Healthcare Medical Devices Biotechnology

Medical Imaging Market

Medical Imaging Market Size, Share, Growth & Industry Analysis, By Product Type (X-ray Imaging Systems, Computed Tomography (CT) Scanners, and others), By Technology, By Application (Cardiology, Oncology, Neurology, and others), By End User, and Regional Analysis, 2024-2031

Pages : 200

Base Year : 2023

Release : January 2025

Report ID: KR1247

Market Definition

Medical imaging is a holistic field of healthcare that involves the use of advanced technologies to generate visual representations of the internal structures and functions of the human body.

These images are crucial for diagnostic, therapeutic, and monitoring purposes, aiding clinicians in the early detection, diagnosis, staging, and treatment planning of diseases and injuries. It also holds great promise for understanding human health, forensic science, and scientific innovation across industries.

Medical Imaging Market Overview

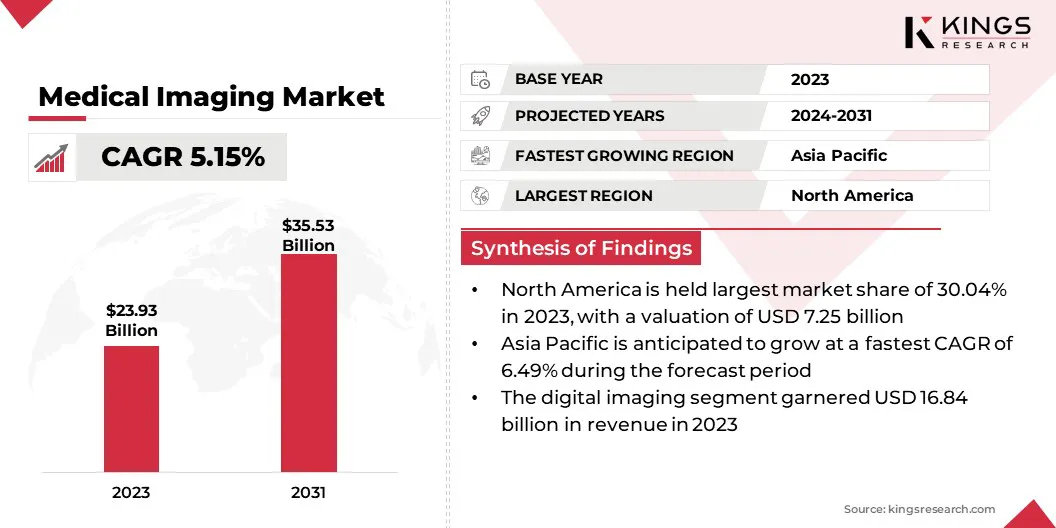

Global medical imaging market size was valued at USD 23.93 billion in 2023 which is estimated to be valued at USD 25.00 billion in 2024 and reach USD 35.53 billion by 2031, growing at a CAGR of 5.15% from 2024 to 2031.

The market is expanding rapidly due to its expanding applications in radiology and oncology. Technological advancements, including AI integration, virtual reality, and enhanced processing speeds in medical imaging, are enhancing efficiency.

In addition, innovations in imaging modalities, such as 3D/4D imaging, wearable devices, and high-resolution MRI and CT scanners, are enabling more accurate diagnostics, reducing scan times, and improving patient comfort.

Major companies operating in the global medical imaging market are Siemens Healthineers AG, GE HealthCare Technologies Inc., Koninklijke Philips N.V., CANON MEDICAL SYSTEMS CORPORATION, Shimadzu Corporation, FUJIFILM Corporation, Samsung Medison Co., Ltd., Hitachi, Ltd., Carestream Health, Hologic, Inc., Esaote SPA, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Agfa-Gevaert Group, Konica Minolta, Inc., Novarad Corporation, and others.

The market is experiencing significant growth due to advancements in machine learning and artificial intelligence. Innovations in medical imaging are transforming the healthcare industry by enhancing diagnostic precision and treatment outcomes.

Furthermore, the growing demand for early disease detection is supporting market expansion, particularly in areas such as oncology, cardiology, and neurology. These advancements are contributing to enhanced patient outcomes by enabling earlier detection of diseases, personalized treatment planning, and real-time monitoring of disease progression.

Key Highlights:

- The global medical imaging market size was recorded at USD 23.93 billion in 2023.

- The market is projected to grow at a CAGR of 5.15% from 2024 to 2031.

- North America held a notable share of 30.04% in 2023, valued USD 7.25 billion.

- The x-ray imaging systems segment garnered USD 7.13 billion in revenue in 2023.

- The digital imaging technology segment generated a revenue of USD 16.84 billion in 2023.

- The oncology segment is expected to reach a value of USD 11.77 billion by 2031.

- The hospitals segment is anticipated to record a valuation of USD 17.96 billion by 2031.

- Asia Pacific is estimated to grow at a CAGR of 6.49% through the forecast period.

Market Driver

"Integration of AI and Increasing Investments"

The integration of AI in medical imaging is revolutionizing diagnosis. AI helps automate image interpretation and improve accuracy, boosting the growth of the medical imaging market. The development of portable imaging devices and wearable imaging technologies is expanding access to imaging, particularly in remote or underserved regions.

- For instance, in May 2024, Siemens Healthineers introduced new cardiology applications powdered by artificial intelligence for the Acuson Sequoia ultrasound system, along with a 4D transesophageal transducer for cardiology exams. These updates enhance the Acuson Sequoia, positioning it as a comprehensive ultrasound solution for regional hospitals and clinics with shared service business models.

These improvements are increasing the efficiency of medical imaging, enabling more accurate results. The rising adoption of AI is fueling market growth by facilitating innovative solutions for diverse applications.

Additionally, increasing government investments in healthcare systems and infrastructure, particularly in developing regions. are accelerating market expansion by creating new opportunities and attracting investments in medical imaging technologies.

- For instance, in January 2024, the Swoop Portable MR Imaging System was launched as an FDA-cleared, AI-powered, portable MR brain imaging solution. The system addresses traditional MRI accessibility challenges, enabling clinicians to make informed decisions in diverse healthcare settings. It is the only FDA-cleared portable MR brain imaging system that integrates ultra-low-field magnetic resonance with proprietary artificial intelligence.

Market Challenge

"High Maintenance Costs and Cloud Privacy Risks"

The medical imaging market faces significant challenges, including high maintenance costs associated with complex equipment such as MRI and CT scanners. These costs, driven by frequent servicing, expensive spare parts, and software updates, strain healthcare providers' budgets.

This burden on healthcare providers can be alleviated through the implementation of predictive maintenance systems powered by artificial intelligence (AI) and Internet of Things (IoT) sensors. By continuously monitoring the condition of imaging equipment, AI can predict when maintenance is needed, reducing unexpected breakdowns and helping to lower the frequency of expensive repairs.

Additionally, the increasing reliance on cloud storage to store patient images, such as X-rays or MRIs, raises data privacy and security concerns. While cloud storage improves accessibility and collaboration by allowing doctors and specialists to access and share images remotely, it also exposes sensitive patient data to ptential breaches.

One solution is to implement end-to-end encryption for all images, ensuring that data is protected both during transfer and while stored in the cloud. Furthermore, the high cost of imaging services, including equipment, operational expenses, and radiologist fees, limits patient access, particularly in underserved populations, potentially delaying diagnoses and treatment while affecting healthcare providers' financial sustainability.

An effective strategy is to adopt teleradiology services, which allow radiologists to interpret images remotely, expanding access to specialized expertise while reducing the need for in-house specialists.

Market Trend

"Rising Awareness of Early Disease Detection and Innovations in Medical Imaging"

The medical imaging market is witnessing significant trends, including a increased focus on early disease detection, fueled by increasing public awareness about the importance of identifying health issues at an early stage. This shift has led to rising demand for regular screenings and proactive health management, resulting in earlier diagnoses and improved patient outcomes.

Moreover, the integration of imaging modalities, such as CT, MRI, PET, and ultrasound, is gaining traction as it provides more accurate and comprehensive diagnostic information, enhancing treatment planning and patient care.

Key players are increasingly focused on innovating within medical imaging to capitalize on the growing market for personalized diagnosis, leading to rapid development and commercialization of cutting-edge solutions.

- In November 2024, Detection Technology Plc introduced an integrated CT detector system for X-ray system manufacturers. This advanced system simplifies architecture and data transfer while offering high performance for both static and rotating CT systems, including support for dual-energy imaging and photon-counting CT.

Medical Imaging Market Report Snapshot

| Segmentation | Details |

| By Product Type | X-ray Imaging Systems, Computed Tomography (CT) Scanners, Magnetic Resonance Imaging (MRI) Systems, Ultrasound Systems, Nuclear Imaging Systems, Mammography Systems |

| By Technology | Digital Imaging, Analog Imaging |

| By Application | Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Obstetrics and Gynecology, Other Applications |

| By End User | Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Specialty Clinics, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (X-ray Imaging Systems, Computed Tomography (CT) Scanners, Magnetic Resonance Imaging (MRI) Systems, Ultrasound Systems, Nuclear Imaging Systems, and Mammography Systems): The x-ray imaging systems segment garnered a value of USD 7.13 billion in 2023 due to its advanced applications in healthcare diagnostics and medical research.

- By Technology (Digital Imaging and Analog Imaging): The digital imaging segment earned USD 16.84 billion in 2023, fueled by its rising use in medical research, healthcare diagnostics, and material science.

- By Application (Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Obstetrics and Gynecology, and Other Applications): The oncology segment held a share of 30.90% in 2023, attributed to the growing demand for custom cell lines for biologics and gene therapies.

- By End User (Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Specialty Clinics, and Others): The hospitals segment is projected to reach USD 17.96 billion by 2031, propelled by the utilization of medical imaging for diagnosing and treating various conditions.

Medical Imaging Market Regional Analysis

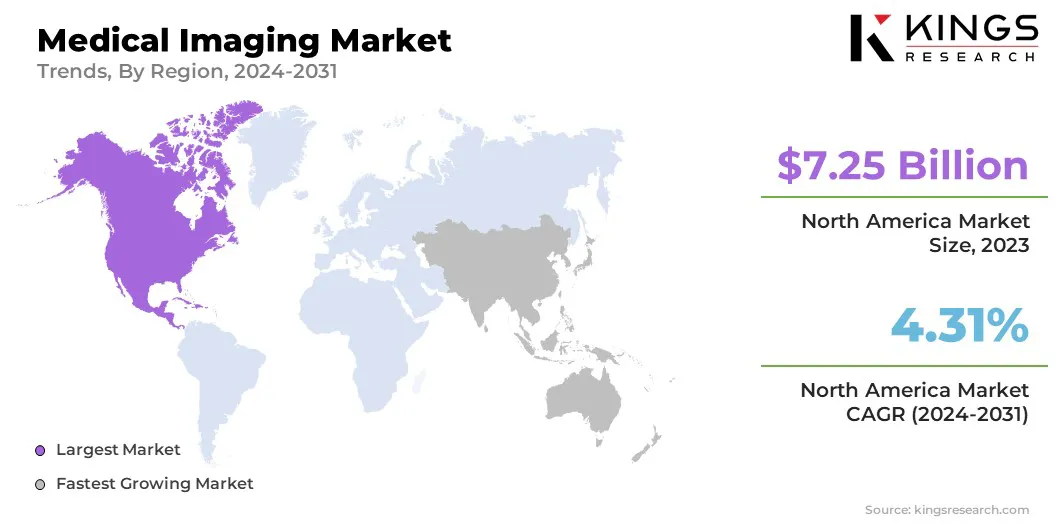

The North America medical imaging market accounted for a substantial share of 30.04% and was valued at USD 7.25 billion in 2023. This dominance is primarily fueled by its robust healthcare infrastructure, extensive research capabilities, and collaborative efforts between the public and private sectors.

This growth is further bolstered by a well-established healthcare system, high adoption of advanced imaging technologies, and favorable regulatory environment. The U.S. leads the market, mainly due to significant government funding and a high rate of imaging device approvals.

Asia-Pacific medical imaging market is expected to grow at a fastest growth CAGR of 6.49% through the projection period. Countries such as China, India, and Japan are increasing investments in healthcare infrastructure and medical research.

Government initiatives and partnerships between academic institutions and biotechnology firms are boosting the adoption of innovative imaging solutions in medical diagnostics and treatment.

Furthermore, the expanding middle class is contributing to higher healthcare spending, fueling the demand for advanced medical imaging technologies. Additionally, growing healthcare needs and a major focus on improving access to advanced medical technologies are driving innovation in medical imaging.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the FDA oversees the approval of imaging devices through rigorous clinical trials, while the NIH funds research to drive innovation in the field. The FDA ensures that emerging technologies undergo comprehensive evaluations before market entry.

- In the EU, the European Medicines Agency (EMA) regulates medical imaging devices market to maintain high standards of safety and performance. The EU enforces compliance with medical device regulations, complemented by strong data protection measures under the General Data Protection Regulation (GDPR).

- In APAC, China has strengthened its regulatory frameworks, mandating stringent approval processes for new imaging technologies and balancing innovation with ethical considerations and patient safety. In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) enforces clear guidelines for the safety and efficacy of medical imaging devices, with an emphasis on protecting patient data.

- Globally, the World Health Organization (WHO) collaboratesy with governments and regulatory bodies to establish global standards for medical imaging. It emphasizes ethical guidelines, particularly for AI-powered solutions, promoting international cooperation to improve healthcare outcomes while ensuring patient welfare.

Competitive Landscape:

The global medical imaging market is characterized by a large number of participants, including both established corporations and rising organisations. Companies are consistently launching new, cutting-edge imaging solutions that leverage AI and machine learning to enhance diagnostic accuracy, operational efficiency, and patient outcomes.

By investing in research and development, these companies aim to stay ahead of technological trends and meet the increasing demand for more precise, cost-effective healthcare solutions. These innovations enable healthcare providers to streamline workflows, reduce diagnostic errors, and improve the overall quality of patient care, solidifying their position in the market.

List of Key Companies in Medical Imaging Market:

- Siemens Healthineers AG

- GE HealthCare Technologies Inc.

- Koninklijke Philips N.V.

- CANON MEDICAL SYSTEMS CORPORATION

- Shimadzu Corporation

- FUJIFILM Corporation

- Samsung Medison Co., Ltd.

- Hitachi, Ltd.

- Carestream Health

- Hologic, Inc.

- Esaote SPA

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Agfa-Gevaert Group

- Konica Minolta, Inc.

- Novarad Corporation

Recent Developments:

- In December 2024, Siemens Healthineers launched the Luminos Q.namix1 platform for next-generation fluoroscopy and radiography at RSNA 2024. This dual-functionality system enhances flexibility, efficiency, and workflows while reducing time, space, and costs. It is available in two models: the remotely controlled Luminos Q.namix R1 and the tableside-controlled Luminos Q.namix T1.

- In November 2024, Radon Medical Imaging acquired Alpha Imaging, a major distributor and servicer of medical imaging equipment in the eastern U.S. to strengthen market presence, expand service capabilities, and broaden geographic reach.

- In November 2024, Detection Technology Plc introduced an all-in-one CT detector system for X-ray system manufacturers. The system simplifies architecture and data transfer, offering high performance for static and rotating CT systems, with support for dual-energy imaging and photon-counting CT.

- In September 2024, Stryker launched the 1788, its next-generation advanced surgical camera in India. The platform offers vibrant 4K high-resolution images, enabling enhanced visualization of critical anatomy. With advanced fluorescence imaging capabilities, it provides clearer perfusion imaging and detailed views of complex anatomical structures, elevating surgical visualization across specialties.

- In July 2024, Trivitron Healthcare launched the "Terrene" CT scanner, the first in India to receive approvals from BIS, AERB, and CDSCO. Manufactured at its ISO-certified facility in Visakhapatnam, the scanner offers advanced imaging, reduced radiation, and improved diagnostics, aiming to make cutting-edge healthcare more accessible across India.

- In February 2024, Philips launched the AI-enabled CT 5300 at #ECR2024. The system, designed for diagnosis, interventional procedures, and screening, increases diagnostic confidence, streamlines workflow efficiency, and maximizes system uptime, improving patient outcomes and department productivity.

- In February 2024, Visage launched Visage Ease VP for Apple Vision Pro, offering immersive diagnostic imaging and multimedia experiences. It combines Visage Ease functionality with cinematic rendering for stunning volume-rendered images. With virtual screens over 4K resolution per eye, it provides flexible, on-the-go access, free from lighting restrictions, and supports intuitive eye, hand, and voice navigation for a seamless user experience.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)