Healthcare Medical Devices Biotechnology

Medical Image Analysis Software Market

Medical Image Analysis Software Market Size, Share, Growth & Industry Analysis, By Software Type (Integrated, Stand-alone), By Modality (Radiology, Cardiology, Oncology, Neurology and others), By End-Use (Hospitals & Clinics, Diagnostic Imaging Centers, Ambulatory Surgical Centers and others) and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : January 2025

Report ID: KR1225

Medical Image Analysis Software Market Size

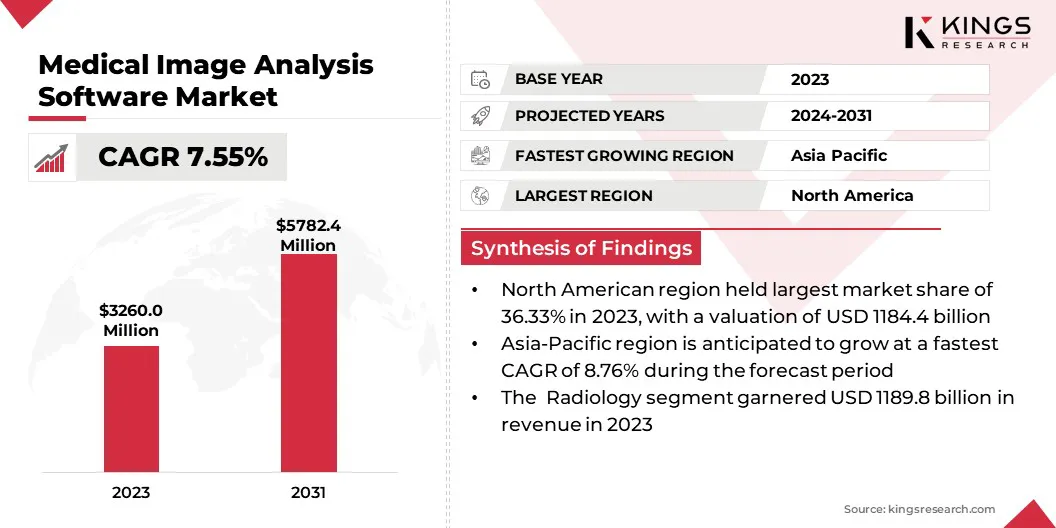

Global medical image analysis software market size was valued at USD 3260 million in 2023, which is estimated to be valued at USD 3474.3 million in 2024 and is projected to reach USD 5782.4 million by 2031, growing at a CAGR of 7.55% from 2024 to 2031.

The global demand for medical image analysis software is rising, due to several factors, including continuous technological advancements, the increasing adoption of artificial intelligence tools within the healthcare sector, rising government initiatives, and the growing prevalence of chronic diseases.

By recognizing the significant growth potential within the market, manufacturers of medical imaging software are making substantial investments in new technologies and research and development to develop highly sophisticated, AI-integrated medical imaging software.

In the scope of work, the report includes products offered by companies such as GE HealthCare, Agfa-Gevaert Group, Koninklijke Philip N.V., Infervision Medical Technology Co., Ltd., Aquilab by Coexya, Pie Medical Imaging B.V., Esaote SPA, Siemens Healthcare Private Limited, Carestream Health, and Canon Medical Systems Corporation, and others.

The growth trajectory of the medical image analysis software market is projected to continue, driven by its increasing integration with electronic health records (EHRs) and advanced healthcare data analytics platforms.

This integration facilitates seamless sharing of images and reports among healthcare providers, enhancing patient care and creating significant growth opportunities for manufacturers within this dynamic market.

Medical image analysis software is used to extract and interpret meaningful information from medical images such as CT scans, MRI, X-Rays, ultrasound, and microscopic images. The market is classified into integrated software and stand-alone software, nased on their compatibility with existing hospital IT infrastructure.

Analyst’s Review

The medical image analysis software market is characterized by intense competition and continuous product development. Companies are heavily investing in incorporating artificial intelligence and machine learning algorithms to improve image analysis accuracy, automate tasks, and provide faster, more efficient diagnoses.

They are creating AI-powered tools that improve precision, reduce patient recovery time, and enhance patient care. Furthermore, larger companies leverage acquisitions to enhance their competitive advantage by acquiring innovative technologies and specialized expertise.

This strategy facilitates rapid expansion into new markets and strengthens their existing product portfolio, leading to increased market share and improved operational efficiency

- For instance, in August 2023, Microsoft's Project InnerEye, collaborated with Javier Alvarez-Valle, Senior Director of Biomedical Imaging, and Raj Jena, a renowned radiation oncologist. This collaborative effort aims to advance research in oncology while ensuring strict adherence to all relevant regulatory requirements for clinical use.

Medical Image Analysis Software Market Growth Factors

The rising demand for computer-aided diagnosis (CAD) systems is contributing significantly to the growth of the medical image analysis market, as these systems enhance the accuracy and efficiency of medical image interpretation.

CAD systems can analyze images from various modalities, including X-rays, CT scans, and MRIs, to identify subtle patterns and features indicative of specific diseases or abnormalities, improving diagnostic accuracy and fostering market expansion.

- For instance, DynaCAD Lung, a prominent CAD system developed by Philips, provides radiologists with a suite of automated tools for analyzing multi-slice CT chest exams. It facilitates the synchronous display and navigation of multiple patient exams, enabling efficient initial review and streamlined comparison of current and prior study findings.

Furthermore, companies are increasingly integrating artificial intelligence, specifically deep learning models, into medical software applications, thus fostering the growth of the medical image analysis software market.

These sophisticated models excel at identifying complex patterns and subtle abnormalities within medical images, thereby minimizing human error through the provision of consistent and objective analysis. This integration has resulted in faster, more accurate, and personalized diagnoses, significantly enhancing patient care.

- In December 2024, Royal Philips partnered with Mayo Clinic, an American academic medical center to leverage AI for advancing MRI. The collaboration aims to increase operational efficiency by reducing MRI exam times and improving workflow.

While the medical image analysis software industry demonstrates promising growth, it faces several challenges, including substantial software licensing costs, stringent hardware requirements, and critical data privacy concerns.

To mitigate these challenges, manufacturers are offering flexible subscription-based models, implementing robust cloud-based solutions, and strengthening security measures to ensure data protection.

Medical Image Analysis Software Industry Trends

Manufacturers are developing new medical image analysis software on cloud computing and edge computing platforms. Cloud-based solutions offer scalable, cost-effective storage, processing, and analysis of large medical image volumes.

In contrast, edge computing brings processing power closer to the source of data, enabling faster analysis and reduced latency, particularly in remote or resource-constrained settings

Furthermore, the medical image analysis software market has witnessed a rise in demand for remote imaging analysis systems, mainly due to the increasing adoption of telemedicine and remote patient monitoring. Cloud-based platforms and AI algorithms allow healthcare providers to analyze images remotely, improving access to care for patients in remote or underserved areas.

Segmentation Analysis

The global market has been segmented based on product type, application, and geography.

By Software Type

Based on software type, the market has been categorized broadly into integrated software and stand-alone software. The integrated software segment is projected to generate a revenue of USD 3187.4 million by 2031.

The integrated software suite is a comprehensive set of tools designed to function within a healthcare institution'sexisting IT infrastructure. It typically encompass modules for image acquisition, storage, processing, analysis, and reporting.

The rise in demand for integrated software solutions can be attributed to their ability to seamlessly integrate with critical systems, including Picture Archiving and Communication System (PACS) and Electronic Medical Records (EMR).

- In December 2024, Philips introduced the CT 5300, an advanced CT scanner that integrates innovative hardware, software, and artificial intelligence technologies to enhance screening quality. It features AI-powered Philips Advanced Visualization Workspace application, which provides essential support to technicians and radiologists throughout the CT workflow.

By Modality

Based on modality, the market has been segmented into radiology, cardiology, oncology, neurology, and others . The radiology segment led the medical image analysis software market in 2023, accounting for a share of 36.50 %.

Radiologists are reponsible for interpreting a large volume of medical images from modalities, including X-ray, CT, and MRI. This necessitates the utilization of medical image analysis software to streamline workflows, enhance diagnostic accuracy, and improve overall efficiency.

In response, manufacturers are creating sophisticated software solutions capable of interpreting complex images, enhancing image quality, detecting potential abnormalities, and facilitating earlier disease detection for improved patient outcomes.

- For instance, in October 2024, GE Healthcare introduced Versana Premier, a multipurpose ultrasound system that incorporates advanced AI capabilities and automated productivity tools. This sophisticated system is designed to deliver exceptional image quality, enhance workflow efficiency, and maximize productivity within the clinical setting.

By End-Use

Based on end-use, the market is segmented into hospitals & clinics, diagnostic imaging centers, ambulatory surgical centers, and others. The hospitals & clinics segment generated the highest revenue of USD 1293.7 million in 2023. Hospitals and clinics perform numerous diagnostic imaging procedures, including X-rays, CT scans, MRIs, and ultrasounds.

Efficient management, analysis, and interpretation of this data is critical for optimal patient care. Medical image analysis software is crucial in streamlining workflows and mitigating the risk of radiologist burnout by automating routine tasks and enhancing diagnostic efficiency.

- In January 2023, Wythe County Community Hospital acquired the state-of-the-art mobile AMS Navigate Digital X-Ray system from GE Healthcare to enhance workflow efficiency and mitigate physical strain on X-ray technologists.

Medical Image Analysis Software Market Regional Analysis

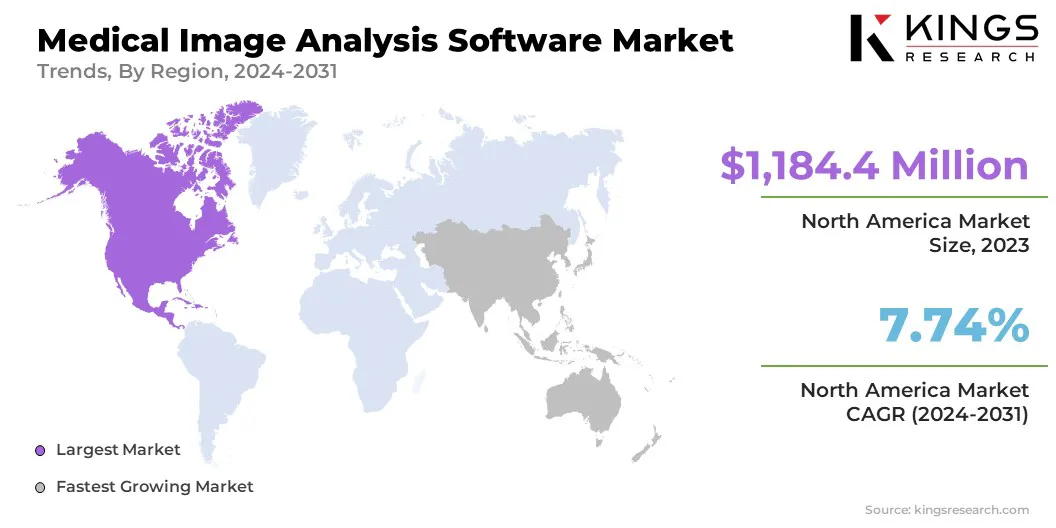

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America medical image analysis software market accounted for a share of 36.33% and was valued at USD 1184.4 million in 2023. North America has a history of early adoption of new technologies, including medical imaging and related software. This has fostered a mature market with established players and a strong demand for innovative solutions.

Additionally, significant investments from governmenst, medical research centers, and other organizations drive advancements in imaging technologies and the development of sophisticated analysis software in this region.

The Asia-Pacific market is projected to grow at a CAGR of 8.76% over the forecast period. This growth is primarily fueled by the rapid economic development in countries such as India, China, Indonesia, and Malaysia, leading to increased healthcare expenditure and investments in advanced medical technologies.

Furthermore, the rising prevalence of chronic diseases, including diabetes, cardiovascular diseases, and cancer, is creating a substantial demand for diagnostic imaging and analysis services.

Competitive Landscape

The global medical image analysis software market report will provide valuable insights with a specialized emphasis on the fragmented nature of the industry.

Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Medical Image Analysis Software Market

- GE HealthCare

- Agfa-Gevaert Group

- Koninklijke Philip N.V.

- Infervision Medical Technology Co., Ltd.

- Aquilab by Coexya

- Pie Medical Imaging B.V.

- Esaote SPA

- Siemens Healthcare Private Limited

- Carestream Health

- Canon Medical Systems Corporation

Key Industry Developments

- December 2024 (Product Launch): GE Healthcare expanded its product portfolio by incorporating new advanced deep learning-based image processing and reconstruction technologies. This enhancement aims to enhance image quality, reduce scan times, and improve patient outcomes.

- December 2024 (Partnership): At the RSNA Annual Meeting, AGFA HealthCare introduced RUBEE, an AI-powered platform developed in collaboration with CARPL.ai, a leading imaging marketplace platform provider. RUBEE leverages AI to automate tasks, enhance visualization, and streamline workflows in medical imaging.

- November 2024 (Partnership): Royal Philips partnered with Amazon Web Services (AWS) to migrate its integrated diagnostics portfolio to the cloud. This strategic collaboration aims to unify diagnostic workflows, improve access to critical insights, and enhance clincial outcomes.

The global medical image analysis software market has been segmented as:

By Software Type

- Integrated software

- Stand-alone software

By Modality

- Radiology

- Cardiology

- Oncology

- Neurology

- Other

By End-Use

- Hospitals & Clinics

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)