 17025 for the biological and chemical testing of medical devices. The launch reflects TÜV SÜD’s ongoing commitment to delivering high-quality medical device services with precision and purpose.

Collaborations among healthcare organizations, research institutions, and technology firms enable the sharing of expertise and resources, fostering innovation in testing methodologies and expanding testing capabilities. These developments ensure faster turnaround times and improved testing accuracy, meeting the increasing demand for high-quality medical devices, which is expected to propel market growth.

Medical Device Testing Market Growth Factors

Stricter regulations from health authorities such as the FDA and EMA are stimulating the growth of the medical device testing market by ensuring that all devices undergo rigorous safety and efficacy evaluations. These regulations mandate thorough testing at every stage of the product lifecycle, from development to post-market surveillance, to meet compliance standards.

Companies are compelled to invest in comprehensive testing services to gain regulatory approval and market access, especially as non-compliance can result in costly delays or product recalls.

- In April 2023, Nelson Labs, a leading provider of microbiological and analytical chemistry testing and consulting services for the medical device and pharmaceutical industries, received ASCA accreditation from the U.S. Food and Drug Administration (FDA) as a biocompatibility testing laboratory.

The rising focus on patient safety and quality assurance is fueling demand for advanced testing solutions and aiding market growth.

The market faces challenges due to stringent regulatory requirements and high compliance costs. Navigating complex regulations can be daunting for manufacturers, leading to potential delays in product development and market entry. Additionally, the need for advanced testing methods to meet evolving standards can strain resources and increase operational expenses.

To mitigate these challenges, key players are investing in automation and digital technologies to streamline testing processes and improve efficiency. Collaborations enhance compliance capabilities by offering integrated services that address multiple testing needs, facilitating faster product development and reducing costs for manufacturers.

- In March 2023, Nemera and Nelson Labs Europe announced a partnership to provide customers with comprehensive integrated services, including leachables, extractables, microbiology, biocompatibility, and chemical testing.

Such partnerships by key players are expected to support market growth in the upcoming years.

Medical Device Testing Industry Trends

The adoption of digital technologies such as artificial intelligence (AI) and machine learning (ML) is boosting the growth of the medical device testing industry by significantly improving testing efficiency and accuracy. AI and ML enable advanced data analysis and predictive modeling, allowing for more precise assessment of device performance, potential failures, and risk factors. This capability reduces testing time, minimizes human error, and enhances the overall quality of results.

- In August 2023, Eurofins BioPharma Product Testing partnered with Huma to create and provide digital clinical trial solutions for medical devices. This collaboration aims to combine Eurofins' proficiency in medical device testing with Huma's expertise in digital clinical trials, enabling medical device companies to accelerate their product market entry more effectively and efficiently.

The increasing complexity of medical devices necessitates streamlined testing processes, which facilitates quicker regulatory approvals and product launches. This trend fuels demand for innovative testing solutions, thereby fostering the expansion of the medical device testing market.

The shift toward patient-centric approaches in medical device testing is gaining momentum, with manufacturers and researchers increasingly involving patients in the testing process. Early patient engagement provides companies with valuable insights into real-world device usage, user preferences, and pain points, enabling them to design more intuitive and effective devices.

This approach improves the usability of medical devices and ensures that they effectively meet the needs of end-users. Incorporating patient feedback helps reduce device failures and enhances patient satisfaction, leading to increased demand for more customized, user-friendly solutions in the market.

Segmentation Analysis

The global has been segmented based on service, sourcing, device class, technology, and geography.

By Service

Based on service, the market has been categorized into testing, inspection, certification, and others. The testing segment led the medical device testing market in 2023, reaching a valuation of USD 5.44 billion. This growth is driven by the rising demand for advanced and compliant medical devices.

Stringent regulatory standards, particularly from health authorities such as the FDA and EMA, necessitate comprehensive testing to ensure device safety and efficacy. The increasing prevalence of chronic diseases further highlights the need for innovative testing solutions. Manufacturers are investing heavily in testing services to minimize risks associated with device failures and meet regulatory requirements.

- In April 2022, Eurofins and SGS, prominent providers of medical device testing services, partnered to offer clients an extensive array of medical device testing solutions. This collaboration aims to enhance both companies’ global presence.

Technological advancements in testing methodologies, including automation and digital solutions, are enhancing testing efficiency and accuracy, thereby propelling segment growth.

By Device Class

Based on device class, the market has been categorized into class I, class II, and class III. The class II segment captured the largest share of 50.44% in 2023. These devices, including infusion pumps, surgical drapes, and diagnostic imaging equipment, are pivotal in various healthcare settings.

The rising prevalence of chronic diseases, including diabetes and cardiovascular conditions, necessitates advanced monitoring and treatment options, leading to increased demand for class II devices.

Additionally, innovations in technology, such as remote monitoring and telehealth solutions, are enhancing the functionality and usability of these devices. Stricter regulatory requirements and the need for clinical validation further contribute to segmental growth, as manufacturers invest in compliance and testing to ensure safety and efficacy.

By Technology

Based on technology, the market has been categorized into active implant medical device, active medical device, non-active medical device, in vitro diagnostic medical device, ophthalmic medical device, orthopedic and dental medical device, and others. The in vitro diagnostic medical device segment is expected to garner the highest revenue of USD 4.86 billion by 2031.

Increased awareness of early disease detection is prompting healthcare providers to adopt IVD tests that offer timely and accurate diagnoses. The rising prevalence of chronic and infectious diseases boosts the demand for innovative diagnostic solutions. Furthermore, advancements in molecular diagnostics and personalized medicine are accelerating product development, resulting in more precise and efficient testing methods.

Regulatory bodies are enforcing rigorous quality standards, prompting manufacturers to invest in compliance and enhance product efficacy. Additionally, the trend toward point-of-care testing is broadening access to IVD devices, making them more widely available across healthcare settings, thus fostering segmental growth.

Medical Device Testing Market Regional Analysis

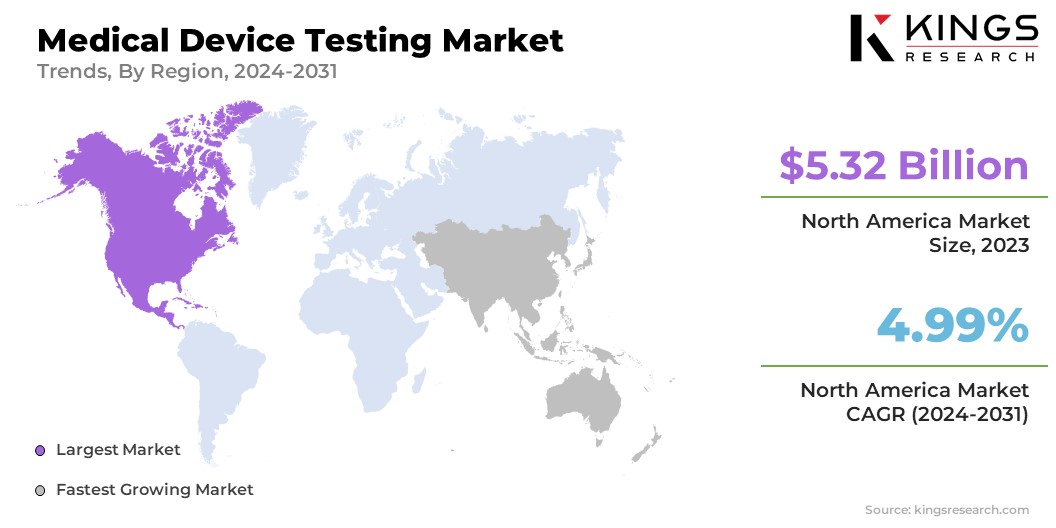

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America medical device testing market held the largest revenue share of 46.50% in 2023, with a valuation of USD 5.32 billion. This growth is largely attributed to increasing healthcare expenditures and a rising focus on innovative medical technologies. Additionally, the presence of leading healthcare companies and research institutions fosters a competitive environment that promotes advancements in medical device testing.

- In March 2023, ARCHIMED, a leading investment firm focused on healthcare industries, funded North America Science Associates Inc. (NAMSA) to acquire SUAZIO, a marketing consultancy firm specializing in the commercialization of new medical devices. This acquisition is expected to enhance NAMSA's market reach by providing immediate cross-selling opportunities within the industry.

Stricter regulatory requirements by the FDA fuel the demand for comprehensive testing solutions. Furthermore, the growing trend of outsourcing testing services allows manufacturers to focus on core competencies while ensuring compliance with regulatory standards, thereby augmenting regional market growth.

Asia-Pacific medical device testing market is anticipated to witness the fastest growth, recording a CAGR of 7.34% over the forecast period. This expansion is fueled by rising healthcare demands and advancements in technology.

- In July 2023, IT Minister KT Rama Rao launched three medical devices developed by Telangana Blue Semi, Huwel Lifesciences, and EMPE Diagnosis to enhance medical device testing and prototyping services.

This initiative underscores the region's commitment to innovation and the development of local capabilities in medical technology.

- Additionally, in January 2024, Tata Consultancy Services (TCS) introduced a single-window portal to streamline the import of medical devices in India. This portal simplifies regulatory processes, promoting faster market access for new devices and enhancing efficiency in the supply chain.

Supportive government policies, increasing investments in healthcare infrastructure, and the growing prevalence of chronic diseases are increasing the demand for advanced medical devices and testing services. Moreover, a focus on regulatory compliance and quality assurance supports the growth of the Asia-Pacific market.

Competitive Landscape

The global medical device testing industry report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Medical Device Testing Market

- SGS Société Générale de Surveillance SA

- Laboratory Corporation of America Holdings

- Nelson Laboratories, LLC

- TÜV SÜD

- Charles River Laboratories.

- North American Science Associates, LLC

- Eurofins Scientific

- Pace Analytical Services LLC

- Intertek Group Plc

- WuXi AppTec

Key Industry Developments

- March 2024 (Expansion): Stryker inaugurated a new facility in India dedicated to the life cycle testing of medical devices as part of its lab expansion efforts. This facility aims to develop medical technologies that adhere to the highest regulatory standards and enhance patient outcomes. Equipped with a skilled team of microbiologists and engineers, the lab offers extensive microbiological testing capabilities to ensure the safety and efficacy of medical devices, along with services for prototyping and product assurance.

- March 2024 (Product Launch): TidalSense, a UK-based respiratory device company, launched a pilot study for a device designed to diagnose asthma in children.

The global medical device testing market is segmented as:

By Service

- Testing

- Inspection

- Certification

- Others

By Sourcing

- In-house

- Outsourced

By Device Class

- Class I

- Class II

- Class III

By Technology

- Active Implant Medical Device

- Active Medical Device

- Non-active Medical Device

- In Vitro Diagnostic Medical Device

- Ophthalmic Medical Device

- Orthopedic and Dental Medical Device

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

-

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)