ICT-IOT

Micro Data Center Market

Micro Data Center Market Size, Share, Growth & Industry Analysis, By Component (Solution, Services), By Type (Rack, Cabinet, Container), By Vertical (BFSI, IT and Telecommunications, Healthcare, Retail, Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : March 2024

Report ID: KR585

Micro Data Center Market Size

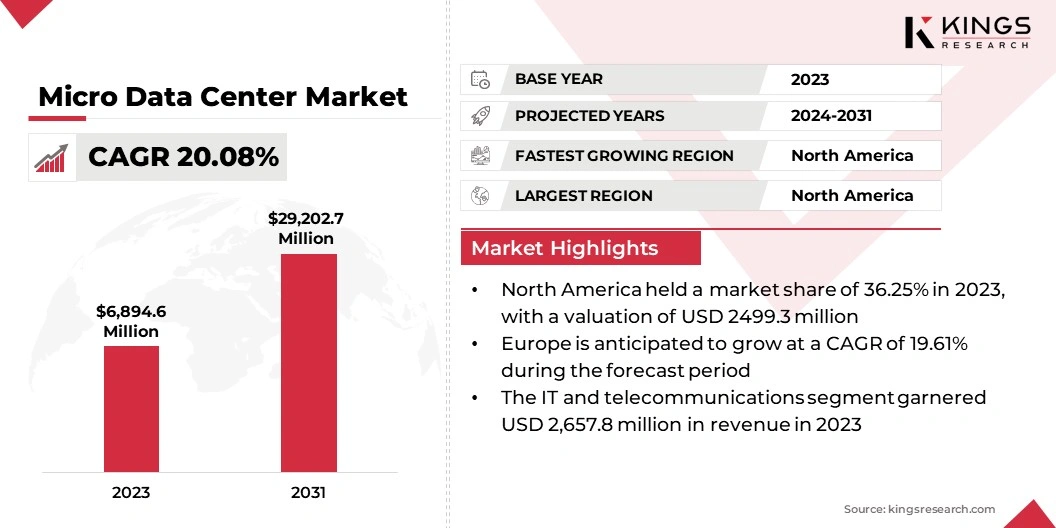

The global Micro Data Center Market size was valued at USD 6,894.6 million in 2023 and is projected to reach USD 29,202.7 million by 2031, growing at a CAGR of 20.08% during the forecast period 2024-2031. North America market size was valued at USD 2499.3 million in 2023. The market is experiencing robust growth, driven by several factors, including the increasing demand for edge computing solutions, the proliferation of IoT devices, and the need for scalable and flexible IT infrastructure.

In the scope of work, the report includes products offered by companies such as Rittal GmbH & Co. KG, Panduit Corp., Vertiv Group Corp., Schneider Electric, Eaton, American Portwell Technology, Inc., Hewlett Packard Enterprise Development LP, Hitachi Energy Ltd., Delta Power Solutions, ALTRON, and others.

The market is characterized by a diverse range of players who offer innovative micro data center solutions tailored to various industry verticals. With the rise of edge computing, the demand for micro data centers is expected to soar in the coming years, as organizations aim to process and analyze data closer to the point of generation.

Additionally, the modularity and scalability of micro data centers make them an attractive option for enterprises looking to quickly deploy IT resources in remote locations or branch offices. Overall, the micro data center market is poised to experience significant growth in the foreseeable future, with key players investing heavily in research and development to stay ahead in this competitive landscape.

Analyst’s Review

The growing demand for edge micro data centers is driven by the increasing adoption of edge computing solutions across various industries. Edge micro data centers play a crucial role in supporting real-time data processing and analysis at the network edge, which is essential for applications such as IoT, autonomous vehicles, and smart cities. As organizations continue to adopt digital transformation initiatives, the need for edge micro data centers is expected to surge in the forecast years.

Moreover, advancements in technologies such as 5G networks are further fueling demand for edge micro data centers, facilitating low-latency, high-bandwidth connections required for edge computing applications. The market outlook for edge micro data centers remains highly positive, with significant growth opportunities anticipated in the forthcoming years.

Market Definition

A micro data center is a compact, self-contained unit that houses essential IT infrastructure components such as servers, storage, networking equipment, and management software within a single enclosure. These data centers are designed to be modular and scalable, allowing organizations to quickly deploy IT resources in remote or edge locations.

Micro data centers come in various types, including prefabricated/modular, containerized, and rack-integrated solutions, catering to different deployment requirements. Industries such as telecommunications, healthcare, finance, manufacturing, and government are among the key adopters of micro data center solutions. These industries utilize this solution for various purposes such as for edge computing, remote office support, IoT deployments, and mobile edge computing, among other applications.

Micro Data Center Market Dynamics

The deployment and commercialization of 5G network connectivity are driving the demand for edge micro data centers. 5G networks promise significantly higher data speeds, lower latency, and increased network capacity compared to previous generations of cellular technology. As a result, there is a growing need for edge computing infrastructure to support applications that require real-time data processing and analysis at the network edge.

Edge micro data centers play a crucial role in enabling low-latency, high-bandwidth connections for 5G applications such as autonomous vehicles, smart cities, augmented reality (AR), and virtual reality (VR) experiences. Additionally, the rollout of 5G networks is driving investments in edge computing infrastructure by telecommunications companies and enterprises looking to capitalize on the opportunities presented by this next-generation technology.

Integration and cost constraints are likely to hamper the growth of the micro data center market. While micro data centers offer numerous benefits, such as modularity, scalability, and energy efficiency, integrating them into existing IT environments can be challenging for organizations. Compatibility issues with legacy systems, software integration complexities, and the need for skilled IT personnel to manage and maintain micro data centers can hinder their adoption.

Furthermore, cost constraints pose a significant challenge for some organizations, especially small and medium-sized enterprises (SMEs), as the initial investment required for deploying micro data centers might be prohibitive. Additionally, ongoing operational costs, including power consumption, cooling, and maintenance, can contribute to the total cost of ownership (TCO) of micro data centers, potentially impacting their affordability for certain market segments.

Segmentation Analysis

The global market is segmented based on component, type, vertical, and geography.

By Component

Based on component, the market is segmented into solution and services. The solution segment dominated the micro data center market with a share of 62.35% in 2023 on account of the diverse range of micro data center solutions offered by key players in the market. These solutions encompass various types of micro data centers, including prefabricated/modular, containerized, and rack-integrated solutions, catering to different deployment requirements and industry verticals.

The solution segment is characterized by continuous innovation and product development efforts by key players to address the evolving needs of customers across various industries. Additionally, the modular and scalable nature of micro data center solutions makes them highly versatile, allowing organizations to customize and deploy them according to their specific IT infrastructure requirements.

By Type

Based on type, the market is classified into rack, cabinet, and container. The cabinet segment is anticipated to witness the highest growth, depicting a CAGR of 21.71% over the forecast period as a result of the increasing adoption of rack-integrated micro data center solutions. Rack-integrated micro data centers offer a compact and efficient way to deploy IT infrastructure in limited space environments, such as small offices, retail stores, and edge locations.

These cabinets are designed to accommodate essential IT components, including servers, storage, networking equipment, and management software, within a single enclosure, simplifying deployment and management. The growing demand for edge computing solutions and the need for compact and scalable IT infrastructure in remote and edge locations are driving the adoption of cabinet-based micro data centers across various industry verticals.

By Vertical

Based on vertical, the market is classified into BFSI, IT and telecommunications, healthcare, retail, and others. The IT and telecommunications segment led the micro data center market in 2023 with a valuation of USD 2,657.8 million owing to the increasing adoption of micro data center solutions by IT companies, telecommunications providers, and service providers. These organizations deploy micro data centers to support a wide range of applications, including edge computing, IoT deployments, content delivery, and mobile edge computing, among others.

The IT and telecommunications segment is characterized by the need for high-performance, scalable, and reliable IT infrastructure to support mission-critical applications and services. Micro data center solutions offer these organizations the flexibility and agility to deploy IT resources closer to the point of use, thereby improving performance and reducing latency for end-users.

Micro Data Center Market Regional Analysis

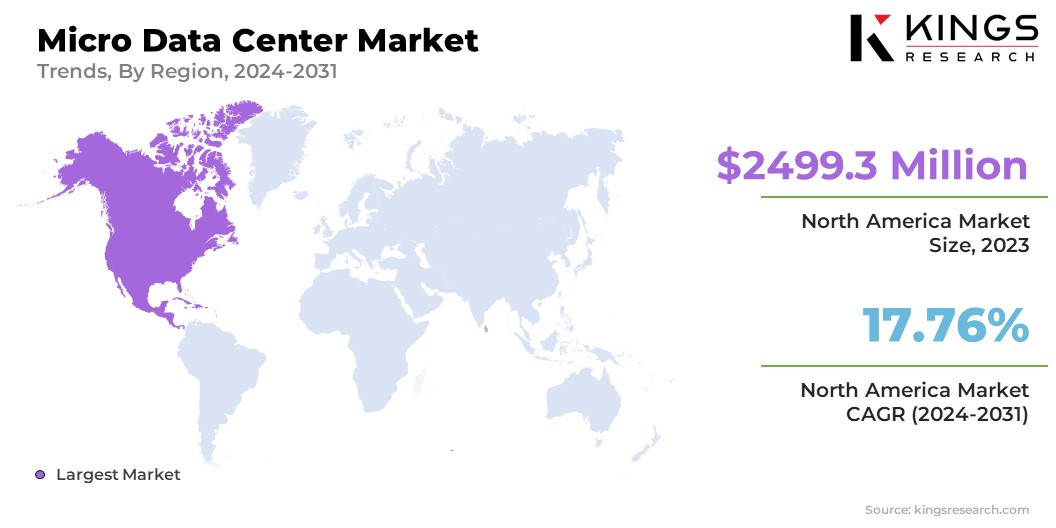

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America Micro Data Center Market share stood around 36.25% in 2023 in the global market, with a valuation of USD 2499.3 million, due to the significant adoption of micro data center solutions across various industries in the region. The presence of key market players, technological advancements, and robust IT infrastructure development are among the major factors contributing to the dominance in the market.

Furthermore, the growing demand for edge computing solutions, IoT deployments, and mobile edge computing in industries such as telecommunications, healthcare, finance, and IT services is driving the adoption of micro data center solutions in North America. The region is characterized by a highly competitive landscape, with key players focusing on research and development initiatives to stay ahead in this rapidly evolving market.

Europe is likely to experience significant growth, depicting a 19.61% CAGR between 2024 and 2031 on account of the increasing adoption of edge computing solutions and the rollout of 5G networks across the region. Edge micro data centers play a crucial role in supporting real-time data processing and analysis at the network edge, which is essential for applications such as IoT, autonomous vehicles, and smart cities. The deployment of 5G networks is driving investments in edge computing infrastructure by telecommunications companies, enterprises, and government agencies across Europe.

Additionally, regulatory initiatives promoting data privacy and security are fueling the adoption of micro data center solutions in the region. Europe is likely to present significant growth opportunities for the growth of the market in the forecast years, with key players focusing on expanding their presence and offerings to capitalize on this growing market.

Competitive Landscape

The global micro data center market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Micro Data Center Market

- Rittal GmbH & Co. KG

- Panduit Corp.

- Vertiv Group Corp.

- Schneider Electric

- Eaton

- American Portwell Technology, Inc.

- Hewlett Packard Enterprise Development LP

- Hitachi Energy Ltd.

- Delta Power Solutions

- ALTRON

Key Industry Developments

- November 2022 (Launch): Schneider Electric unveiled the EcoStruxure Micro Data Center R-Series 42U Medium Density, thus expanding its ruggedized Micro Data Center portfolio. This strategic move aims to equip IT professionals and solution providers with a comprehensive, pre-integrated solution, streamlining the ordering and deployment process for enhanced efficiency.

The Global Micro Data Center Market is Segmented as:

By Component

- Solution

- Services

By Type

- Rack

- Cabinet

- Container

By Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Retail

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)