Advanced Materials and Chemicals

Microcrystalline Cellulose Market

Microcrystalline Cellulose Market Size, Share, Growth & Industry Analysis, By Source (Wood based, Non wood based), By Form (Powdered, Liquid), By Application (Pharmaceutical, Food & Beverages, Personal Care & Cosmetics, Paints & Coatings, Others), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : March 2025

Report ID: KR1452

Market Definition

The market involves the production, distribution, and consumption of MCC, a refined, partially depolymerized cellulose derived from wood pulp or plant fibers. MCC is widely used as a functional ingredient in pharmaceuticals, food & beverages, cosmetics, and other industries, due to its binding, stabilizing, and bulking properties.

Microcrystalline Cellulose Market Overview

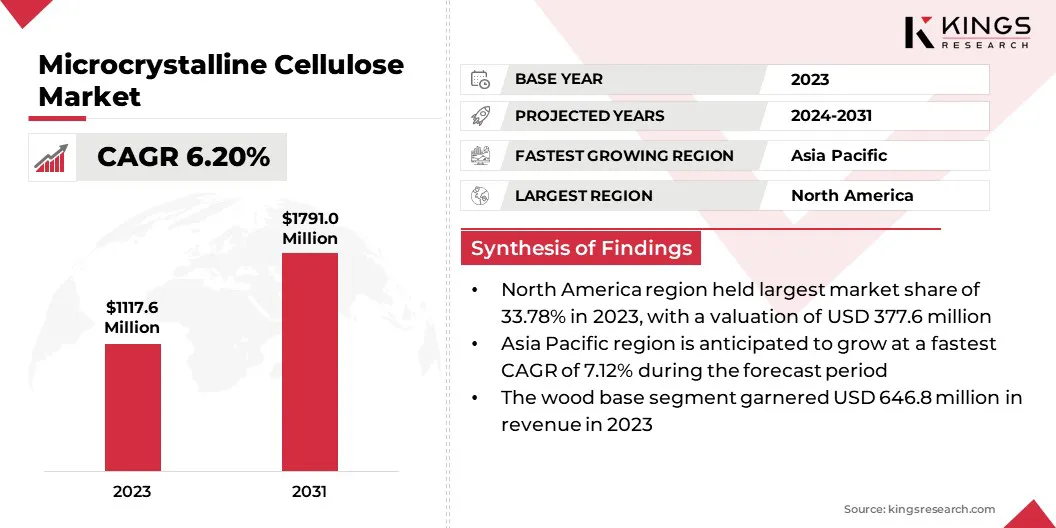

The global microcrystalline cellulose market size was valued at USD 1117.6 million in 2023 and is projected to grow from USD 1175.7 million in 2024 to USD 1791.0 million by 2031, exhibiting a CAGR of 6.20% during the forecast period.

This growth is driven by the increasing demand across pharmaceutical, food & beverage, and personal care industries, due to MCC’s versatile applications as a binding, stabilizing, and anti-caking agent. The expanding pharmaceutical sector, particularly in emerging markets, is fueling the demand for MCC as an excipient in drug formulations.

Major companies operating in the microcrystalline cellulose industry are Fengchen Group Co., Ltd, International Flavors & Fragrances Inc., Ankit Pulps and Boards Pvt Ltd., Asahi Kasei Corporation, Roquette Frères, Sigachi Industries, SEPPIC, FMC Corporation, Wei Ming Pharmaceutical Mfg. Co., Ltd., Accent Microcell Ltd., DFE Pharma, Vivion, Quadra, Mingtai Chemical, and JRS PHARMA.

Rising consumer preference for clean-label and plant-based ingredients is propelling its adoption in food & cosmetic products. Technological advancements in cellulose processing and sustainable raw material sourcing further contribute to the market expansion.

Key Highlights:

- The microcrystalline cellulose industry size was valued at USD 1117.6 million in 2023.

- The market is projected to grow at a CAGR of 6.20% from 2024 to 2031.

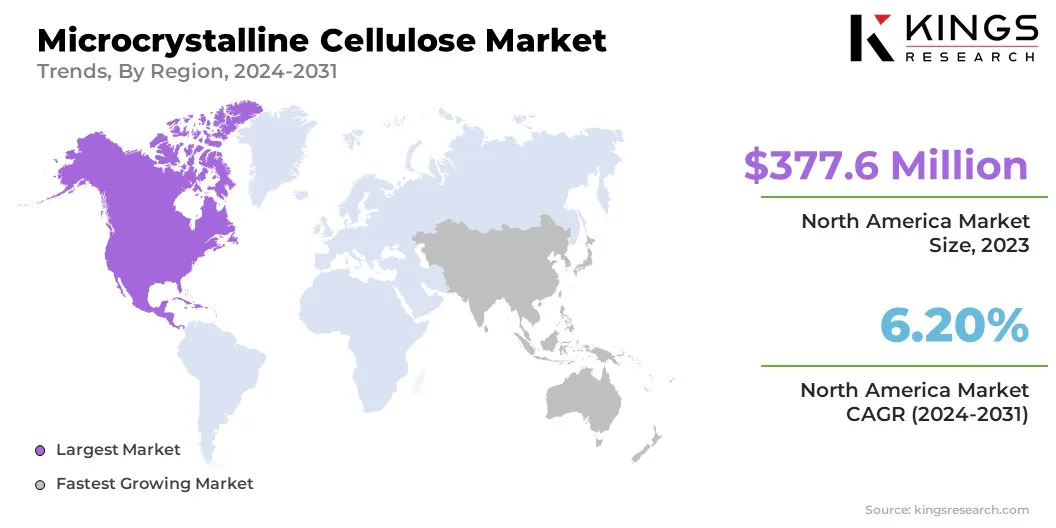

- North America held a market share of 33.78% in 2023, with a valuation of USD 377.6 million.

- The wood based segment garnered USD 646.8 million in revenue in 2023.

- The powdered segment is expected to reach USD 979.7 million by 2031.

- The pharmaceutical segment is expected to reach USD 480.0 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.12% during the forecast period.

Market Driver

"Growing Demand for Pharmaceutical Excipients"

The microcrystalline cellulose market is primarily driven by the rising demand for pharmaceutical excipients, due to the expanding global pharmaceutical sector. MCC plays a crucial role as an excipient in drug formulations, functioning as a binder and bulking agent in tablets and capsules, ensuring uniformity and stability in dosage forms.

The increasing prevalence of chronic diseases, such as cardiovascular disorders, diabetes, and cancer, has heightened the need for effective drug formulations that offer enhanced bioavailability, stability, and controlled release properties.

Pharmaceutical companies are investing in innovative drug delivery systems to improve patient compliance and therapeutic outcomes as the global burden of these diseases continues to rise. MCC plays a vital role in these advancements by ensuring uniformity in tablet formulations, enhancing disintegration, and improving the overall quality of oral solid dosage forms.

Market Challenge

"Supply Chain Disruptions and Raw Material Dependency"

A significant challenge in the microcrystalline cellulose market is the dependency on raw materials, primarily wood pulp and other plant-derived sources, which are subject to price volatility and supply chain disruptions. Manufacturers can explore alternative sustainable sources such as agricultural residues or microbial cellulose to reduce dependence on traditional wood pulp.

Additionally, investing in regional production facilities and diversifying supplier networks can enhance supply chain resilience. Technological advancements in cellulose extraction and processing can also improve yield efficiency, reducing reliance on scarce raw materials.

Market Trend

"Rising Demand for Clean-label and Plant-based Ingredients"

A key trend shaping the microcrystalline cellulose market is the increasing consumer preference for clean-label and plant-based ingredients across multiple industries, particularly in food, pharmaceuticals, and personal care. Consumers are becoming more conscious of product formulations, leading manufacturers to replace synthetic additives with natural, sustainable alternatives.

MCC, derived from plant-based cellulose, aligns with this demand, as it offers excellent functionality without compromising product purity or safety. In the pharmaceutical sector, the shift toward plant-derived excipients has encouraged manufacturers to invest in MCC-based formulations that meet stringent regulatory and consumer requirements.

Additionally, the growing demand for biodegradable and sustainable personal care products has positioned MCC as a viable ingredient in cosmetics and skincare formulations.

- In November 2023, BASF Pharma Solutions and IFF Pharma Solutions collaborated to integrate IFF's Avicel microcrystalline cellulose into BASF's ZoomLab platform, enhancing formulators' access to high-quality excipients.

Microcrystalline Cellulose Market Report Snapshot

|

Segmentation |

Details |

|

By Source |

Wood based, Non wood based |

|

By Form |

Powdered, Liquid |

|

By Application |

Pharmaceutical, Food & Beverages, Personal Care & Cosmetics, Paints & Coatings, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Source (Wood based and Non wood based): The wood based segment earned USD 646.8 million in 2023, due to its widespread availability, high purity, and cost-effectiveness. Wood-derived MCC remains the preferred choice, due to its superior binding and stabilizing properties, making it ideal for pharmaceutical and food applications.

- By Form (Powdered and Liquid): The powdered segment held 54.76% share of the market in 2023, due to its ease of handling, superior compressibility, and extensive use in solid dosage formulations in the pharmaceutical industry.

- By Application (Pharmaceutical, Food & Beverages, Personal Care & Cosmetics, Paints & Coatings, and Others): The pharmaceutical segment is projected to reach USD 480.0 million by 2031, owing to increasing drug production, rising demand for excipients in tablet formulations, and stringent quality standards requiring high-performance binding agents.

Microcrystalline Cellulose Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a microcrystalline cellulose market share of around 33.78% in 2023, with a valuation of USD 377.6 million. The region’s dominance is attributed to the strong presence of pharmaceutical and food industries, high demand for excipients in drug formulations, and strict regulatory standards ensuring the use of high-quality MCC.

The U.S. leads the regional market, due to its advanced healthcare infrastructure, increasing R&D investments, and rising consumption of processed foods.

The microcrystalline cellulose industry in Asia Pacific is poised to grow at a significant CAGR of 7.12% over the forecast period, driven by expanding pharmaceutical manufacturing, increasing disposable income, and rising demand for functional food ingredients. Countries like China, India, and Japan are registering significant industrial expansion, fueling the adoption of MCC in pharmaceutical, food, and cosmetic applications.

The region benefits from low-cost raw material availability, rapid urbanization, and growing investments in healthcare infrastructure, making it a key region in the market.

- In July 2024, a World Bank study projected China’s healthcare spending to exceed USD 2 trillion annually by 2035, up from USD 500 billion in 2014. This factor is driving the demand for advanced medical equipment, including processing seals. With rising local competition and a $100 billion ICU expansion plan, the medical processing seal market is open to several opportunities in China.

Regulatory Frameworks:

- In the U.S., the Food and Drug Administration (FDA)'s Center for Drug Evaluation and Research (CDER) regulates the market for pharmaceutical applications. MCC must meet stringent regulatory requirements, including safety assessments, formulation standards, and compliance with industry guidelines, to ensure its suitability for drug manufacturing.

- In Europe, the market is regulated by the European Medicines Agency (EMA) for pharmaceutical applications, ensuring compliance with quality and safety standards. The European Food Safety Authority (EFSA) oversees its use as a food additive, evaluating its safety and functionality in various food & beverage formulations.

Competitive Landscape

The global microcrystalline cellulose market is characterized by a large number of participants, including established corporations and rising organizations. Key market players focus on product innovation, capacity expansion, and strategic partnerships to strengthen their market position.

Leading companies emphasize high-purity MCC production, sustainability initiatives, and compliance with regulatory standards to cater to the growing demand from pharmaceutical, food & beverage, and personal care industries. Major players in the market engage in mergers, acquisitions, and joint ventures to expand their global footprint.

Additionally, advancements in cellulose processing technologies and the introduction of organic & non-GMO MCC variants have intensified competition. Companies are also investing in regional production facilities to enhance supply chain resilience and reduce dependency on raw material imports.

The competitive landscape is expected to evolve further as companies focus on sustainable sourcing, cost-efficient production, and meeting the increasing demand for plant-based and clean-label excipients.

- In September 2023, Nitika Pharmaceutical Specialties inaugurated its MCC manufacturing plant in Nagpur, reinforcing India's growing role in MCC production. This expansion strengthens domestic supply, reduces import dependency, and enhances India's position in the global market, catering to the rising demand from pharmaceutical and nutraceutical industries.

List of Key Companies in Microcrystalline Cellulose Market:

- Fengchen Group Co., Ltd

- International Flavors & Fragrances Inc.

- Ankit Pulps and Boards Pvt Ltd.

- Asahi Kasei Corporation

- Roquette Frères

- Sigachi Industries

- SEPPIC

- FMC Corporation

- Wei Ming Pharmaceutical Mfg. Co., Ltd.

- Accent Microcell Ltd.

- DFE Pharma

- Vivion

- Quadra

- Mingtai Chemical

- JRS PHARMA

Recent Developments (New Product Launch)

- In October 2023, Roquette launched new moisture-protection excipients, enhancing innovation in the market by addressing stability challenges in moisture-sensitive drug formulations. This strategic move strengthens its market position and aligns with the growing demand for high-performance pharmaceutical excipients that improve drug efficacy and shelf life.

- In January 2023, Asahi Kasei completed its second Ceolus microcrystalline cellulose plant at Mizushima Works, Japan, expanding production capacity to address the growing global demand. This development enhances supply stability and supports the pharmaceutical & food industries, further solidifying the company’s competitive position in the market.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)